What is SoftBank: Everything you need to know and its $100 billion investment vision for America

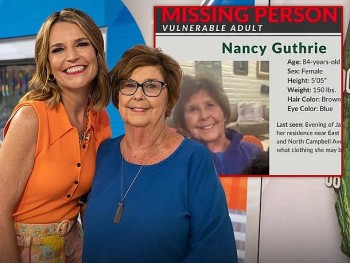

Who is Masayoshi Son (SoftBank CEO): Bio, Career, and Net Worth Who is Masayoshi Son (SoftBank CEO): Bio, Career, and Net Worth SoftBank CEO Masayoshi Son announced a $100 billion investment in the U.S. over the next four years during visit to President-elect Donald Trump’s residence Mar-a-Lago ... |

|

| Masayoshi Son: Chairman & CEO, SoftBank Group Corp. |

1. Overview of SoftBank

What is SoftBank?

SoftBank Group Corp. is a Japanese multinational conglomerate headquartered in Tokyo, Japan. It is best known for its diverse portfolio, which includes telecommunications, e-commerce, technology, media, and significant investments in startups and established businesses worldwide.

SoftBank has positioned itself as one of the largest technology investors globally, driving innovation across industries such as AI (artificial intelligence), robotics, telecommunications, and clean energy.

- Founder: Masayoshi Son

- Founded: September 3, 1981

- Headquarters: Tokyo, Japan

- CEO: Masayoshi Son (as of 2024)

