Gold price forecast 2021: Target of $US2,400 or Drop to $US1,500 an ounce?

|

| Gold price forecast 2021: Target of $US2,400 an ounce? Picture: Capital |

Will the price of gold go up in 2021?

2020 has seen a “phenomenal” inflow of gold-backed exchange-traded funds, fueling an investment-led rally, but while ETF inflows are still expected to be strong, 2020’s level of inflows would be hard to keep up.

After setting fresh records this year, will gold prices go up past $2,000 per ounce once again any time soon?

In a latest report, Goldman Sachs, the investment bank, said that it is maintaining its 2021 gold price target of $US2,300 an ounce as the global economy returns to balance between positive news of potential vaccines for the COVID-19 virus and the still prevalent risks of further economic damage from more waves of the virus.

Citibank is also optimistic about the commodity’s future. In their latest gold price prediction, the bank’s analysts said they see the metal rising to $2,200 per ounce in three months and to $2,400 per ounce in six to 12 months. “We lift the 2021E base case gold price forecast by $300 per ounce, versus our early July update, to a record $2,275 per ounce,” they added.

In their note on the gold price in 2021, analysts at Australian bank ANZ predicted the metal to rise to $2,200 per ounce by the end of 2020 and then hike further to $2,300 by early 2021. However, this valuation will likely mark a peak in the commodity’s rally.

Gold Prices: Short-Term and Long-Term?Goldman expects the falling US dollar to continue to weaken into 2021, which should help support gold prices. Although Goldman Sachs economists see a strong economic recovery in the US and worldwide next year, commodity analysts Jeffrey Currie and Mikhail Sprogis, the authors of the gold report, said that there is still a “strong strategic case for gold.” “In our view, the structural bull market for gold is not over and will resume next year as inflation expectations move higher, the U.S. dollar weakens and E.M. (Emerging Markets) retail demand continues to recover,” the analysts said. “Near term, however, it may be difficult for gold to generate a meaningful momentum in either a higher or lower direction.” In the short-term, gold prices could continue to consolidate sideways, as “it may be difficult for gold to generate meaningful momentum in either a higher or lower direction,” Goldman said. But in the longer-term, gold “should benefit from continued strong investment demand.” |

