Top 15 World Largest Satellite Companies by Market Value

|

| World Largest Satellites Companies by Market Value |

| Table Content |

Here is their listing for the top 15 largest satellite companies in the worrld by latest market value in 2022.

This list ranks companies based on revenues from all customized communications sources and includes operators of teleports and satellite fleets. While listing the companies by revenue (source:https://www.value.today/), there may be contradictory figures in this list.

1.Boeing

Boeing is the World's largest aerospace company and leading manufacturer of commercial jetliners, commercial aircrafts, defense, space and security systems, and service provider of aftermarket support. As America’s biggest manufacturing exporter, the company supports airlines and U.S. and allied government customers in more than 150 countries.

World Rank (Jan-07-2022): 115

Market Value (Jan-07-2022): 126.650 Billion USD

Number of Employees: 141,014

Annual Revenue in USD: 58,160 Million USD

Annual Net Income in USD: 11,870 Million USD

2.Northrop Grumman

Northrop Grumman is Aerospace and Defense based Technology company with headquarters in Virginia, USA.

Northrop Grumman is a leading global security company providing innovative systems, products and solutions in autonomous systems, cyber, C4ISR, space, strike, and logistics and modernization to customers worldwide. They have approximately 97,000 employees in all 50 states and in more than 25 countries as on December 2020.

They work on aeronautics systems, defense systems, space systems, mission systems.

World Rank (Jan-07-2022): 285

Market Value (Jan-07-2022): 63.001 Billion USD

Annual Revenue in USD: 33,840 Million USD

Annual Net Income in US: 2,248 Million USD

Number of Employees: 97,000

3.Safran

SAFRAN is Technology Company with expertise in Space, Aerospace and Defense Technology related Products. Headquarters in Paris, France.

Safran is an international high-technology group, operating in the aviation (propulsion, equipment and interiors), defense and space markets. Its core purpose is to contribute to a safer, more sustainable world, where air transport is more environmentally friendly, comfortable and accessible.

Safran has a global presence, with 76,000 employees and sales of 16.5 billion euros in 2020 and holds, alone or in partnership, world or regional leadership positions in its core markets. Safran undertakes research and development programs to maintain the environmental priorities of its R&T and innovation roadmaps.

World Rank (Jan-07-2022): 345

Market Value (Jan-07-2022): 54.377 Billion USD

Annual Revenue in USD: 29,606 Million USD

Annual Net Income in USD: 2,855 Million USD

Number of Employees: 78,900

4.SpaceX

SpaceX is capable of sending satellites through private rockets. Founder of the company is Elon Musk. Headquarters is in California, USA. Vision of SpaceX is to launch 40,000 satellites and to help even people in remote places to have powerful internet and communication network.

World Rank (Jan-07-2022): 427

World Rank (Sep-01-2021): 427

Number of Employees: 8,000

Annual Revenue in USD: 2,000 Million USD

5.Mitsubishi Electric Corporation

Mitsubishi Electric is one of the world's leading names in the manufacture and sales of electrical and electronic products and systems used in a broad range of fields and applications.

Japan based electrical and electronics company with around 142,000 employees as on Dec-2018. Core manufacturing products are in business segments.

From its founding in 1921, Mitsubishi Electric has been at the forefront of Japan’s technical ingenuity and product innovation.

Number of Employees: 146,518

Annual Revenue: 4462.5 Billion JPY

Annual Net Income: 221.8 Billion JPY

|

| satellite |

6.HEICO Corporation

HEICO Corporation is a successful and growing technology-driven aerospace, industrial, defense and electronics company. For more than 60 years, HEICO has thrived by providing customers with innovative and cost-saving products and services.

HEICO's products are found on large commercial aircraft, regional, business and military aircraft, as well as on a large variety of industrial turbines, targeting systems, missiles and electro-optical devices.

HEICO Corporation is a New York Stock Exchange listed company (NYSE: HEI and HEI.A) and has also been ranked as one of the 100 "World's Most Innovative Growth Companies", 100 "Best Small Companies" and 200 "Hot Shot Stocks" by Forbes over the past decade. With headquarters in Hollywood, Florida, and multiple locations around the world - HEICO provides over 1 million square feet of design, manufacturing, repair, overhaul, distribution, sales and support capabilities.

The Electronic Technologies group produces electrical and electro-optical systems and components serving niche segments of the aerospace, defense, communications, and computer industries. The Electronic Technologies group is a worldwide leader in the design, manufacture and sale of electrically and electro-optical engineered products used in the aerospace, defense, space, and electronics industries.

