How to Accelerated Benefits of Life Insurance

Top 10 Best Life Insurance Companies In The World - Cheapest Quotes Top 10 Best Life Insurance Companies In The World - Cheapest Quotes |

Life Insurance: Meaning, History, Types and Benefits Life Insurance: Meaning, History, Types and Benefits |

|

| What Are Benefits Of Life Insurance? Photo KnowInsiders.com |

Nobody is too poor to benefit from purchasing life insurance. Life insurance can help your loved ones pay the bills if you pass away, regardless of how much money you make. Also, you may be surprised to learn that life insurance is relatively cheap.

What is Life Insurance?

A policyholder purchases life insurance from an insurance company in exchange for a promise that the company will pay a specified amount to the policyholder's beneficiaries in the event of the policyholder's untimely demise. The insurance death benefit is paid in exchange for a premium. The beauty of life lies in its unpredictable nature. No matter how clever or hard you work, you can never predict what the future will bring.

Life insurance, in particular, is not something you want to leave to chance. Since death and taxes are the only two things that can be counted on in life, it's wise to get coverage for the eventuality of both.

Why you Need a Life Insurance Now?

The "peace of mind" provided by a life insurance policy is a major reason why it is important to have one. Having a sufficient amount of life insurance, however, allows you to put concerns like:

When I pass on, what will happen to my family financially?

If I were to die tomorrow, how would my family pay the bills?

What if I get hurt and lose my job? How will I support my family then?

Why am I having so much trouble saving for my kid's college?

How do I secure my retirement income?

How is it Helpful?

If you are the sole or primary breadwinner, you have a special responsibility to secure your family's financial future. If you were to pass away unexpectedly, your loved ones would still be provided for thanks to your life insurance policy. Having life insurance can help safeguard your family's financial security. It guarantees that you and your loved ones will always be provided for monetarily.

Top 20+ benefits and advantages of life insurance

|

| Photo Consumer Coverage |

1.Life Insurance Payouts Are Tax-Free

If you pass away while your life insurance policy is still active, your heirs will receive a cash payout. Beneficiaries do not need to include death benefit money they receive from life insurance in their yearly tax returns because it is not considered taxable income.

2.Your Dependents Won’t Have to Worry About Living Expenses

The standard recommendation is to insure yourself for seven to ten times your annual income. Those who rely on your income won't have to stress about meeting basic needs or making other large purchases if you have a policy (or policies) in that amount. Your insurance policy may be able to pay for your children's college expenses so that they won't have to take out loans.

3.Life Insurance Can Cover Final Expenses

As of 2019 (midpoint), the average cost of a funeral in the United States (including a viewing and burial) was $7,640. 4 Due to the fact that many Americans do not have even $400 saved for an emergency, funeral costs can be a significant burden. 5 Having a life insurance policy means that your loved ones won't have to spend their own money or take out a loan to cover your final expenses.

Final expense insurance is a service offered by some insurance companies. These policies feature low annual maximums and low monthly premiums.

4.You Can Get Coverage for Chronic and Terminal Illnesses

Endorsements, also known as riders, can be added to a policy from many different life insurance providers in order to expand or modify coverage. You can get a portion of your death benefit or even the whole thing early with an accelerated benefits rider. If you have been given a prognosis of less than 12 months to live, you may be able to access your death benefit while you are still alive under the terms of certain policies.

5.Policies Can Supplement Your Retirement Savings

In addition to paying out a death benefit, a whole, universal, or variable life insurance policy can also build cash value over time. The accumulated cash value can be put toward large purchases like a car or a down payment on a house. You can use it during retirement if necessary.

But a life insurance plan is not a suitable substitute for a 401(k) or an individual retirement account. In addition, the premiums for cash value life insurance are much higher than those for term life insurance, which provides only a death benefit and no savings component.

