Can You Retire Before 67? How Early Social Security Cuts Your Monthly Check

|

| The Full Retirement Age Hits 67 in 2026 |

For many Americans, retiring before 67 sounds appealing. You’re tired of working. You want flexibility. And Social Security lets you start benefits as early as 62.

What many people don’t realize is this: claiming Social Security before age 67 permanently reduces your monthly check if you were born in 1960 or later. And starting in 2026, that rule applies squarely to millions of retirees reaching key decision ages.

What is “full retirement age,” and why 67 matters

Under Social Security, full retirement age (FRA) is the age when you qualify for 100% of your earned retirement benefit.

-

If you claim before FRA, your benefit is reduced

-

If you claim at FRA, you receive the full amount

-

If you delay after FRA (up to age 70), your benefit increases

For anyone born in 1960 or later, full retirement age is 67. That’s why 2026 is a turning point: many Americans turning 62 or 66 that year will be affected by the age-67 rule for the first time.

Read more:

- Retirement Age Changes in 2026: Claiming Social Security at 62, 67, or 70?

- Which U.S. States Will See the Biggest Boost in Social Security Payments in 2026?

Can you retire before 67?

Yes. Social Security allows you to start benefits as early as 62.

But there’s a tradeoff.

If you claim before 67, your monthly benefit is reduced for life. This is not a temporary penalty and it does not reset when you later reach 67.

How much is your benefit cut if you claim early?

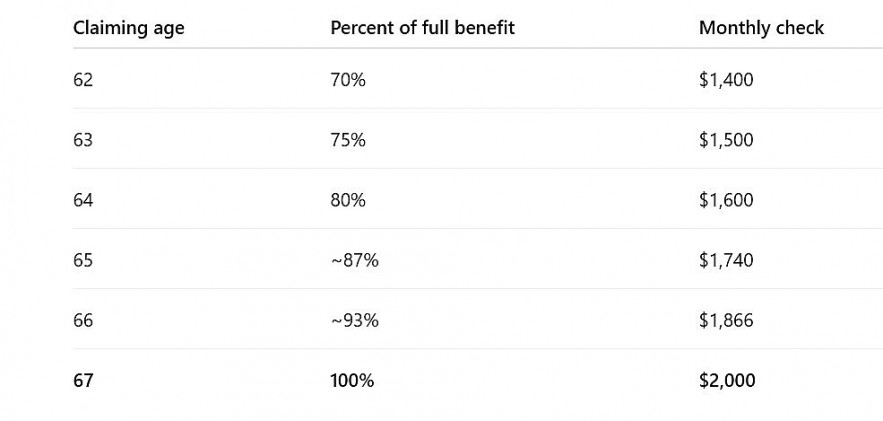

If your full benefit at 67 would be $2,000 per month, here’s what early claiming looks like:

|

| How much is your benefit cut if you claim early |

The earlier you claim, the larger the permanent cut.

Claiming at 62 instead of 67 means giving up about 30% of your monthly benefit for life.

Example: retiring at 62 vs. 67

Let’s say your full retirement benefit at 67 is $2,200 per month.

-

Claim at 62 → about $1,540 per month

-

Claim at 67 → $2,200 per month

That’s a difference of $660 every month.

Over a 20-year retirement, that adds up to more than $158,000, not including future cost-of-living increases.

Why the reduction is permanent

Social Security is designed to be actuarially adjusted. In simple terms, the system assumes that if you claim earlier, you’ll receive payments for more years.

To balance that, your monthly amount is reduced—and that lower amount becomes your base for all future increases.

Cost-of-living adjustments (COLAs) still apply, but they’re calculated on a smaller number.

A common and costly mistake

Many people assume:

“I’ll claim at 62 or 63, then it’ll switch to full benefits at 67.”

That’s not how it works.

Once you claim early, the reduction generally stays with you for life. There are limited exceptions early on, but for most retirees, the decision is effectively permanent.

When claiming before 67 might make sense

Early claiming isn’t always wrong. It can be reasonable if:

-

You need income right away

-

You have limited savings

-

You expect a shorter lifespan due to health or family history

-

You plan to stop working completely and need predictable cash flow

In those cases, getting money earlier—even at a lower rate—may be the right tradeoff.

When waiting usually pays off

Delaying benefits can be especially valuable if:

-

You expect to live into your 80s or beyond

-

You’re still working or have other income

-

You want higher guaranteed income later in life

-

You’re protecting a spouse who may rely on survivor benefits

Each year you delay after 67 (up to age 70) increases your monthly benefit by roughly 8%.

The bottom line

Yes, you can retire before 67. Social Security allows it.

But if you were born in 1960 or later, 67 is the age that determines whether you receive your full benefit. Claiming earlier means smaller checks every month, for as long as you live.

The most important step isn’t choosing the “right” age for everyone—it’s making the choice with clear, up-to-date information, not outdated assumptions.