How To Apply For An Apple Pay Later Loan

|

| How To Apply For An Apple Pay Later Loan |

| Contents |

What is Apple Pay Later?

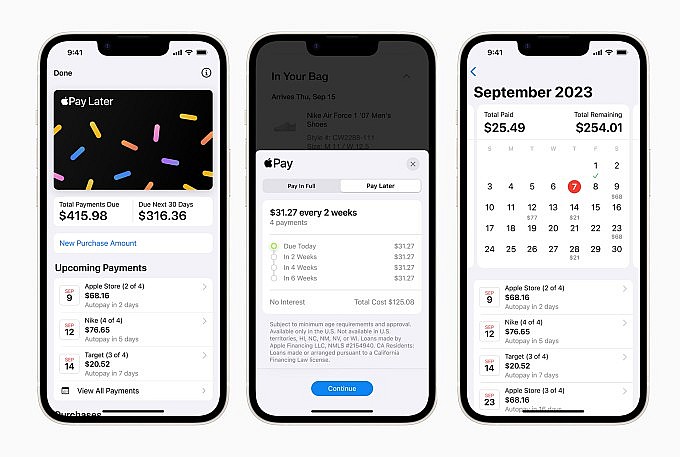

Apple Pay Later allows you to divide a purchase into four equal payments over the course of six weeks, with no interest or fees. We pay the merchant and you repay us over time when you use Apple Pay Later to make a purchase.

Apple Pay Later is available at participating online and in-app merchants that accept Apple Pay.

Apple Pay Later is available for purchases ranging from $50 to $1,000 made on Apple Pay-enabled iPhone and iPad devices. When you apply for an Apple Pay Later loan, your credit is not affected, and you'll know if you're approved in seconds.

READ MORE: How to Check and Link to Get My Payment -Third Stimulus Check

Does Apple Pay Later charge any fees?According to Apple, Apple Pay Later will have "zero interest and no fees of any kind." However, it is currently unknown what will occur if you fail to make one of your payments. Apple Pay Later will be free of charge, minus any bank overdraft fees. While users of the service will be able to manually make a payment early, it appears that Apple Pay Later payments will be automatically deducted from your bank account on the due date of each payment. While it is unclear what kind of penalty will be imposed if your bank account does not permit overdrafts, Apple has stated that "a user's card-issuing bank may charge a fee if the user's debit card account contains insufficient funds." |

How does Apple Pay Later work?

|

The amount you will receive is determined by your credit report and score. "Loans are subject to eligibility checks and approvals," Apple stated. Furthermore, rumors suggest that Apple will assess borrowers' creditworthiness based on previous purchases at Apple retail stores, the App Store, and even which company devices they currently own.

Cupertino will also use customer data for identity verification and fraud prevention. As a result, if you have a good financial standing with Apple and other banks and have avoided fraudulent activities, you are more likely to be approved for Apple Pay Later.

The question now is, who will lend you the money for your Apple Pay purchases? Cupertino, on the other hand, will not use Goldman Sachs to lend money for its Apple Pay Later feature, as it does for Apple Card. To finance your spending habits, Apple will use its own subsidiary, Apple Financing LLC. So, in essence, you will repay your loan to Apple rather than a bank.

In terms of technology, Apple will use Mastercard's system to connect customers and merchants. When a user uses Apple Pay Later to make a purchase, the merchant will receive a 16-digit card number generated by Goldman Sachs, indicating that the purchase was made using Apple's new financial feature.

READ MORE: Simple Tips to Make a Picture on Your iPhone an Apple Watch Face

How to apply for Apple Pay Later?

According to Apple, you will be able to apply for Apple Pay Later when making Apple Pay purchases or directly in the Wallet app. There is no word yet on whether an application procedure will be introduced.

How to set up Apple Pay Later on Apple Watch

|

To get started with your first app, add Apple Pay Later to your Apple Wallet:

Open the Wallet app on your iPhone. Go to Settings on your iPad and select Wallet & Apple Pay.

Select the Add button.

Tap Continue after setting up Apple Pay later.

To apply for an Apple Pay Later loan, follow the onscreen instructions. When prompted, enter the total value of the purchase you intend to make using Apple Pay Later, including estimated shipping and taxes.

Next, confirm your name, date of birth, and address.

After reviewing your personal information, tap Agree & Apply.

Examine your payment plan and loan agreement details, then tap Add to Wallet.

You have up to 30 days after being approved to use your Available to Spend amount to make a purchase.

How to buy products with Apple Pay Later?

When you use Apple Pay to make a purchase, you will have the option to "Pay In Full" or "Pay Later." If you select the latter, you will apply for the Pay Later program and, if accepted, you will proceed with your purchase.

Keep in mind that in order to use Apple Pay Later, you must link your debit cards to the service, and the system will automatically collect payments from your bank account every two weeks unless you opt out.

You will also be able to see how many installments you have left in the Wallet app, and if you find yourself with extra cash, you will be able to pay the next amount before the due date.

Which one is better: Apple Pay Later, Affirm, Afterpay, Klarna or PayPal’s “Pay in 4”?

Apple Pay Later

- Interest rate: 0%

- Payback timeframe: 4 payments over 6 weeks

- Loan amount limit: $50 to $1,000

- Fees: $0

Affirm

- Interest rate: 0% to 36%

- Payback timeframe: 1 to 48 months

- Loan amount limit: Up to $25,000

- Fees: No late fees. However, a late payment could negatively impact your ability to get a loan in the future and possibly hurt your credit score.

- Worth knowing: Affirm’s “Pay in 4” option allows users to divide their purchase into four interest-free payments made every two weeks. This option does not charge late fees.

Afterpay

- Interest rate: 0%

- Payback timeframe: 4 payments over 6 weeks

- Loan amount limit: Variable, but increases the more you use Afterpay. A long-term user will typically have access to more funds than a new user.

- Fees: Late fee of $8 or 25% of the transaction, which ever is less

Klarna

- Interest rate: 0% to 29.99%

- Payback timeframe: Up to 24 months

- Loan amount limit: Variable and is based on factors such as your payment history with Klarna and your outstanding balance.

- Fees: Up to $7 or 25% of the installment amount. Additionally, use of Klarna’s services are restricted until the missed payments are made.

- Worth knowing: Users can divide their purchase into four interest-free payments made every two weeks with Klarna's "Pay in 4" option. Late fees are the lesser of $7 or 25% of the installment amount for this option, and services are restricted until missed payments are made.

PayPal’s “Pay in 4”

- Interest rate: 0%

- Payback timeframe: 4 payments over 6 weeks; first payment is due at time of purchase

- Loan amount limit: Between $30 and $1,500

- Fees: $0. However, a late payment could negatively impact your ability to get a loan in the future and possibly hurt your credit score.

Apple’s Events For Next iPhones, MacBook Pros and More Apple’s Events For Next iPhones, MacBook Pros and More A series of big events of Apple are waiting for you this fall. Check out full details about them! |

How to Screenshot on Apple Watch and Where to Find How to Screenshot on Apple Watch and Where to Find Taking a screenshot is a quick and easy way to capture your watch display, and this process is also a piece of cake for the ... |

10 Best Free Ways To Watch Apple TV+ in 2023/24 10 Best Free Ways To Watch Apple TV+ in 2023/24 It is easy to enjoy movies and shows on Apple TV+ for free without having to pay too much. Read on this article to know ... |