Who Are Richest People In The U.K - Top 10

|

| Photo: Forbes |

As of early March 2021, there are 56 U.K. billionaires, up from 45 last year. Of these, three have become billionaires for the first time, including Matt Moulding of Hut Group fame and Fisker Inc. Chief Financial Officer Geeta Gupta-Fisker. The year has also marked the return of nine former U.K. billionaires, who have reclaimed their spot in the three comma club–among them publishing baron Richard Desmond, and David McMurtry of engineering firm Renishaw. They rejoin the Forbes list thanks in part to the strength of the pound-sterling against the U.S. dollar and a steady rise in public stocks. One U.K. billionaire died over the past 12 months: David Barclay, owner of The Daily Telegraph and Very Group.

In all, these 56 tycoons are worth an estimated $213.9 billion, up from $152.9 billion on last year’s list—meaning U.K. billionaires are $61 billion richer than a year ago. Excluding the new and returning billionaires, those who made both the 2020 and 2021 lists have gained more than $44 billion.

1. James Ratcliffe

NET WORTH: $17 billion (Up $6 billion)

SOURCE OF WEALTH: Chemicals

|

| Photo: Getty Images |

James Ratcliffe, born in Manchester, the son of a joiner father and accounts office worker mother, James lived there in a council house in Failsworth until the age of ten. His father ran a factory making laboratory furniture. Aged ten, he moved with his family to Yorkshire, and James attended Beverley Grammar School and lived in Hull up to the age of 18.

James graduated from the University of Birmingham with a degree in Chemical engineering in the year 1974.

His first job was with the oil giant Esso, but he decided to broaden his skills into finance by studying management accounting and taking an MBA at London Business School. He subsequently, in the year 1989, joined US private equity group Advent International.

James was a co-founder of INSPEC, which leased the former BP Chemical site in Antwerp, Belgium. In the year 1998, James formed Ineos in Hampshire to buy out INSPEC and the freehold of the Antwerp site.

James has two sons with his first wife and one daughter with his second wife.

