What is the stock market and how does it operate? Its types, history, and other aspects

What Time Does the UK Stock Market Open & Close? What Time Does the UK Stock Market Open & Close? |

Can Foreigners Buy Or Invest In UK Stock Market? Can Foreigners Buy Or Invest In UK Stock Market? |

|

| What Is The Stock Market and How Does It Work? |

| Table of Contents |

Stock markets are some of the most important parts of today’s global economy. If you want to invest in stocks right now, you must first understand what the stock market is and how it operates. The stock market is a marketplace for investors to buy and sell investments, most commonly stocks, which are shares of ownership in a publicly traded company.

To know more about the details, keep reading KnowInsiders.com article to understand deeper before investing in the stock.

What is the stock market?

People can buy and sell shares of companies on the stock market depending on how much they anticipate their future value to be. The New York Stock Exchange in the United States and the London Stock Exchange in the United Kingdom are two of the larger stock exchanges in the world. Every share of stock you purchase entitles you to one share of the business you are purchasing it from.

The best way to gauge a stock market's performance is to examine the value of its major indexes. The S&P 500 in the United States, the FTSE 100 in the United Kingdom, and the Nikkei Index in Japan are a few examples of indexes that include the best-performing companies on the stock market.

The stock markets frequently move up or down, and when you see that in the news, it usually means that the stock market indexes have also moved. Investors who engage in stock market trading seek to profit from changes in stock prices, which refers to the value the index as a whole gains or loses.

History of The Stock Market

Early stock and commodity markets

The 1500s saw the advent of the first real stock markets. There were, however, many early instances of markets that were comparable to stock markets.

For instance, France had a system where courtiers de change handled agricultural debts across the nation on behalf of banks in the 1100s. The men effectively traded debts, making it the first significant example of brokerage.

Later, it was claimed that Venetian traders had begun dealing in government securities as early as the 13th century. Soon after, traders in government securities also started operating in the nearby Italian cities of Pisa, Verona, Genoa, and Florence.

The world’s first stock markets (without stocks)

The first stock exchanges in the world were typically located in Belgium. In the 1400s and 1500s, Bruges, Flanders, Ghent, and Rotterdam in the Netherlands all had their own "stock" market systems.

However, it is widely acknowledged that Antwerp had the first stock market system in the world. The influential Van der Beurze family called Antwerp home, and the city served as Belgium's commercial hub. Early stock markets were therefore frequently referred to as Beurzen.

One thing was missing from all of these early stock markets: stocks. Although the institutions and infrastructure resembled modern stock markets, no one was actually trading company shares. Instead, the markets handled matters relating to the government, corporations, and personal debt. Despite the fact that the actual properties being traded were different, the system and organization were similar.

The world’s first publically traded company

The East India Company is frequently cited as the first publicly traded company in history. The East India Company became the first publicly traded company for one straightforward reason: risk.

Simply put, it was too risky for any one company to sail to the far reaches of the planet. Explorers sailed to the East Indies in large numbers when it was discovered that it was a haven of riches and trade opportunities. Unfortunately, very few of these journeys returned home. After ships went down and money was lost, financiers realized they needed to take action to reduce all of the risk.

As a result, in 1600, a special corporation known as the "Governor and Company of Merchants of London trading with the East Indies" was established. The renowned East India Company was the first business to employ a limited liability structure.

Investors came to the realization that investing in East Indies trading was not something they should do with all of their "eggs in one basket." Say there was a 33% chance that a ship leaving the East Indies would be captured by pirates. Investors could buy shares in several businesses rather than risk losing all of their money on a single venture. The investor would still be profitable even if one ship out of three or four invested companies was lost.

The strategy worked out very well. Similar charters had been granted to additional businesses in Belgium, the Netherlands, France, and England within a decade.

The Dutch East India Company issued shares on the Amsterdam Stock Exchange in 1602, making it the first publicly traded company in history. Investors received shares of stock and bonds in exchange for their money, and they also received a fixed share of the East India Company's profits.

