What is AAVE - How it works, Features and Characteristic, Road Map

|

| AAVE. Photo: Bitcoin Popo |

What is Aave?

Aave (pronounced “ah-veh”) is a decentralized cryptocurrency lending platform. In fact, it was the first DeFi lending protocol when it launched its first main net as ETHlend in 2017 (this was before DeFi was even a thing!).

ETHlend/Aave’s founder Stani Kulechov is passionate about working with leading developers from other projects within the DeFi space and is hyper-focused on ensuring the platform appeals to institutional and retail investors both inside and outside of cryptocurrency.

To briefly recap, ETHlend was a sort of marketplace where borrowers and lenders could negotiate terms without a third party. You can think of it as a job posting board but with loans instead. The platform was moderately successful, but the team decided they were “ready to be serious players” in the DeFi space.

This led to the launch of Aave in January of this year when the Aave mainnet launched and introduced a completely new protocol to its users along with a few novel features that have changed DeFi forever, according to Coinbureau.

How does Aave work?

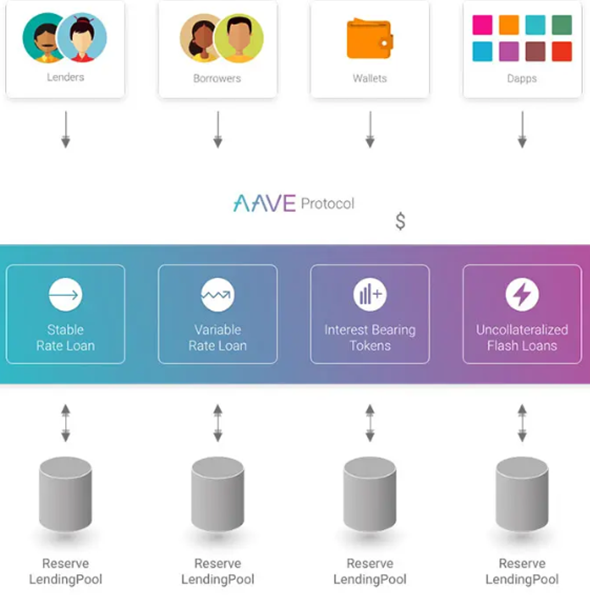

Aave is perhaps best described as a system of lending pools.

Users deposit funds they wish to lend, which are then collected into a pool. Borrowers may then draw from those pools when they take out a loan. These tokens can be traded or transferred as a lender wishes.

To facilitate this activity, Aave issues two types of tokens: aTokens, issued to lenders so they can collect interest on deposits, and AAVE tokens, which are the native token of Aave.

The AAVE cryptocurrency offers holders several advantages. For instance, AAVE borrowers don’t get charged a fee if they take out loans denominated in the token. Also, borrowers who use AAVE as collateral get a discount on fees.

AAVE owners can further look at loans before they are released to the general public if they pay a fee in AAVE. Borrowers who post AAVE as collateral can also borrow slightly more.

The data firm Nomics has a more extensive list of AAVE's features.

Features and characteristics of ETHLend Coin

ETHLend creates a friendly environment for lenders and borrowers to meet and transact quickly and safely. Borrowing in the system is not only encapsulated in cryptocurrencies but can encroach on legal currencies and real assets. Due to the advantage of being a decentralized application in the Ethereum ecosystem, ETHLend can be linked to other applications to better support customers. Here are some typical features of ETHLend announced:

Lending based on reputation

ETHLend will link with other decentralized applications (such as Bloom, uPort) of Ethereum to create a data system that allows the rating of each user’s credit score. As a result, lending will be safer and more transparent. In addition, ETHlend also records the history of transactions and thus forms its own credit rating system. These credit data can be extracted to other blockchains or applications.

Sharing risk with other lenders

When a lender does not trust the borrower, it is possible to turn to the form of multiple co-lenders, dividing the loan, minimizing the risk.

Market forecast for credit risk assessment

Predict the cryptocurrency market to help lenders make better and more secure lending decisions.

Reverse auction

ETHLend will hold auctions where lenders will bid on the amount they can lend.

*Also Read: 5 Most Profitable Cryptocurrencies to Invest in Now

Aave Roadmap

|

| Photo: Zephyrnet |

Keeping in tune with its theme of transparency, Aave clearly defines their roadmap on their website’s About page. The only problem is that it ends in May of this year and does not show any future milestones for the project.

Every single one of them was met and some of the important ones included successfully launching the protocol, integrating the Chainlink oracle, adding support for MyEtherWallet and Trust Wallet, and the integration of the Uniswap Market on Aave which allows traders to do all sorts of magic with Aave’s Flash Loans.

Most of the chatter surrounding Aave’s development has been about the introduction of governance to the protocol. This would allow holders of the LEND token to have a say in the future of the project, turning it into a DAO.