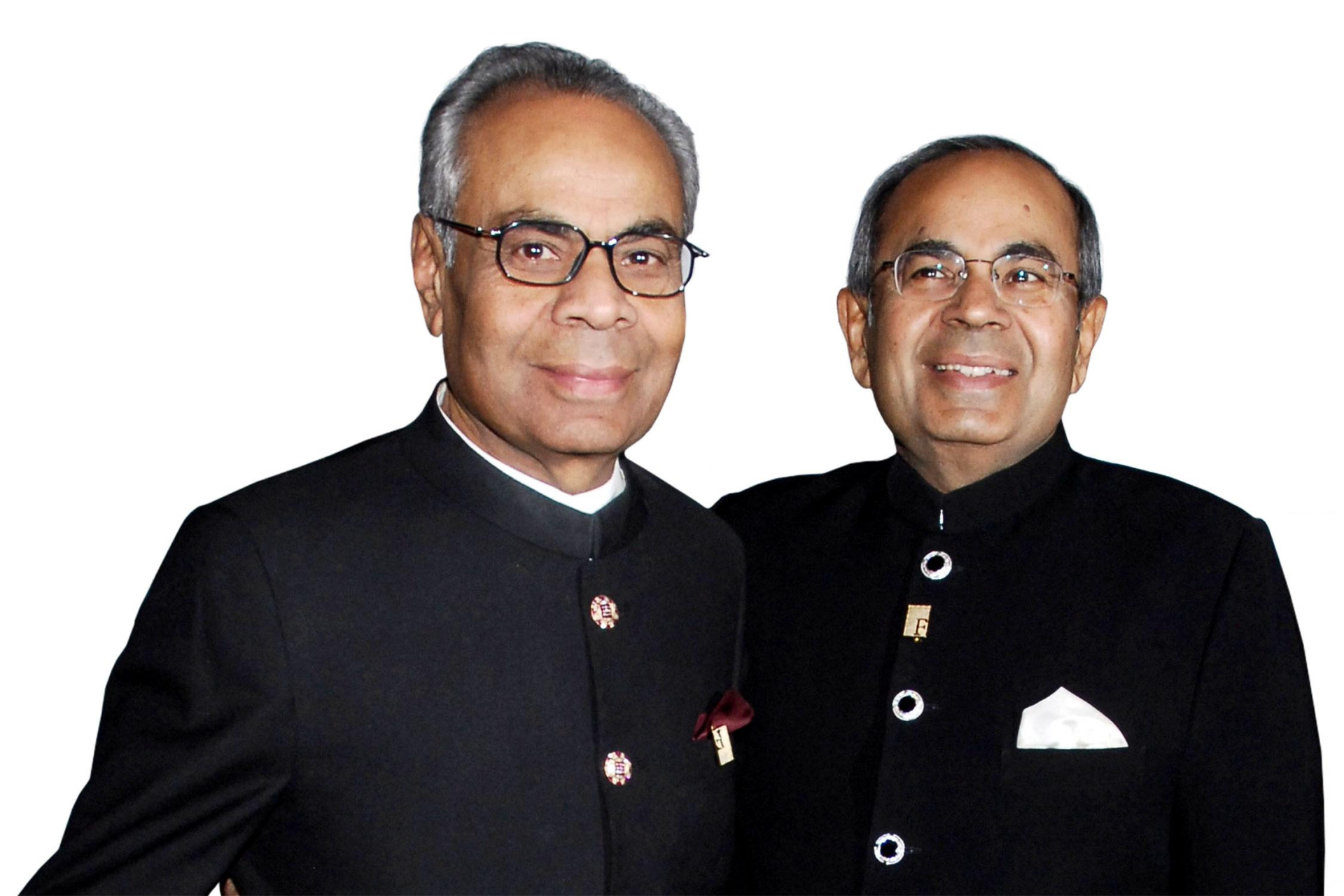

2. Hinduja Brothers

NET WORTH: $14.9 billion (Up $2 billion)

SOURCE OF WEALTH: Diversified

|

| Photo: The Times |

Hinduja Group is an Anglo-Indian transnational conglomerate based in Mumbai, India and headquartered in London, United Kingdom. The group is present in eleven sectors including Automotives, Oil and Specialty Chemicals, Banking & Finance, IT & ITeS, Cyber Security, Healthcare, Trading, Infrastructure Project Development, Media & Entertainment, Power, Real Estate.

The company was founded in 1914 by Parmanand Deepchand Hinduja, who was from a Sindhi family based in India. Initially operating in Shikapur (erstwhile Pakistan) and Mumbai, India, he set up the company's first international operation in Iran in 1919. The headquarters of the group remained in Iran until 1979, when the Islamic Revolution forced it to move to Europe.

Group Chairman Srichand Hinduja and his brother Gopichand, also Co-Chairman, moved to London in 1979 to develop the export business; the third brother Prakash manages the group's operations in Geneva, Switzerland while the youngest brother, Ashok, oversees the Indian interests. The brothers are all devout Hindu, vegetarian and teetotallers, and dress in similar ways, with a preference for black suits and round glasses.

The group employs over 150,000 people and has offices in many major cities around the world including in India.In 2017, Srichand and Gopichand Hinduja were described as the wealthiest men in Britain with an estimated wealth of £16.2 billion in the Sunday Times Rich List 2017.

In 2015, at The Asian Awards, the Hinduja brothers were honoured with the Business Leader of the Year Award. Ashok Hinduja was felicitated with the ABLF Global Asian Award at the UAE Government-backed Asian Business Leadership Forum in 2017. OneOTT Intertainment Limited (OIL), the Media Vertical arm of Hinduja Group, was awarded the 2019 Innovation Leaders award by Telecomlead.com.

3. Michael Platt

NET WORTH: $13 billion (Up $5 billion)

SOURCE OF WEALTH: Hedge funds

|

| Photo: Getty Images |

Platt was born in Preston, England. Following in the footsteps of his father – a professor at Manchester University – Platt studied Civil Engineering at Imperial College London. After a year, he grew bored and switched to Economics and Mathematics at the London School of Economics, graduating in the year 1992.

