Can Foreigners Buy or Invest in the US Stock Exchange?

|

| Can Foreigners Buy Or Invest In US Stock Market? |

| Contents |

There are no restrictions on foreign investment in the US, and non-US residents who invest there are typically only taxed on certain gains and income with US sources. There are a few things to be on the lookout for, including taxes, changes in currency, and additional dealing fees.

Here is everything we believe you should know if you're thinking about investing in the US!

Can You Trade in the U.S. Stock Market if You’re a Non-Citizen?

Many non-citizens wonder if they can participate in the US stock market given its size and expansion. Yes, US law does regulate US stocks and bonds. However, it turns out that anyone can trade on the US stock market, regardless of citizenship. Non-US citizens are not specifically prohibited from investing in the US stock market by any laws.

In actuality, a lot of investment firms serve foreign clients.

The Securities and Exchange Commission, as well as our government, actively promote foreign investment in the debt and equity markets that support the US economy and capital markets. Why is that so? It's because foreigners who aren't US citizens and investors pour a lot of cash into US markets!

It is also a good idea to diversify your portfolio by including stocks from various nations. Exposure to the international market is this.

US investors adore purchasing shares of foreign corporations. Examples of this include Baidu, JD.com, and Alibaba. Non-US citizens must, however, clear some additional hurdles in order to include US stocks in their portfolios. Even as a foreigner, you can open an online trading account with some US brokers, but more paperwork will be needed.

There will likely be additional paperwork that includes other requirements in addition to identity and visa verification.

What Time Does the US Stock Market Open and Close - NYSE, Dow Jones, Nasdaq What Time Does the US Stock Market Open and Close - NYSE, Dow Jones, Nasdaq |

Identity Requirements for Non-U.S. Citizens

|

| Photo: seedly |

One of the aims of the Patriot Act of 2001, which was passed in the wake of the 9/11 terrorist attacks, was to stop anyone connected to terrorism from using American capital markets to finance their illicit activities.

Because of the act, brokerage companies now have stricter guidelines for confirming customers' identities, especially for foreign nationals. Additionally, a provision of this law mandates that stockbrokers notify the American government of any suspicious account activity. However, it is clear that the vast majority of foreign investors are unaffected by these regulations because they have no ties to organized crime.

In order to comply with their specific policies, some brokerage firms may request additional forms of identification from non-U.S. citizens. A Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting form (also known as a W-8BEN) or visa information are a few examples of what qualifies.

Non-U.S. citizens may also need to submit paper applications to some brokerages rather than online applications in order to open accounts.

What time does the US stock market open?The NYSE and NASDAQ are open Monday-Friday 9:30 a.m. to 4:00 p.m. Eastern Time. There are 9 trading holidays when markets are closed plus several scheduled half-days. On half-days markets closed at 1:00 p.m. Pre-market trading is 6:30 a.m. to 9:30 a.m. and after-hours trading is 4:00 p.m. to 8:00 p.m. Most online brokers allow retail investors to place trades during extended hours. |

Opening a Foreign Brokerage Account

Opening a brokerage account with a US broker is the simplest way to trade US stocks.

However, depending on their residency status, brokerage firms have different procedures for non-citizens, and non-citizens will need to provide more documentation to meet their internal requirements.

Additionally, not all brokerages work with foreign investors.

Typically, foreign investors in the US stock market choose to manage their investments through a brokerage company. Employing a reputable broker ensures that investments will adhere to applicable laws, and a broker based in the US who is knowledgeable about international investments can assist people in navigating the somewhat complex subject.

Make sure the brokerage firm you choose accepts foreign investors if you are a non-resident of the US looking to invest. Finish your homework. Take the time to confirm that they are compatible with the country in which you currently reside because some brokerage firms only operate in particular regions.

Additionally, some brokers demand additional paperwork from foreign investors, such as identity proof, visa information, and tax records.

Key TakeawaysThe ownership of stocks in American corporations is not subject to citizenship requirements. Foreign owners and holders of assets with U.S.-based ownership are subject to a variety of U.S. laws designed to protect U.S. interests, so there may be additional requirements before non-U.S. investors can invest in US stocks. In order to comply with their specific policies, some brokerage firms may request additional forms of identification from non-U.S. citizens. There are also some US companies that list their stocks on foreign exchanges for investors who really want to invest in the U.S. market but are running into entry barriers. |

U.S. Dividend Income

|

| Photo: fool |

You are subject to Chapter 3 withholding as a non-U.S. taxpayer. Any dividend income from an investment in a U.S. security is subject to withholding at the time of payment by your broker. Because the withholding is sent to the IRS on your behalf when the income is deposited into your account, you might not have a year-end tax bill.

