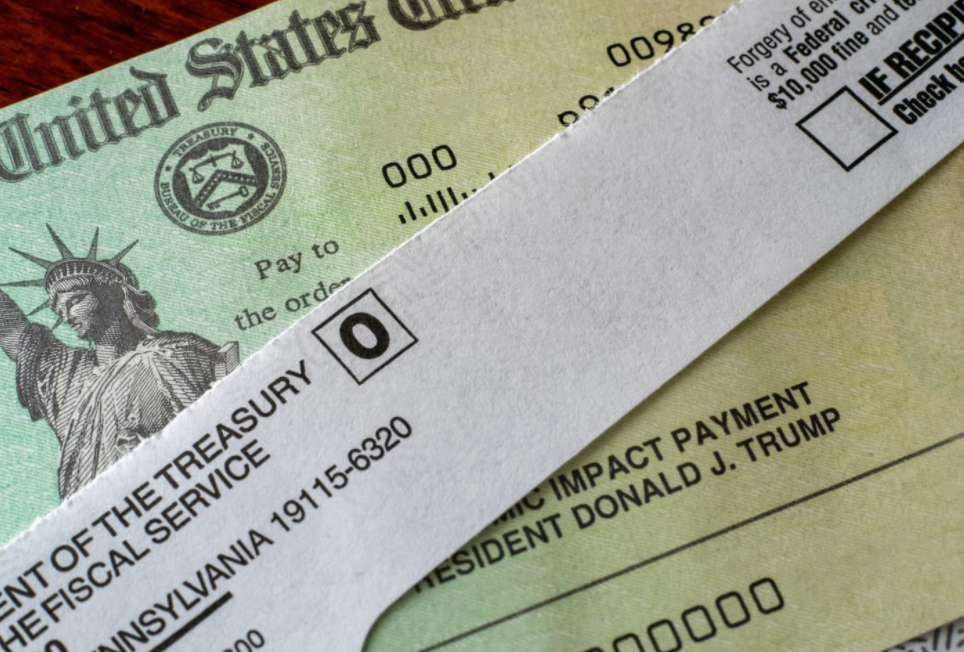

Stimulus checks in the US: How to claim & Who involved?

|

| Photo: CNBC |

What is a Stimulus Check?

A stimulus check is a check sent to a taxpayer by the U.S. government. Stimulus checks are intended to stimulate the economy by providing consumers with some spending money. When taxpayers spend this money, it boosts consumption and drives revenues at retailers and manufacturers and thus spurs the economy. A stimulus check can be part of a larger federal stimulus package designed to support the economy, which was the case with the stimulus payments that were part of the CARES Act in 2020.

Stimulus checks have been mailed out to U.S. taxpayers on several occasions. These checks vary in amount according to the taxpayer's filing status. Joint taxpayers generally receive twice as much as those filing singly. In some instances, those who had unpaid back taxes saw their stimulus checks automatically applied to their outstanding balance.

In March 2020, the U.S. government approved a bill to send Americans stimulus payments to provide relief for economic hardships caused by the coronavirus pandemic. Among other provisions, the CARES Act specified tax rebates of $1,200 per adult and $500 per qualifying child. The amount of the rebate phases out for incomes above $75,000 per year for individuals and $150,000 for joint filers.

|

| Photo: Entrepreneur |

How Stimulus Check benefit citizens?

The new payment would top off the previous $600 payment that started to be distributed in December. Around $465 billion of Biden’s $1.9 trillion ‘rescue plan’ is earmarked to go directly to Americans’ wallets. The bonus per dependents would be $1,400 and would apply to all dependents. Previously, parents or guardians could only claim the bonus for dependents under 17. Now the bonus can be claimed for college students, disabled adults, and other adults who are dependents.

