Top 10 Largest Stock Exchanges In The World

|

| Top Largest Stock Exchanges In The World. Photo: knowinsiders. |

| Table Content |

The great economic depression of 1929 started with a crash of the value of the shares. All the recessions that we have witnessed are closely related to the decline in the share market values. It is important to know the various stock markets available to have a better understanding of the stock market.

There are over 60 stock exchanges in today’s world, with more than 30 of them heavily active. Here in this article, we intend to discuss the top 10 stock exchange markets globally and what makes them the best 10.

The list of top 10 largest stock exchanges in the world today

1. New York Stock Exchange, United States

2. NASDAQ, United States

3. Shanghai Stock Exchange, China

4. Euronext, Europe

5. Japan Exchange Group

6. Hong Kong Exchange

7. Shenzhen Stock Exchange, China

8. London Stock Exchange Group

9. TMX Group, Canada

10. National Stock Exchange of India

*****

What are the largest stock exchange in the world?

1. New York Stock Exchange, United States

NYSE is the biggest stock exchange in the world which is located at 11, Wall Street, New York City, USA. NYSE has 2400 listed companies which include many blue-chip companies like Walmart, Berkshire Hathaway Inc, J.P. Morgan Chase, etc.

NYSE is one of the oldest stock exchanges which was founded in the year 1792. The market cap of all listed companies on NYSE is approximately $22.9 trillion as of 2021. The movement of the NYSE invariably affects trading at other exchanges on the next trading day. The NYSE lists 2400 companies, with most household names being listed there, such as JPMorgan Chase, ExxonMobil, American Express, IBM, McDonald’s, Walmart, and Nike.

The NYSE’s benchmark index is the Dow Jones Industrial Average (DJIA), a 30-stock price-weighted index of 30 prominent stocks. Even with its outsized influence, the DJIA has come under criticism because it does not represent an adequate cross-section of the companies on the NYSE.

Other well-considered indexes include the S&P 500 (tracking 500 of the largest companies in the US) and the NYSE Composite Index (a free-float MCap weighted index covering the common stock on the NYSE).

The daily average trading volume is anywhere between 2 to 6 billion shares. NYSE is the only stock exchange in the US that provides floor trading to important dealers.

|

| NYSE is the biggest stock exchange in the world. Photo: thetealmango. |

| The New York stock exchange is the world’s largest stock exchange with the highest market capital and gross value. It is often referred to as the big board. It has 2,400 listed companies spread across various domains of business. The NYSE has been the largest stock exchange ever since world war 2. The USA’s big giants, such as the coco-cola, Walt Disney ltd, are listed on the NYSE. With a market capitalization of 22.9 trillion dollars USD, NYSE stands at the top of the share marketing world. It has its headquarters located in New York. It is the oldest stock exchange with a history of 223 years. |

2. NASDAQ, United States

National Association of Securities Dealers Automated Quotations or NASDAQ is the second-largest stock exchange in the World with a market capitalization of 19.34 trillion dollars. Headquartered at 151 W, 42nd Street, New York City, NASDAQ is the World's first electronically traded stock market.

More than 3,000 companies are listed on NASDAQ, including the World's biggest tech giants- Apple, Microsoft, Amazon, Google, and Facebook. Apart from Facebook, all four companies have a market capitalization of more than 1 trillion dollars, and Facebook is not far away.

NASDAQ has gained a lot of interest in the recent past, and the interest began around the period of the dot-com bubble in the late 90s. It continues to gain more and more interest from the market participants with the advancements in technology and the development for the U.S. and the World along with the same.

The Nasdaq Composite is the NASDAQ’s benchmark MCap-weighted index, comprising most of the stocks that are exclusively listed on the exchange. To be listed on the Nasdaq Composite, the stock needs to be common stock, not preferred or exchange-traded funds.

Another notable index is the Nasdaq 100, which only includes the 100 biggest non-financial companies listed on the NASDAQ. These 100 companies make up over 90% of the Nasdaq Composite.

|

| National Association of Securities Dealers Automated Quotations. Photo: thetealmango. |

| NASDAQ, which stands for National Association of Securities Dealers Automated Quotations is the second-biggest stock exchange in the world. NASDAQ is based at 151 W, 42nd Street, New York City. NASDAQ was instituted in 1971. It is the first electronically traded stock market all across the world with a total market cap of $10.8 trillion. There is an interesting fact about the NASDAQ stock exchange which you will be surprised to know that it has no company listed from the oil and gas sector or utility sector as the exchange is more inclined towards Technology, Healthcare, and Consumer services sector. |

What Time Does The Stock Markets Open In America and Asia?

