What Is Better: Term Life or Whole Life Insurance

Top 10 Best Life Insurance Companies In The US - Cheapest Quotes Top 10 Best Life Insurance Companies In The US - Cheapest Quotes |

Top 10 Best Life Insurance Companies In the UK - Cheapest Quotes Top 10 Best Life Insurance Companies In the UK - Cheapest Quotes |

|

| Term Life And Whole Life Insurance: Which Is Better? Photo KnowInsiders |

| Contents |

What is term life insurance?

Term life insurance is a straightforward form of protection that provides financial support in the event of your untimely demise within a specified time frame (typically 10 or 20 years). You won't leave any money to your beneficiaries if you outlive the policy's term. Typically, the death benefit and your premiums will remain constant throughout the duration of a policy.

Your term life insurance policy's duration should be proportional to the length of the debt it is meant to alleviate. For the first twenty years after having a child, a parent may wish to purchase a policy to ensure their financial security. Term life insurance policies are offered by every major life insurance provider, making it simple to shop around for the best rates online.

The benefits of term life insuranceInexpensive to begin with. Large sums of money can be insured with term insurance for a small outlay of money. Like whole life, term insurance allows you to tailor coverage to your specific requirements. Many people worry about leaving behind enough money to pay off their mortgage, fund their children's college educations, or replace a portion of their lost income. These are short-term requirements that may disappear after a few years or persist for quite some time. Having the right amount of insurance to cover these costs will give your loved ones the peace of mind they need when making tough choices about the future. Convertible. If your short-term needs become permanent, you can usually convert your term policy to a whole life policy (though there may be age restrictions). The reality of term life insuranceThe policy is temporary. Term insurance is designed to last for a specific amount of time (term). After the term period is over, many policies are guaranteed to renew on an annual basis at a higher premium, and may become unaffordable. |

What Happens to Term Life Insurance at the End of the Term?As your term life insurance policy nears its end, you may be considering your options. Plans are often renewable for a certain amount of time, so don't worry if you still need coverage for your loved ones. In addition, you may have a term plan that can be changed to a permanent one. You can choose to have your term policy automatically renew into permanent coverage when the initial term expires. With a policy that accumulates cash value, you can have insurance during the years when you need it the most while still getting lifetime coverage. |

What is whole life insurance?

The most common type of permanent life insurance, whole life insurance, also happens to be more expensive than term life. This is due to the fact that it provides coverage for the rest of your life and guarantees payment upon your death. A savings feature known as a cash-value account is included. Your premium contributions will accumulate over time. Once you’ve built up enough cash value, you can borrow against the account or surrender the policy for cash.

Whole life insurance is a more complex form of permanent life insurance than term life, but its operation is simpler than that of other permanent forms of insurance. No matter how long you live, your premiums will never go up, and both the death benefit and the cash value will grow at a set rate.

Benefits of Whole life insuranceThe death benefit from whole life insurance is paid out continuously. Also, it has a cash value component that builds up over time and can be accessed for spending or borrowing purposes. Coverage that lasts forever. In contrast to term life insurance, coverage under a whole life policy continues for the policyholder's entire lifetime. Your beneficiaries are eligible to receive a death benefit as long as your policy is still active when you pass away. Invest in your own property. Part of the premiums you pay into a whole life policy accumulate as value over time. Loans and withdrawals can be taken out against your cash value once it has accumulated to a certain point. The cash value of a whole life policy is an additional asset that can be used however you see fit, if at all. Accessing cash value, however, may have repercussions depending on the action and the method used to access the cash. 1 Expensive alternatives. Traditional whole life policies have premiums paid until the policyholder reaches age 100, but there are also policies with a shorter payment term, such as 10, 15, or 20 years. Dividends are a possible outcome. Depending on the company's success, whole life policyholders may receive dividends from their insurer. Dividends can be distributed in the form of cash, invested at a competitive interest rate, used to buy additional coverage, or even applied to the policy's premium. The potential for dividends is a selling point of whole life policies, but policyholders should be aware that they are not guaranteed. Making preparations for your estate. This isn't a luxury item for the privileged only. Many people wish to leave money to their children or other relatives, to charity, or to someone with special needs. Purchasing a whole life insurance policy can be an effective way to leave a financial legacy for future generations. The reality of whole life insuranceCosts will be greater at the outset. While the upfront cost of whole life insurance may be more than that of comparable term coverage, policyholders shouldn't mistake the former for the latter. Whole life insurance is a good option for diversifying your financial portfolio and meeting your long-term financial security needs because of the lifetime protection it provides, the guaranteed cash value it accrues over time, and the dividends it pays out if you choose to participate. |

Term vs. whole life: Policy features

|

| Photo Insurance Geek |

| Policy feature | Term life | Whole life |

|---|---|---|

| Choice of policy length | ✓ | |

| Accumulates cash value | ✓ | |

| Provides lifelong coverage | ✓ | |

| Premiums typically stay the same | ✓ | ✓ |

| Might be eligible for annual dividends | ✓ | |

| Life insurance payout amount is guaranteed | ✓ | ✓ |

| Low premium | ✓ |

READ MORE: Best Tips To Purchase Health Insurance

Term vs. whole life: Cost Comparison

Term life insurance is cheap because it’s temporary and has no cash value. Whole life insurance premiums are much higher because the coverage lasts your lifetime, and the policy grows cash value. Here’s how much annual premiums compare for a $500,000 policy of term life insurance vs. whole life.