Number of Employees: 5,600

Annual Revenue: 1,787 Million USD

Annual Operating Income: 376.6 Million USD

7.China Satellite Communications

China Satellite Communications Co.,Ltd. is mainly engaged in satellite space segment operation and related application services, mainly used in satellite communication broadcasting. The company was founded in 2001 and is headquartered in Beijing, China.

World Rank (Jan-07-2022): 2,025

Market Value (Jan-07-2022): 9.095 Billion USD

Annual Revenue in USD: 407 Million USD

Annual Net Income in USD: 73 Million USD

8.Iridium Communications

Iridium Communications is a Mobile Satellite Communications company. It offering voice and data connectivity through a constellation of 66 crosslinked LEO satellites and keeps people and things connected on the land, in the air or at sea. The company products are accessories, IoT products, partner products, iridium pilot and satellite phones. The headquarters is in USA.

World Rank (Jan-07-2022): 3,079

Market Value (Jan-07-2022): 5.396 Billion USD

Number of Employees: 522

Annual Revenue in USD: 583 Million USD

Annual Net Income in USD: -56 Million USD

9.China Spacesat

China Spacesat is specialized in the development of small satellites and micro satellites and satellite ground application system integration , aerospace high tech enterprise of terminal equipment manufacturing and satellite operation services company.

In 2019 , the company achieved annual operating income of 6,459 billion Yuan, with a total profit of 415 million Yuan and the economic operation was healthy and stable. It is having 4,100 employee as on 2019. The headquarters is in China.

World Rank (Jan-07-2022): 3,319

Market Value (Jan-07-2022): 4.916 Billion USD

Number of Employees: 4,100

Annual Revenue in USD: 1,051 Million USD

Annual Net Income in USD: 53 Million USD

10.SEO

SES is a Telecommunications company. It is a leverage a vast and intelligent network that spans satellite and ground infrastructure to create, deliver and manage video and data solutions that connect more people in more places with content that enriches their personal stories. The headquarters is in Luxembourg.

World Rank (Jan-07-2022): 3,524

Market Value (Jan-07-2022): 4.573 Billion USD

Annual Revenue in USD: 11 Million USD

Annual Net Income in USD: -22 Million USD

11.Inmarsat

Inmarsat is a Mobile Satellite Communications company. It provide governments, commercial enterprises and humanitarian organisations with mission critical voice and high speed data communications on land at sea and in the air and has been powering global connectivity for four decades. The headquarters is in UK.

Inmarsat was acquired by investment companies Apax and Warburg Pincus as on Oct-2019 for 2.6 Billion GBP.

Inmarsat was delisted from stock exchanges as on Dec-2019.

World Rank (Jan-07-2022): 3,950

World Rank (Sep-01-2021): 3,950

World Rank (Jan-01-2021): 3950

Market Value (Jan-01-2021): 3.400 Billion USD

Number of Employees: 1,500

12.Kratos Defense & Security Solutions

Kratos Defense & Security Solutions is develops and fields transformative, affordable technology, platforms and systems for United States National Security related customers, allies and commercial enterprises company. The company is specializes in unmanned systems, satellite communications, cybersecurity or warfare, microwave electronics, missile defense, hypersonic systems, training and combat systems. The headquarters is in USA.

World Rank (Jan-07-2022): 5,730

Market Value (Jan-07-2022): 2.295 Billion USD

Annual Revenue in USD: 748 Million USD

Annual Net Income in USD: 80 Million USD

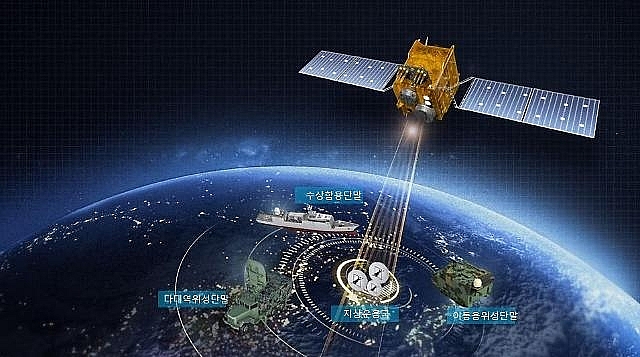

13.KOREA AEROSPACE

Aerospace Company manufacturing aerospace products, satellites with headquarters in South Korea

Company Rank in South Korea in 2021 is 94

Annual Revenue in USD: 2,458 Million USD

Annual Net Income in USD: 65 Million USD

Annual Results for Year Ending

14.Eutelsat Communications

Eutelsat Communications is a leading satellite operators with a powerful fleet of satellites serving users across Europe, Africa, Asia and the Americas. It is focusing on delivering the highest quality of service through technological performance, market expertise and innovation. The headquarters is in France.