Read More: Top 10 Largest Stock Exchanges In The World

Selling stocks in coffee shops

|

| Photo: KnowInsiders |

Investors used to conduct business in coffee shops before they shouted across trade floors and threw order forms into the air. Investors traded early stocks with one another in coffee shops. These stocks were handwritten on sheets of paper.

In other words, because investors would go to coffee shops to buy and sell stocks, these places were the first true stock markets. A dedicated market place where businessmen could trade stocks without having to place a coffee order or shout across a crowded café soon became apparent as a way to make the entire business world more efficient.

The first stock market bubble

In those early days, no one really recognized the significance of the stock market. Though its strength and value were acknowledged, nobody truly grasped its full potential.

Because of this, the stock market's early years were chaotic. Businesses in London would open up over night and issue shares of some illogical new venture. Many times, businesses made thousands of pounds before a single ship even sailed out of the harbor.

There was no regulation and little that could be done to distinguish between legitimate and illegitimate businesses. Consequently, the bubble quickly deflated. Company dividend payments to investors ceased, and the English government forbade the issuance of shares until 1825.

The first stock exchange

Even though issuing shares was prohibited, the London Stock Exchange was formally established in 1801. This was a very restricted exchange because corporations were not permitted to issue shares until 1825. Because of this, the London Stock Exchange was able to stop the emergence of a true world superpower.

Because of this, the founding of the New York Stock Exchange (NYSE) in 1817 was a crucial turning point in human history.

Since its very first day, the NYSE has traded stocks. Contrary to popular belief, the NYSE wasn't the country's first stock exchange. That distinction belongs to the Philadelphia Stock Exchange. However, the lack of any domestic rivals and the NYSE's location in New York at the epicenter of American trade and economics quickly led to it becoming the most powerful stock exchange in the nation.

The primary stock exchange for Europe was the London Stock Exchange, whereas the primary exchange for the rest of the world was the New York Stock Exchange.

Modern stock markets

Today, almost all nations in the world have their own stock exchange. Major stock markets typically began to develop in the developed world in the 19th and 20th centuries, not long after the London Stock Exchange and New York Stock Exchange were established. All of the world's major economic powers, from Switzerland to Japan, have highly developed stock markets that are still thriving today.

For instance, Canada established its first stock exchange in 1861. According to market capitalization, that stock exchange is the biggest in Canada and the third-largest in North America. It includes companies with locations both domestically and abroad. One key factor in the TSX's high market cap is that it hosts more oil and gas companies than any other stock exchange in the world.

Even nations ravaged by war, like Iraq, have their own stock exchanges. Although there aren't many publicly traded companies on the Iraq Stock Exchange, it is open to foreign investors. Additionally, it was one of the few stock markets that was unaffected by the 2008 financial crisis.

There are stock markets all over the world, and there is no denying the significance of stock markets on a global scale. The global stock markets, which trade trillions of dollars daily, are the lifeblood of the capitalist system.

The New York Stock Exchange faced its first real rival in the 1970s after dominating the global economy for nearly three centuries. The NASDAQ stock exchange was established in 1971 by the National Association of Securities Dealers and the Financial Industry Regulatory Authority.

NASDAQ is structured differently from conventional stock exchanges and has always been. For instance, NASDAQ is entirely held on a network of computers, and all trades are carried out electronically, as opposed to having a physical location.

The NASDAQ had several significant advantages over its rivals thanks to electronic trading. It first and foremost decreased the bid-ask spread. Competition between Nasdaq and the NYSE over the years has pushed both exchanges to innovate and grow. For instance, the NYSE and Euronext merged in 2007 to form NYSE Euronext, the world's first transatlantic stock exchange.