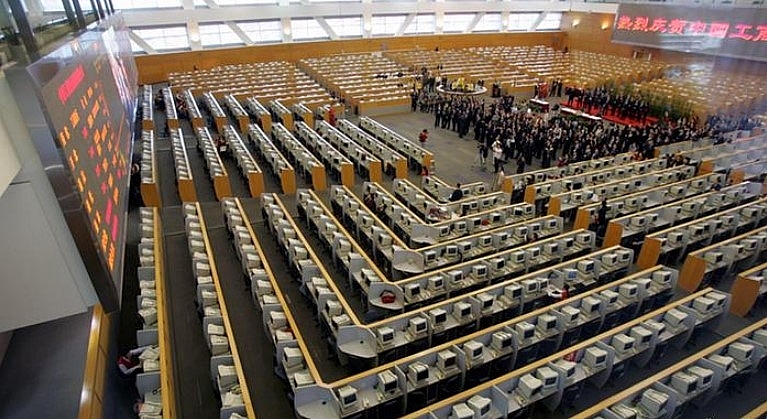

3. Shanghai Stock Exchange, China

The largest stock market in Asia, the SSE has an MCap of $6.98tn. It was founded in the year 1866 however it was adjourned in 1949 due to the Chinese revolution and its modern foundations were laid in 1990. It is a non-profit entity under the purview of the China Securities Regulatory Commission (CSRC). Capital account controls by the Chinese government mean that it is not fully open to foreign investors.

The SSE trades stocks, bonds, derivatives, and funds. Two types of stocks are available on the exchange – ‘A’ shares in the local renminbi yuan and ‘B’ shares in US dollars. As of December 2002, carefully vetted investors are allowed to invest in ‘A’ and ‘B’ shares, with a USD 80bn quota as of 2012.

The SSE’s benchmark index is the SSE Composite, comprising all stocks on the exchange. Other indexes include the SSE 50 Index (a float-adjusted capitalization index of the top 50 stocks) and the SSE 180 Index (same as the SSE 50 but for the top 180 stocks).

SSE has more than 1450 public limited companies listed on its platform whose combined market capitalization is around $4 trillion.

SSE is a little different when compared to its counterparts like NYSE, NASDAQ where market regulators impose circuit breakers to curb price volatility. Whenever there is adverse news or uncertainty Chinese government holds the right to stop trading for the day.

| The Shanghai Stock Exchange is a Chinese stock exchange or bourse based in the city of Shanghai. It is one of the three stock exchanges operating independently in the People's Republic of China. The other two are the Shenzhen Stock Exchange and the Hong Kong Stock Exchange. But the contrast to the Hong Kong Stock Exchange, the Shanghai Stock Exchange is still not entirely open to foreign investors due to tight capital account controls exercised by the Chinese mainland authorities. |

|

| Shanghai Stock Exchange. Photo: dw. |

After all, the SSE is operated by a state-owned enterprise with direct links to the Communist Party and its chairman is appointed by the central government. The company itself is not profit-oriented.

The SSE is very susceptible to even the smallest changes in economic, financial and monetary policy. It is also the ultimate testing ground for both the Chinese state and its companies to try out the market. In this context, the small investors are insignificant actors who play at their own risk.

4. Euronext, Europe

EURONEXT is an abbreviation for European New Exchange Technology. It is a pan-European stock exchange which makes it the biggest and the most liquid stock exchange in Europe and the seventh-largest stock exchange in the World.

The Amsterdam-headquartered Euronext is a pan-European stock exchange network, with an MCap of $6.65tn. Euronext operates exchanges in Amsterdam, London, Paris, Lisbon, Brussels, Dublin, Milan, and Oslo. Euronext’s offerings include equity as well as derivatives, with products such as stocks, ETFs, bonds, forex trading, options and futures, etc. It lists more debt and funds than any other exchange worldwide.

