Top 10 Best Car Insurance Companies in UK - Cheapest Quotes

10 Best Life Insurance Companies In The UK: Cheapest Quotes and Good Services 10 Best Life Insurance Companies In The UK: Cheapest Quotes and Good Services |

Top 10 Best Global Health Insurance Companies for Expats Top 10 Best Global Health Insurance Companies for Expats |

|

| 10 Best Car Insurance Companies in UK - Cheapest Quotes and Good Services |

| Contents |

To legally operate a motor vehicle in the United Kingdom and elsewhere, you must have auto insurance. To legally own or operate a motor vehicle in the United Kingdom, you must carry at least the minimum level of liability coverage required by law. Even if you don't drive your car but keep it on the road, driveway, or in a garage, you still need insurance.

There are many criteria by which to evaluate auto insurance providers. We hope this post will make comparing the various car insurance providers in the United Kingdom a little less of a chore.

Below is the list 10 best car insurance companies with cheap quotes and good services for every UK car owner, ranking by Knowinsiders.com.

What type of car insurance do you need to drive legally in the UK?

In the United Kingdom, you must have auto insurance or risk being fined or even arrested.

There are no exemptions to this rule, and any motorist caught without proper insurance will be fined via automated camera equipment installed in police vehicles.

The bare minimum required by law is known as "third party" coverage, but it won't protect your vehicle if it's damaged in any way. That way, at the very least, if you cause an accident and damage someone else's property, you won't be responsible for paying for it out of your own pocket.

A more comprehensive policy, including coverage for theft, fire, and damage to or breakdown of your vehicle, is available to you but is not required by law.

A statutory off-road notice (SORN) must be filed with the relevant authorities if a vehicle is kept on public roads but will not be driven.

Many Types of Car Insurance in the UK

Auto insurance that covers only accidents in which the insured party is at fault

The bare minimum for car insurance is known as third-party coverage. All it does is protect you from financial ruin in the event that you injure someone else or cause damage to their property and have to pay compensation. To operate a motor vehicle in the United Kingdom, this insurance is a bare minimum.

That means you'll have to pay out of pocket for any costs related to vehicle damage, driver injuries, theft, or mechanical failure.

Coverage against damage, fire, and theft

As with third-party-only coverage, the other people involved in an accident with you are protected by third-party, fire, and theft coverage. It safeguards you in the event of a fire or theft of your car.

Keep in mind that it does not cover repairs to your own vehicle in the event of an accident. That leaves you on the hook for any damage done to your vehicle in an accident where you were not at fault.

Complete coverage auto insurance

In the event of an accident, comprehensive auto insurance will pay for repairs to your vehicle and any damage it causes, as well as any medical bills incurred by you or your passengers. Additionally, it prevents criminals from damaging or stealing your vehicle.

It's also usually the least expensive option, as insurers view policyholders who opt for full coverage to be less of a risk than those who opt for bare-bones protection or a hybrid of TPFT and TPV.

UK car insurance costs

Car insurance costs in the UK will depend on factors including:

-insurance type;

-vehicle value;

-driver age, history, and profile;

-what you will use the vehicle for.

The average cost for car insurance in the UK in 2018 was £431 a year. This is among the highest in the EU.

You can look to lower your annual car insurance premiums by:

-taking precautions to protect your vehicle, such as installing security devices to deter theft;

-Enroll in telematics insurance, wherein a "black box" is installed in your vehicle to monitor your driving patterns. Your premiums may go down if you demonstrate a history of safe driving.

-paying the yearly sum all at once as opposed to making monthly payments;

-raising your deductible, the portion of a claim that you are responsible for paying out of pocket. If your claim is worth £500 and your excess is £100, the insurance company will only pay you £400. Every insurance policy must have an excess, but you can raise yours voluntarily to save money.

You can include other safe drivers on your policy even if you're a new or young driver.

| How to rank the best car insurance companies in the UK? We have compiled the most up-to-date information about nearly 50 different auto insurers, using both expert review and customer feedback. We didn't just give these providers a rating based on cost; we did extensive research to determine who was the best in terms of coverage and customer service. These positions reflect the most recent information available from Bought by Many as well as other factors. High marks for customer service and complaints handling from Fairer Finance and other financial services review firms helped Bought by Many rise in the rankings, as did the quality of the coverage, both base and supplemental. |

1. John Lewis Finance

|

| John Lewis Finance |

John Lewis has been a staple on British high streets for over 150 years, and for good reason: they sell high-quality goods at reasonable prices and provide exceptional customer service. As a result, you can rely on us to provide tranquility even when it comes to financial services.

