Top 10 Best Car Insurance Companies in Australia - Cheapest Quotes

Top 10 Best Hospitals In Australia In 2023 for Citizens and Visitors Top 10 Best Hospitals In Australia In 2023 for Citizens and Visitors |

Top 10 Best Life Insurance Companies In Australia - Cheapest Quotes Top 10 Best Life Insurance Companies In Australia - Cheapest Quotes |

|

| Best Car Insurance Companies in Australia |

| Contents |

Car insurance shields you from financial ruin in the event of an accident, theft, natural disasters, or any other covered event covered by your policy. Damage to vehicles, buildings, and people can be expensive to repair or replace without insurance. Consumers in Australia may find it challenging to sort through all the available auto insurance policies and settle on the best one.

Auto insurance providers can be evaluated across a wide range of criteria. This post was made to help Australians find the best car insurance company for their needs by providing a side-by-side comparison of several leading providers.

Below is the list of the 10 best car insurance companies with cheap quotes and good services for every Aus car owner, ranked by Knowinsiders.com.

Types of Car Insurance in Australia

There are 4 different types of car insurance in Australia. Below is an explanation of each of the different types of car insurance and help you decide what type of insurance you can consider.

Explanation of "CTP" Insurance, or Compulsory Third Party

In all Australian states, compulsory third-party "CTP" insurance is a legal requirement. When someone else is hurt or killed in an accident, CTP will pay for their medical bills and funeral expenses.

If you're walking to the store and suddenly a car comes careening off the road and slams into you, the driver of the car is at fault and must pay for your medical bills and the repairs to your car and any others involved in the accident.

Explanation of Third-Party Property

Vehicles and property belonging to others are typically covered by third-party insurance policies, but your own vehicle is typically excluded.

If you hit a parked car and are found to be at fault, your insurance company will pay for repairs to both vehicles and any nearby property that was damaged. Unfortunately, your bomb will be useless because it will not be protected.

Maintaining your vehicle is crucial. Thus, third-party property insurance is a must if you cannot afford comprehensive auto insurance (discussed further below). In Australia, this is the bare minimum for car insurance coverage.

Think about how your significant other would react if you t-boned Kyle Sandilands' Ferrari and didn't have coverage.

Accidental Burns and Robberies

In the event that your vehicle is stolen or damaged in a fire, you will be compensated for your losses through Third-Party Fire and Theft coverage, which is otherwise identical to Third-Party Property coverage.

Your fire and theft coverage may be set at a fixed amount that you and the insurance company "agree" on, or it may be set at market value.

Let's pretend you spent $10,000 a year ago on a car. The'market value' may be $9,000 this year, with a $1,000 deduction for the vehicle's age.

To put it simply, if you have a "market value" auto insurance policy and you receive a payout, you will get whatever the insurance company determines the car to be worth at the time of the payout. This is typically calculated using the going rate for automobiles of the same make and model.

Talk to your insurance company again if you don't think they're paying you fairly. When you have proof (market research, online advertising, expert testimony, etc.) that increases the value of your car, use it. A payout increase of even $500 is cash in your pocket.

A car insurance policy with a predetermined value or coverage amount is exactly what it sounds like. Some insurance companies will offer you the chance to insure your wheels for a flat rate when you sign up for coverage.

If you paid $10,000 for a car six months ago but it's only worth $8,000 now, you might ask to be insured for $10,000.

Comprehensive Car Insurance

As they might say in Mexico, Comprehensive car insurance is “the whole enchilada”.

If you’re at fault, your Comprehensive car insurance provides cover for:

-Your car, plus

-The other person’s car, plus

-Property damage, and

-Covers you if your car catches fire or gets stolen

Again, sometimes you can agree on a fixed level of cover or market value, which can be determined as the current value of your car when it was crashed.

Top 10 best car insurance companies in Australia

1. Australian Seniors

|

| Australian Seniors |

When you think of an insurance company in Australia, you might think of National Seniors. It offers coverage for vehicles, trailers, homes, landlords, vacations, health, life, and businesses.