Major stock market crashes throughout historyAny market where public perceptions are a factor will inevitably result in stock market crashes. At some point in history, crashes have happened on the majority of the major stock markets. Speculative economic bubbles naturally come before stock market crashes. When expectations for a stock's value are stretched far beyond reality, a stock market crash may result. Numerous significant crashes have occurred throughout history, such as the Terrible or Black Thursday of 1929, which was followed by Black Monday and Black Tuesday. The Dow Jones Industrial Average lost half of its value during this crash, plunging much of the world and America into a severe economic downturn and wiping out billions of dollars. Other major stock market crashes include: -Stock Market Crash of 1973-1974 -Black Monday of 1987 -Dot-com Bubble of 2000 -Stock Market Crash of 2008 Although none of these crashes came close to 1929 in severity, they all resulted in double-digit percentage losses globally. The development of electronic trading has led many to doubt the tenets of the stock market, including the efficient-market hypothesis, the theory of rational human behavior, and the theory of market equilibrium. The 1987 stock market crash was the first significant crash of the electronic trading era, and it was notable because no one really anticipated it. It wasn't preceded by significant news or world events. Instead, it appeared to have happened suddenly and for no discernible reason. In Hong Kong, where stock markets dropped 45.5% between October 19 and October 31, the 1987 crash got its start. Major stock markets all over the world had double-digit declines by the end of October. For instance, markets in Australia fell by 42%, while losses in the US and Canada were both around 23%. |

Types of Stock

|

| Photo: KnowInsiders |

Even though there are two main types of stock—common and preferred—the term "equities" is generally used to refer to common shares because of their much larger combined market value and trading volume than preferred shares.

The primary difference between the two is that, while preferred shares typically do not have voting rights, common shares typically do, allowing common shareholders to participate in corporate meetings (like the annual general meeting, or AGM), where decisions regarding the election of directors or the appointment of auditors are voted on. The reason why preferred shares are so named is because preferred shareholders receive dividends and assets before common shareholders in the event of a liquidation.2

The voting rights of common stock can be used to further categorize them. While the fundamental idea behind common shares is that each share should have an equal number of votes (one vote per share held), some businesses have dual or multiple classes of stock, each of which has a different set of voting rights. Class A shares, for instance, may have ten votes per share in a dual-class structure, whereas Class B subordinate voting shares may only have one vote per share. Dual- or multiple-class share structures are made to give a company's founders control over its finances, strategic course, and capacity for innovation.

Why are stock markets essential?

*Stock markets make it possible for businesses to raise money and be publicly traded. Ownership and capital transfers take place in a controlled, secure setting.

*Stock exchanges encourage investment. Companies can expand their operations, grow their businesses, and add jobs to the economy by raising capital. This investment is a major force behind economic growth, prosperity, and trade.

*Stock markets offer a way for investors to invest money in order to possibly share in a company's profits (while also being aware that there is a risk of loss). Due to the extensive liquidity in the majority of the major stock markets, active investors and traders can easily buy and sell their securities.

Why trade stocks?

There are numerous reasons why companies, banks, funds, investors, and traders buy and sell company stocks:

Investment Gains

Stock ownership may help your money grow. Over the long term, the benefits of investing in stocks typically far outweigh those of holding money in lower-return assets like cash.

Diversification

Trading a variety of stocks can assist you in distributing your risk among various economic sectors, geographic locations, and asset classes. This will increase your portfolio's potential for profitable returns.

Income

Some stocks provide income as regular dividends, even if the stock has lost value. That is income you can keep or reinvest. You can also register votes in company activities.

Control

Every day, millions of shares are traded in stocks, making it simple for you to trade, buy, and sell shares whenever you want. You can choose which company to invest in and when thanks to this freedom.

Owning a piece of a company's present and future is possible through stock trading. The advantages can be numerous and diverse, depending on your risk tolerance and timeframe.