If Biden's proposal is the same as the Democrats’ $2,000 stimulus plan passed by only the House in December, the income eligibility criteria would mirror the requirements for the current $600 stimulus payments being distributed. The payments would reduce gradually for those with adjusted gross income (AGI) over $75,000 for single filers without dependents and $150,000 for married couples without dependents. The phaseout thresholds would change depending on the number of dependents in the household.

Eligibility would likely be based on your most recent tax return and your adjusted gross income. For the second round of checks, the Internal Revenue Service used 2019 tax returns to determine who qualified for the direct payment.

The $2,000 stimulus checks would also mean a big increase in income for America’s poorest families. The 20% of households with the lowest incomes would see their annual income increase by 29% if Congress passed the Democrats’ $2,000 stimulus check proposal, the Institute on Taxation and Economic Policy (ITEP) found. The effect of Biden’s plan would be similar. For comparison’s sake, the current $600 payment gives the same group just an 8% raise, while the $1,200 direct payments last spring under the CARES Act lifted their incomes by 11%.

Who is counted as "dependent"?

That depends on the definition in the next stimulus package. For the first and second checks, a dependent is any child aged 16 or younger, but previous proposals from Democrats seek to expand the definition to include anyone you can claim on your tax returns -- such as children over 16 and adults under your care, according to Cnet.

If Congress approves Biden's proposed amount -- and again, all of this is still in negotiation territory for now -- that could bring a family $500 or $600 more per person you support, based on the per-child allowance outlined in the first and second checks, respectively. It isn't clear if there would be a cap on the number of dependents you could claim in this situation or if new qualifying dependents might quality for more. It also isn't clear if the new qualifications would only apply to people excluded in the first two rounds, as a make-up payment, or if each third stimulus check would also come with a fresh injection of cash per dependent.

A quick calculation: If you have one dependent who qualified in the first two rounds and three that qualify in the third, that would get your family $1,000 to $1,200 more if you have no other changes. Try our third stimulus check for an estimate.

|

| Photo: Chicago Tribune |

Biden's proposal on Stimulus Check

The Biden administration recently proposed a $1.9 trillion economic relief package. The American Rescue Plan, as it is known, would include a $1,400 stimulus check, additional unemployment insurance, a bigger child tax credit, and a lot more if passed as is. It may not pass as is, however.

While changes are possible, it is still unclear what those changes would be and how they would affect the overall package. Direct payments, which have bipartisan support, will likely remain in some form. But the amount and the threshold to qualify could be adjusted. Other components of the president’s stimulus package could shift to other bills or fall by the wayside entirely. Some experts believe the final package will end up being in the neighborhood of $1 to 1.5 trillion.

Worth approximately $618 billion, the GOP version of the package includes $1,000 direct payments — rather than $1,4000 — for individuals earning up to $40,000 per year and less for those earning between $40,000 and $50,000. Dependents would receive $500. The $300 weekly federal unemployment supplement would be extended through June, rather than September, and not rise to $400, Minnesota cited.

The counteroffer leaves out aid to state and local government, a sticking point that hindered stimulus talks in the lead-up to the election and the end of the year. It also doesn’t include the $15 federal minimum wage.

|

| Photo: AARP |

Who Biden's stimulus plan applied?

Household with children

Biden's stimulus plan has not yet sketched out how much money would apply to children, but his inclusion of dependents of any age signals that there would be additional money for this group in the next round. A White House proposal from October offered to keep the same age restriction for children, but double the payout to $1,000. So in this specific and very hypothetical scenario, if you have one dependent, your third check could be $500 greater than the first check ($500 per child dependent) and $400 larger than the second ($600 per qualified dependent).

If you had or adopted a new child, or if an older relative moves in, or if for whatever reason you gain a dependent since the last check, you may also see $500, $600, or $1,000 more, depending on the amount stipulated in the final bill text. It's likely the third stimulus check would use the figures from your 2020 taxes.