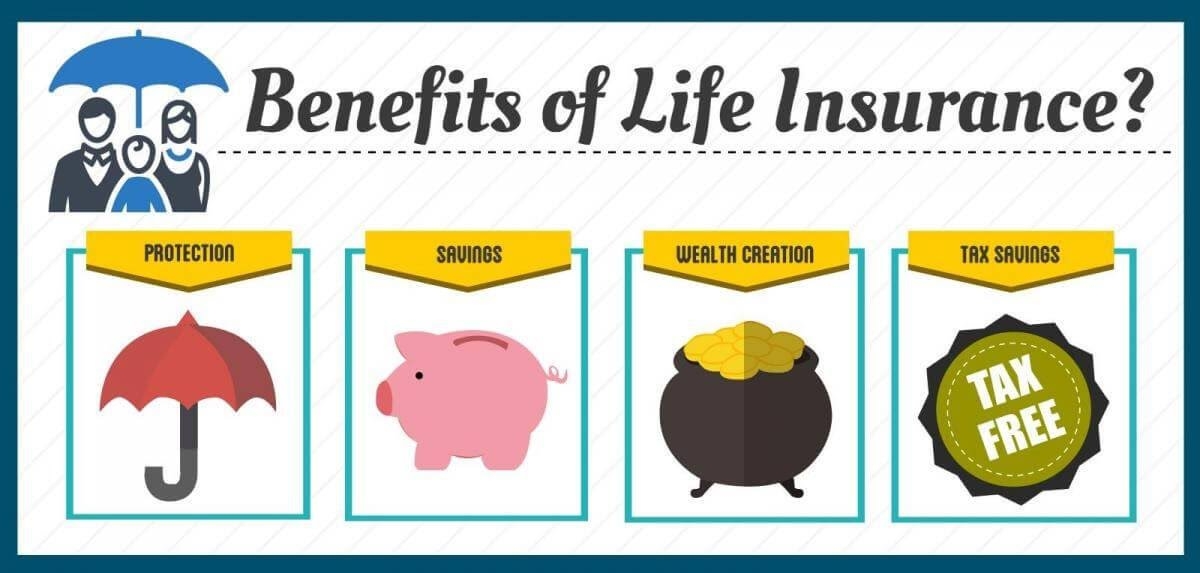

What are the advantages of Life Insurance?1.Financial Security - With life insurance in place, you can rest easy knowing your loved ones are taken care of. This is because people want to ensure that their loved ones are provided for monetarily in the event of their untimely demise. We all have bills to pay and people who depend on us financially, but with a good life insurance policy, you won't have to worry about them after you're gone. 2.Wealth Creation - In addition to providing financial security, some life insurance policies also allow policyholders to participate in wealth accumulation features. These policies not only provide life insurance, but also put your premium toward a variety of investments with the goal of generating returns that are higher than the rate of inflation and adding to your savings. 3.Tax Savings -There are two tax advantages associated with life insurance policies. Section 80C of the Income Tax Act allows for a tax deduction on premium payments. Maturity insurance plans, on the other hand, might be exempt from all taxes. This tax break is provided for in the Income Tax Act, specifically Section10(10D). 4.Save More - There is a window of opportunity in your younger years during which you may purchase life insurance at a low premium rate. You can expect to pay considerably more for the identical plan if you wait until you're older to purchase it. |

READ MORE: What is Business Insurance: Definition, Types and Cost

Benefits of different kinds of life insurance

|

| Photo Google |

There are two basic kinds of life insurance: term and permanent like whole life.

With a term life policy, you pay a specific premium for a defined term (say 10 years). If you die during that time, a death benefit is paid to your beneficiaries – but when the term is over you must get new coverage or go without. A whole life policy is permanent life insurance that last your entire life.

Life insurance applications are now simpler.

Policygenius simplifies life insurance price comparisons. You can get free quotes from several life insurance companies in 10 minutes and choose the best one.

In two commercial breaks while watching "The Good Place," you can complete the life insurance application online. Just bring medical and financial records. Contact an expert for assistance.

Financial concerns have increased.

Costs keep rising. Rent/mortgage, council tax, utilities, phone line, and TV license were fewer. Many of us now pay TV package, broadband, mobile phone, and other subscription services.

Before car ownership. Though these are choices, few of us could survive without them.

Since we don't think we'll die, we buy these. If the worst happened, could your loved ones keep making these payments? .

Few have enough savings.

The 2018 Mintel Report** found that 25% of people without life insurance have savings of more than £10,000, and the 2019 Mintel Report*** found that 7% have more than £50,000.

Saving money can be difficult, and unplanned expenses, both good and bad, can quickly deplete savings.