Fairer Finance, an independent research and rating agency, ranked John Lewis Finance fourth due to its excellent customer service and complaints handling.

Since 1865, customers have been able to turn to John Lewis Finance for affordable, dependable financial services. The company's car insurance provides protection against misfueling, uninsured motorists, courtesy transportation, onward travel protection, and European coverage for up to 90 days. Customers can also tailor their policies to their needs with add-ons like legal protection, roadside assistance, and a guaranteed no-claims discount. Covea Insurance plc is responsible for underwriting its policies.

2. Direct Line

|

| Direct Line |

The Direct Line Group is well-known in the personal lines (PCW) market thanks to the success of the Churchill, Darwin, and Privilege motor insurance brands in addition to the Direct Line brand. While the Direct Line brand accounted for 67% of sales in 2020, the PCW channel accounted for 30.2% of premiums. The launch of the new motor insurance platform demonstrates the company's commitment to technology. And with the opening of the Darwin office, the company's profile has been raised on price comparison websites.

The number of active auto insurance policies increased by 0.4% to 4.1 million in 2020, despite a 2.1% decline in gross written premium.

Customers purchasing new or pre-owned vehicles from a Volkswagen, SEAT, Audi, or KODA dealer in the United Kingdom can receive a discount on their annual insurance premiums from Direct Line, which is part of the UK Insurance Group's partnership with Volkswagen (which is part of Direct Line Group).

Some of the special features offered by Direct Line are the preservation of your no-claims discount in the event of a no-fault claim and other similar provisions. Though Direct Line's gross written premiums for home insurance are higher, auto insurance is where the company really shines, accounting for half of all premiums written.

3. Aviva

As an alternative, Aviva's MultiCar insurance is a viable choice. If you live in the same house as at least one other vehicle on your policy, you can save 10% per car. Each car will be eligible for its own no-claims discount, so an accident with one won't lower your savings on the others. Supplemental items are not eligible for price reductions.

You can only get a quote from Aviva by visiting their site or calling them directly; they do not participate in any price comparison sites.

Aviva offers two distinct types of auto insurance:

You can protect yourself financially in the event of an accident or other covered loss with Aviva's car insurance, which offers both comprehensive and third-party, fire and theft coverage.

The AvivaPlus is a subscription service that provides the same kinds of coverage as the standard plan (accident, third-party, fire, and theft), but with more leeway in terms of payment and cancellation. You can make interest-free monthly payments, cancel at any time, and add or remove coverage at no extra charge. But locating this protection on the Aviva site was a challenge.

| Additional forms of car insurance in the UK In the UK, motorists can purchase supplemental insurance policies to cover a wider range of potential losses. Among these are: Coverage for repairs, towing, and finding alternative transportation in the event of a breakdown are all covered by breakdown insurance. The car's mechanical issues are covered by the warranty. MotorEasy is one company that offers a warranty in addition to the one typically included with a new car. Coverage of legal costs in the event of a lawsuit is provided by legal liability insurance. Your no-claims bonus is safeguarded in the event of a claim with no-claims protection. Typically, a minimum period of time without filing a claim is required (typically 3 years); Having health insurance that protects you in the event of an accident and the resulting medical expenses; Driving Abroad - Currently, UK Insurance Policies Cover Cars Taken to EU Countries, but this may change. Coverage in additional countries can be added at the same premium as in the UK; Keys are replaced at no cost if they are lost or stolen. |

4. Admiral

|

| Photo: contact-centres |

When it comes to auto insurance, Admiral is a household name both in the United Kingdom and abroad. From a mere 57 employees in 1993, the company has expanded to employ over 10,000 people across its branches in the United Kingdom, Spain, Italy, France, the United States, Canada, India, Mexico, and Turkey.

In the United Kingdom, you'll find Admiral, an insurer that focuses specifically on car coverage. The insurance provider jumps nine places, from tenth to second on the list. Consumers surveyed by software firm Reevoo gave it an 8.9 out of 10 for its overall quality, 8.9 for its simplicity of purchase, 8.9 for the clarity of its policy details, and 8.7 for its affordability.

