Top 10 Stocks Should to Buy During Covid-19 Pandemic

|

| Top 10 stocks to buy during Covid-19 |

Given the strong possibility of economic recovery in 2021, it might be tempting to fill up your portfolio with every laggard stock that got crushed during the pandemic in 2020. But the new year doesn’t promise any less uncertainty than its predecessor, so investors should remain cautious, as always.

“The unknown question is how people will react to taking the vaccine, and how quickly people will feel comfortable returning to some semblance of normality,” says Judith Lu, founder of Blue Zone Wealth Advisors.

This suggests caution when picking the stocks that will be poised for a big rebound in 2021. Major brokerages, such as Wells Fargo, UBS and J.P. Morgan, and the experts we’ve interviewed for this piece, offered a nuanced look at the 2021 outlook.

Just remember, the 2021 stocks listed below are merely suggestions based on expected macroeconomic trends. Think of them as thoughtful advice about the year to come as they are not in any way recommendations to buy a particular stock.

Here are the top 10 stocks that can manage the coronavirus well in 2021.

1. Amazon

|

| Photo: Bloomberg |

At times when people favor staying home and avoiding crowds, they turn to online shopping. Clearly, e-commerce giant Amazon.com (NASDAQ:AMZN) has benefited since the start of the crisis.

Earlier this year, customers were turning to Amazon for essentials during a lockdown. The company's wide variety of services made it a one-stop-shop. Those same customers could also shop for general merchandise and, through Prime membership, watch films and download e-books. All this was exactly what consumers were looking for as they were forced to spend more time at home.

Amazon ramped up staffing to make sure it could meet this growing demand. This year, the company hired more than 400,000 employees worldwide. And its delivery-service partners have recruited about 75,000 new drivers since February, Fool cites.

The retailer's efforts are showing in this year's earnings reports. For example, in the third quarter, revenue rose 37% to more than $96 billion. And net income tripled to $6.3 billion. Both metrics reached their highest levels ever in this most recent quarterly report.

If the coronavirus crisis continues through 2021, consumers will continue to favor online shopping. And that's likely to translate into more revenue and profit increases for Amazon.

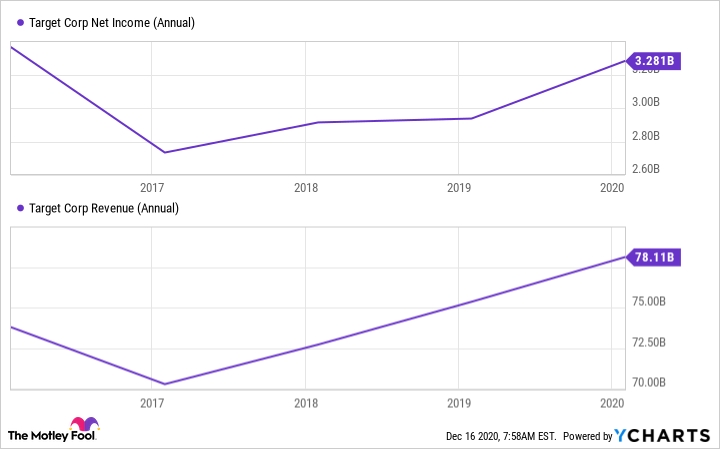

2. Target

|

| Photo: The Motley Fool |

Like Amazon, Target (NYSE: TGT) provided all that customers needed right from the start of the crisis -- essentials and general merchandise. And like Amazon, Target provided the option of a contactless experience. Customers could order online, then select same-day delivery, drive-up, or pickup. These same-day services soared 217% in the third quarter. And digital sales surged 155%.

Customers haven't crowded the aisles at Target's stores throughout the crisis, but these stores still played a central role in the company's success. In the third quarter, for instance, stores fulfilled more than 95% of the companies online sales. This is significant because store fulfillment leads to shipping cost savings for Target. Per unit, it's 90% less expensive for Target than when the retailer ships items from a warehouse.

