Third Stimulus Check in March: When the $1,400 Payment Distributed, Who Eligible, Qs&As

|

| Photo: Getty Images |

If all goes as planned, millions of Americans will soon be getting another stimulus payment. This time, it’s up to $1,400 for individuals, $2,800 for couples, and an additional $1,400 for dependents.

The payments under the American Rescue Plan, which was adopted by the Senate on Saturday, are the third and so far the largest of the payments sent to Americans under coronavirus relief packages over the last year.

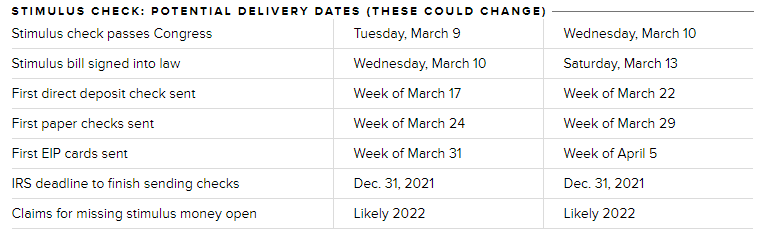

When the payment distributed?

The $1,400 stimulus checks are in the home stretch, with the House of Representatives poised to pass the $1.9 trillion stimulus bill in "the next 24 to 48 hours," House Speaker Nancy Pelosi said Monday. The package is expected to pass and move on to President Joe Biden to be signed into law any time before March 14.

The good news is that Biden has said the checks will start to arrive in March. "The Treasury Department is working on what this looks like and what the processing looks like," White House Press Secretary Jen Psaki said Monday. "We expect a large number of Americans to receive relief by the end of the month, but in terms of the mechanics of it, the Treasury just has to work through that. An update will likely come from them."

The date the IRS begins to send stimulus payments may not square up with the date you actually receive your money in your bank account or in the mail. Remember, it takes time for the IRS to process the well over 100 million payments expected in this third round of checks. Even tiny errors could cause a delay in you receiving your full or partial payment.

The bill is on track to become law by March 14, which means that the first batch of payments will begin to go out before April 1. Tens of millions of direct deposit recipients could receive a check before April 1, followed by staggered start dates for physical checks and EIP cards.

|

| Photo: CNET |

Who Would Be Eligible for $1,400 Payments?

The maximum amount for the third round of stimulus checks would be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly. Each eligible dependent — including adult dependents — also would qualify for a payment of $1,400. That means a family of four could receive as much as $5,600 in total.

Under both the House and Senate versions, single adults who reported $75,000 or less in adjusted gross income on their 2019 or 2020 tax return would receive the full $1,400 payments, as would heads of household who reported $112,500 or less. Couples filing jointly who earned $150,000 or less in adjusted gross income would receive the full $2,800.

The size of the payment would gradually decrease for those who earned more than those amounts until it disappeared entirely for higher-income households. Under the Senate bill, single filers who earned more than $80,000 in adjusted gross income, heads of household who earned more than $120,000, and couples filing jointly with more than $160,000 in income would not receive stimulus payments in the third round. In the House bill, single filers who earned more than $100,000, heads of household who earned more than $150,000, and couples earning more than $200,000 would not have received stimulus checks.

The increase in the amount dependents could receive is one big change with this third round of stimulus payments. For the first round of payments, checks were $500 per eligible dependent younger than 17. The amount was $600 per eligible child dependent for the second round. But this time around, for the first time, adult dependents would be eligible to receive stimulus payments. That change could be a big financial boost to families who serve as caregivers for their loved ones or who have students older than 16 in college or pursuing other educational opportunities. AARP has advocated strongly during each round of proposed relief legislation for adult dependents to be eligible for stimulus checks.

