Three Stocks Predicted to Soar In Next Ten Years

|

| Illustrative photo. |

Energy Stock

As energy stocks have bounced back, some are good additions to a portfolio since they have higher amounts of free cash flow and lower debt levels. Crude oil prices could be less volatile in 2021 since the outlook for the energy market is positive as the economy recovers, says Michael Underhill, chief investment officer of Capital Innovations in Pewaukee, Wisconsin. The U.S. Energy Information Administration projects that the share of renewables in the electricity generation mix will increase from 21% in 2020 to 42% in 2050, Yahoo News reported.

NextEra Energy (NYSE:NEE) as a great dividend growth stock, but that's only because the company has tremendous growth prospects in a disruptive industry, according to Fool.

NextEra Energy started off in 1925 as a traditional utility, then called Florida Power & Light, but it ventured into alternative energy as early as the '90s. By 2009, NextEra had become the largest wind and solar energy producer in the United States. That early-mover advantage into renewable energy, coupled with aggressive growth moves, has turned NextEra Energy into the world's largest solar and wind energy company today.

Chevron Corp. (CVX)

Chevron has maintained a generous dividend yield of 5.43%. The oil behemoth acquired Noble Energy, another oil producer, in a $5 billion all-stock deal last July. Chevron exhibits many qualities of the classic value stock, says Robert Johnson, a finance professor at Creighton University's Heider College of Business in Omaha, Nebraska. It sells at a price-to-sales ratio of 1.84, considerably lower than the price-to-sales ratio of the S&P 500 of 2.88, and also sells at a price-to-book ratio of 1.36, roughly a third of the market price-to-book ratio of 4.27, he says. "Chevron gets the Warren Buffett seal of approval," Johnson adds. "Berkshire Hathaway's stake in CVX was increased in the past quarter. In fact, it is the tenth-largest holding of Berkshire Hathaway (BRK.A, BRK.B) at 1.52% of the portfolio."

Read more: Dating App Bumble IPO: Prices, Potential BMBL Stock and Female Founder

Healthcare stock

|

The healthcare industry has been one of the strongest drivers of GDP growth in recent decades, which has translated into massive returns for healthcare stocks. The healthcare sector’s total return of 296% during the 2010’s only trailed two other sectors, technology and consumer discretionary.

Some of the biggest winners during the decade were managed care providers and health insurers, which rode the Affordable Care Act to massive returns. Biotech and medical device companies were also strong performers.

That trend is expected to continue in the decades to come, with health spending projected to outpace GDP growth in the majority of OECD countries over the next decade, resulting in health spending per capita reaching an estimated 10.2% of GDP by 2030, up from 8.8% in 2018. In the U.S, the Centers for Medicare and Medicaid Services Office of the Actuary projects that healthcare will account for 19.4% of GDP in 2027, up from 17.9% in 2017, driven by an aging population and price increases.

E-commerce stock

E-commerce is defined as the business platform that allows individuals to market and purchase items over the internet. The platform has helped businesses reach a wider market by providing a more efficient alternative to purchasing products.

The ongoing digitalization of the modern world has helped make E-commerce become widely popular in our society. In 2019, an estimated 1.92 billion people globally purchased goods and services online. During the same year, e-retail sales were $3.5 trillion worldwide.

Shopify (NYSE:SHOP) is only scratching the surface, having cornered only 8.6% of the U.S. retail e-commerce so far. The company's unique selling proposition (USP) is its platform that enables merchants of all sizes to easily create digital storefronts and manage the entire sales process. From entrepreneurs to larger brands, Shopify has something for everyone.

Over the years, Shopify has aggressively expanded its international footprint; forged partnerships with big names including Amazon (NASDAQ:AMZN), Facebook, PayPal Holdings, Snap, and Pinterest, to name a few; set up multicurrency, multichannel payment options, and launched its own logistics and funding arms.

5 Top Stock Skyrocketed: Sundial Growers, Under Armour 5 Top Stock Skyrocketed: Sundial Growers, Under Armour Sundial Growers, Under Armour, Atlas Crest Investment, TreeHouse Foods and NIC are five top Stocks Skyrocketed. Traders are ramping up their bets on these stocks. |

Update - The Top Rocket Stocks and and Best Predictions for Stock Market in the Future Update - The Top Rocket Stocks and and Best Predictions for Stock Market in the Future The Top Robinhood & Rocket Stocks - Update: Shares must be recording accelerating earnings growth, strong profitability, and meet additional fundamental requirements that we've found ... |