Target continues to work toward accommodating the customer's preference for contactless experiences. The company doubled the drive-up parking spaces it sets aside in its store lots this holiday season (compared to last year). And Target has made fresh and frozen grocery products available through pick-up and drive-up at more than 1,600 stores. Target's location in the heart of neighborhoods and its focus on contactless-pickup options set it up for success through the next stages of the pandemic.

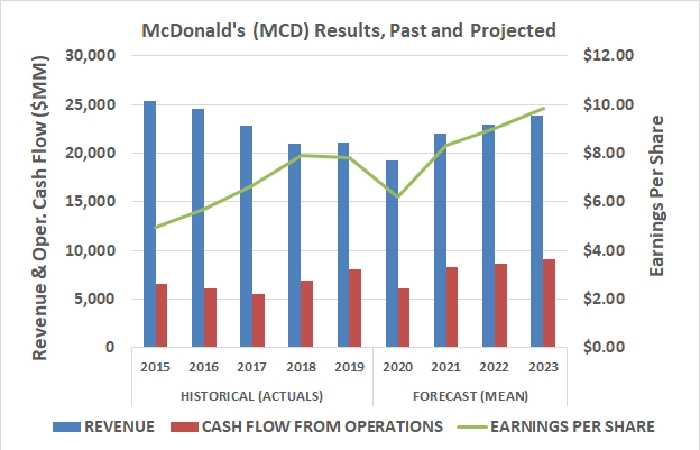

3. McDonald's

|

| Photo: Nasdaq |

McDonald's (NYSE:MCD) didn't have an easy time of it at the start of the coronavirus outbreak. Though 75% of the chain's restaurants remained open during the height of the crisis, potential customers were more focused on stockpiling essentials at home than eating out.

But the recovery is happening quickly. And that's even as cases of coronavirus climbed at times during McDonald's' third quarter, notes US News.

For example, in that quarter, McDonald's said sales improved from month to month. And at the end of the quarter, U.S. sales rose 4.6% for the period. Overall sales fell only 2.2% after dropping more than 23% in the second quarter.

Though the coronavirus pandemic isn't over, lockdowns and stay-at-home orders are more flexible these days. In many cases, offices and schools are starting to open back up, resulting in more people needing to be out and about on a daily basis.

4. NetEase (NTES)

|

| Photo: Via News |

Chinese online gaming company NetEase may not be expanding as quickly as Square or Amazon, but its strong track record of growth, pipeline and valuation make it an attractive growth stock to buy for 2021. Sales growth over the last five years has clocked in at more than 38% annually and remains impressive with a 27.5% growth rate just last quarter. In development are games based on already-popular franchises such as "Harry Potter," "The Lord of the Rings," "Diablo" and "Pokemon." One of several more modestly priced stocks on this list, NTES trades for just 21 times forward earnings. In 2019, the company began a policy of paying out between 20% and 30% of earnings as a dividend each quarter, a practice that currently yields 1% for investors in the Asian growth stock.

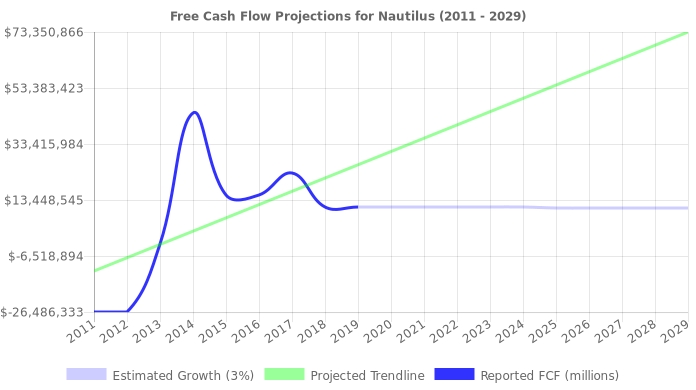

5. Nautilus (NLS)

|

| Photo: Trendshare |

Peloton (PTON) is thought of as a high-end home exercise bike company, but for the money, competitor Nautilus is a better stock to buy. Nautilus doesn't just make its namesake workout equipment. The company owns Bowflex and Schwinn, and it's following Peloton's lead by getting into the subscription trainer-led workout business. Last quarter, Nautilus revenue jumped 152% year over year. This sort of pandemic-fueled growth can't last forever, but at about 13 times forward earnings, NLS looks like a steal, especially with high-margin recurring subscription revenue set to make up a larger slice of Nautilus' overall business. Nautilus was also picked as one of U.S. News & World Report's 10 best stocks to buy for 2021 overall.