Platt started in the city when his grandmother gave him some shares to invest in, and he discovered a talent. He joined the JP Morgan in 1991 as an MD responsible for relative value trading. Platt assumed responsibility for developing JP Morgan swaps and options trading business in April 1992 and, in April 1996, became the head of trading for all swaps products relating to the 11 founder nations of the single European currency. In 2000, Platt co-founded BlueCrest Capital Management LLP, with Williams Reeves.

Platt is married and lives in Geneva, Switzerland. He is a notable art collector having built a contemporary art collection not by shopping for pictures, but by commissioning them from well-known artists. He has a private showroom in the crypt of a deconsecrated church at One Marylebone, which displays a selection of art by, among others, taxidermist Polly Morgan, the Turner Prize-winning sculptor and installation artist Keith Tyson and Reece Jones.

4. James Dyson

NET WORTH: $9.7 billion (Up $3.8 billion)

SOURCE OF WEALTH: Electronics

|

| Photo: Fortune |

James Dyson was born on 2 May, 1947 in Cromer, Norfolk, England and was one of three children. Dyson attended Gresham’s School in Holt, Norfolk, from 1956 to 1965.

After graduation Dyson went to London where he spent one year (1965-1966) at the Byam Shaw School of Art, and then studied furniture and interior design at the Royal College of Art (1966-1970) before moving into engineering.

Dyson is now an industrial designer and founder of the Dyson Company. He is married and has three children. In 2006 he was knighted Sir James Dyson by Queen Elizabeth II.

In 1970 while studying at the Royal College of Art, Dyson helped to design the Sea Truck, a small, fast, fibreglass landing craft for use by military. His first original invention was the Ballbarrow, a wheelbarrow that has been modified so that it has a ball instead of a wheel.

In 1993, Dyson set up his own manufacturing company, Dyson Ltd, and opened his own research centre and factory in the Cotswolds. Two years later he released his Dual Cyclone model vacuum cleaner, which became the top-selling vacuum cleaner in Britain. Dyson’s appliances have won many design awards around the world.

In 2006, Dyson invented the Dyson Airblade, an improvement of a hand dryer. This hand dryer scrapes water off your hands like a windshield wiper, but with air. The Dyson Airblade is three times more environmentally friendly than traditional hand dryers, using one-sixth of the amount of energy, taking 12 seconds instead of 40 and overall is more efficient.

Another recent invention of Dyson is his Air Multiplier which was released in 2010. This is a futuristic fan without blades, instead air is drawn through the base and is blown out through a ring. Since this item has been released Dyson has been battling to take down Chinese imitations of his design.

5. Ian & Richard Livingstone

NET WORTH: $9.3 billion (Up $2.9 billion)

SOURCE OF WEALTH: Real Estate

|

| Photo: Evening Standard |

• Brothers Richard and Ian Livingstone own properties throughout London including high-end shops, swanky hotels, and tony apartments.

• Among their signature projects is Panama Pacifico, a master planned city they're developing in Panama with Colombian billionaire Jaime Gilinski Bacal.

• When finished, Panama Pacifico will include 20,000 residential properties, industrial parks and retail and commercial space.

• Their real estate firm London & Regional, which owns more than 45 Holiday Inn Express in Europe, also operates hotels in L.A., Las Vegas and Miami.

• The firm is also tapped to revitalize Albert Island, a 25-acre site between London's Royal Docks and the Thames River, into a mixed-use development.

6. Anthony Bamford & family

NET WORTH: $7.9 billion (Up $2.7B)

SOURCE OF WEALTH: Construction equipment

|

| Photo: Business Live |

Lord Bamford is best known for his position at JCB, one of Britain’s most successful family-owned businesses. As Chairman of the iconic construction equipment manufacturer since 1975, he has presided over the prolific global expansion of a brand that stands for strength, durability and reliability in products ranging from 46 tonne tracked excavators to children’s toys and DIY equipment.

