Full List of South Africa Stock Market Holidays: Are the Market Closed or Opened Today

|

| South Africa Stock Market. Photo: KnowInsiders |

Overview of Johannesburg Stock Exchange in South Africa

The JSE is South Africa’s main bourse, founded in 1887 by Benjamin Wollan, during a gold rush.

The discovery of gold on the banks of Witwatersrand in June 1886 began the transformation of South Africa from an agro-based economy to a mineral-based one. There was a need for a transparent marketplace for buyers and sellers to transact on these new found mineral resources. The JSE was founded to fulfill this need.

Since then, the market has evolved into one of the major exchanges of the world. The JSE acquired a number of smaller exchanges. These include the Bond Exchange of South Africa (BESA) as well as the South African Futures Exchange (SAFEX). These acquisitions enabled the JSE to act as a trading venue for up to five asset classes. Stocks, bonds, commodities and interest rate derivatives are all traded on the JSE. It has also launched the AltX, which is an exchange for small and mid-cap stocks, equivalent to the penny stocks in the US.

The JSE is also listed on the Johannesburg Stock Exchange as JSE Limited, under the ticker JSE.

Understanding the Stock Market

The stock market is a vital part of our economy. It allows both companies and investors to gain financially. Investing in the stock market is a way for you to really build real wealth. And participating in the stock market is one way companies have for getting funding needed to boost their profits (which they then share with the investor – you).

Before you begin any type of investing, it is important that you understand what choices you have available to you. Although there are various investment categories available, for the sake of keeping things simple, all categories fall under two main options; equities and bonds.

Equities

Equities (also known as shareholder equity) are made up of stocks and shares. Investing in equities allows you to purchase individual shares or stocks.

Stocks are a collection of shares from either one company or various companies. A share is one or more units or a percentage of a single company.

When you buy stock (a collection of shares) in a company, you are buying a part of that company. You essentially claim a percentage based on how much of the company you bought. You may then sell the shares in your stock to buyers who would also like to own a small unit or percentage of the company.

The number of shares that make up a stock and how much they cost depend on the company, and they change every minute. This is where we can imagine the Wall Street Stock Exchange; a lot of numbers and graphs constantly changing before our eyes…

Bonds

Bonds are a type of debt that you provide a company for the purpose of raising capital and to finance long term investments. A bond investment works on a pay out of a fixed interest rate (usually twice a year) from the money you invested. A bond allows you to create a predictable income stream above-inflation returns. This is because they offer higher annual interest rates than your traditional saving account. They are considered secured investments (because they borrowed money from you in exchange for interest) and the more you invest, the more you will receive in returns. You can invest in a variety of bonds such as, property bonds, RSA Retail Savings Bonds, Government Bonds or corporate bonds which can find through a registered online stock broker.

Investment Programs

You can invest in different types of bonds and equities individually, but many prefer to build their portfolio using an investment program. They make it a lot easier to maximize your gains and diversify between both equities and bonds. They are also perfect for those of us who aren’t full-time traders.

Let’s look at a few common types of investment programs you can start researching today.

Mutual Funds – Low Risk

Mutual funds allow investors to pool their money together and build a large portfolio fund of bonds, equities, and other commodities. The value of shares included in a mutual fund do not fluctuate every few minutes like equities purchased on their own. Instead, their worth is measured on the net asset value (NAV). NAV looks at the mutual fund’s total asset value minus any liabilities such as debt and staff salaries, then dividing the difference by the number of shares held by investors.

Exchange-Traded Fund (ETF) – Mid Risk

Like mutual funds, an ETF is also a fund that allows investors to pool their money together to maximize returns. They also contain a range of stocks, bonds and other commodities such as gold and cash value items. You buy a percentage of this fund and benefit from the net asset value (NAV). Returns are measured on industry trends rather than the individual companies’ performance.

Unlike mutual funds, which can be expensive, ETF’s don’t require a large amount of capital. This makes this type of investing a great option for beginners. They are well regulated by the Johannesburg Stock Exchange (JSE) and offer you a variety of well-known companies with proven growth track records. A common strategy used with EFT’s is “Rand Cost Averaging”. This strategy allows you to invest a fixed amount monthly regardless of whether the price of stocks and bonds go up or down. This way you average your overall investment over a long period of time to ensure you still benefit.