The website productreview.com.au ranks Australian Seniors as Australia's best car insurance provider, with scores of 4.6 for transparency, 4.7 for value for money, and 4.7 for customer service. Notably, 88 out of the 92 people whose claims were listed on the website were granted compensation.

Hollard provides comprehensive, third-party property damage, and third-party, fire, and theft coverage options for senior citizens in Australia through their auto insurance policies. Optional features include legal liability coverage of up to $20 million and roadside assistance.

2. Australian Warranty Network (AWN)

|

| Photo: awninsurance |

AWN received ratings of 4.7 for transparency, 4.7 for value for money, and 4.7 for customer service on productreview.com.au. Customers commended the insurer’s quick response to inquiries, excellent service, and efficient claims process.

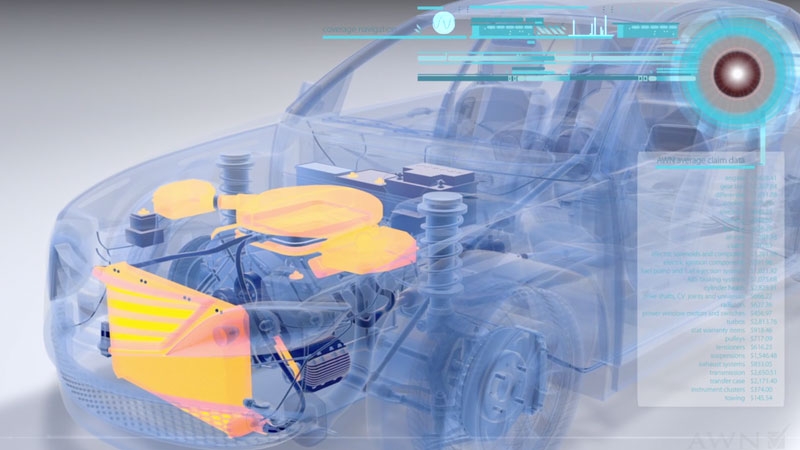

AWN is known for its mechanical breakdown insurance, which provides coverage for various vehicles, such as cars, motorbikes, scooters, motorhomes, and caravans. Its other products and services are general insurance, administration and claims management, roadside assistance, asset protection, and training programs.

3. Youi Comprehensive Car Insurance

|

| Australian Warranty Network - Photo: auzzi |

Youi is a 100% owned subsidiary of Rand Merchant Insurance Holdings Group company OUTsurance International Holdings Pty Limited (RMIH). Insurance for vehicles, motorcycles, travel trailers, homes, boats, and businesses are all underwritten by the company.

Youi's policies offer a variety of customizable features at a reasonable cost. Without having to wait for an insurance company to evaluate the damage, you can get up to $1,000 to pay for repairs, or you can use that money for lodging and transportation if you're more than 100 kilometers away from home. This policy also includes standard emergency roadside assistance coverage. Hire car coverage from Youi will get you back on the road in the event of theft or an accident for which you are not at fault (for up to 14 days). If your car is less than two years old and is totaled (and has less than 40,000 kilometers on the odometer), Youi will replace it with a brand new one at no extra cost to you.

What Are Extras In Car Insuarance?Insurance plans for your vehicle may offer additional incentives, or "extras," in an effort to win your business. Extras, also known as "benefits," are a common part of many policies. You can choose whoever you want to do the repairs. Do you have a go-to garage for your vehicle maintenance needs? With this extra, you can choose who will fix your device if anything breaks. If you don't pick this option, your insurer may get to choose the repair shop. If your car has been totaled, use a car service. This extra may be useful if you rely heavily on your car for things like getting to and from work or maintaining your current standard of living. If your car is totaled, your insurer may pay for a rental car for you for a certain amount of time if you purchased this optional coverage. There could be a price increase for this service. Remove any surplus glass from your windows. The windshield of your car could be damaged if another car on the highway ahead flicks up a stone and sends it flying at your windshield. An insurer may require you to pay hundreds of dollars in deductibles before they will cover the costs of repairing this kind of damage. The excess you'd owe in the event of windscreen repair or replacement can be reduced in exchange for a higher monthly premium if you opt for this add-on. Help Along the Way If your car ever breaks down, you can rest easy knowing that roadside assistance will come to your rescue. The iSelect car insurance providers offer optional roadside assistance packages that may include services like battery replacement, flat tire changes, towing, lost key retrieval, and even emergency fuel delivery. insurance for private belongings The cost to replace stolen or lost items in your vehicle may be covered by your insurance policy (up to a certain value). Key Substitutes Should you lose your keys, your insurance company may pay to have new ones made. When shopping for auto insurance, you may find a variety of optional coverage additions to consider. It's important to read the fine print when adding on optional coverage, just as you would with any insurance policy, to make sure you know exactly what you're getting and how it might affect your premium. |