|

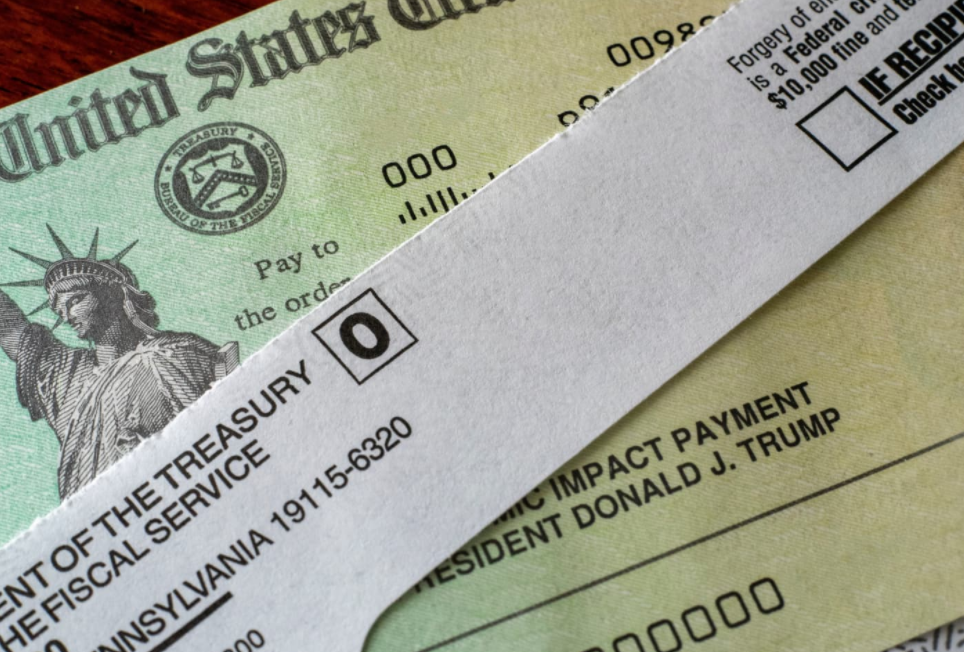

| Photo: Getty Images |

Will I have to do anything to get a stimulus payment?

At this point, the IRS will probably issue advance payments either based on your 2019 federal return or your 2020 return if you have filed one already.

If your income was too high for a payment based on your adjusted gross income for 2019 but you think you may be eligible based on your circumstances from last year, you should file your tax return as soon as you can.

For example, you may have lost your job last year. You may have had a child, which would make you eligible for a dependent payment of $1,400.

However, the IRS has cautioned that you shouldn’t file before you have all the information you need to submit an accurate return.

“We are building a number of contingencies related to any new legislation that would come out,” Ken Corbin, the IRS’s wage and investment commissioner and its new chief taxpayer experience officer, said during a news conference last month. “And one of the things that we are, of course, thinking through is what would that experience be for those taxpayers who might be entitled to more based on a tax year 2020 filing? But our advice would be to file an accurate return. If you don’t have all the information or you’re still waiting on some additional documentation, don’t rush to file that return. File it accurately, and that will make the experience better for the taxpayer.”

To claim your stimulus payments from the previous two rounds of relief, look for Line 30 on your tax return.

*For more information about stimulus checks, click here to read!

How much do I have to earn to qualify for a payment?

You don’t have to have income to qualify for a stimulus payment. But there are income caps.

For the third round of payments, eligible individuals with an adjusted gross income (AGI) of $75,000 or less are entitled to the full $1,400. The ceiling is $112,500 for individuals filing as head of household and $150,000 for couples filing jointly. Eligible taxpayers will also receive an additional $1,400 for each dependent.

How will I get my money?

In previous rounds, the IRS issued payments either by direct deposit, a mailed check or prepaid debit card.

However, just because you got a direct deposit previously doesn’t mean the payment will be delivered the same way for this third round. You may get a check. It’s also possible the IRS may send payments on a prepaid debit card.

*READ MORE: Third Stimulus Checks Q & A: Who and When will Get

Third Stimulus Checks Q & A: Who and When will Get Third Stimulus Checks Q & A: Who and When will Get Eligible Americans will start receiving their third round of stimulus checks this month, President Joe Biden announced. Check out Q & A - Who will ... |

The US Third Stimulus Check: Who Gets the Full $1,400, Payment Timeline and Income Qualifications The US Third Stimulus Check: Who Gets the Full $1,400, Payment Timeline and Income Qualifications The Third Stimulus Check in the US - Update: Who is likely to get the full $1,400 under a third stimulus check under the latest ... |

The Third Stimulus Check of US: Who Can Get It & How Much to Receive? The Third Stimulus Check of US: Who Can Get It & How Much to Receive? Update the Third Stimulus Check: The 3rd stimulus check in President Joe Biden's $1.9 trillion coronavirus relief plan has been proposed for the $1,400 payments, ... |

Stimulus checks in the US: How to claim & Who involved? Stimulus checks in the US: How to claim & Who involved? A group of Republican senators is pushing a stimulus plan aimed at reducing the $1.9 trillion in spending President Joe Biden has proposed. This time ... |

What about Social Security recipients and other federal beneficiaries?During the first round of stimulus payments last year, one of the big questions was what people who did not file a 2018 or 2019 tax return should do to get their stimulus payment, especially people for whom Social Security benefits were the primary source of income. Now that the government has been through the process of issuing payments twice already, things have run more smoothly with stimulus payments for non-filers. According to the legislation for the third round of payments, you would not need to take additional steps to receive the third stimulus payment if you already receive federal benefits through any of these programs: Social Security Old-Age retirement, Survivors or Disability Insurance Supplemental Security Income (SSI) Railroad Retirement Board benefits Veterans Affairs (VA) benefits AARP played a big role last year in getting the government to issue stimulus payments automatically to recipients of Social Security, SSDI, SSI, VA and other federally run benefits. AARP also advocated to have the maximum amount of the first round of stimulus be $1,200 rather than $600, the cap was that considered in one proposal. |