It has many flagship indexes, such as the blue-chip Euronext 100, comprising the 100 most liquid and largest stocks on the exchange. French companies make up almost 65% of this index. Noted companies include Aegon, Peugeot, Michelin, Phillips, Alstom, L’Oreal, ArcelorMittal, BNP Paribas, Royal Dutch Shell, Unilever, Schneider Electric, and so on.

Other indexes on the exchange include national indexes such as AEX (Netherland companies), BEL 20 (Belgium), FTSE MIB (Italy), and OBX 25 (Norway). Central securities depositories (CSDs) in Denmark, Italy, Norway, and Portugal provide Euronext’s custody and settlement services. Euronext has more than 1300 companies listed on its platform with a total market capitalization of more than $4.2 trillion. Its benchmark indices are AEX-INDEX, the PSI-20, and the CAC 40. The total monthly average volume is approximately $174 billion.

|

| Euronext. Photo: bloomberg. |

| It was founded on September 22, 2000, and has a market capitalization of $4.88 trillion. It is headquartered in Amsterdam, Netherlands. The top 5 companies (by market capitalization) listed on EURONEXT are Procter & Gamble, LVMH, Royal Dutch Shell, Merck & Co., and L'Oreal. |

5. Japan Exchange Group

The Japan Exchange Group was formed by the merger of the Tokyo Stock Exchange and the Osaka Securities Exchange on January 1, 2013. Together, they have a market capitalization of 6.35 trillion dollars which is very close to the market capitalizations of the third and fourth-largest stock exchanges in the World.

Its two main indexes are the Tokyo Price Index (TOPIX) and the Nikkei 225. The TOPIX ranks companies using a free-float capitalization-weighted metric, while the Nikkei 225 ranks the top 225 stocks by their price.

The TSE has two sections: the First Section comprises large companies and the Second Section includes mid-sized companies. Its trading products include stock, global equities, index funds, index futures, etc. It is well-known for its compliance and market surveillance mechanisms. Infamously however, real estate and stock price inflation in Japan came to a head in the 90s, leading to the TSE crashing and serious economic decline. This period is generally referred to as Japan’s Lost Decade.

There are more than 3,700 companies listed on the Japan Exchange Group. Almost all of these companies are listed on the Tokyo Stock Exchange. The benchmark index of the Tokyo Stock Exchange is Nikkei, and Toyota, Suzuki, Honda, Mitsubishi, and Sony are a few of the eminent companies listed here.

You will be astonished to know that TSE has suspended its operations completely for 4 years after World War II. TSE allows members to trade in Derivatives, Global Equities, Bonds, etc. TSE has more than 1000 employees on its payroll and it is best known for providing trading compliance and market surveillance.

|

| Photo: tadviser. |

| The TSE was established in 1878 and lists 3700 companies with an MCap totaling around $5.67tn. Some of the greatest companies in the world are listed on this exchange are Toyota, Honda, Mitsubishi, Sony – all household names across the world. |

What Time Does the Japan Stock Market Open & Close? What Time Does the Japan Stock Market Open & Close? When does the Japan stock market (Tokyo Stock Exchange) open or close? Check out the information below for more about the opening & closing hours, ... |

6. Hong Kong Exchange

Hong Kong comes under the category of the World's important financial hubs. Hong Kong provides an all-encompassing and high-quality financial environment to people working in the financial industry. Due to this, it has attracted a lot of foreign market participants.

Founded on February 3, 1891, the Hong Kong Exchange is the World's fourth largest and Asia's second-largest stock exchange with a market capitalization of 6.48 trillion dollars. It is almost as big as the Shanghai Stock Exchange, and provided it keeps up the tremendous pace at which it has developed in the past; it can surpass the Shanghai Stock Exchange in the near future. More than 2000 companies are listed on the Hong Kong Exchange. AIA, Tencent Holdings are the largest ones.

HKSE benchmark index is the Hang Seng Index. There are 1200 total debt securities and more than 2300 companies listed on HKSE out of which around 50% of them are from mainland China.

The total market capitalization of all listed HKSE stocks is more than 4 trillion. HKSE generates a trading volume of more than 1 million derivatives contracts per day with HSCEI futures.