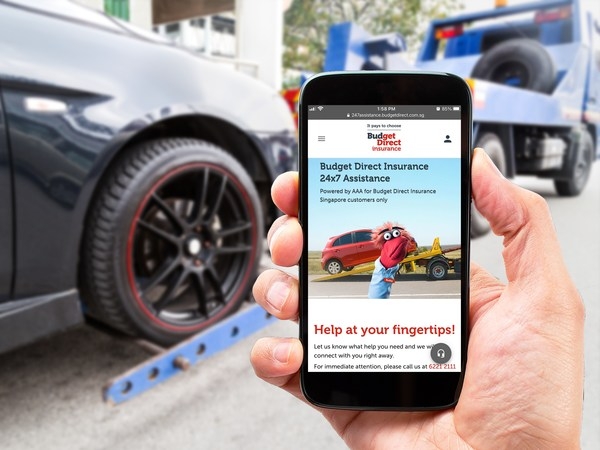

4. Budget Direct Gold Comprehensive Car Insurance

|

| Photo: prnasia |

Over 3 million Australians have relied on Budget Direct since 2000, and they always have their insurance needs met.

Budget Direct is an Australian general insurance provider with over nine million policyholders, 1,300 employees, and partnerships with hundreds of auto shops and construction firms across the country. Policyholders have round-the-clock access to claim services and the flexibility to tailor their protection with a variety of add-ons, such as rental car reimbursement after an accident or protection against flood damage to their dwelling.

In addition to its multiple auto insurance award wins, Budget Direct has been recognized as Mozo's Value Insurance Provider of the Year. Hire car coverage for up to 14 days following a theft or not-at-fault accident (up to $1,000 total) is just one example of the helpful features included in this policy. In addition to the $1,000 for lost keys and $500 for personal property, you will also be covered for new-for-old car replacement (when the car is under two years old or has driven less than 40,000km). The first year's premium can be reduced by 15 percent if you apply for the policy online.

5. Integrity Extended Warranties

The customer service, value for money, and overall honesty of Integrity Extended Warranties were all rated as 4. Customers felt their policies were a good value for the money. Even repeat claimants had a positive experience with the helpful staff and swift procedure.

The Royal Automobile Club of Victoria (RACV) and Lumley Insurance are just two of the long-standing partners of Integrity Extended Warranties. Absolute and Endurance are the two types of coverage it offers. The Absolute coverage plan, sold by car dealerships, replaces the manufacturer's warranty in its entirety after its expiration. On the other hand, the Endurance plan provides coverage for listed components and parts for one to five years, depending on the age and mileage of the vehicle.

6. Real Insurance

|

| Photo: youtube |

Life insurance, along with other products like auto, home, pet, and travel coverage, is offered by Real Insurance, an Australian company. Established in 2005, Real Insurance is a trusted name in the industry. It's not just a life insurance company; they also sell policies for your car, house, landlord, pet, funeral, trip, and bike. Hannover Life Re of Australasia Ltd. underwrites and distributes its life insurance policies.

According to Real Insurance, the price of its life insurance policies fluctuates based on factors such as the applicant's age, gender, smoking status, and coverage needs. The applicant's response to a battery of health and lifestyle questions used to determine the premium is another possible factor.