| Person covered | 20-year term life | 30-year term life | Whole life |

|---|---|---|---|

| Male, 30 | $229. | $358. | $4,308. |

| Female, 30 | $193. | $300. | $3,802. |

| Male, 40 | $341. | $595. | $6,388. |

| Female, 40 | $289. | $476. | $5,467. |

| Male, 50 | $840. | $1,506. | $9,875. |

| Female, 50 | $654. | $1,137. | $8,347. |

| Average of three lowest prices available in each category for healthy men and women. Source: Quotacy. Age is at time of issuance. Premiums stay level throughout the length of the policy. | |||

What Is Better: Term Life or Whole Life Insurance?

|

| Photo Insurance Geek |

The primary distinction between term and whole life insurance is that the former provides protection for a limited time frame, while the latter covers you for the rest of your life. One of the most prominent aspects of term insurance is the death benefit. But whole life insurance policies incorporate both a death benefit and a savings component.

Term insurance has an advantage in that it is typically less expensive than other types of insurance because it does not include the added benefit of having a savings account. The policy will be worthless after its term ends, which is a major drawback.

The primary benefit of whole life insurance is that policy funds can be used during your lifetime for investment, borrowing, or withdrawal. This sum is drawn from the policy's cash value, which increases over time. One major drawback is that it typically takes many years, sometimes decades, for cash value to accumulate in most policies.

| Term Life | Whole Life |

| Basic type of life insurance | More complex type of life insurance |

| Maximum term policy sold is usually a 30-year plan1 | No limit on the amount of years you can purchase since coverage lasts for a lifetime, as long as premiums are paid |

| Death benefit is paid to beneficiaries only if you die with an active policy—e.g. If you have a 20-year policy, a death benefit is paid if you die during those 20 years or your policy has been renewed after 20 years and is still active | Death benefit is paid regardless of when you die, as long as the policy is active |

| Cost starts out low, but may become expensive later in life—e.g. If the term ends at age 55 and you renew, it may be expensive since you’re older | Cost starts out high but may get lower over the life of the policy |

| Premiums for most plans remain the same only for the term—increases when you renew | Premiums for the most common type of plan stays the same for the life of the policy |

| Typically provides more insurance protection per dollar | Usually provides less insurance protection per dollar in the early years of the policy |

| Death benefit can stay the same, increase, or decrease depending on the type of plan | Death benefit typically remains fixed as long as the policy is in force |

Top 20+ Advantages of Life Insurance and How to Accelerated Benefits Top 20+ Advantages of Life Insurance and How to Accelerated Benefits Do you really know benefits and advantages of life insurance and how to get more benefits when buying? |

Term Vs. Whole Life Insurance: Factors To Consider

|

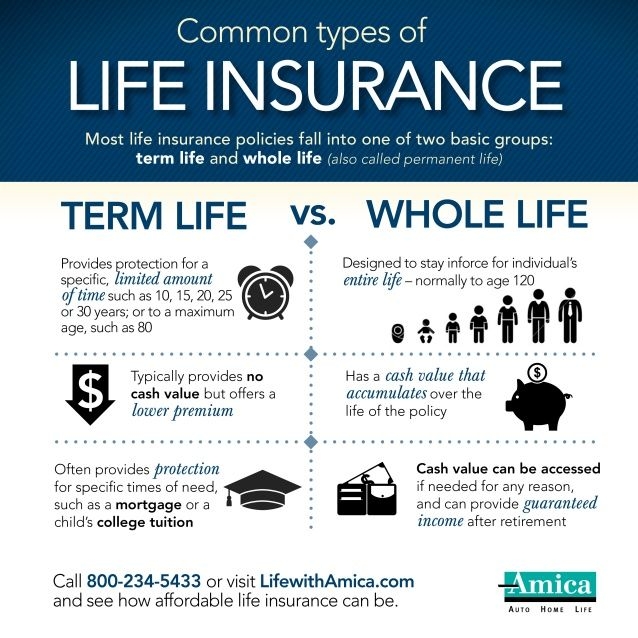

| Photo Amica |

Purchase term life insurance if you:

-If you only need life insurance to replace your income for a limited amount of time, like the years that you’re paying off your mortgage or raising children.

-You want the cheapest coverage.

-You can’t afford whole life insurance now but want it later. Most term life policies ARE convertible to permanent coverage.

Purchase whole life insurance if you:

-You want to reduce estate taxes on the inheritance for your heirs.

-If you have a child with disabilities, life insurance can help fund a trust to provide care for that child.

-You want to leave money aside for final expenses, such as funeral costs.

What Is Mortgage Insurance and How Does It Work? What Is Mortgage Insurance and How Does It Work? What is mortgage insurance, how it works, and what are its benefits? Scroll down to understand more details about the advantages of mortgage insurance. |

How To Find The Best Car Insurance? How To Find The Best Car Insurance? Car insurance is one of the most essential parts when you own a vehicle as private transportation. But how can we find the best insurance ... |

New Policy in UK from 1st January 2021: European Health Insurance Card expiring New Policy in UK from 1st January 2021: European Health Insurance Card expiring New Policy- New Law in UK: Since January 2021, there would be some major changes to the law in the UK relating to the European ... |