There are also personal loans and vehicle financing available, in addition to insurance for your car, van, home, and travels. Each division of the company routinely solicits customer input and is rewarded for going above and beyond in its support of the company's more than 6.5 million global customers.

Admiral offers three different types of auto insurance: full coverage, third-party only, and third-party, fire, and theft. Insurance against third-party liability, fire, theft, and the expense of fixing or replacing a vehicle that has been involved in an accident or deliberately damaged is all provided for under this policy's all-inclusive coverage. Coverage for broken windshields, rental cars, and even more protection while driving abroad are just a few of the perks that come with this policy.

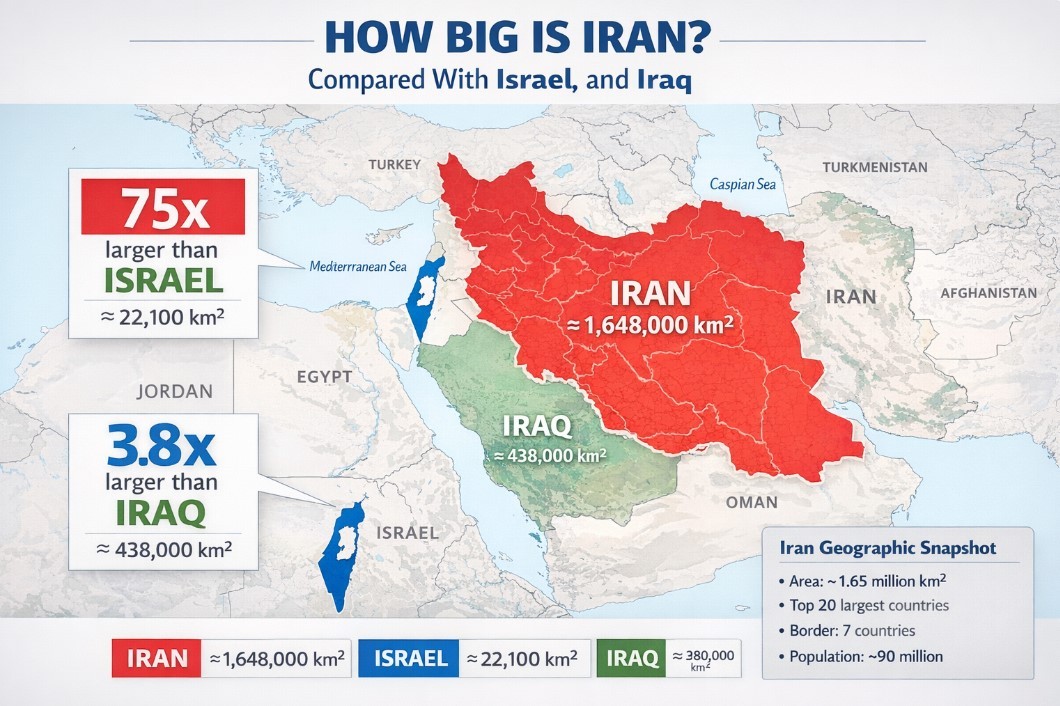

5. Hastings

|

| Photo: topcashback |

Hastings is another well-known name, especially among consumers who rely on price comparison websites (PCWs). As a matter of fact, in 2018, the PCW market accounted for 73% of Hastings' premiums written to new auto insurance customers. Hastings offers a variety of insurance products under the Hastings Direct, Hastings Premier, Hastings Essential, Hastings Direct Smart Miles (a black box plan), insurePink, and People's Choice names.

Hastings is geared toward consumers who prefer to shop around. If finding the lowest premium is your top priority, you may find cheaper options from other insurers in the top 10 (such as their "Hastings Essential" plan, which is only available through PCWs) depending on your location.

Insurance policies from Hastings can be customized to include extra coverage types like roadside assistance, towing, key replacement, and more.

Canceling a contract or changing providerYou are free to switch auto insurance companies at any time during your policy. After signing up for coverage, you have the right to cancel within 14 days and receive a full refund from your insurer. Cancelling after this time may result in charges, however. Standard contracts last for one year, but you can usually get out of them or switch providers halfway through if you change your mind. The good news is that if you pay for an entire year in advance, you won't be charged again until the following year, but the bad news is that insurance companies typically charge cancellation fees and sometimes additional administrative fees. When you sign up, you should be given details about these. In the United Kingdom, auto insurance policies often renew automatically unless the policyholder contacts the insurance provider to cancel coverage. Be wary of this and start looking for new, more affordable coverage well in advance of your current policy's expiration date. |

6. Churchill

|

| Photo: fxuk |

As one of the top providers of multi-vehicle and commercial auto insurance in the United Kingdom, Churchill Insurance comes highly recommended.