You can choose to pay your premiums every two weeks, every month, or every year. According to Real Insurance, there is no surcharge for biweekly or monthly premium payments.

7. Eric Insurance

|

| Photo: anthonycrookes45 |

An insurance company that has been around for over 20 years, Eric Insurance is 100% Australian-owned. Their primary goal is to aid in the management of unforeseen circumstances. Either two- or four-wheeled vehicles can be protected by Eric.

Auto insurance premiums are notoriously situationally variable. Quotes can vary depending on a number of factors, including your gender, the make and model of your vehicle, the level of coverage you require, your years behind the wheel, and your driving record. In order to determine whether or not a product is right for you, it is important to read the Product Disclosure Statement.

Eric only offers full coverage auto insurance, which helps pay for repairs to your car and the property of others if you're at fault in an accident. In addition to standard coverage for things like theft and natural disasters, Eric also provides supplemental coverage options like a used car warranty and protection for your tires and wheels.

At present, Eric's full coverage auto insurance includes the following features:

New car swap within 2 years of registration

Alterations due to accidental damage

Compensation in the event of theft, fire, or other damage to your belongings

If your car has been stolen, you can rent a replacement.

Situations requiring immediate evacuation and overnight stays

In addition, the following extras are available to customers for an additional fee:

Glass breakage reimbursement (as much as $600)

Used vehicle guarantee (12, 24, or 26-month options)

Protective covering for tires and wheels

8. Huddle Comprehensive Car Insurance

|

| Photo: huddle |

The customer service, pricing, and openness of Huddle Insurance were all rated at 3.2, 3.5, and 3.1, respectively. Customers were pleased with the company's reasonable premiums, prompt response to claims, and high quality of service.

More than 35,000 people are currently enrolled in Huddle Insurance, and the company has a small army of Huddle Bots, which are AI-powered bots that use algorithms to source useful data and provide 24/7 support to customers. Its auto insurance offerings include both full coverage and liability policies, each with their own set of perks and customization possibilities.

Coverage under this all-inclusive policy extends to both the policyholder's vehicle and any other vehicles or property that may be damaged as a result of an accident. Contrarily, the Third Party Property Plan will only pay for repairs to other people's cars or buildings if they are damaged in the accident.

9. Woolworths Comprehensive Car Insurance

|

| Photo: productreview |

Woolworths Insurance advertises its comprehensive car insurance product as a way for customers to protect their vehicles from things like accidents, natural disasters, fires, theft, attempted theft, and malicious damage on the part of third parties, as well as from the driver's legal responsibility for any damage they may cause to other people's property while driving.

For eligible policyholders, Woolworths Insurance will provide a brand-new replacement vehicle if your vehicle is written off within two years of its registration. In addition to protecting you from financial loss due to theft or vandalism, these policies will pay up to $20 million if you cause damage to someone else's vehicle or property.

Additional characteristics consist of:

The cost of fixing the damage caused by extreme weather

Things of value that were in your car at the time of the accident

Towing

Duplicate keys and lock cylinders

Campers and trailers

Accommodation and travel arrangements in the event of an emergency

Urgent maintenance

Dangers in transit

Accidental harm caused by fellow travelers

Optional extras that can be purchased by customers include the following:

Windshield that doesn't go overboard

Pay for a car cover

assistance on the side of the road

Woolworths Insurance also advertises a "Drive Less Pay Less" policy, in which the premium (cost) is based on the number of miles you drive rather than a flat rate. Your annual mileage must be less than 15,000 kilometers for the provider to consider lowering your premiums.

10. State Government Insurance Office (SGIO)

The Insurance Australia Group operates under the SGIO brand in the state of Western Australia. Effective February 1, 1917, the State Government Insurance Office (SGIO) was established as the successor to the State Accident Insurance Office under "The Insurance Act of 1916," with the latter's former Workers' Compensation Department becoming part of the SGIO.

SGIO was ranked 2.3 for openness, 2.4 for value, and 2.5 for service from customers. Some long-term policyholders have testified to the insurer's superior customer service, competitive pricing, and hassle-free claims processing.