6. Alibaba Group (BABA)

|

| Photo: Markets Insider - Business Insider |

Investors shouldn't be entirely focused on the U.S. in their portfolios. When looking abroad, the single-largest market and most attractive investment landscape has to be China, with a population around 1.4 billion. Importantly, the Chinese middle class has been expanding rapidly, too – it's likely China's middle class already exceeds the entire population of the U.S. This is an enormous secular tailwind for the country's largest e-commerce company, Alibaba, which, despite doing roughly $90 billion in annual sales, grew revenue by 30% last quarter. In late December, the Chinese government announced an antitrust probe into the business, leading to a sell-off – and a nice opportunity for investors to buy BABA on the dip going into 2021 at just 17 times forward earnings.

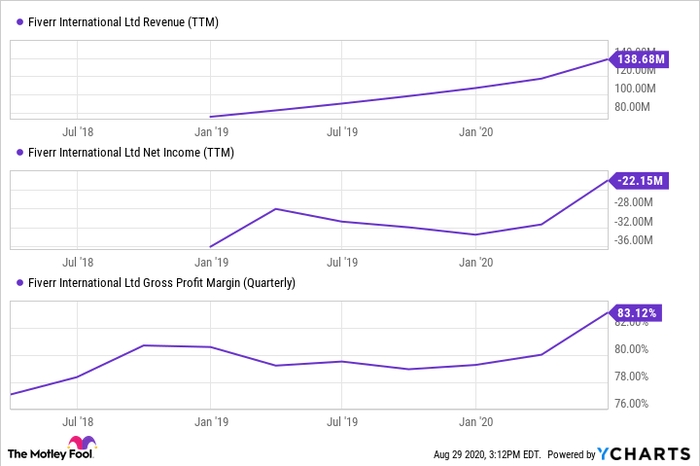

7. Fiverr International (FVRR)

|

| Photo: Nasdaq |

Fiverr is an e-commerce marketplace matching buyers and sellers in the fast-growing gig economy. Freelancers can seamlessly connect with parties looking to hire someone for a wide range of services, including design, marketing, translation, animation, programming, website creation, data entry and more. The "flywheel effect" is hard at work with FVRR. As more buyers use Fiverr to find freelance talent, growing demand attracts more sellers to the platform, bringing deeper talent and a wider range of services, in turn attracting more buyers. Fiverr is expected to break into the black and not look back when full 2020 results are in, and top-line growth is bonkers, with revenue jumping 88% year over year last quarter. Expect FVRR to be volatile. Shares have roared about 750% higher in 2020, and at more than 40 times sales, the stock isn't cheap. But with momentum and exploding profitability, FVRR is a risky growth stock worth the stretch for more aggressive investors.

8. Editas Medicine (EDIT)

|

| Photo: Markets Insider - Business Insider |

Editas is arguably the most speculative of the best growth stocks to buy for 2021, as its value is wholly derived from its potential to successfully spearhead a futuristic groundbreaking technology. One of the few pure plays on the CRISPR gene-editing technique, one of Editas' scientific founders, Feng Zhang, conducted pioneering research critical to the development of CRISPR technology, which essentially allows humans to edit DNA. The $5 billion Editas has a leading candidate in clinical trials for the treatment of the top cause of childhood blindness and filed with the U.S. Food and Drug Administration to begin clinical trials for a treatment of sickle cell disease. Although Editas' long-term prospects look promising, investors seeking to bet on the future of CRISPR in a more diversified way may consider owning a piece of Crispr Therapeutics (CRSP) as well.