While the exact mechanics of this have not been officially announced, in a recent interview with Messari, Stani Kulechov stated that holders of LEND will be able stake the token to earn a fraction of the interest being paid on loans. This pool of staked LEND tokens would also function as emergency reserves for the protocol, with small amounts being liquidated to maintain stability during black swan events.

What do you have to know before you buy Aave?

You might already know that investing in cryptocurrency is risky. Yes, it is also true that you can get a high return on investments while trading in crypto. However, at the same time, you can lose all your invested funds in digital currencies. If you are lucky, then there are chances that you earn a good return on investment. Also, don’t forget that many people lost their life savings, because of poor research.

High risk

It is recommended by professionals, that you invest in assets when you have extra money. What do we mean by extra money? The money you have other than your everyday needs. Firstly, you need to separate money that you need for your rent, food, medicines, some money for hard times, and necessities of life.

Timing

The cryptocurrency market gives you opportunities to earn money by investing at the right time. Make sure when you decide to invest in Aave, it is the right time. Check the trends of other cryptocurrencies. There are chances that Aave will follow the same trend. If you buy Aave at the wrong time, you will put yourself in a difficult position. The image below shows the right time to invest in Aave.

Right time to invest in Aave

Research

If you want to invest in Aave, please do thorough research about the project. Check how much money the currency raised. Also, the team plays a crucial part in the success of the project. Get the information about the team and its past achievements. Moreover, review the historical data and past trends of Aave. There are many more things to consider, but we only mentioned a few of them. It is better to do thorough research before investing in Aave or any other cryptocurrency. It will help you avoid making silly mistakes in your investment journey.

Below we have compiled a list of few fundamental things to consider before selecting an exchange to buy Aave:

Trading volume

Fees

Absence of wash trading

Liquidity

Reputation

LEND Price Analysis

You may be surprised to find that the price of Aave’s LEND token has never risen above 1$USD. The LEND token made its debut on the crypto market in November of 2017 and got swept up in the historic bull run which began a month later. It reached its all time high of over 40 cents USD before crashing down to below 2 cents and eventually 1 cent where it remained until the end of 2019.

As you might have guessed, the introduction of the new Aave protocol in January of this year has sent the LEND token into orbit. It gradually appreciated in price from 1 cent USD to over 14 cents USD in June of this year when DeFi really started heating up.

This is somewhat impressive given the token’s limited use as an optional means of paying fees on the protocol. It will be interesting to see what effects the introduction of governance will have on the price of LEND once it is rolled out.

AAVE Governance

Aave’s native token – AAVE – is an ERC20 token with a total supply of 16,000,000 tokens.

LEND was originally used as a utility token within the ETHLend platform. It provided users with a variety of benefits including reduced fees, improved loan-to-value ratios, and staking rewards.

However, as ETHLend shut down and was replaced by Aave, the LEND token took on additional use-cases including platform governance as it moves toward a more decentralized model.

Most recently, LEND was migrated to AAVE, used to vote on proposals made by the development team, as well as economic parameters including interest rates, liquidation configurations, and new assets.

AAVE can be staked in the Safety Module to collect protocol fees and rewards.

Aave prospers as part of the seemingly more resilient DeFi marketAave is a decentralised finance (DeFi) protocol that is created with the idea to allow its users to lend and borrow cryptocurrencies. Aave was (as well as its predecessor ETHLend) founded by Stani Kulechov. The project has picked up market traction due to its strong fundamentals, making it one of the top decentralized finance ventures. Aave’s overall outlook is bullish, mostly due to its extraordinary fundamentals. The project continuously helps the market by sponsoring events and giving grants to other perspective ventures. Aave managed to post week-over-week gains of 19.36%. When compared to other cryptocurrencies, BTC posted a loss of 12.47%, while ETH managed to gain 2.40% over the same period. At the time of writing, Aave is trading for $194.5, representing a price increase of 113.55% compared to the previous month’s value, according to Invezz. |

For more interesting news of KnowInsiders, check out below!

5 Most Profitable Cryptocurrencies to Invest in Now 5 Most Profitable Cryptocurrencies to Invest in Now So far, 2021 is predicted to be a good year for the cryptocurrency market. Since Blockchain evolved to be one of the most feasible technology, ... |

Prediction: Prices of Bitcoin, Cryptocurrency and Blockchain in 2021 Prediction: Prices of Bitcoin, Cryptocurrency and Blockchain in 2021 2020 is coming to an end in just a few days, so let’s take a look at some cryptocurrency and blockchain predictions for 2021. |

Bitcoin price forecast 2021: How much is Bitcoin worth? Bitcoin price forecast 2021: How much is Bitcoin worth? Bitcoin price forecast 2021: After a multi-year bear market, Bitcoin was again trading near its all-time high by December 2020. From the halving cycle to ... |