One of the largest general insurers in Australia and New Zealand is Insurance Australia Group (IAG), which is the parent company of SGIO. All-inclusive, All-inclusive Plus, Third-Party Property Damage, Third-Party Fire & Theft, and Coverage for Vintage, Collector, and Veteran Automobiles are just some of the options available to customers in its auto insurance product line.

Tips To Make Your Car Insurance CheaperUsing these strategies could save you up to $500 or more on car insurance: Do annual price comparisons. The majority of insurance companies actually reward NEW customers rather than loyal ones. Put a yearly reminder in your phone's calendar or on your computer's Google, Apple, or Microsoft calendar to check out the competition. The same coverage may be available online for $50 to $200 less. Make sure your car is parked in a safe place. Tell your insurer if you always park your car in a garage or other secure location. Also, if you only drive for a few hours a day, let your insurance company know. After all, it only makes sense that someone who doesn't drive very often would pay less than someone who does. Avoid a collision at all costs! (obviously). If you're a good driver who never gets in an accident, your premiums will stay the same from year to year and you won't have to pay any deductibles. Please refrain from installing any "mods" or "aftermarket" components in your vehicle (they look lame anyway). Modifications such as larger tires or dragon-skull paint jobs signal to your insurer (and the world) that you have too much free time on your hands, and may increase the premiums you pay for car insurance. What could go wrong? Your car becomes unsafe for the road and no longer qualifies for insurance coverage. To improve safety, add additional safeguards. Most modern vehicles are equipped with alarm systems, while others have immobilizers. Vehicles equipped with these safety features often receive insurance discounts. Online insurance purchases should be seriously considered. Online customers can get the same coverage from some companies at a discount. |

Full List of Car Insuarance Providers in Australia

For help finding the best car insurance in Australia, view our list of providers listed below. Please note that this is subject to change at any time.

- 1300 Insurance

- 1Cover

- 1st for Women

- AAMI

- AANT (Automobile Association of the Northern Territory)

- AI Insurance

- Allianz

- ANZ

- Apia

- Australia Post

- Australian Seniors Insurance Agency

- Australian Unity

- Bank of Melbourne

- BankSA

- Bendigo Bank

- Best Buy Insurance

- Beyond Bank

- Bingle

- Blue Badge Insurance Australia

- BOQ (Bank of Queensland)

- Budget Direct

- Bupa

- Cashback

- CCI Personal Insurance

- CGU

- Coles

- CommInsure

- COTA Insurance

- Elder’s Insurance

- Eric Insurance

- Essentials by AAI

- Famous Insurance Agency Pty Ltd

- GIO

- Guild Insurance

- HBF

- HSBC

- IAL

- ING

- Huddle

- Hume Bank

- Kogan Insurance

- Latitude Financial Services

- Lumley Special Vehicles

- MB Insurance

- NAB

- National Seniors Australian Insurance Holdings

- NRMA

- Over Fifty

- Ozicare

- People’s Choice Credit Union

- Poncho Insurance

- Progressive

- QBE

- RAA

- RAC (WA)

- RACQ (QLD)

- RACT (TAS)

- RACV (VIC)

- Real Insurance

- Retirease

- Ryno Insurance

- SGIC

- SGiO

- Shannons

- George Bank

- Suncorp

- Territory Insurance Office (NT)

- Vero

- Virgin Money

- Westpac

- WFI

- Woolworths

- Youi

10 Best Car Insurance Companies in UK - Cheapest Quotes and Good Services 10 Best Car Insurance Companies in UK - Cheapest Quotes and Good Services There are lots of different car insurance providers in the United Kingdom, but prices and services can really vary. How can you find the best ... |

Top 10 Best Car Brands in the United States Top 10 Best Car Brands in the United States The best car brands in the US have been named this year, with 10 companies in the rankings. |

10 Best Car Insurance Companies in Canada - Cheapest Quotes and Good Services 10 Best Car Insurance Companies in Canada - Cheapest Quotes and Good Services There are dozens of auto insurance providers in Canada, but prices and services can really vary. How can you find the best insurance providers? |