Even over 50s life cover, which has lower premiums than term cover and a predictable pay-out to cover your funeral, can make up for a lack of savings after you die.

| LIFE INSURANCE COSTS WAY LESS THAN MOST PEOPLE THINK This is one of the best life insurance facts: Life insurance is usually overestimated by 300%. Fidelity Life offers a $250,000 term life insurance policy for a healthy 30-year-old woman for $27 per month. |

| More detailed considerations There are many reasons to consider life insurance, but some are more obvious than others. Buying a house is one. It may be the biggest purchase of your life, and if you have a repayment mortgage, you want to make sure your loved ones can stay in their home after you die. When you have children, you realize that they are completely dependent on you. Naturally, you'll want to spend as much time with them as possible, but knowing they're taken care of will comfort you in an emergency. |

|

| Photo HSBC |

How to get more benefits when buying life insurance?

The most cost-effective way to buy life insurance is to do it when you are younger and healthier. Life insurance companies generally give younger customers lower rates for reasons that are easy to understand:

-They tend to have a longer life expectancy

-They are less likely to have been diagnosed with a serious disease

-They are likely to pay premiums over a longer number of years

Not in your twenties anymore? Don’t worry.

Many affordable options remain. However, doing your research and determining your coverage needs will maximize your premium dollar. Riders add valuable benefits to most policies for a small fee. Top riders include:

1.Accelerated death benefit: This rider can help pay for needed care of a diagnosed chronic or terminal illness. While this can be very useful in a time of need, you should also know that funds paid out will typically lower the death benefit paid to your family.5

2.Disability waiver of premium: This valuable rider gives you the ability to stop paying premiums if you have a disability while keeping your coverage.6

There are other kinds of riders you should know about as well, so talk to an experienced professional – like a Guardian financial professional – before deciding to purchase one policy or another. You should also find out about other ways to control your policy costs, including:

1.Purchasing a joint policy for you and your spouse

2.Getting insurance at group rates through your employer

3.Purchasing a whole life policy that accumulates cash value, which can be used to reduce monthly premium costs later

Term Life & Whole Life Insurance: Which Is Better? Term Life & Whole Life Insurance: Which Is Better? Are you considering between term life insurance and while life insurance? This article might give you suggestions to make decision. |

Life Insurance: Myths and Facts

Myth 1: Life insurance isn’t important right now because I’m young, single and don’t have any dependents.

Fact:

This is a common misunderstanding about the purpose of life insurance. As they don't yet have families or significant financial commitments, some young adults may not see the need for life insurance. However, life insurance coverage typically increases in cost as one ages, so it's best to get it while you're young and healthy to lock in the most affordable premium you can. A life insurance policy can help alleviate the financial burden on your loved ones caused by your passing by paying off any outstanding debts (such as student loans, car loans, or credit card balances) and covering any final expenses (such as a funeral).

When you're young and get a permanent life insurance policy like American Family's Whole Life coverage, you can start building cash value, which you can borrow* from later to pay for a home, college tuition for your kids, retirement income, or even a business. The earlier you start saving, the more time you'll have to accumulate a sizeable sum. Learn how you and your loved ones can benefit from the cash value of a life insurance policy.

Myth 2: It would always be better to put my money in savings instead of towards life insurance.

Fact: It's been discovered by a lot of people that they can save money and buy life insurance at the same time. Buying life insurance can provide you and your loved ones with a measure of financial security and peace of mind, as mentioned throughout this article. Whether or not you should invest in life insurance depends on your personal financial situation, but your agent can help you explore your options so you can see if and how life insurance could fit into your budget and your savings targets.

In addition to providing a death benefit for your beneficiaries, permanent life insurance also allows you to build cash value, which can be borrowed* against. If you want to know how life insurance can help you in the here and now, read on.

Myth 3: Life insurance is too overwhelming! There are too many options...

Fact: Try not to fret! Obtaining life insurance doesn't have to be a hassle. You can use the many tools we offer to learn about your choices. A local American Family Insurance agent is your best bet for getting answers to your questions about life insurance, but you can also learn more about your options by browsing our life insurance coverages and perusing our resource hub. The deeper your knowledge, the better able you are to shield what's dearest to you.