What is the difference between Stock Market vs Stock Exchange?

|

| Photo: KnowInsiders |

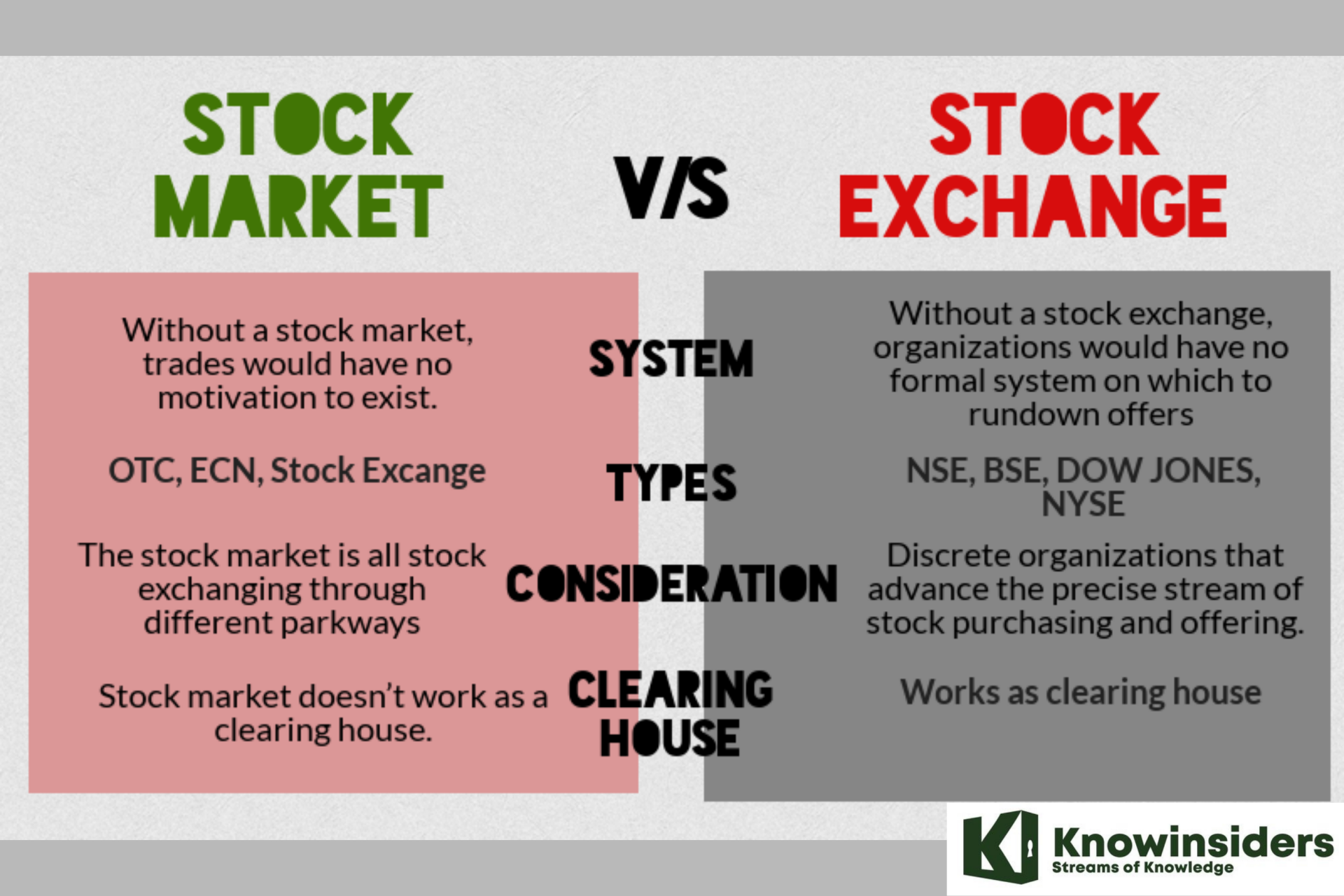

The stock market and stock exchange are not the same things, even though the terms are frequently used interchangeably. Consider a stock market as a whole rather than as a collection of individual stock exchanges, such as the Nasdaq or New York Stock Exchange (NYSE) in the United States.