World Rank (Jan-07-2022): 5,108

Market Value (Jan-07-2022): 2.792 Billion USD

Annual Revenue in USD: 1,508 Million USD

Annual Net Income in USD: 351 Million USD

15.AeroVironment

AeroVironment develop Aircraft systems, satellite systems and missile systems. The headquarters is in USA.

Number of Employees: 699

Company Rank in USA in 2021 is 1616

Annual Revenue in USD: 394 Million USD

Annual Net Income in USD: 23 Million USD

Top 10 Hottest Satellite Companies 2022 - by Via Satellite

|

| satellite |

Via Satellite editors choose the companies on this list based on their expected activity for the year, and a mix of market share, transformational technology, ground-breaking deals, and overall industry excitement.

1.AST SpaceMobile

AST SpaceMobile is taking a novel approach to satellite connectivity by designing a satellite to connect directly with unmodified cell phones. Instead of needing satellite-specific terminals or devices to use satellite broadband, AST SpaceMobile has designed its satellite BlueWalker 3 to communicate directly with unmodified mobile phones on Earth.

AST SpaceMobile is targeting summer 2022 for its launch, contingent on SpaceX for the final launch window, after it pushed back its target by a few months. While its technology is unproven, AST SpaceMobile has potential to disrupt space-based communications. All eyes are on the company for this key launch in 2022, if it will validate its space-to-cell technology and business model.

2.BlackSky

The company collects imagery with its 12-satellite constellation, and then fuses that imagery with other sources of data from space, IoT, and terrestrial-based sensors and feeds. The Spectra AI platform processes the data and provides insights for customers. This could take the form of a monitoring solution that alerts the customer when there has been a change on the ground, for example.

BlackSky’s focus is on the software and its ability to deliver insights. In an interview with Via Satellite last year, CEO Brian O’Toole said he sees BlackSky as more of a software and data analytics company than a space company.

The company, based in Herndon, Virginia, is targeted at the defense and intelligence industry. It kept up a steady flow of U.S. government contracts in 2021 with the National Reconnaissance Office, National Geospatial-Intelligence Agency, and the Intelligence Advanced Research Projects Activity. It also inked a strategic partnership with big data darling Palantir to integrate its imagery and analytics into Palantir’s platform.

BlackSky ended 2021 with a lot of momentum — the company doubled its small satellite constellation through a Rocket Lab launch campaign and cemented its new status as a public company after a special purpose acquisition company (SPAC) merger. BlackSky may be considered “New Space” but it’s established in terms of software, space assets, ground architecture, and customers. In 2022, BlackSky will be one to watch for how it grows as a public company and if it will be on track to hit its projected $546 million in sales in 2025.

3.Eutelsat

The challenge for traditional operators like Eutelsat is to reinvent themselves in the modern era. While historically, Eutelsat’s efforts to change course haven’t been as drastic or expensive as those of its peers, the operator has recently made some impactful moves that have captured the industry’s attention.

Eutelsat recently appointed Eva Berneke to become its first ever female CEO. In an instant, Berneke, who joined from Danish software and IT company KMD, became one of the most high-profile women in the satellite industry. It will be interesting to see how Berneke builds on the work of former CEO Rodolphe Belmer.

In addition, the company acquired a 23 percent stake in OneWeb, which shows it is looking to position itself in a Non-Geostationary (NGSO) environment and opens the door for multi-orbit services. Eutelsat’s Konnect satellite, aimed at reducing the digital divide in Africa, kickstarted the company’s broadband strategy, which it will follow up with Konnect VHTS this year to cover Europe. And the launch of Eutelsat’s reconfigurable Quantum satellite in 2021 was another exciting technical development years in the making.

Last year was an eventful year for the company, and it will be interesting to see how Eutelsat capitalizes further in 2022.

4.GhGSat

GHGSat is a Montreal-based startup that designed satellites capable of measuring air emissions from targeted industrial facilities. The company says the satellite technology is so powerful that it can detect greenhouse gasses from sources 100 times smaller than those detected by other satellites. Founded in 2011, GHGSat launched its first product, Pulse – a free global map of methane concentration satellite data that is updated weekly – in October 2020. Eight months later, GHGSat launched Spectra, an asset-specific emission indicator platform that helps customers make decisions and optimize their methane emission management activities.

In 2021, the company closed its Series B funding round and more than doubled its existing fundraising total to $70 million, netting $45 million from an investment group that included the government of Québec (through its Investissement Québec program), OGCI Climate Investments, and Space Capital.