Churchill Insurance, established in 1989, was an early pioneer of direct auto insurance in the United Kingdom. Its car insurance includes a new vandalism promise, a courtesy car, and a 24-hour emergency hotline. It also guarantees repairs for five years if the policyholder uses Churchill-approved repairers. When a car is totaled, the customer has the option of getting a new one, an upgrade, or cash.

Though their customer service and ratings may be slightly lower than the top-ranked brand on our list (LV=), Churchill can be a solid option for those who prioritize price, as they are often the cheapest quote on offer at one of the major comparison sites (Moneysupermarket). In addition to the company's own website, Churchill insurance can be found on a wide variety of price comparison websites (but not yet via our partner, QuoteZone). One of Direct Line Group's "budget" brands is called Churchill. In the United Kingdom, Direct Line ranks second only to Admiral in terms of auto insurance policies sold, with 28.1% of those policies sold through price comparison websites under the Churchill and Privilege names.

Churchill is also well-known for its low-priced DriveSure telematics insurance policy.

7. CSIS

|

| Photo: csisinsuranceservices |

People who work for the government have access to CSIS, the Civil Service Insurance Society. It had the highest customer satisfaction rating of any insurance provider considered for the list. Customers who have filed complaints with CSIS have given the company an overall satisfaction rating of 97% or higher. The insurance company was honored with a Times Money Mentor Gold Award for outstanding service to customers. Their auto insurance plans stand out from the competition in a number of ways, including the ability to pay in monthly installments at zero interest.

CSIS is a non-profit organization, so all of its proceeds go to the CSIS Charity Fund, which supports organizations that provide essential public services. The insurance company has given away over $7 million to good causes over the past decade.

8. Bell Insurance

The advent of black box car insurance has alleviated the unfairness of age-based premium increases for safe young motorists (who are prone to having expensive accidents). Bell provides two types of insurance coverage: third-party, fire, and theft, and comprehensive. The black box is mandatory for the first six months of your policy, but after that it is optional. In addition, Bell does not have any limits on mileage or hours of operation.

Black box auto insurance is aimed at less risky young drivers (those between the ages of 17 and 25), with the goal of separating them from the more reckless members of their age group. Instead of paying a higher premium because of their age, safe young drivers can show an insurer that they drive safely by installing a monitoring device in their vehicle.

Bell's black box is a simple plug-in device that will monitor your driving for the first six months of your policy and could result in a reduced premium when your policy renews. Bell guarantees that your insurance premium will not increase because of a poor black box rating, though it will increase at renewal.

9. Age Co

|

| Photo: ageco |

The financial products and services offered by Age Co. are well-known among those over the age of 50. Insurance for your car and home, as well as retirement and death planning services and alternative care options for the elderly are all part of their repertoire of services.

Age Co offers three distinct types of auto insurance, each tailored to a different age group: drivers over the age of 60, 70, and 80. Customers can choose from full coverage, third-party fire and theft, or third-party liability.

Age Co's auto insurance plans feature amenities like an accident message relay service, coverage for permanently installed audio equipment, a Get You Home service, unlimited windscreen coverage, motor breakdown protection, and coverage in Europe for up to 180 days per year. Coverage for lost keys, additional losses, and legal liability for motor vehicles are all available as add-ons.

10. Dial Direct

|

| Photo: youtube |

Dial Direct is a UK-based insurance broker that works with a carefully selected group of top-tier insurance companies to provide competitive rates and first-rate service to policyholders through its in-country call center.

It offers car, home, and van insurance, all of which come with various benefits as standard.

We at BISL Limited use the name "Dial Direct" as a trading name. The BGL Group, which also owns Budget Insurance and Junction, is the parent company.

Only on price comparison websites does Dial Direct provide full coverage, which includes a host of extras.

Dial Direct's all-inclusive policyholder perks include many useful features.

Towing and Assistance from RAC Drivers.

Protection for your no-claims discount and cancellation of excess fees in the event of an accident with an uninsured driver.