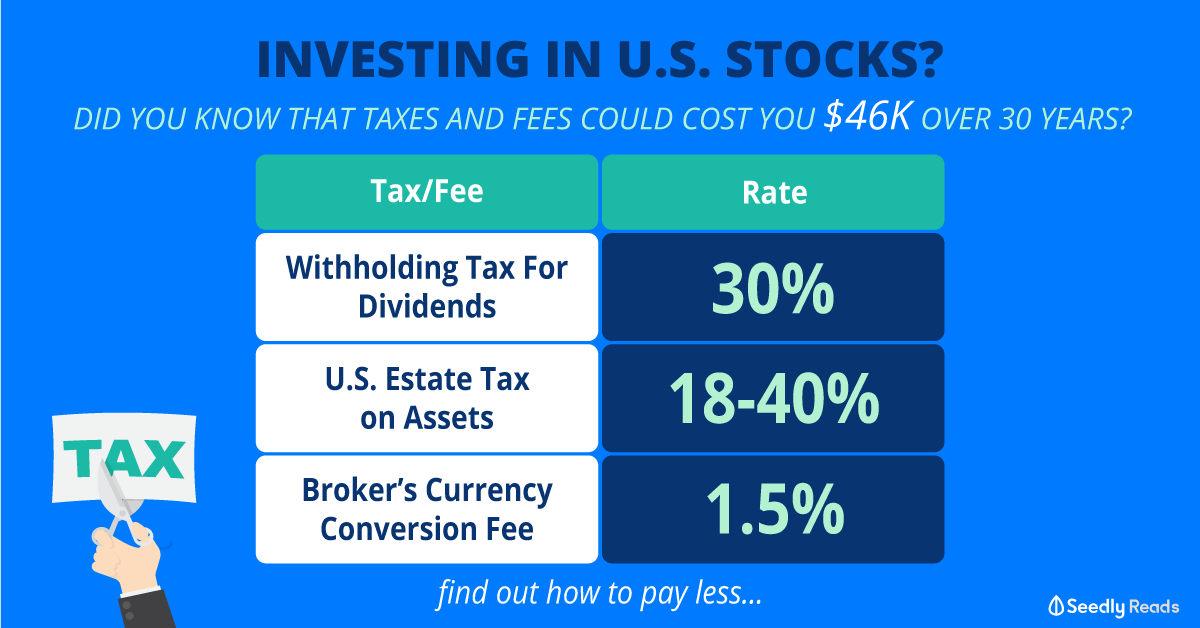

30% is the statutory tax rate. If you are eligible and have claimed the exemption on an IRS Form W-8BEN, you might be eligible for a reduced rate under a treaty that some nations have signed with the United States. Visit the IRS website's tax treaty tables to find out more information about tax treaties.

Non-U.S. Dividend Income

Dividend income received from non-U.S. securities may already have the country of incorporation’s tax deducted before the income is received. The net amount is distributed to your account; additional U.S. withholding is not applicable.

Top 9 Most Expensive Stocks In The World Top 9 Most Expensive Stocks In The World Stock price is an indicator of a company's market value, but the price of a share of stock will also depend on the number of ... |

W-8BEN Tax Form For Foreign Investors

A typical tax form needed by foreign investors is the W-8BEN. A lot of foreign investors opt to use a web-based brokerage account. They no longer have to worry about looking for a branch location and can access their accounts whenever they want from anywhere.

Many online brokerage companies target foreign investors specifically.

Three years after the date you signed Form W-8BEN, it becomes invalid. You should always receive a renewal notice from your broker before it expires. Even if you are from a country where taxes are exempt, if yours has expired, your account will be subject to the standard taxation for a foreigner.

Some foreign financial institutions will let you open brokerage accounts that will give you access to US stock exchanges if you can't find a broker you like in the US.

By collaborating with US financial institutions like Merrill Lynch or using global depository receipts, some large brokerage firms and foreign financial institutions have access to the US stock market. So, make sure to inquire about which financial institutions in your home nation provide these services.

Patriot Act (2001) - New Restrictions and Regulations

|

| Photo: foxnews |

One of the objectives of the Patriot Act, which was passed in the wake of the 9/11 terrorist attacks, is to forbid entities and people connected to terrorism from funding their nefarious activities through American markets.