|

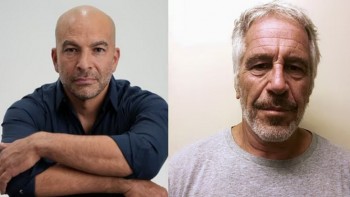

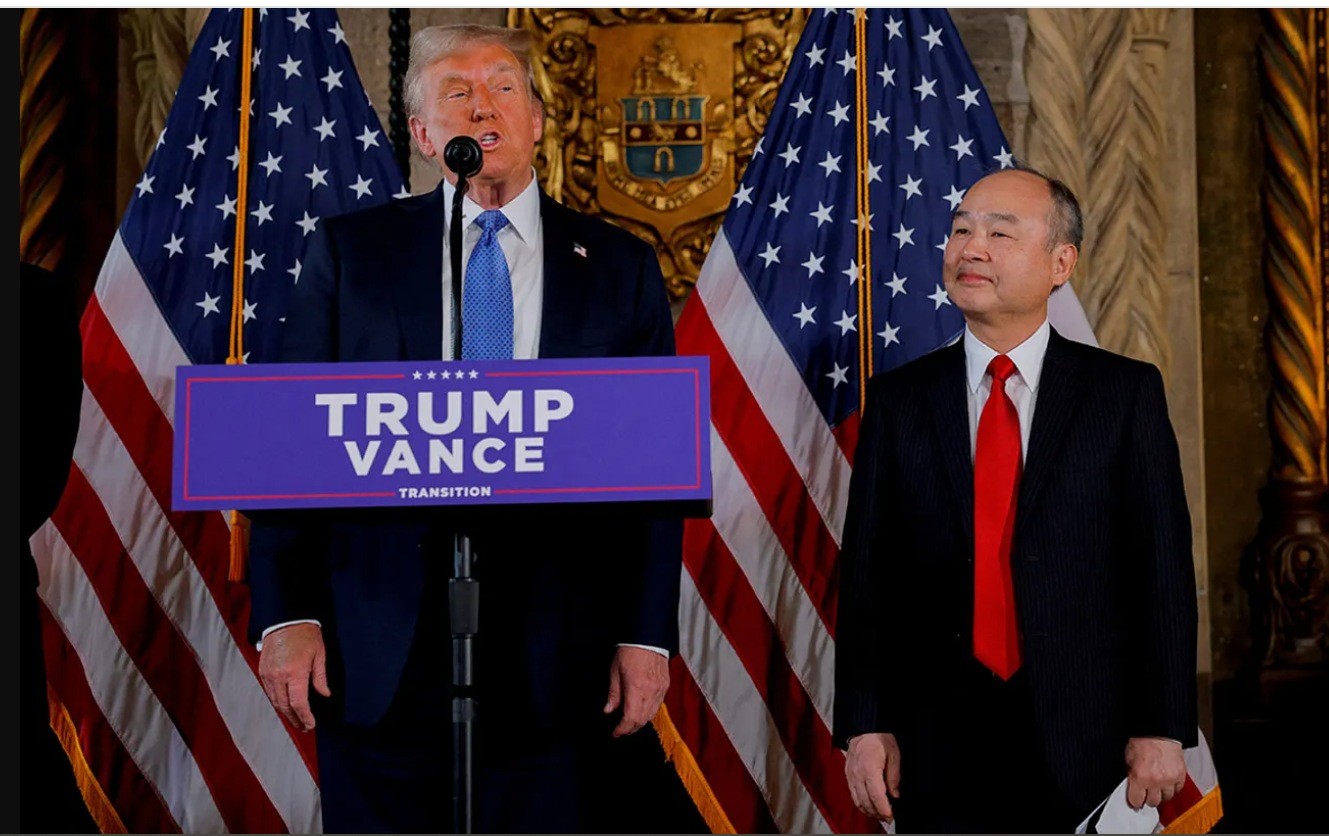

| President-elect Donald Trump and SoftBank Group CEO Masayoshi Son announced at Mar-a-Lago that the company is expected to invest $100 billion in US projects over the next four years |

SoftBank’s History

Founded by Masayoshi Son, a Japanese entrepreneur of Korean descent, SoftBank initially started as a software distributor. Over time, Son transformed it into a powerful conglomerate, shifting focus to telecommunications and investments in high-growth technology companies.

Some key milestones:

- 1996: SoftBank entered telecommunications by acquiring stakes in Yahoo Japan.

- 2000: It survived the dot-com bubble crash.

- 2006: SoftBank acquired Vodafone Japan, marking its entrance into mobile operations.

- 2017: Launch of the $100 billion Vision Fund, the world’s largest technology-focused investment fund.

SoftBank’s success is driven by Son’s ability to identify and invest in transformative technologies and promising companies.

Global Reach and Influence

SoftBank operates across multiple industries, including:

- Telecommunications: SoftBank Mobile (Japan), investments in Sprint (U.S.).

- Investments: Vision Fund (1 & 2) has funded global startups.

- AI and Robotics: Focus on AI and automation through investments like Boston Dynamics.

- E-commerce: Investments in Alibaba Group and Coupang (South Korea).

SoftBank is active in over 30 countries and manages a portfolio worth hundreds of billions of dollars, influencing how technology shapes our world.

|

2. SoftBank’s Vision Funds

Vision Fund 1 (2017)

In 2017, SoftBank launched the SoftBank Vision Fund, a $100 billion investment fund, to revolutionize technology investments.

Key Details

- Size: $100 billion

- Purpose: Investing in tech companies focusing on AI, e-commerce, fintech, and emerging industries.

- Key Investors:

- SoftBank ($28 billion)

- Saudi Arabia’s Public Investment Fund (PIF) ($45 billion)

- Mubadala (UAE), Apple, and Qualcomm.

Vision Fund 2 (2019)

Building on Vision Fund 1's success, SoftBank announced Vision Fund 2 in 2019 with an additional $108 billion goal.

- Focus: AI-driven companies, automation, and innovative technology sectors.

- Investors: Unlike Vision Fund 1, Vision Fund 2 relied heavily on SoftBank’s own capital.

Combined Impact: The Vision Funds have invested in over 300 companies worldwide.

| The Japanese internet and telecommunications company estimates that its U.S.-based investments will create 100,000 jobs focused on artificial intelligence and emerging technologies and plans to complete the work before Trump leaves office in 2029. During an event at Mar-a-Lago, Trump’s private Florida club, Trump asked Son to further increase the company’s previously negotiated $100 billion investment. “Would you make it $200 billion?” Trump asked. Son paused and said, “I will try to make it happen.” |

3. SoftBank’s Investments in America

SoftBank’s investment strategy in the U.S. focuses on technology, innovation, and creating jobs. Masayoshi Son’s vision is to make impactful investments that will transform industries and generate economic growth.

$100 Billion Investment Strategy in America

Masayoshi Son pledged to invest $100 billion in American technology and infrastructure, primarily through the Vision Funds. The focus has been on startups and companies driving:

- AI and automation

- E-commerce platforms

- Financial technology (fintech)

- Robotics and clean energy

Key SoftBank Investments in the U.S.

1. Uber Technologies

- Investment: $7.6 billion in Uber’s ridesharing business.

- Impact: Helped Uber maintain dominance in the U.S. and globally.

2. WeWork

- Investment: Over $10 billion in total (including bailouts).

- Impact: WeWork revolutionized shared workspaces but later faced financial challenges.

