Why Millions of Americans Are Cutting Back in 2026 — And What It Means for the Economy

Why Americans Felt Poorer in 2025 — Even After Inflation Fell Why Americans Felt Poorer in 2025 — Even After Inflation Fell |

The 2026 U.S. Economy Forecast: Prepare Now or Get Left Behind The 2026 U.S. Economy Forecast: Prepare Now or Get Left Behind |

By the close of 2025, a noticeable shift set in across the United States. Shoppers who once shrugged at small price hikes began scrutinizing receipts. Families delayed trips, paused subscriptions, and rethought “nice-to-haves.” The message was clear: Americans are cutting back—and not just out of caution, but out of necessity.

This pullback matters. Consumer spending drives roughly two-thirds of the U.S. economy. When households tighten belts, the effects ripple outward—from retail sales to hiring plans—shaping the outlook for 2026.

Read more: Americans Are Spending Less in 2026: 7 Costs Families Can’t Ignore

|

| Americans are pulling back on spending |

Where Americans are cutting back first

The cutbacks are showing up in predictable, everyday places:

Dining and entertainment. Restaurant visits are down as families cook more at home and save nights out for special occasions. Movie tickets, concerts, and weekend entertainment are increasingly “planned purchases,” not spur-of-the-moment decisions.

Travel. Many Americans are swapping flights for road trips, shortening vacations, or postponing travel altogether. Even modest getaways now require careful budgeting.

Retail shopping. Apparel, home décor, and electronics are being delayed unless there’s a clear need or a steep discount. Holiday sales that once felt irresistible are now approached with caution.

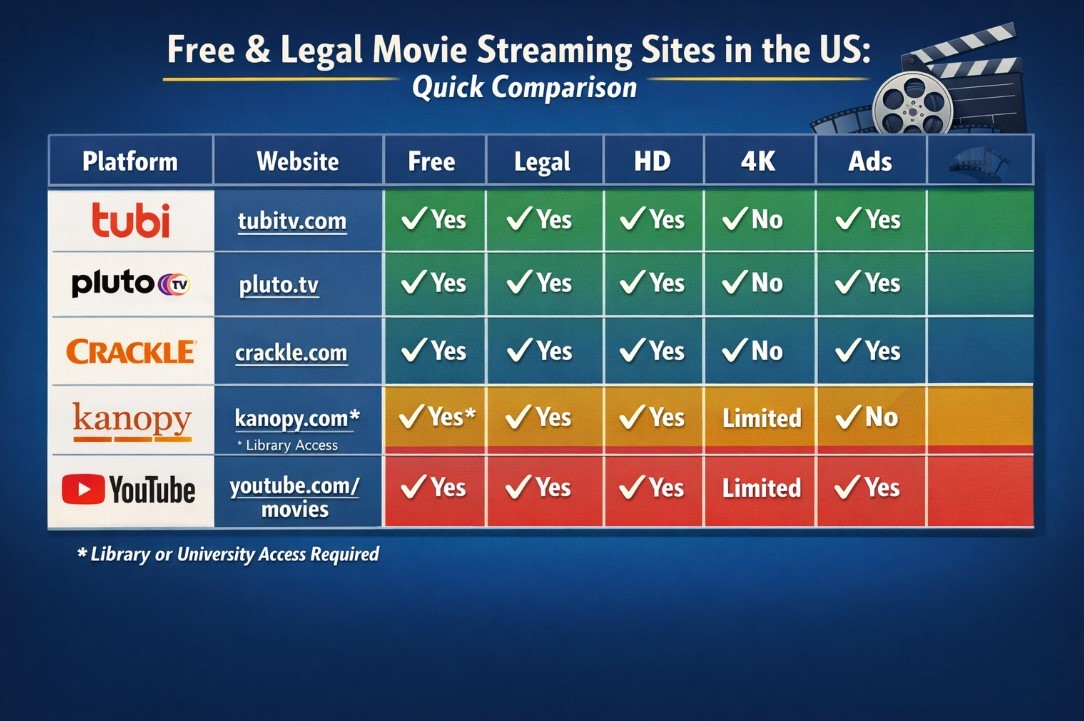

Subscriptions. Streaming platforms, meal kits, fitness apps, and premium news subscriptions are among the first to go. Households are asking a simple question: “Do we really use this?”

Individually, these cuts seem small. Collectively, they signal a broader defensive posture.