The US government has taken great measures to prevent certain groups that have been connected to terrorist activities, along with their members or suspected members, from being able to in any way finance their operations through American capital markets.

This implies that brokerage companies must confirm the identities of their clients and notify the government of any suspicious account activity. The majority of individual international investors are not impacted by these regulations.

It is safe to say that you should be perfectly within your rights to own stock in US-based companies if you are not engaged in any illegal activities or any activities that the US government and its organizations may find offensive.

To be on the safe side, you must always deal with a reputable international broker. By doing this, you can be sure that you are adhering to the numerous new and updated regulations that apply to US stocks.

Be sure to prepare for any additional challenges you might face before starting your investment program.

Tax Implications For Foreign Investors

|

| Photo: capcf |

Trading US stocks by non-US citizens may involve complex tax complications. Nonresident aliens typically pay a 30% tax on their investment income. The involved brokerage firm will typically withhold the tax at the source.

You are exempt from paying capital gains tax if you meet the requirements to be a non-resident foreign national of the US.

This indicates that your brokerage company won't deduct that tax from earnings from foreign investments. However, the majority of nations mandate that citizens who earn money in foreign markets pay capital gains tax. The income and capital gains may need to be reported at home.

Dividend income is subject to taxation for non-resident foreign nationals. Foreign nationals who are non-residents pay a flat tax of 30% on their income. Dividends that you have earned that come from US companies in which you have invested are regarded as income.

There are some circumstances where you might be charged a lower rate. This depends on any treaties that your country has with the US as well as whether the dividends are linked to interest.

Working with an international broker might be preferable because of navigating international taxation. A trustworthy broker will ensure that you are aware of all the tax implications of your investments in the US.

You can still invest in US stocks even if you are not a citizen of the US. Just be aware that there may be some additional obstacles you must overcome.

What Time Does the US Stock Market Open and Close? What Time Does the US Stock Market Open and Close? When does the US stock market (NYSE, Dow Jones, Nasdaq,...) open or close? Check out the opening & closing hours, break, holidays and more. |

Deciding On A Brokerage as a Foreign Investor

To trade on the US stock market, for instance, UK citizens can open a brokerage account with Saxo Bank or Barclays. Another illustration is that CIMB Bank allows Malaysian residents to invest in the US stock market.

Do your research because there might be brokerage companies or other financial institutions offering comparable services everywhere.

Some US-based brokers do not permit foreign customers to open trading accounts with them, but a few do provide online services to customers in particular nations.

Online foreign clients can trade with US brokers such as Firstrade, MBTrading, Zecco, TradeStation, TD Ameritrade, Sogotrade, and Just2Trade. There is a list of nations that each of these accepts customers from. Find out if it supports the country in which you currently reside before selecting any of the options on the list.

Some brokers are present in different countries. This indicates that, despite having their headquarters in the US, they have offices around the globe. Charles Schwab and InteractiveBrokers are the two brokers that make up this group. They have offices in Hong Kong, Singapore, Japan, the UK, and a few European nations.

The Risks of Foreign InvestingThe flip side of international investing exists though. Emerging markets are viewed as riskier in general because of volatility. They may experience sharp changes in market value, and political risk occasionally has the power to completely change the course of a country's economy. Also to be considered is the fact that foreign markets may be less tightly regulated than American ones, which raises the possibility of manipulation or fraud.1 Despite having extraordinary access to 24-hour global news, investors today run the risk of receiving inaccurate information from a market that is frequently thousands of miles away. This may make it more difficult for the investor to comprehend or interpret events. Finally, changes in the exchange rate relative to the investor's home currency can result in currency risk. Of course, currency movements can go both ways and favor investors. There are six ways to get exposure to growth outside of the United States if you're willing to take on the opportunity and risk of international investing. |

Can Foreigners Buy Or Invest In Japan Stock Market? Can Foreigners Buy Or Invest In Japan Stock Market? How to buy (invest in) stocks in Japan for overseas residents? Check out the guidelines and tips for investing the Japan Stock Market for foreigners! |

Can Foreigners Buy Or Invest In Australian Stock Market? Can Foreigners Buy Or Invest In Australian Stock Market? How to buy (invest in) stocks in Australia for overseas residents? Read on to know the guidelines and tips for investing the stocks in Australia ... |

Can Foreigners Buy Or Invest In UK Stock Market? Can Foreigners Buy Or Invest In UK Stock Market? How to buy (invest in) stocks in the UK for non-UK residents? Read on to know the guidelines and tips for investing the stocks for ... |