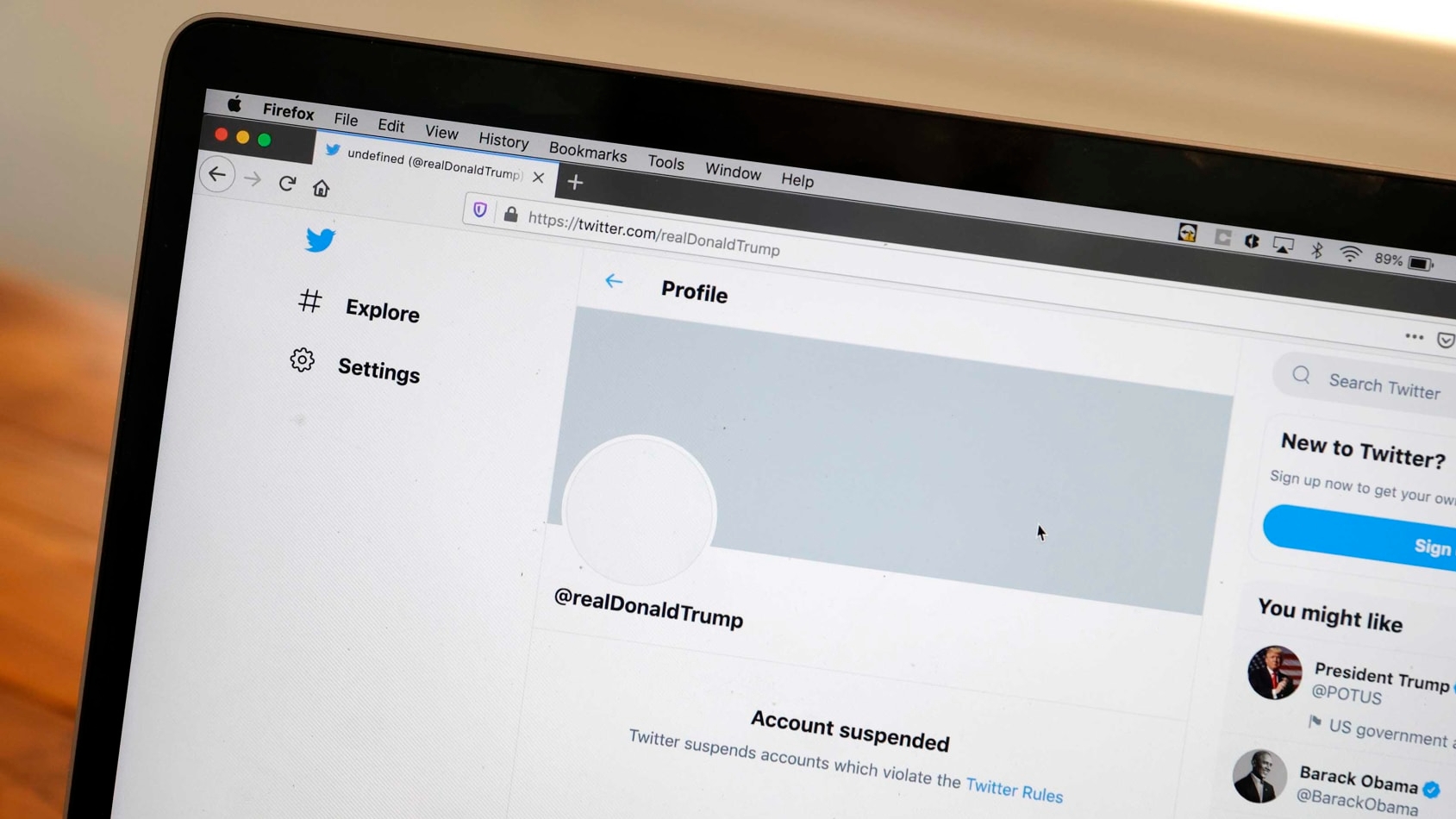

Big Tech stocks tumble following Trump’s banning: How the situation, Recommends for investors Big Tech stocks tumble following Trump’s banning: How the situation, Recommends for investors Stock prices of several Big Tech firms including Twitter, Facebook, Microsoft … dropped after banning President Donald Trump. |

Top 10 Stocks Should to Buy During Covid-19 Pandemic Top 10 Stocks Should to Buy During Covid-19 Pandemic For a lot of people, the arrival of 2021 is welcome. It’s understandable that after months of chaos, tragedy and uncertainty, everyone is looking ahead ... |

These Stocks Predicted to Soar in 2021 These Stocks Predicted to Soar in 2021 Technology and environmental stocks have been the big winners of 2020, but which stocks will skyrocket next year? Check out this article to know what ... |