Since becoming Chairman, he has taken JCB from a one-factory operation in Staffordshire with a turnover of £43 million to a global business with 22 plants around the world employing over 15,000 people making over 300 different products. Recent results speak for themselves - JCB reported a record turnover of £4.1 billion in 2018 and earnings of £447 million. A new £63m factory was opened in Brazil in 2012 and two new factories costing £62 million were opened in Jaipur, India during 2014. A sixth factory is under construction in the coastal state of Gujarat.

Lord Bamford has held some key positions in British society over the years but it is for his many business achievements that he has achieved the most recognition, including National Westminster Young Exporter of the Year (1972), The Guardian Young Businessman of the Year (1979) and Chevalier de l’Ordre National du Merite (1989). He was knighted by Her Majesty The Queen in 1990 and awarded the Commendatore al merito della Repubblica Italiana in 1995.

Lord Bamford and his wife, Carole, Lady Bamford OBE make sure JCB becomes an integral part of every community in which the company operates. JCB supports the NSPCC in the UK and its employees are active fundraisers for the charity’s campaigns to end cruelty to children. There are also many projects at JCB’s overseas locations to support local communities, including the Lady Bamford Charitable Trust in India to assist villages near its factories and the Lady Bamford Center for Early Childhood Development in Savannah, USA. Lord Bamford has also donated machinery to support disaster relief efforts across the globe, for example after the Asian tsunami, earthquakes in Ecuador, Haiti, Indonesia, China and Turkey and after Typhoon Haiyan in the Philippines.

7. David Reuben

NET WORTH: $7.7 billion (Up $900 million)

SOURCE OF WEALTH: Real Estate

|

| Photo: Getty Images |

Born in Bombai (Mumbai), India, David Reuben together with his mother and brother Simon immigrated to the UK in the 1950s. The reason for them to migrate was the separation of their parents. His mother Nancy brought them to London, while she had family here. They settled in Islington, one of the London boroughs, and according to some reports they were almost destitute and had to rely on Jewish poverty in order to survive.

The Reuben family moved to the UK while the brothers were still teenagers, they received education in London. On arrival David as well as his brother Simon was sent to a state school in Islington. After completing his education at school, David, unlike his brother, who had never received formal education, started his secondary education at Sir John Cass Sixth Form College in Stepney.

With the Russian growth of domestic forces in the industry, the Reubens eventually sold up for £300million to Roman Abramovich's oil conglomerate Sibneft in 2000. Another reason was that at that time Vladimir Putin came to power.

In addition the Reuben Brothers hold quite a few number of investments in real estate either in the UK or around the world. Some key London investments include The Millbank Centre & Millbank Tower, Westminster; The John Lewis headquarters, Victoria Street; A seven floor office building on Buckingham Palace Road, Victoria; A Grade II listed building on Grosvenor Place, Belgravia; A three storey office building on Buckingham Gate, Victoria; Jubilee House, Putney; numerous prime Sloane Street shops. Thus, their London property portfolio contains more than 100 buildings and continues to grow.

Top 10 Richest People in the World - A View to Their Net Worth Top 10 Richest People in the World - A View to Their Net Worth |

8. Simon Reuben

NET WORTH: $7.7 billion (Up $900 million)

SOURCE OF WEALTH: Real Estate

|

| Photo: The Times |

Born in Bombai (Mumbai), India, Simon Reuben together with his mother and brother David immigrated to the UK in the 1950s. The reason for them to migrate was the separation of their parents. His mother Nancy brought them to London, while she had family here. They settled in Islington, one of the London boroughs, and according to some reports they were almost destitute and had to rely on Jewish poverty in order to survive.

The Reuben boys were sent to a state school in Islington. David went on to Sir John Cass Sixth Form College in Stepney, but Simon never completed formal education.

Reuben Brothers hold quite a few number of investments in real estate either in the UK or around the world. Some key London investments include The Millbank Centre & Millbank Tower, Westminster; The John Lewis headquarters, Victoria Street; A seven floor office building on Buckingham Palace Road, Victoria; A Grade II listed building on Grosvenor Place, Belgravia; A three storey office building on Buckingham Gate, Victoria; Jubilee House, Putney; numerous prime Sloane Street shops. Thus, their London property portfolio contains more than 100 buildings and continues to grow.