When people discuss the stock market's performance, they are referring to the thousands of publicly traded companies that are listed on various stock exchanges. Furthermore, the stock market can be thought of as covering a very wide range of securities aside from just stocks, such as bonds, mutual funds, exchange-traded funds (ETFs), and others.

How does the stock market work?

The idea behind how the stock market operates is fairly straightforward. The stock market enables price negotiations and trades between buyers and sellers.

You may be familiar with the New York Stock Exchange or the Nasdaq, two of the exchanges that make up the stock market. An initial public offering, also known as an IPO, is a process by which businesses list shares of their stock on an exchange. These shares are bought by investors, enabling the company to raise capital for business expansion. The exchange then tracks the supply and demand of each listed stock, and investors can trade these stocks among themselves.

Supply and demand play a role in determining the price of each security or the prices at which investors and traders on the stock market are willing to buy or sell.

The highest price that buyers are willing to pay, known as a "bid," is typically less than the price that sellers "ask" for in return. The bid-ask spread is the name given to this difference. A buyer must raise his price or a seller must lower hers in order for a trade to take place.

Even though it may seem complicated, the majority of price calculations are usually performed by computer algorithms. When purchasing stock, you can view the bid, ask, and bid-ask spread on your broker's website. However, in many cases, the difference will only be a few cents, so novice and long-term investors won't need to worry too much.

In the past, stock transactions probably happened in a real-world marketplace. The stock market operates electronically these days thanks to the internet and online stockbrokers. Each trade is conducted stock by stock, but due to news, political developments, economic reports, and other factors, overall stock prices frequently move together.

How volatile is the stock market?

The stock market is naturally erratic, and a variety of factors influence this erratic behavior. Market changes may be influenced by regional and national economic factors, such as tax and interest rate policies. For instance, the stock market may be severely impacted if a bank sets short-term interest rates for overnight borrowing.

Long-term stock market trends and volatility may be influenced by additional factors, such as a shift in inflation trends. For instance, a major weather event that affects a significant oil-producing region could cause an abrupt rise in oil prices. The cost of stocks with an oil focus may also rise as a result of this rise.

Another element influencing the volatility of the stock market is political uncertainty. Global stock markets were quickly affected by the US election in November 2020, and trade agreements between powerful nations can also affect stock prices.

A major world event can also cause the stock market to fluctuate greatly. The global stock market impact of the coronavirus pandemic is depicted in the graph below.

What are the risks of investing in the stock market?

|

| Photo: KnowInsiders |

The biggest danger of stock market investing is the possibility of losing all of your money if the value of the stock you own drops to zero, as might happen if the company in which you own stock declares bankruptcy.

A market crash occurs when the value of the stock market drops by less than 10%. A severe market collapse could even start a recession. There have been a number of well-known stock market crashes throughout history, including the "Black Tuesday" Wall Street crash in 1929 and the financial crisis that followed the US housing bubble in 2008.

A bear market is one in which the price of stocks drops by 20% from its peak. Any asset class is susceptible to bear markets, which have the potential to reverse years of gains.

You run the risk of losing money if you buy and sell stocks. Day trading is viewed as risky by some due to the lack of any profit guarantees. Long-term stock market investing, as opposed to short-term trading, may, however, be more profitable, but you still need to be aware of the dangers of market crashes.

What is the stock market doing today?Investors frequently use a broad market index, such as the S&P 500 or the DJIA, to monitor the performance of the stock market. The top ten stock markets in the world today reflect the shifting roles that various nations have played throughout history. The top 10 stock markets today include both markets in developed nations and markets in Asia's developing regions. Here are the top 10 stock markets in the world today ranked by market capitalization:

Other rising stock markets outside of the top 10 include the Bombay Stock Exchange based in Mumbai, India, as well as the BM&F Bovespa stock exchange based in Sao Paulo, Brazil. |

How to Invest in the Stock Market

If you want to invest in the stock market, the process to get started is easier than you think:

-Decide what kind of account you want to open. From retirement savings to college savings, from short-term goals to long, there really is an investment account for everything.