3. Sprint Corporation

- Investment: Acquired Sprint in the U.S. and facilitated its merger with T-Mobile.

- Impact: Boosted U.S. telecommunications infrastructure.

4. DoorDash

- Investment: $680 million investment in DoorDash, a U.S. food delivery service.

- Impact: DoorDash expanded significantly and went public in 2020.

5. Arm Holdings

- Investment: SoftBank acquired British chip designer Arm for $32 billion in 2016 and strengthened its operations in the U.S.

6. Fortress Investment Group

- Investment: SoftBank acquired this American private equity firm for $3.3 billion.

Other Notable Investments in the U.S.:

- Slack (business communication software)

- Compass (real estate platform)

- Boston Dynamics (robotics)

Economic Impact in the U.S.

SoftBank’s $100 billion investment pledge has had significant economic effects:

- Job Creation: Investments in startups like Uber, DoorDash, and WeWork created thousands of jobs.

- Technological Advancements: Boosted innovation in AI, e-commerce, and logistics.

- Support for Entrepreneurs: SoftBank’s capital has enabled American startups to scale rapidly.

Read More: What is Mar-a-Lago: Private Club, Politics, and Media

4. Major Challenges and Criticisms

While SoftBank’s investments have led to incredible growth, they have also faced major challenges:

WeWork’s Collapse

SoftBank’s $10+ billion investment in WeWork turned into a high-profile failure. The company’s flawed business model and leadership issues resulted in significant financial losses.

High-Risk Investment Strategy

- Critics argue that SoftBank’s aggressive investment approach focuses on growth over profitability, which can backfire.

- Some companies funded by SoftBank, such as Oyo Rooms and Zume Pizza, failed to deliver on expectations.

Geopolitical Scrutiny

- Investments backed by Saudi Arabia’s Public Investment Fund have faced ethical concerns due to geopolitical issues.

- Increased regulatory scrutiny over investments in AI and data privacy sectors.

5. Success Stories: SoftBank’s Biggest Wins

Despite its challenges, SoftBank has secured some of the most lucrative investments in tech history:

1. Alibaba Group

- Initial Investment: $20 million (2000)

- Current Value: Worth over $60 billion at its peak.

- Impact: One of the greatest investments in SoftBank’s history, transforming the Chinese e-commerce giant.

2. Uber Technologies

- Uber went public in 2019, giving SoftBank a significant return on investment.

3. DoorDash

- SoftBank’s early funding helped DoorDash grow and achieve a successful IPO in 2020.

4. Arm Holdings

- Arm continues to be a leader in semiconductor design, critical to industries like mobile computing and AI.

5. Coupang

- SoftBank invested in South Korean e-commerce company Coupang, which went public in 2021.

6. FAQs: Everything You Need to Know

Q1: What is SoftBank’s Vision Fund?

A: The Vision Fund is a $100 billion investment fund launched by SoftBank in 2017 to support tech startups and innovative businesses globally.

Q2: How much has SoftBank invested in the U.S.?

A: SoftBank pledged to invest $100 billion in American technology and infrastructure. Major investments include Uber, WeWork, and DoorDash.

Q3: Who owns SoftBank?

A: SoftBank is a publicly traded company, but its founder and CEO, Masayoshi Son, remains the key figure driving its strategy.

Q4: What companies has SoftBank invested in?

A: Notable investments include Uber, DoorDash, WeWork, Slack, Alibaba Group, and Arm Holdings.

Q5: What challenges has SoftBank faced?

A: SoftBank faced major challenges like WeWork’s collapse, high-risk investments, and geopolitical scrutiny over partnerships.

Q6: Why is SoftBank investing so heavily in the U.S.?

A: The U.S. offers a robust tech ecosystem, innovation-driven startups, and growth opportunities that align with SoftBank’s goals.

Q7: What are SoftBank’s biggest success stories?

A: SoftBank’s most successful investments include Alibaba, Uber, DoorDash, and Coupang, yielding multi-billion-dollar returns.

Q8: Who is Masayoshi Son?

A: Masayoshi Son is the founder and CEO of SoftBank, known for his visionary leadership and bold investment strategy.

Q9: How does SoftBank choose its investments?

A: SoftBank focuses on tech-driven companies, emphasizing AI, robotics, fintech, and businesses with high-growth potential.

Q10: What is the future of SoftBank in America?

A: SoftBank plans to continue investing in AI, clean energy, and transformative technologies, driving innovation and job creation in the U.S.