|

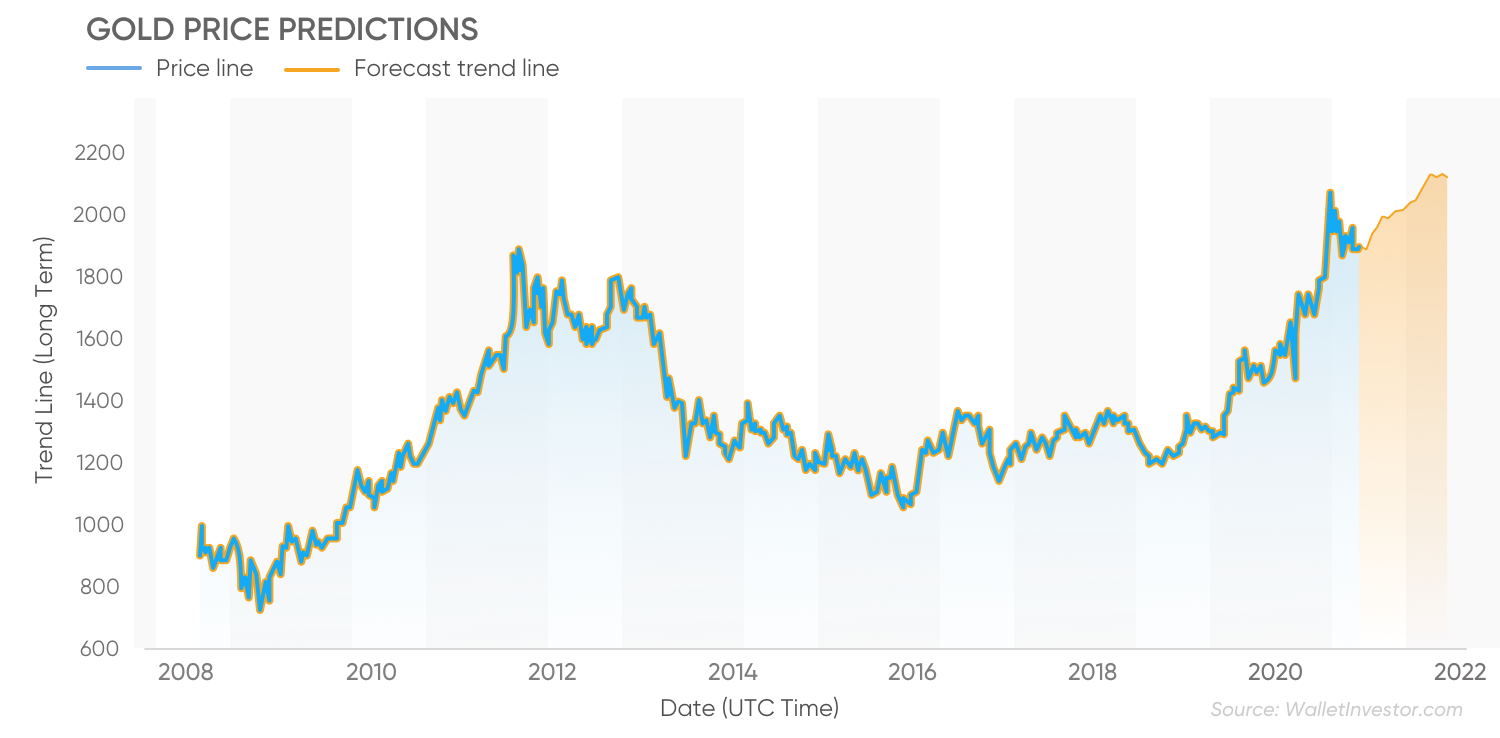

| Gold price forecast |

World Bank: Gold Prices in 2021 are expected to average 27.5% higher in 2020

Gold prices are stuck in a consolidation patter with prices hovering around $1,900 an ounce as the World Bank noted that prices rose 12% in the third quarter, its eighth consecutive quarter of gains.

"Prices are expected to average 27.5% higher in 2020 and remain broadly stable in 2021 as the global economy recovers," the World Bank analysts said in their October commodity report.

"Gold benefited from its status as a safe-haven asset during the pandemic and was buoyed by continued monetary easing by major central banks," the analysts said. "Long-term real bond yields falling further into negative territory and a weaker U.S. dollar further supported prices."

HSBC: Gold will average a price of $1,965 an ounce in 2021

In the meantime, the gold price expectation of Jim Steel, chief precious metals analyst at HSBC, sees the commodity at $1,965 per ounce in 2021: “We’re looking for strength in the early part of the year and maybe more moderation in the second part, but don’t forget that’s an average, which means that the market will likely stay at about $2,000 for some time, and some time under $1,900.”

Answering the question “Why is gold going up now?” Steel noted: “Most gold rallies are supported by two features: debt and liquidity, and some varying degrees of one, the other, or both. Right now, the gold market is the beneficiary, and has been for quite some time, of both debt and liquidity, and by that I mean we’ve had highly accommodative monetary policies going on for a very long time.”

However, Steel warned investors: “Gold is sensitive to geopolitical risk. If we’re going to get some rapprochement on the trade issues between the US and the other countries, and it’s not just one country, it could be from several, and we also get a charm offensive from the Biden Administration to US allies or to others, and the geopolitical risks come down and there’s the progress made on the trade front, then that would be negative for gold.”

More bearish gold predictions provided by Trading Economics put the metal at $1,852 per ounce by the end of this quarter, suggesting it drops to $1,749 per ounce in the following 12 months.

On the other hand, based on the opinion of Wallet Investor, an online forecasting source, the metal is expected to end 2020 at $1.891 per ounce; 2021 at $2,124 per ounce; and 2025 at $3,048 per ounce.

Speaking of the gold price 2021, analysts at Heraeus Precious Metals explained: “A worsening pandemic situation will mean a weaker economy and that seems to have triggered selling in the financial markets. Gold was not spared from the sell-off. The gold price has had a strong inverse correlation with US bond yields and real interest rates which have begun to rise. Short term, the price could fall further but gold’s safe-haven status should provide some support.”

Speaking of the gold price 2021, analysts at Heraeus Precious Metals explained: “A worsening pandemic situation will mean a weaker economy and that seems to have triggered selling in the financial markets. Gold was not spared from the sell-off. The gold price has had a strong inverse correlation with US bond yields and real interest rates which have begun to rise. Short term, the price could fall further but gold’s safe-haven status should provide some support.”

Brokerage Firm: Gold price could drop to $1,500 in 2021

Carley Garner, founder of the commodity brokerage firm DeCarley Trading said that there are a lot of mixed technical signals in gold and silver, but ultimately she is bearish the precious metals as too many investors are discounting the U.S. dollar strength.

"I believe that the U.S. dollar is bottoming so any rally in gold and silver should be sold," she said to Kiko News.

Garner said that the yield differential between the U.S. and other countries will continue to provide support for the U.S. dollar.

As to how low gold prices could fall, looking at historical charts, Garner said that she could see prices about 25% from current levels. That would put gold back in the $1,500 level range. She added that she sees silver trading around $15 an ounce.

Garner said that gold is currently creating the same chart pattern from its 2011 highs. Gold prices consolidated in a $300 range for more than a year before selling off sharply in 2013.

Gold Price Could Hit $5,000 In 2021? Gold Price Could Hit $5,000 In 2021? Economists believe gold prices can extend its record-breaking run to hit a whopping US$5,000 an ounce by end of 2021? |