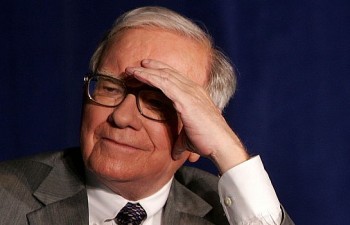

3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text)

|

| Warren Buffett's Letter to Shareholders |

Warren Buffett, the investing legend, has released his 2024 letter to Berkshire Hathaway shareholders, which provides investment advice for those who want to become as wealthy as he did.

Buffett has written letters to shareholders on a regular basis since 1965, sharing his analysis of Berkshire's investments as well as assessments of financial trends and pitfalls in the investing process.

In a previous letter, Buffett referred to fear and greed as two "super infectious diseases" that constantly plague the investment community. He advises wise investors to "be fearful when others are greedy, and greedy when others are fearful."

We has compiled some of Warren Buffett's advice for investors from his 2024 letter:

Ignore predictions from "experts"

Warren Buffett began his letter with praise for his sister, Bertie. He described her as someone who enjoys reading and is familiar with many accounting terms, despite the fact that she is not an economist. Her sharp intuition inspired the first piece of advice Buffett wishes to give investors this year.

"My sister is a very smart person and she knows she should ignore the experts," he wrote in an email. If Bertie could accurately predict tomorrow's stock price increase, would he freely share that valuable information, increasing the number of competitors? That's like finding gold and giving the entire neighborhood a map with the location marked."

Be patient when looking for great businesses

The "sage of Omaha" then discussed some of Berkshire's long-term and successful investments, such as American Express and Coca-Cola. These two businesses began operations in 1850 and 1886, respectively.

Berkshire invested heavily in Coca-Cola in 1988 and American Express in 2001. Buffett noted that Berkshire has maintained these investments for decades, despite the fact that the two companies have occasionally failed to expand or made management mistakes.

The billionaire wrote, "What lessons can we learn from Coca-Cola and American Express?" When you find a truly excellent business, stick with it. Patience pays off, and a great business can compensate for many of the mediocre choices that everyone makes."

Do not lose money

Warren Buffett believes that markets are increasingly resembling casinos. He wrote: "When the general sentiment becomes overexcited, any stupid investment trick that can be promoted will be enthusiastically promoted; not everyone does it, but there will be. "People do that".

He warned investors not to be duped by stupid tricks; otherwise, when the game is over, they will find themselves "confused, poor, and possibly vengeful."

He went on to say: "One of the investment rules that has always been held firmly at Berkshire and will not change is to never take risks and risk permanent loss of capital."

Full Text (152 pages) of Warren Buffett's Annual Letter to his Shareholders

Warren Buffett cautions against listening to Wall Street pundits and attributes Charlie Munger's success to him at Berkshire Hathaway. The complete text of Warren Buffett's yearly letter to shareholders can be found here.

Life Lesson: Really Smart People are Constantly 'Hungry' Life Lesson: Really Smart People are Constantly 'Hungry' Only when you are "hungry" can you turn the wheel upward and continue to gain strength. Only when you are "hungry" can you live a ... |

Life Lesson: Three Indications That You Will be Extremely Lucky Life Lesson: Three Indications That You Will be Extremely Lucky To enhance your chances of good fortune, it is imperative to cultivate personal growth and endeavor to evolve into an improved iteration of yourself. |

What was Warren Buffett's Biggest Investment Mistake? What was Warren Buffett's Biggest Investment Mistake? One of the worst decisions of Warren Buffett's career, according to him, was the purchase of the shoe manufacturer Dexter Shoe. Additionally, Buffett foresaw that ... |

4 Habits That Help You Become Rich 4 Habits That Help You Become Rich Life Lesson: A person's good life habits are the cornerstone of wealth. |