One of the biggest initiatives by now is their plan to restore Picadilly 94, a down-at-heel GradeI-listed Palladian mansion.

The substantial overseas holdings are mainly in Europe. Some of these are pPrime coastline land spanning 6.3 kilometres, Ibiza Spain; The Lloyd’s Bank Headquarters, Monaco; Equity House, Jersey; a portfolio of retail investments across France; a series of developments across Romania; development projects in Prague, Czech Republic; prime development project Tel Aviv, Israel.

Apart from their investment enterprise, the Reuben Brothers founded the Reuben Foundation. Formed in 2002 with an initial endowment of $100 million, the Reuben Foundation is committed to the betterment of society in the UK and around the globe through focused charitable giving in the areas of education, health and the community.

Top 11 New Billionaires from IPOs in 2021 Top 11 New Billionaires from IPOs in 2021 |

9. Denise Coates

NET WORTH: $6.5 billion (Up $2 billion)

SOURCE OF WEALTH: Online gambling

|

| Photo: The Guardian |

Denise Coates was born on 26th September 1967 in England. Her nationality is English, and her ethnicity is White. She is the eldest daughter of the Peter Coates, chairman of Stoke City FC, and a director of Bet365. She also has a brother named John Coates. About her education, she earned a first-class degree in econometrics from the University of Sheffield. She is Christian by religion, as of 2020 she celebrated her 53rd birthday with her parents.

Denise Coates purchased the domain name Bet365.com in the month of January 2000, and she spent a year creating a new online betting site. Bet365 was launched in the year 2001. The business borrowed $20 million from RBS against the family betting shop estate. In the year 2005, these shops were sold to Coral for $50 million, which also paid off the loan to RBS.

Bet365 has grown into one of the world’s largest online gambling companies, with the $2 billion in revenues and facilitating $45 billion in bets in the year through March 2016.

Apart from that, the company also owns a majority stake in the Stoke City Football Club. Bet365 moved its headquarters to Gibraltar because of its favorable regulations in 2015.

She still runs the company alongside her brother, and Co-CEO, John Coates.

She is the majority shareholder, with 50.1% of Bet365. In the year 2017, she was criticized for paying herself $300 million with Mike Dixon, CEO of Addaction, saying, “It cannot be right that the CEO of a betting company is paid 22 times more than the whole industry ‘donates’ to treatment.”

10. Christopher Hohn

NET WORTH: $5.9 billion ($900 million)

SOURCE OF WEALTH: Hedge funds

|

| Photo: Financial Time |

• Activist investor Chris Hohn founded London-based hedge fund, the Children's Investment Fund, in 2003.

• The son of a Jamaican car mechanic, Hohn attended Southampton University in the U.K. and got his MBA at Harvard.

• He briefly worked in consulting and private equity, before joining Richard Perry's hedge fund, Perry Capital in 1996.

• He opened Perry's first U.K. office and launched his own portfolio, then left to start Children's Investment Fund.

Top 10 Richest Billionaires in India Top 10 Richest Billionaires in India India has the second-largest population in the world. In spite of the ongoing global coronavirus pandemic, the total wealth of billionaires in India increased by ... |

Who is the Richest Black Woman in the World? Who is the Richest Black Woman in the World? There are a bunch of wealthy self-made black women in the worth in these days and ages. But, who is the richest black woman in ... |

Top 7 Richest Black Americans Top 7 Richest Black Americans Annually the compile list of the wealthiest people in the world is revealed including the top richest billionaires, top richest woman, and man… from around ... |

How many American Billionaires in 2021 and Fact About the List of Richest People How many American Billionaires in 2021 and Fact About the List of Richest People Fact About America's billionaires 2021: According to data from billionaire lists compiled and updated by Bloomberg and Forbes, Most of America's richest continue to ... |