Exchange-Traded Note (ETN) – High Risk

ETN’s are like ETF’s but function more like a bond. The difference is that they are unsecured, and instead of investing in various companies’ bonds and stocks you invest in banks. The interest earned is not fixed and can change depending on how the bank performs. Like ETF’s you pay into them monthly, however, if the ETN that you invested in went bankrupt, you will lose your investment. If this type of investment interests you, make sure you’ve researched the risks well and you understand the marke

South Africa 2022 Holidays

|

| Photo: Christmas Genius |

The free South Africa 2022 holidays list can be printed or downloaded in PDF, Word or Excel format. The PDF format works best for those who like to print the holidays, while the MS Word and Excel holidays list can be easily modified or customized with notes, size or color changes.

| Holiday Name | Date | Day |

|---|---|---|

| New Year's Day | January 01, 2022 | Saturday |

| Human Rights Day | March 21, 2022 | Monday |

| Good Friday | April 15, 2022 | Friday |

| Easter Sunday | April 17, 2022 | Sunday |

| Family Day | April 18, 2022 | Monday |

| Freedom Day | April 27, 2022 | Wednesday |

| Workers' Day | May 01, 2022 | Sunday |

| Public Holiday | May 02, 2022 | Monday |

| Mother's Day | May 08, 2022 | Sunday |

| Youth Day | June 16, 2022 | Thursday |

| Father's Day | June 19, 2022 | Sunday |

| Nelson Mandela Day | July 18, 2022 | Monday |

| National Women's Day | August 09, 2022 | Tuesday |

| Heritage Day | September 24, 2022 | Saturday |

| Day of Reconciliation | December 16, 2022 | Friday |

| Christmas Day | December 25, 2022 | Sunday |

| Day of Goodwill | December 26, 2022 | Monday |

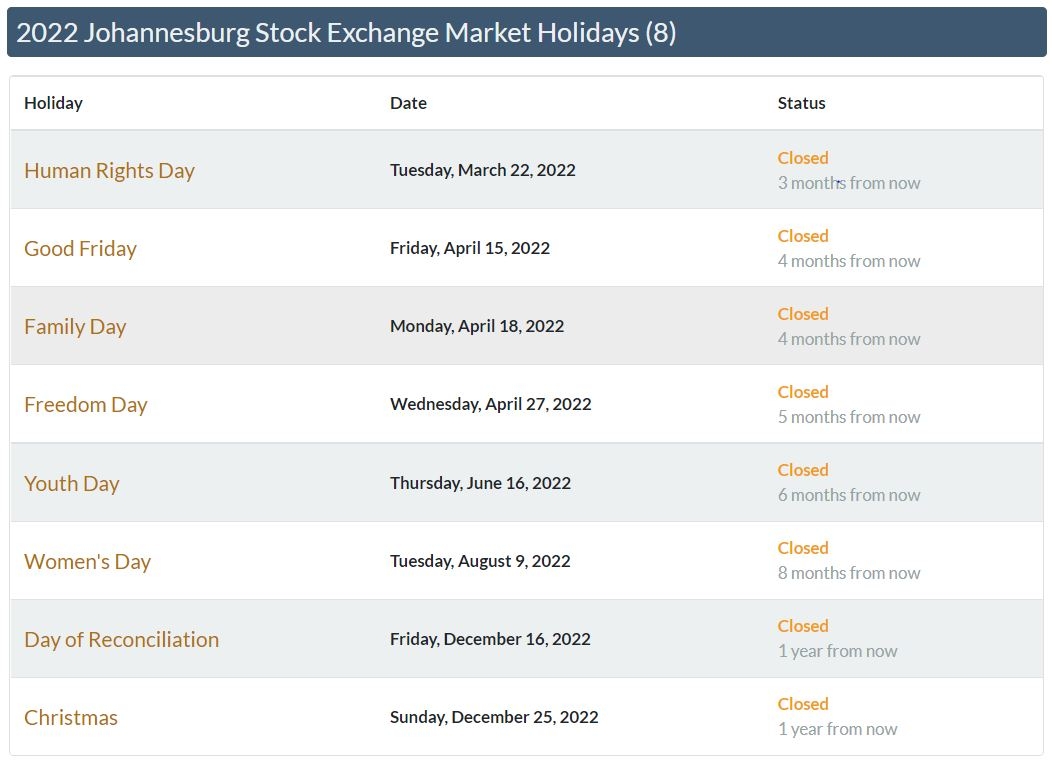

What Holidays is the South Africa Stock Market Closed in 2022?