Costs associated with getting home or finding overnight lodging if an accident prevents you from continuing your journey.

The top 10 leading car insurance companies in the UK(Ranked by Bought by Many) 1. Direct Line 2. Admiral 3. Aviva 4. John Lewis Finance 5. Hastings 6. Churchill 7. CSIS 8. Bell Insurance 9. Age Co 10. Dial Direct |

How to make a complaint about a UK car insurance company?Follow these procedures if you feel you have been treated unfairly by a UK car insurance company: -Complain in writing to the insurance firm you're utilizing. The company has eight weeks to investigate your complaint and respond to your request for a ruling; If you are unhappy with the outcome of your complaint, you may submit it to the Financial Services Ombudsman. If the complaint is upheld, you could receive up to £150,000 in compensation; If your issue isn't resolved to your satisfaction, you can file a claim in Small Claims Court. This court rarely rules differently than the Ombudsman, so you should be sure you have a valid complaint before bringing it here. |

Cheapest car insurance companies in the UK

Search for quotes from multiple top comparison sites, like Go Compare, Confused, and MoneySuperMarket, to find the most affordable car insurance in the United Kingdom.

Compare the lowest cost money market rates

The lowest annual premium found on Money Supermarket was with Admiral, at just £263.20. There was a mandatory £150 excess and an optional £250 excess with this plan. The standard package included medical payments, windshield replacement, and a rental car. From £44.95, you can add breakdown protection, and for an extra $24.95, you can get legal protection. The Admiral Group's other subsidiaries, Elephant and Diamond, offered identical protection for £264.32 and £265.44.

Cheapest Start comparing prices now

GoCompare's lowest-priced quote was £290.08, also from Admiral. Both the mandatory excess of £150 and the optional excess of £250 were included in this policy. The standard package included both medical payments coverage and a loaner vehicle in the event of an accident.

Cheapest Review competing price estimates from the Market.

Admiral's annual premium quote of £322.56 was the lowest I found on Compare the Market. There was a minimum mandatory excess of £150 and an optional excess of £250 with this policy. Standard benefits included both medical payments and a loaner vehicle in the event of an accident. While LV='s annual premium of £408.46 is higher than the average, their mandatory excess of £100 is the lowest among the major insurers.

Tips to get cheaper car insuranceIt's best to renew early, by a few weeks. MoneySavingExpert found that the best time to get a car insurance quote is between 20 and 26 days before a policy expires or renews. To those who are looking to renew soon, this appears to be the optimal option. Quotes can be locked in 30 to 60 days before renewal with some providers. When it comes time for renewal, you can compare all of the quotes you've collected up until that point and pick the one that's the most affordable. Browse around When it's time to renew your insurance policy, it's in your best interest to call around and see what you can save. You may be eligible for a "standard" discount from your insurer if you give them a call. If you've shopped around and found cheaper quotes from other providers that offer the same level of coverage, that could give your negotiation more clout. In most cases, seasoned drivers can save money by opting for comprehensive coverage. The insurer may offer a cheaper comprehensive policy to a driver who they perceive to be less of a risk. Black box insurance might be more affordable for some younger drivers. Rent multiple vehicles and save! Premiums can be reduced by taking advantage of discounts such as those available exclusively online or for having multiple vehicles insured with the same company. For instance, LV= claims its customers can save up to 20% by insuring more than one car with them at the same time, and Admiral's MultiCar policies offer discounts for each additional vehicle insured. Select a vehicle from a low insurance group. Finally, the car group you fall into will have an impact on your premium. Insurance rates typically start at the lowest tier (Group 1) for vehicles and increase steadily from there. Our comprehensive guide provides more information about auto insurance classifications. |

10 Best Car Insurance Companies in Canada - Cheapest Quotes and Good Services 10 Best Car Insurance Companies in Canada - Cheapest Quotes and Good Services There are dozens of auto insurance providers in Canada, but prices and services can really vary. How can you find the best insurance providers? |

Top 5 Most Attractive Places in Alaska Top 5 Most Attractive Places in Alaska Best places to visit in Alaska: Alaska is easily the largest state within the United States, at 586,412 square miles, offering visitors thousands of attractions ... |

Top 10 Biggest States In The United States - By Population Top 10 Biggest States In The United States - By Population The United States is one of the largest countries in the world. This article below will demonstrate what states are the biggest and most crowded ... |