The Best Ways to Select the Right Life Insurance Plan and Company

What Type of Life Insurance is Best for You? What Type of Life Insurance is Best for You? |

Life Insurance: Purposes, Types, Benefits and Cost Life Insurance: Purposes, Types, Benefits and Cost |

|

| How to Select the Right Life Insurance Plan and Company |

| Contents |

What is a life insurance policy, and what are its key features?

A life insurance policy is an agreement between an insurance company and a person (or legal entity). Each life insurance policy is different, and each state’s laws regulating insurance policies are different. In general, most insurance policies identify the following:

♦ The insurer: Only a select group of organizations are permitted to offer life insurance, and state insurance departments oversee these organizations.

♦ The person or organization that owns (or "holds" the policy is referred to as the policyholder. Examples include a family trust or a company. The policy has two options for coverage: either the holder or a third party.

♦ The person whose life is insured is known as the insured.

♦ The sum that the insurer will pay out upon the death of the insured is known as the death benefit.

♦ The recipients of the death benefit are known as beneficiaries. It can be distributed proportionally among many different people and entities (for example, three children could each receive 30% and 10% could go to a charity), or it can all go to a single person (for example, the surviving spouse).

♦ The period of time the insurer agrees to provide a death benefit is known as the policy length. This can be for a set period of time, like 10 or 20 years, or it can be permanent, meaning that as long as premiums are paid, the policy will be in effect for the insured's entire lifetime.

♦ The monthly or yearly payments required to keep the policy in force are referred to as the premium.

♦ Monetary value: Whole life insurance and other permanent life insurance policies both have a cash value component that accumulates over time and can be withdrawn or used as collateral for loans. Term life insurance has no cash value.

What are the different kinds of life insurance policies and how do they work?

|

| Photo: The Financial Express |

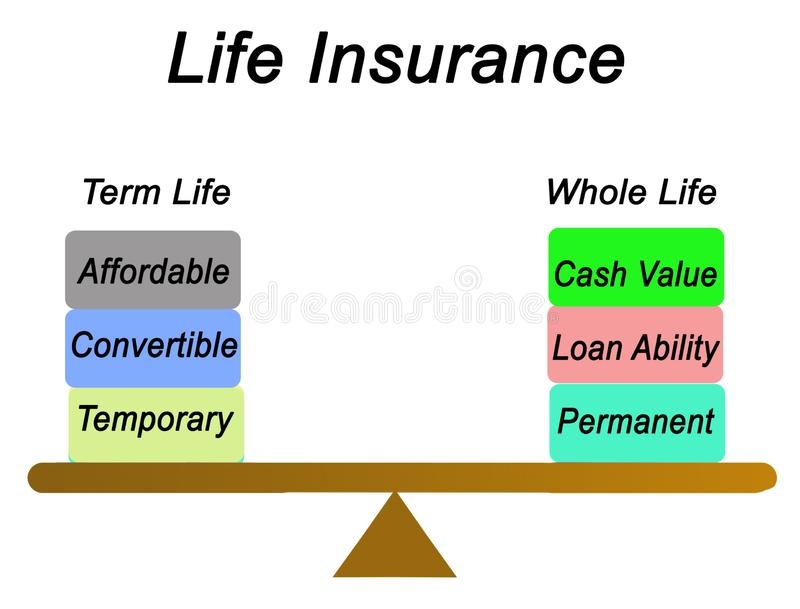

There are two basic types of life insurance: term and permanent life insurance.

Term life insurance offers protection for a predetermined amount of time, usually between 10 and 30 years. It is sometimes referred to as "pure life insurance" because, unlike whole life insurance or permanent policies, there is no cash value component to the policy; after the term has expired, nothing remains.

Lifelong coverage is offered by permanent life insurance. Contrary to term, it is not a "pure life insurance" product because it has a cash value element that extends coverage while the insured is still alive and premiums are being paid and offers additional financial advantages. Although a portion of your premium money is invested and your cash value increases over time tax-deferred, the entire death benefit is paid out right away on the first day you purchase the policy. On the other hand, it might take some time for the cash value to increase to a sizeable sum.

Whole and universal life are the two primary types of permanent insurance. Whole life insurance is easier to understand because the premium stays the same for the duration of the policy, the death benefit is guaranteed, and the cash value increases at a set rate. Although universal life insurance may be less expensive, the premiums, death benefits, and growth rates of the cash value may differ, adding complexity to the policy.

Best Life Insurance Companies of 2023/2024Best Overall: Prudential Best Instant Issue: State Farm Best Value: Transamerica Best Whole Life: Northwestern Mutual Best Term Policies: New York Life Best for No Medical Exams: Mutual of Omaha Best for Military: USAA |

How can you choose the best life insurance plan?

Here is a guide of Knowinsiders.com to help you select the right policy that suits all your needs.

1. Assess your life insurance goals

Individuals may have various objectives. Investing in a good life insurance policy is the first step toward achieving your goals for life insurance. If protecting your loved ones' financial stability is your top priority, a term insurance policy with generous coverage and reasonable premiums is a good option.