In the year 2017, HKSE transitioned from the physical trading process into electronic trading. Many big business conglomerates like HSBC Holdings, AIA, Tencent Holdings, China Mobile, etc. are listed on HKSE.

|

| Photo: wikimedia. |

The Hong Kong Exchanges and Clearing Limited (HKEx) is the holding company of the Hong Kong Stock Exchange. Its formation stemmed from progressive integration of the derivative markets and securities, which saw the creation of the Stock Exchange of Hong Kong Limited (SEHK), the Hong Kong Futures Exchange Limited (HKFE), and their clearinghouses.

By operating under the supervision of the SFC, HKEx regulates and operates the market securities and derivatives. Some of the products HKEx deals with include securities, bonds, funds, and warrants.

A new applicant for listing in the Hong Kong Stock Exchange is required to generate positive cash flow from its operating activities of at least an aggregate of HK$20 million for the first two financial years immediately after listing.

7. Shenzhen Stock Exchange, China

Shenzhen stock exchange is located in Shenzhen which is popularly known as Silicon Valley of China. Shenzhen is the second stock exchange in China along with Shanghai Stock Exchange which was established on December 1, 1990.

Shenzhen is the eighth largest stock exchange in the world. Shenzhen has more than 1400 companies listed on its platform with a total market capitalization value of approximately $3.92 trillion. Its benchmark indexes include the SZSE Component Index, comprising 500 stocks and the SZSE 100, a listing of the top 100 companies on the exchange.

Although the SZSE is a self-regulatory legal entity, it is closely supervised by the China Securities Regulatory Commission (CSRC). The CSRC has the power to step in during times of high volatility. For instance, at a particular point in a stock’s price variation, it can step in and stop trading on that stock for the day.

Most of the companies listed on this exchange are based in China and all the trades shares are in Yuan currency. As most of the listed companies are China-based Chinese government has all the authority to stop trading for the day if there is any adverse news or event impacting stocks. China has two sets of shares available for investors and traders

- A-shares which are traded in local currency Yuan and

- B-shares which are trades in U.S. dollars for foreign investors

|

| Photo: thetealmango. |

| Established in 1990, the SZSE is the seventh on this list, with an MCap of around $3.9 trillion. Around 1900 companies are listed on it, with the majority of them based in China. The exchange is the trading platform for A-shares (which trade in the local currency) and B-shares (trading in US dollars for foreign investors), as well as other common instruments, such as mutual funds, options and futures, ETFs, etc. |

8. London Stock Exchange Group

Among the oldest established stock exchanges in the world (est. 1801), the London Stock Exchange - LSE has more than 3000 listed companies totaling an MCap of $3.71 tn. The LSE set up the first benchmark price, market, and equity-market liquidity data in Europe. Its benchmark index is the Financial Times and London Stock Exchange (FTSE) 100 index. Other indexes include the FTSE 250, the FTSE 350, and the FTSE All-Share index.

There LSE has two markets to trade on — the Main Market, which has over 1300 big companies all over the world. The other market is the Alternative Investment Market, an international market for smaller cap companies.

The LSE’s secondary market instruments include bonds, derivatives, ETFs, debt securities, exchange-traded commodities (ETCs), global depository receipts (GDRs), gilt-edged securities, among others.

The LSE merged with Borsa Italiana S.P.A, the Italian stock exchange, in June 2007, with the merged entity called the London Stock Exchange Group (LSEG).

The London Stock Exchange Group (LSEG) is a stock exchange and financial information company headquartered in London. It owns the London Stock Exchange, Refinitiv, LSEG Technology, FTSE Russell and has a majority stake in LCH and Tradeweb.

Located at the heart of the World's financial center, more than 1300 companies are listed on the LSEG, providing it a market capitalization of $3.67 trillion. A few big companies listed on the LSEG are Barclays, British Petroleum, Toyota Motors, Unilever, HSBC, and AstraZeneca.

LSE was the world’s largest stock exchange until the occurrence of World War I. Later NYSE toppled LSE to become the world’s biggest stock exchange after the end of world war I.

Many big prominent British companies like Barclays, British Petroleum, Vodafone, GlaxoSmithKline among others are listed on LSE.

|

| Photo: PA/thetealmango |

| London stock exchange which is one of the oldest stock exchanges in the world is owned and administered by the London Stock Exchange Group. LSE, which was established in 1698 ranks seventh in the list of the world’s largest stock exchanges. There are approximately 3000 companies listed under the London Stock Exchange with a combined market capitalization of more than 3.7 trillion dollars. |

What Time Does the UK Stock Market Open & Close?