|

| Photo: Screenshot of tradinghours |

Johannesburg Stock Exchange Trading Hours

| Time | Session |

|---|---|

| 08:30 - 09:00 | Opening Auction |

| 09:00 - 16:50 | Continuous Trading |

| 12:00 - 12:15 | Intraday Auction Call Session |

| 16:50 - 16:59:45 | Closing Auction Call Session |

| 17:00 - 17:05 | Closing Price Publication Session |

| 17:05 - 17:10 | Closing Price Cross Session |

| 17:10 - 17:15 | EOD Volume Auction Call Session |

| 17:15 - 18:15 | Post Close Sessions |

Auction Periods

|

| Photo: Bloomberg |

1. Continuous Trading Session (09:00 - 16:50)

* Regular orders may be entered, amended, and cancelled

* Regular orders will be matched

* All orders entered during this session will be added to the order book

* Regular orders will be matched

2. Intraday Auction Call Session (12:00 - 12:15)

* Orders may be entered, amended, and cancelled

* All orders entered during this session will be added to the order book

* Hidden orders may not be entered, amended, or cancelled

* Orders with 'GFA' (Good For Auction) and 'GFX' (Good For Intraday Auction) validity tags entered during the continuous trading session will be added to the order book

* Orders will be matched at the end of auction call

3. Closing Auction Call Session (16:50 - 16:59:45)

* Orders may be entered, amended, and cancelled

* All orders entered will be added to the order book

* Hidden orders may not be entered, amended, or cancelled

* Orders with GFA (Good For Auction) validity after the intraday auction call will be added to the order book

* Orders with ATC (At The Close) validity will be added to the order book

* Orders will not be matched

4. Closing Price Publication Session (17:00 - 17:05)

* Orders will not be matched

* Orders may be cancelled

* Orders with validity tags 'ATC' (At The Close), 'OPG' (At The Opening), 'GFA' (Good For Auction), 'GFX' (Good For Intraday Auction), 'IOC' (Immediate Or cancel), and 'FOK' (Fill-Or-Kill) will be rejected

* Orders with validity tags 'DAY' (Day), 'GTD' (Good Till Date), 'GTC' (Good Till Cancel), 'GTT' (Good Till Time), or 'CPX' (Closing Price Cross) may be amended

* Closing Price will be published

5. Closing Price Cross Session (17:05 - 17:10)

* Market orders entered will be eligible to participate in the closing session, excluding validity tags 'GFA' (Good For Auction), 'GFX' (Good For Intraday Auction), 'OPG' (At the Opening), and 'ATC' (At The Close)

* Limit orders with a limit price equal to or better than the published Closing Price with a valid validity tag will be eligible to participate in the crossing session

* No orders may be amended

* All orders (including market orders) entered during this session get a lower priority than orders entered during previous sessions

* Orders will be matched by time priority

* New orders may remain unmatched if there are insufficient orders on the contra side

Order Types: Limit and Market orders will be eligible to participate in the uncrossing.

JSE Market SegmentsThe JSE operates a tiered system of classification for its listed companies, and divides the securities traded on it into three market segments. These segments are as follows: Main Board: This is the primary category of listing and features the most capitalized stocks on the JSE. There are 40 of such stocks, tracked by the FTSE/JSE Top 40 index. AltX: AltX stands for “alternative exchange”, which is where small and mid-cap stocks are listed. These stocks have less capitalization than the stocks listed on the Main Board. Debt Market: The JSE also operates a bond market, where government and corporate bonds can be traded. This is the broadest market segment on the JSE as it features more products than the Main Board and the AltX. This segment features a lot of institutional participation from Africa and beyond. The JSE is the largest exchange in Africa and also has the greatest market depth because it attracts listings from international companies. Many of the world’s biggest companies also list on the JSE and are part of the JSE All-Share Index. This makes the bourse a sought-after destination for investors looking for profitable exposure to the emerging markets of Africa and their investment capital. |

What Holidays is the UK Stock Market Closed in 2022? What Holidays is the UK Stock Market Closed in 2022? The stock market closes on some UK holidays. Check out the full list of market holidays for LSE in 2022! |

What Holidays is Canada Stock Market Closed in 2022? What Holidays is Canada Stock Market Closed in 2022? Canada Stock Market is closed on some official holidays in 2022. Check out the full list of holidays. |

What Holidays is the U.S Stock Market Closed 2022? What Holidays is the U.S Stock Market Closed 2022? The US stock market closes on some US holidays every year. Scroll down to know more about the holiday time, holiday schedules of the US ... |