Whether you're planning for your kid's college tuition or your own dream home, a unit-linked insurance plan can help you reach your savings goals. You can also choose to invest in a retirement plan that provides a steady stream of money to help cover your living costs once you've left the workforce.

2. Calculate the optimal insurance cover that you need

It is recommended by many financial experts that you purchase life insurance with a face value that is ten to fifteen times your annual income. However, there are a number of factors to think about when determining the correct amount of life insurance to purchase. If you have debts, your loved ones may have a hard time keeping up with the Equated Monthly Instalments (EMIs) in your absence. As if that weren't enough, you also have to set aside money for your kids' weddings and/or college tuition. Inflation could make it difficult for your family to continue living the way they do without you, the primary breadwinner. Therefore, you must add the following:

• Your family’s annual expenses multiplied by the number of years for which income replacement might be necessary

• The total amount of your outstanding debts and the cost of repaying mortgages, if any

• The amount you need to set aside for future expenses like your child’s education, wedding, etc

From the expenses mentioned above, you can deduct the sum of your liquid assets like cash in hand or bank and any other kind of investments to arrive at an adequate life insurance cover.

3. Determine the amount you have to pay as the premium and find the policy offering the best deal

You can use online premium calculators to ascertain how much premium you have to pay for the required amount of life insurance. Compare different plans to find a policy that offers the highest coverage at rates that fit your budget. You should also assess your premium paying term based on your earnings for the upcoming years.

4. Select the correct policy term

The policy's duration should match the timeframe during which your loved ones will be economically dependent on you. A good rule of thumb for determining the optimal policy term is to subtract your current age from the age at which you anticipate your income to cease or wish to achieve a specific life goal.

5. Opt for a reputable life insurance provider

Companies offering life insurance with a consistent Claims Settlement Ratio (CSR) of 95% or higher are typically safe bets. The CSR is the ratio of claims paid out by the company to the total number of claims filed during a given fiscal year. To view the most recent CSR reports from various insurance companies in India, visit the IRDAI website. It's also a good idea to check online reviews to see if policyholders found the life insurance company's claims process to be swift and easy.

6. Do not conceal facts from your life insurance provider

Tell your life insurance company if you are a smoker, alcoholic, or work in a dangerous profession. You must also disclose the presence or history of any serious illnesses in your family. Your risk profile is impacted by these elements. To avoid future claim rejection, it is critical that you provide accurate information.

7. Read the final policy document carefully

Understand all the terms and conditions clearly, before you make the final commitment. Find out relevant details such as the lock-in period and the circumstances in which the claim will not be valid.

8. Buy life insurance at an early age

Life insurance premiums are lower when you are younger. Thus, you can save on the cost of your premium if you buy your life insurance policy as soon as you start earning. You can begin with lower coverage and add more riders as your income increases.

9. Choose a comprehensive plan

Medical contingencies might affect your income adversely. Hence, it’s necessary to choose a comprehensive plan, with appropriate riders for yourself:

• If you are diagnosed with a life-threatening illness, such as kidney failure, cancer, or heart disease, the Critical Illness rider will pay your entire claim. This sum can help cover medical expenses and cushion you against potential income loss due to illness.

• Fatal Mishaps In case of your untimely demise as the result of an accident, a benefit rider will provide your loved ones with additional financial support. You can rest assured that your family's current standard of living and future financial stability will be protected in this way.

• If you become permanently disabled as a result of an accident, the Permanent Disability rider will act as a premium waiver for the rest of your life. As long as your policy is in effect, you will be covered for life.

• In the event that you are diagnosed with a terminal illness such as cancer, the Terminal Illness rider will pay out in full prior to your death.

It would help if you always looked for an insurance provider that offers such benefits without charging you any hidden fees.

10. Evaluate your life insurance needs regularly

It is essential to assess your life insurance needs from time to time as your financial goals might change with age and life events like marriage or childbirth. You can review your life insurance needs periodically and adjust your cover accordingly. This will also take care of inflation.

|

| Photo: Dreamstime |

Tips to choose the right life insurance company

Life insurance is a highly competitive business, in which the salesforce depends almost entirely on commissions.

Insurance companies pay fat commissions for selling whole life policies; perhaps 80% of your first year's premium goes to the agent. Commissions for selling term-life policies amount to roughly the same percentage of first-year premiums. But since whole-life premiums are much higher than premiums for term-life policies with the same death benefit -- they can be five to ten times more -- agents make much more money selling a whole-life policy than they do selling a term policy.

You and your family, is follow some basic tips – and in no time, you’ll be on the right path to finding a company that’s a great fit for you and your budget.

Financial wellness

People buy life insurance for many reasons, but the biggest one of them all is to ensure that their loved ones are in good financial shape no matter what. Similarly, the life insurance company that you choose must also be in good shape from a standpoint of dollars and cents.

Products offered

The two most common types of life insurance offered by companies are term life and permanent life. While most insurance companies offer both types of policies, some may focus exclusively on one.

Consider twice before signing on with a life insurance firm that claims to offer every conceivable type of policy. As far as we're concerned, it's best to get life insurance from a firm that focuses exclusively on such coverage. In this way, you can rest assured that you're working with a seasoned expert in the field of life insurance who will assist you in tailoring a policy to provide maximum financial security for your loved ones at the lowest possible premium.