-Open a brokerage account. Once you’ve decided what kind of account you want, you’re ready to open an account at a provider called a brokerage. When choosing a company, consider its fees and available investment options.

-Deposit money. To get started, you need to make an initial deposit. You can also set up recurring deposits to automate your investments going forward.

-Choose your investments. Once your account is open, you can buy and sell securities. You can opt for individual stocks and bonds or mutual funds, index funds, and exchange-traded funds (ETFs) that contain hundreds of individual securities. Many experts recommend a diversified, fund-based approach to minimize the risk anyone bad investment loses you money.

-Purchase your investments. Once you’ve settled on what you want to buy, simply enter the ticker symbol in the buy field and indicate how many shares you want to buy.

When do stock markets close around the world?

The fact that there are stock markets in almost every country on the planet is one of the many benefits of having them. The majority of stock markets around the world open between 9:00 and 10:00 am local time, and they close between 4:00 and 5:00 pm. The 9:30 opening time applies to the NYSE, NASDAQ, TSX, and Shanghai Stock Exchange.

A lunch break is also taken by some stock markets. In the middle of the day, four significant Asian markets take a lunch break that lasts between an hour and an hour and a half. The Tokyo Stock Exchange, Hong Kong Stock Exchange, Shanghai Stock Exchange, and Shenzhen Stock Exchange are a few of these markets.

Some international stock markets are still open on American public holidays because different countries observe different holidays on different days of the year.

Read More: What time does the global stock market open and close?

What is the future of the stock market?

The existence of stock markets won't end soon. They continue to be a major economic force in almost every nation on earth. Analysts are unsure of what the stock market's future holds, but there are some crucial factors to take into account.

First of all, the NYSE continues to be the biggest and (potentially) the most influential stock exchange in the entire world. In fact, it is so big that its market capitalization is greater than the sum of Tokyo, London, and NASDAQ.

Second, over the ensuing years, stock markets will probably continue to converge. Some have even predicted that there will one day be just one global stock market, but this seems unlikely.

Whatever the stock market's future may hold, they will continue to play a significant role in global economies for the foreseeable future.

What is the largest stock market in the world today?There have been stock exchanges for more than 200 years. The venerable NYSE can be traced back to a meeting of 12 brokers in Lower Manhattan in 1792, when they agreed to trade securities for commission.5 Under the terms of the agreement, New York stockbrokers reorganized as the New York Stock and Exchange Board in 1817 and made some significant changes.14 Based on the combined market capitalization of all the companies listed on the exchange, the NYSE and Nasdaq are the two biggest exchanges in the world. Nearly two dozen U.S. stock exchanges are listed with the Securities and Exchange Commission, but the majority are owned by the NYSE, Nasdaq, or CBOE.15 The 20 largest exchanges worldwide are shown in the table below, ranked by the combined market value of the companies that trade on those exchanges. Read More: Top 10 Largest Stock Exchanges In The World |

Top 10 Best Online Stock Brokers for Non-US Residents Top 10 Best Online Stock Brokers for Non-US Residents If you are looking to invest in the US stock market, below is a list of the 10 best online brokers for non-US residents. |

Top 9 Most Expensive Stocks In The World Top 9 Most Expensive Stocks In The World Stock price is an indicator of a company's market value, but the price of a share of stock will also depend on the number of ... |

Three Stocks Predicted to Soar In Next Ten Years Three Stocks Predicted to Soar In Next Ten Years Due to uncertain developments of megatrends, it is predicted that these stocks would flourish in the next decades. Let’s check out what are they? |