If you meet specific qualifications, you and the child's other parent may both be entitled to claim extra stimulus money. That means you could get an extra $500 or more in the third stimulus check, especially if anything in your situation changed between the time you filed your 2019 tax return and your future 2020 return. The third check allowance would be based on your most recent tax filing.

Mixed-status families

According to Biden's stimulus plan, more families who are considered "mixed-status" would be eligible for a stimulus check. The second payment broadened the rules for the first check by making it possible for families where one spouse is a US citizen to be eligible for a check. Biden's proposal would work with more scenarios; for example, it would potentially provide stimulus check money to a household of US citizen children with noncitizen parents.

Just-married couples

Depending on several variables that include your spouse's filing status and any new dependents, a change in marital status could result in a larger check. For example, if you were single and filing alone, you got $1,200 at most the first time around. Married, you could be eligible for up to $2,400 since the IRS formula used to determine your total stimulus money is based on your combined household income.

If a third stimulus check arrives for $2,000 per person, your spouse could double it to $4,000. Alternatively, if your personal AGI would only get you a partial stimulus check payment on your own, filing jointly with a spouse with an income under the threshold could qualify you for the whole check total.

Undocumented residents

No compromise was reached in the lengthy session, Biden’s first with lawmakers at the White House, and Democrats in Congress pushed ahead with the groundwork for approving his COVID relief plan with or without Republican votes. Despite the Republican group’s appeal for bipartisanship, as part of Biden’s efforts to unify the country, the president made it clear he won’t delay aid in hopes of winning GOP support.

White House Press Secretary Jen Psaki said that while there were areas of agreement, “the president also reiterated his view that Congress must respond boldly and urgently, and noted many areas which the Republican senators’ proposal does not address.”

Missing stimulus check money? Here's how to claimThe Internal Revenue Service is essentially done sending stimulus checks for now, but if you didn't receive your fully promised payment, don't worry — there's a quick fix. Americans who have not received their coronavirus stimulus check payments, or who received the incorrect amount, can claim the missing money when they file their 2020 tax return. The first check was based on either your 2018 or 2019 tax return, while the second check was based on your 2019 return. But in some instances, Americans either didn't receive the stimulus check or didn't receive the full amount they were entitled to, given instances like job losses or the birth of a child. If you think the IRS owes you stimulus money, you can use a recovery rebate worksheet to calculate how much you should receive and claim that amount on Line 30 of Form 1040 and Form 1040-SR. The IRS will include your stimulus payments as part of your refund check. Even if you don't earn enough money to typically file a return, you will need to submit one this year to receive your allotted payment. The IRS opened Free File, free online tax preparation software, in January for taxpayers who earn less than $72,000 to prepare and file their income tax returns, although they will not begin processing returns until Feb 12. “For 2021, eligible taxpayers who did not receive the full amount can claim it as the Recovery Rebate Credit when they file their 2020 tax return,” the IRS said. “Use IRS Free File to file and claim this important benefit.” The fastest way to receive your money is to file your taxes electronically as the IRS deals with a backlog of nearly 7 million unprocessed paper returns from last year. The agency said it expects nine out of 10 taxpayers to receive their refund within 21 days of filing electronically. |

Update Second Stimulus Check: $2,000 payment Dead, Third Round in 2021? Update Second Stimulus Check: $2,000 payment Dead, Third Round in 2021? Update Second Stimulus Check: Efforts to send eligible Americans a $2,000 second stimulus check are effectively dead...until now Jan 3. Senate Majority Leader Mitch ... |

Who Would Get the Second Stimulus Check and Who Would NOT? Who Would Get the Second Stimulus Check and Who Would NOT? The second stimulus check, thanks to the $900 billion economic relief package that Congress passed earlier this week, had been expected to land in the ... |

What to know about the second COVID-19 relief package in US? What to know about the second COVID-19 relief package in US? The second COVID-19 relief package is approved after a long consideration. Stimulus checks are included in the deal and there will be an extension of ... |