Customer Satisfaction

Life insurance companies have been in business for decades, sometimes more than a century, making them some of the most seasoned insurers in the United States. For this reason alone, you can assume that the company understands what it takes to provide excellent service.

A life insurance company may have been around for a long time, but that doesn't mean they're doing a great job.

Cost of coverage

Numerous surveys have demonstrated that the competitive nature of the life insurance market helps to maintain reasonable premiums. Take care not to make the common mistake of choosing the cheapest option without doing any further research. After all, our data shows that consumers aren't always looking for the cheapest life insurance policy possible.

Who Owns the Company?

There is a common misconception that people should only purchase life insurance from publicly traded financial or insurance conglomerates. The problem is that this isn't always the wisest course of action.

Why? Because the interests of the shareholders come before all else for large corporations. Everything the management does—from setting prices to producing and selling goods—is geared toward maximizing profits for stockholders. Hence, the customers aren't the top priority.

10 Best Life Insurance Companies In The World 10 Best Life Insurance Companies In The World If you are wondering about the best life insurance companies to protect your family, here is the list of the top 10 best life insurance ... |

Things to Consider when Choosing the Right Type of Life InsuranceLife insurance premiums are based on a number of factors and we'll clue you in on six of them: 1. Age Your age is one of the key factors in deciding which life insurance product you select—and even what products are available to you. In general, you'll have more options to choose from as you get younger. Your eligibility to purchase some types of life insurance, such as basic term life insurance, expires at age 60. 2. Gender Additionally, women typically live seven years longer than men do, which results in a cheaper policy for them. The difference in life expectancy, though, is beginning to narrow. Your life insurance premium will be priced primarily using your age and gender. 3. State of Your Health Almost all life insurance policies demand a medical history questionnaire or a physical examination to determine your health. It probably goes without saying that your insurance policy will be less expensive the healthier you are as a person. Smoking has a significant impact on life insurance premiums. Your price will be significantly higher if you list nicotine. Remember that life insurance companies frequently link your age and health. As a result, it is assumed that you will be healthier as you age and vice versa. 4. Budget In general, term life insurance is less expensive than permanent life insurance; this is because the policy is only in force for a predetermined amount of time and there is no cash value being accrued inside the policy. With a term insurance policy, you decide how long your life is covered (typically 10, 20, or 30 years). When that period expires, a new rate is calculated, and it will go up significantly if you want to keep that specific policy (which is typically because your health has significantly deteriorated). With a permanent insurance policy, the insurance is in force for the rest of your life and the premium stays the same. Consider term life insurance if you're really concerned about your budget. Term life insurance, also known as "starter life insurance," enables you to purchase a plan that is practical and within your price range. Term life insurance is a good place to start, but if you conducted a needs analysis with a qualified agent, it might suggest that you should have more coverage. 5. Duration of Need Are you interested in a policy that only offers you protection for a limited time? For instance, you might want to get life insurance if you recently bought a house with a 30-year mortgage. A 30-year term insurance policy might be the best option for you if making sure that your mortgage balance is paid off after your passing is one of your top priorities. A permanent life insurance policy is more appropriate for your needs if your main concern is having protection in place even 45 years from now. |

Consider term life insurance if...

Term life insurance lets you match the term to the need. If you have young children and want to ensure college funding, you might buy 20-year term life insurance. Buy a term policy to repay a debt that will be paid off in a set time.

You need lots of life insurance on a tight budget. This insurance pays only if you die during the policy term, so the rate per thousand of death benefits is lower than for permanent life insurance. If you survive the term, coverage ends unless you renew or buy a new policy. Unlike permanent insurance, cash savings do not build equity.

Consider "convertible" term policies if your financial needs may change. These let you buy permanent insurance without a medical exam for higher premiums.

As you age, premiums rise. Renewing term insurance usually raises the premium. Some policies require a medical exam at renewal for the lowest rates.

Consider permanent life insurance if...

Permanent policies pay death benefits whether you die tomorrow or live to 100.

You want to build a tax-deferred savings account that can be used to borrow money. If you can't pay life insurance premiums, you can use the savings element for any purpose. You can borrow these funds even with bad credit. If you die before repaying the loan, the insurance company takes its share of the death benefit before giving it to your beneficiary.

Permanent policies cost more than term insurance. Permanent policies have a fixed premium, but the term can increase every time you renew them.

Permanent insurance policies include whole (ordinary), universal, variable, and variable/universal.

Best Tips To Purchase Health Insurance Best Tips To Purchase Health Insurance Buying insurance is a significant investment, and you’ll want to invest wisely. Check out this article to know 10 tips to consider before buying health ... |

Most Weirdest Insurance Policies Around The World Most Weirdest Insurance Policies Around The World What are the weirdest insurance policies in the world? Insurance is available even after the escape of aliens, vampire and bride run away in marriage, ... |

What Is Mortgage Insurance and How Does It Work? What Is Mortgage Insurance and How Does It Work? What is mortgage insurance, how it works, and what are its benefits? Scroll down to understand more details about the advantages of mortgage insurance. |