9. TMX Group, Canada

Canada hosts the tenth largest stock exchange and the last member of our list- the TMX Group, headquartered in Toronto. TMX group owns the two stock exchanges in Canada-Toronto Stock Exchange (TSX), which serves the senior equity markets (mid-cap and large-cap companies are listed here), and TSX Venture Exchange (TSXV), which serves the public venture equity market (small-cap companies are listed here). It has a market capitalization of $2.5 trillion.

Toronto Stock Exchange is owned and operated by the TMX group. TSE was established in 1852 and is located in Toronto, Canada. TSE has around 2200 listed companies with a total market capitalization of $2.1 trillion.

The TSX has 2231 listed companies as of November 2019, totaling an MCap of $3.1tn. Financial instruments traded on the TSX include exchange-traded funds (ETFs), equities, bonds, futures and options, commodities, investment trusts, etc. The TSX has a special affinity for oil and gas (O&G) and mining companies, with more such companies listed on it than any other stock exchange in the world. On average, its monthly trading volume is around $97bn. In the 2010-11 period, the TSX was looking to merge with the London Stock Exchange (LSE), hoping to make it an entity with an MCap of almost $6tn. However, talks broke down since the proposition did not receive the required 67% approval from TSX shareholders.

The TSX’s benchmark index is the Standard and Poor (S&P)/TSX 60, mainly dominated by energy companies.

Multiple financial instruments like Real estate investment trusts, Stocks, Bonds, Commodities, ETF’s, etc. are traded on Toronto Stock Exchange whose average monthly trading volume is $97 billion.

|

| Photo: the balance |

TSE was recently in the news to merge itself with the London Stock exchange however the deal did not go through as shareholders rejected the proposal.

Around 1,500 companies are listed on the TSX and around 1,600 companies on the TSXV. A few of the big companies listed on the TSX are Fortis, CGI, National Bank of Canada, Franco-Nevada and Rogers.

10. National Stock Exchange of India

National Stock Exchange (NSE) is one of the two stock exchanges in India. The other and the older one is the Bombay Stock Exchange (BSE).

Established in April 1993 and located in Mumbai, Maharashtra, NSE has a market capitalization of $2.57 trillion and is the ninth-largest stock exchange in the World. It is the largest derivative stock exchange in the World.

NIFTY is the benchmark index of NSE. A few of NIFTY's prominent constituents are Reliance, HDFC Bank, Infosys, HDFC, ICICI Bank, Tata Consultancy Services, and Kotak Mahindra Bank. The benchmark index of BSE is Sensex.

As of May 2021, the Mumbai-based NSE has reached an MCap of $3tn. It is the youngest stock exchange on this list, having only been in existence since 1992 as India’s first dematerialized (demat) electronic exchange. It has over 1950 companies listed on it. Its flagship index is the NIFTY 50, comprising the top 50 stocks on the exchange. The index is a primary indicator of the Indian stock market’s health, with domestic as well as foreign investors keeping a keen eye on it.

|

| Photo: eduwar |

The NSE’s position in India is continuously threatened by the venerable Bombay Stock Exchange (BSE), which has an MCap of around $3.1tn as of May 2021. Set up in 1875, the BSE is Asia’s first stock market. It lists around 5000 companies on it. Its benchmark Sensex index consists of 30 established stocks. The BSE also allows trading in equities in China, Russia, Brazil, and South Africa.

Can Foreigners Buy Or Invest In UK Stock Market? Can Foreigners Buy Or Invest In UK Stock Market? How to buy (invest in) stocks in the UK for non-UK residents? Read on to know the guidelines and tips for investing the stocks for ... |

Top 9 Most Expensive Stocks In The World Top 9 Most Expensive Stocks In The World Stock price is an indicator of a company's market value, but the price of a share of stock will also depend on the number of ... |

Three Stocks Predicted to Soar In Next Ten Years Three Stocks Predicted to Soar In Next Ten Years Due to uncertain developments of megatrends, it is predicted that these stocks would flourish in the next decades. Let’s check out what are they? |