A word of caution, though: there will be interest charges on any loans made against your life insurance policy. At the time a death benefit is claimed, it will be reduced by the total outstanding loan balance (principal and interest). This policy may expire if the loan balance exceeds the cash value.

Life insurance FAQs

Do I need life insurance if I already get it through work?

Life insurance through an employer's group policy is a common, low-cost option that does not require a health exam. Group policies, on the other hand, may only pay out an amount equal to one or two years of salary, or something similarly low. This may or may not be sufficient to meet your family's needs.

Additionally, you may be unable to retain your current life insurance policy if you switch jobs. Since obtaining life insurance may become more challenging and expensive as we age, supplementing your employer-provided policy with a separate individual policy may make sense.

What’s better: A term life policy or a whole life policy?

Ultimately, it's up to you and your needs: Both whole life and term policies pay out upon the policyholder's death, but whole life policies typically have lower premiums and greater policyholder flexibility. While your premiums for a term life policy will be stable for its duration, you can count on paying much more for another policy after its term ends because of rising costs associated with the increased risk of death.

How much life insurance do I need?

There are general rules for determining how much life insurance you need. Typically, people want to provide enough of a death benefit to cover the lost salary and key expenses – like a mortgage – that their family will face, especially while their children are still at home.

How much does life insurance cost?

Life insurance costs vary. Risk dominates. Life insurance premiums rise with mortality risk. Life insurance is cheaper for young, healthy people. Underwriters consider age, medical history, smoking, drinking, and dangerous hobbies like skydiving to assess risk. Cancer, heart disease, and dementia can deny applications. Most insurers require medical exams.

The type of policy, coverage amount, and length of coverage can affect life insurance premiums. Riders—customized policy provisions—usually cost extra.

What are the life insurance options for seniors?

It depends on your needs. Life insurance generally gets more expensive with age, so many seniors get policies with just enough coverage to provide for funeral expenses to avoid burdening their family. Life insurance can also be used for estate planning strategies, where it can be a tax-advantaged way to leave assets to heirs.

How can I save money and still get the coverage I want?

Don't delay, buy now. Nobody will ever be younger than they are right now. Premiums often take the insured's age into account. If you have multiple policies with the same insurer, you may be eligible for a discount on one or more of those policies if you ask for it (a practice known as "bundling").

How long should my coverage last?

Your life insurance coverage should last as long as your financial obligations and debts. If you don't select a long enough term length, you could end up having to buy more coverage when you're older, and premiums will be significantly more expensive.

What happens if I can’t pay my policy premiums?

Most life insurance policies include a 30- to 31-day grace period after your payment due date (the exact period can vary by insurer or state). If you don’t pay your premium within that period, your policy will lapse and you will need to work with your insurer to reinstate your coverage.

How are death benefits paid?

The structure of your death benefit should be determined by your goals and the needs of your loved ones. The benefit can be paid out in a lump sum or, more commonly, in installments spread out over time. This will ensure that your beneficiary does not receive the entire benefit at once. In order to help your spouse save for their own retirement, you can set up your life insurance policy so that the death benefit is deposited into an IRA.

What kinds of deaths are not covered by term life insurance?

If you have been paying your premiums on time and die while your policy is still active, the payout will go to the people you designate. However, there are a few instances in which your insurer may refuse to pay out: murder (if your beneficiary murders you, they will not receive the death benefit due to the Slayer Rule), suicide, and death due to a risky hobby (if you didn't inform your insurance company that you regularly go bungee jumping, for example) (if you die during the suicide clause period, which is the first two years of the policy).

Best Tips To Purchase Health Insurance Best Tips To Purchase Health Insurance Buying insurance is a significant investment, and you’ll want to invest wisely. Check out this article to know 10 tips to consider before buying health ... |

Most Weirdest Insurance Policies Around The World Most Weirdest Insurance Policies Around The World What are the weirdest insurance policies in the world? Insurance is available even after the escape of aliens, vampire and bride run away in marriage, ... |

What Is Mortgage Insurance and How Does It Work? What Is Mortgage Insurance and How Does It Work? What is mortgage insurance, how it works, and what are its benefits? Scroll down to understand more details about the advantages of mortgage insurance. |