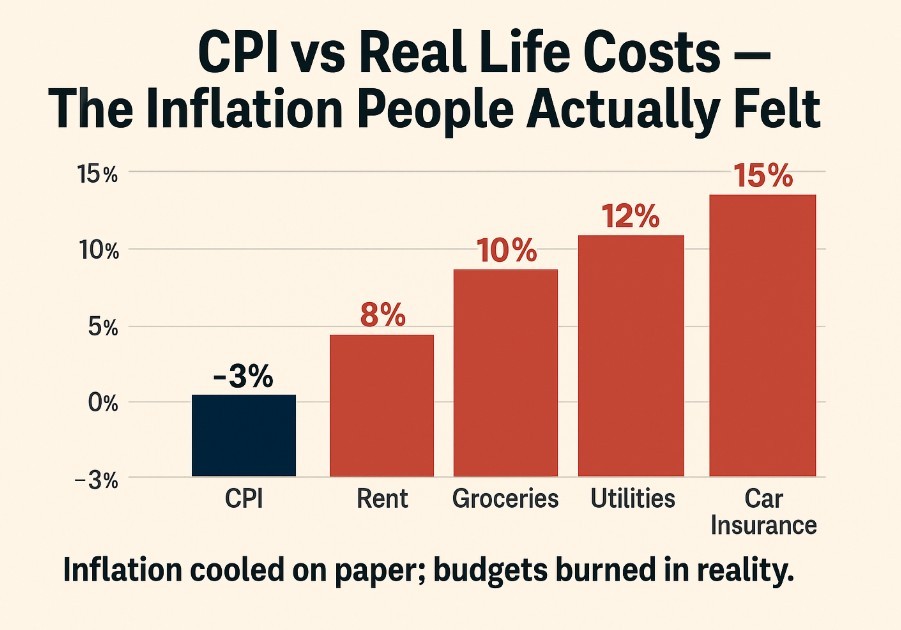

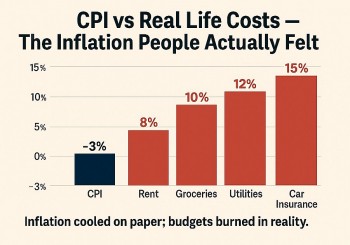

Inflation isn’t “hot” anymore—but it still hurts

On paper, inflation looks calmer than it did during its peak. Headline numbers have cooled, and the word “inflation” no longer dominates daily headlines. Yet for many Americans, the cost of living still feels uncomfortably high.

That’s because inflation slowing doesn’t mean prices fall—it means they rise more slowly. Grocery bills remain elevated compared with just a few years ago. Rent payments are still near historic highs in many regions. Utilities, insurance, and medical costs continue to creep upward.

For households whose wages haven’t kept pace, this creates a squeeze. Essentials take up a larger share of income, leaving less room for discretionary spending—even if inflation data looks “better” to economists.

Why confidence is falling—even without a jobs collapse

One puzzle of late 2025 has been the disconnect between employment data and consumer sentiment. The labor market hasn’t collapsed. Unemployment remains relatively low by historical standards. Yet consumer confidence has slid.

Several factors help explain the gap:

Cost anxiety beats job security. Having a job doesn’t guarantee financial comfort when rent, healthcare, and debt payments rise faster than paychecks.

Debt fatigue. High interest rates mean carrying balances—especially on credit cards—has become painfully expensive. Even stable earners feel pressure when interest compounds month after month.

Future uncertainty. Americans aren’t just reacting to today’s bills; they’re worried about what comes next. Will healthcare costs rise again? Will rent jump at renewal? Will layoffs spread if spending slows?

Confidence, after all, is about expectations. And expectations have turned cautious.

A shift toward “defensive spending”

Economists increasingly describe 2026 as a year of “defensive” or “protective” spending. Instead of chasing upgrades, households are prioritizing resilience.

That means:

-

Building emergency savings, even if slowly

-

Paying down high-interest debt instead of making big purchases

-

Choosing value over convenience

-

Avoiding long-term financial commitments unless absolutely necessary

This doesn’t signal panic. It signals prudence.

Read more: Student Homelessness in America Is Exploding: The Education Crisis Hiding in Plain Sight

What this means for the economy in 2026

When millions of households pull back at once, businesses feel it. Retailers adjust inventory. Restaurants cut hours. Companies delay expansion plans. Hiring slows—not because demand has vanished, but because it’s less certain.

The risk isn’t necessarily a dramatic recession. It’s a quieter slowdown driven by caution. Growth becomes harder to sustain when consumers spend defensively rather than confidently.

At the same time, this environment rewards businesses that adapt—those offering clear value, flexible pricing, or essential services. It also underscores why policymakers watch consumer confidence so closely: it often shifts before the broader economy does.

What households should prepare for

For American families, the lesson heading into 2026 is realism, not fear.

Budgets that worked a few years ago may no longer fit today’s prices. Reviewing subscriptions, renegotiating bills, and planning major purchases carefully can create breathing room. So can focusing on debt reduction and modest savings goals.

Most importantly, understanding that this pullback is widespread—not a personal failure—can help households make clearer decisions.

Millions of Americans are spending less because the math demands it. And as long as everyday costs remain elevated, caution is likely to define consumer behavior in 2026—reshaping not just household budgets, but the economy itself.