9. iRobot Corp. (IRBT)

|

| Photo: Yahoo News Malaysia |

iRobot might strike some as a silly name, but take one look at the company’s financials and you'll realize it's no joke. Founded in 1990, the company makes robotic cleaning products that automate the home-cleaning process. Its two leading products are the Roomba automatic vacuum and the Braava automatic floor mop. Business is on the upswing, with revenue jumping 43% year over year last quarter as consumers placed more importance on their home surroundings amid widespread lockdowns. At about 16 times earnings, iRobot's 18% annualized earnings growth, which analysts expect in the next five years, comes at a discount. IRBT is also venturing into a new product line of educational coding robots aimed at teaching children to program.

10. Twitter (TWTR)

|

| Photo: Markets Insider - Business Insider |

Among the best growth stocks to buy for 2021 is Twitter, which has enjoyed a unique position in the market for years as a live, crowdsourced tool for unearthing current events on a real-time basis. Twitter played an important role in the Arab Spring in 2011, and 10 years later, it remains a unique technological tool and increasingly vital part of modern society. Growth in Twitter's monetizable daily active users has increased sharply in the last two years. For the first four quarters, mDAU growth ranged from 9% to 17%, while the last four quarters each saw growth between 21% and 34%. Revenue is expected to jump by roughly 22% in 2021 as advertising revenue recovers from the 2020 recession. And if talk of testing a subscription model for some aspects of Twitter manifests into action, investors will likely applaud the effort to diversify its revenue streams.

| Sectors to Avoid in 2021 A wide-scale economic reopening in 2021 means some sectors might see a slowdown. “There will be a dial-back from stocks that have benefited from Covid-19 because they may be viewed as overvalued, such as work-from-home companies and home gym companies,” says Daniel J. Laginess, investment advisor, certified public accountant and managing partner at Creative Financial Solutions. Yet that dial-back doesn’t mean all Covid boom stocks will slide back to their pre-pandemic valuations. “We will most likely see continued use of [some of these] technologies as we are now accustomed to our new way of working from home,” he says. As you review your portfolio and assess where you might be under- or over-weighted, think about stocks you own that might have benefited from Covid-related demand. Then consider what “normal-use levels” of those stocks might be. For example, did grocery stores benefit from panic purchasing? Or were subscription-based meal services over-subscribed because of pandemic restrictions? Also keep in mind that even in sectors that may succeed long term, we could be in store for some turbulence as America and the world sifts through any implications of vaccine rollout and a new presidential administration. However, Patrick Healey, certified financial planner (CFP) and president of Caliber Financial Partners, takes any potential shake-ups with a grain of salt. “There will be some short-term volatility for stay-at-home companies, but I would suspect some will continue to do well after that initial volatility based on the reset of how we do business and how we live our lives going forward,” he says. |

What’s Your Strategy for 2021?

No matter how anxious you might be to leave 2020 in the rearview, your portfolio likely benefited this year from the Covid bump: As of mid-December 2020, the S&P 500 is up more than 13% for the year and almost 64% from its March lows. That’s a good reminder to carry into the new year: Even when the market looks dreary, you never know what’s to come.

As you consider your investment opportunities for 2021, also think about your investment horizon, goals and risk tolerance when evaluating new holdings for your portfolio. While individual stocks and sectors may be positioned for a particularly good year, broad-based, low-cost index funds provide you with exposure to many of the same sectors and stocks that may make it big in 2021. They also take the burden off of you picking individual winners.

If you do opt for individual stocks, “overall, look for companies with strong profits, continued growth as well as strong dividends and dividend appreciation,” says Laginess—which is sound advice for stock selection, pandemic or no. When in doubt, you can always reach out to a financial advisor for advice tailored to your needs.

For more interesting topics, please check out our KnowInsiders!

|

There are already some fantastic new games for 2021 including for the new generation consoles - the Xbox Series X and PS5 - as well ... |

|

If you want to bring a brand-new experience and fascinating viewpoint that is totally different from those of face-to-face practice, virtual field trips are good ... |

|

Technology and environmental stocks have been the big winners of 2020, but which stocks will skyrocket next year? Check out this article to know what ... |