5.Hanwha Systems

The whole world seems to be investing in LEO. While SpaceX and Amazon dominate the headlines, South Korean defense company Hanwha Systems became one of the most talked about companies in the satellite sector with its own LEO plans.

Last year, Hanwha Systems announced its intent to launch a 2,000-satellite LEO constellation, which is expected to come into service in 2025. The company plans for the system to serve land and maritime applications first, then aircraft and urban air mobility applications and later, 6G. Then, Hanwha Systems joined OneWeb’s global ownership consortium with a $300 million investment for an 8 percent share in the company.

However, Hanwha also has substantial assets in satellite mobility terminals. The company acquired the assets of Phasor Solutions and has invested in Kymeta. With activity in building a LEO system and satellite antennas, Hanwha Systems has scale to its ambition. This Asian player is certainly a company to watch in the sector.

6.HawkEye 360

HawkEye 360’s strategic focus on providing data to the government sector has paid off and it is uniquely positioned to dominate a growing field of space-based radio frequency (RF) analytics. The Northern Virginia-based company is coming off what it claims to be a lucrative fiscal year in 2021. HawkEye says that its newly launched next-generation satellites have enabled the company to secure more than $50 million in new contracts since the start of last year.

HawkEye 360 operates a constellation of nine satellites that identify, locate and analyze RF transmissions around the globe from a variety of emitters. The company is about to begin an action-packed 18-month schedule of new satellite launches that will significantly increase the size of its fleet.

The company shows no signs of slowing down as it comes into a new year. In January, it grabbed a $5 million investment from Leidos to improve its capabilities in national security space. In return, Leidos will have access to a vast commercial RF data archive. These funds will be added to HawkEye’s $145 million investment chest it has filled from various investors that are pitching in to help grow its data and analytic services.

7.Intellian

Intellian turned heads in August 2021 when it unveiled the “briefcase” terminal with OneWeb. Weighing about 22 pounds, the terminal is billed as compact and easy to use. It was designed to bring OneWeb’s LEO connectivity to communities and businesses in remote areas, even agricultural IoT and research stations.

Intellian is investing in its continued success, and opened two new facilities in 2021 — a new R&D center next to its headquarters in Pyeongtaek, South Korea, and a European headquarters and logistics center in Rotterdam in the Netherlands. The company is also working on an emerging technology facility in Maryland. This is rapid growth for the company founded in 2004, which has grown from a $10 million to a $120 million leader in mobile VSATs. Intellian is laying the groundwork through its partnerships and investment in R&D to be a continued leader in satellite hardware.

8.Spaceflight

Rideshare launch provider Spaceflight had a tremendously successful 2021. After achieving the first launch of its next-generation Sherpa-FX1 orbital transfer vehicle (OTV) in January, it launched the industry's first electric propulsion OTV, Sherpa-LTE1, alongside a second free-flyer, Sherpa-FX2, aboard the SpaceX Transporter-2 mission in June.

Spaceflight is also close to rolling out two new iterations of its Sherpa vehicle. The new chemical propulsion Sherpa-LTC features a high-thrust, chemical propulsion subsystem that enables quick maneuvers on orbit and could pave the way for the OTV to deploy spacecraft to multiple orbits on a single mission.

9.Terran Orbital

Terran Orbital has massive plans to make its mark on the space industry and Florida’s Space Coast. The company is establishing a 660,000 square foot, $300 million facility on Florida’s Merritt Island at the former NASA Space Shuttle Landing Facility. It will be one of the largest satellite manufacturing facilities in the world, and the company boldly projects that it will produce 1,000 smallsats per year and create 2,100 new jobs.

At the same time, the company is going public through a SPAC with a $1.58 billion valuation, and plans to build an Earth observation constellation with synthetic aperture radar (SAR) capabilities through subsidiary PredaSAR.

10.Viasat

Viasat has long been considered one of the technology leaders in the satellite industry with its ecosystem of spacecraft and ground technology. Founder Mark Dankberg, who was at the helm as CEO for more than 30 years, is a leading voice in the industry. Building on this legacy, Viasat is now at the start of an exciting new chapter.

Viasat made the biggest deal in the satellite sector in 2021, with its acquisition of Inmarsat. With the combined company, Viasat wants to create a mobility powerhouse in maritime and aviation, as well as government and broadband. It positions the company as more of a global player, with Inmarsat’s strong footprint in the United Kingdom, as well as Viasat’s presence in the United States. It was a major statement of intent for Viasat in the 2020s and beyond. This followed the acquisition of RigNet, which made Viasat a vertically integrated energy communications company. More so, the company started the first two quarters of its fiscal year 2022 with record revenue.