Facts About AAVE - Non-Custodial Money Market Protocol

|

| AAVE. Photo: Blockchain News |

Aave is a decentralized finance protocol that allows people to lend and borrow crypto.

Lenders earn interest by depositing digital assets into specially created liquidity pools. Borrowers can then use their crypto as collateral to take out a flash loan using this liquidity.

Aave (which means “ghost” in Finnish) was originally known as ETHLend when it launched in November 2017, but the rebranding to Aave happened in September 2018. (This helps explain why this token’s ticker is so different from its name!)

AAVE provides holders with discounted fees on the platform, and it also serves as a governance token — giving owners a say in the future development of the protocol.

About Aave today

|

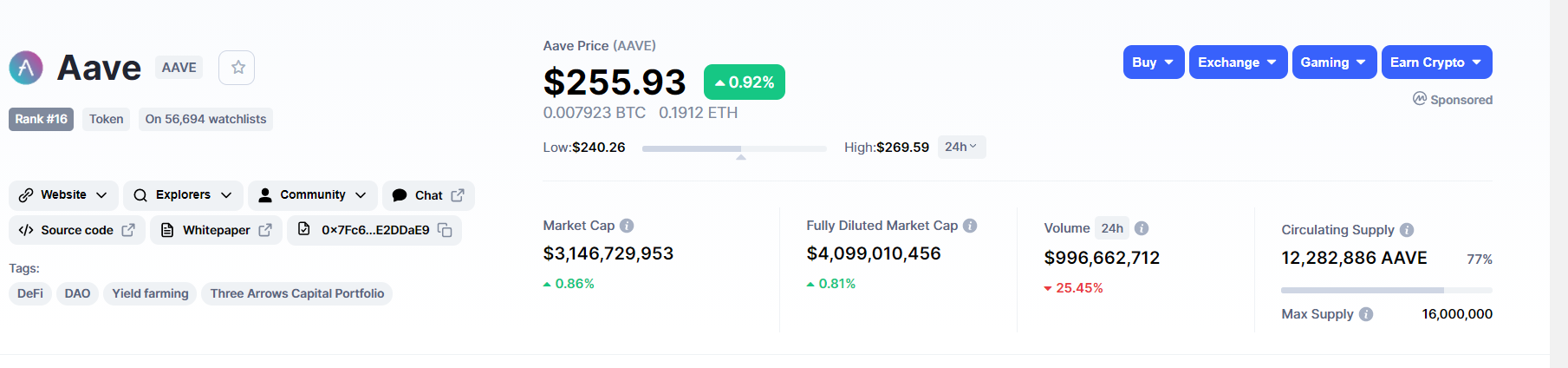

| Photo: Screenshot of AAVE |

Aave price today is $256,19 USD with a 24-hour trading volume of $996.662.712 USD. Aave is down 81% in the last 24 hours. The current CoinMarketCap ranking is #16, with a market cap of $3.146.729.953 USD. It has a circulating supply of 12.282.886 AAVE coins and a max. supply of 16.000.000 AAVE coins.

The top exchanges for trading in Aave are currently Binance, Huobi Global, BitZ, OKEx, and HBTC. You can find others listed on our crypto exchanges page, according to Coinmarketcap.

Aave mission of breaking new barriers holds

|

| Photo: Fxstreet |

At the time of writing, AAVE is trading at $268 after retreating from the new record high. Despite the drop, buyers seem to have control over the price, as reinforced by the Moving Average Convergence Divergence or MACD.

The indicator follows an asset’s trend and calculates its momentum as well as direction. With the 12-day moving average above the 26-day moving average, it is clear that the least resistance path is upwards.

Santiment, a behavioral analysis platform, confirms that Aave’s network has been improving over the last two weeks. The number of newly-created addresses rose from 711 on January 11 to 1,395 at the writing time, representing a 49% upswing. Such a positive growth suggests that AAVE price may continue to rally in the near term while the project’s adoption increases.

Data shows that the number of Aave-related mentions on different social media networks surged in the past days. The rising chatter around the token allowed it to rise to Santiment’s top ten trending topics.

Increased attention is not necessarily a good sign for the continuation of the uptrend. When prices pump, and the crowd starts paying attention, then the dump usually follows shortly after. Therefore, increased crowd attention can be considered a leading indicator of a short-term price correction.

Meanwhile, it is essential to note that the uptrend may be abandoned altogether if the AAVE closes the day under $270. Moreover, overhead pressure will rise if investors begin to dump, as indicated by the social media related mentions. On the downside, support is envisaged at $200, as highlighted by the 50 SMA, the 100 SMA, and the 200 SMA, as reported by Fxstreet.

Altcoins ETH, AAVE Sees ATH Price Rallies, XRP Prays For SEC’s Deliverance

Altcoins With Impressive Growths: AAVE Under The Spotlight

Aave (AAVE) has done a lot to impress its holders as the coin continues to beat new price milestones. Although the coin dropped below $200 on January 21st, the market bulls have been able to regain the market and pushed the price back up. According to CoinMarketCap data, Aave surged to $285, setting a new all-time high price.

The DeFi token’s growth has been impressive this year with a growth of over 210% thus far. Aave’s fundamentals appear to be setting it up for more growth in the near term.

SEC’s Backoff or ATH Record: What Should Be XRP’s Main Focus?

Amidst the ongoing altcoin rally, XRP appears to have a dual concern, including the prayers to get its partner company Ripple delivered from the Securities and Exchange Commission (SEC) and in its journey to trail its contemporaries to hit and surpass its ATH.

The former focus is apparently more significant as it forms the yardstick upon which the coin can see a massive pump in price. The SEC lawsuit against Ripple has pushed XRP down as much as 50% of its price and unless there is a dramatic change in the proceedings, XRP may be doomed to see more price plunges, as cited by BlockChain News.

Now, the coin is a long way from hitting its ATH price of $3.84 that was set about 3 years ago. The coin is currently worth $0.2750 and while it may be intimidated by its peers, the coin will rather pray it gets delivered from the SEC as the reported division amongst law enforcement officials ahead of the court duel may turn out to be in favor of the cryptocurrency.

Aave - USD Exchange

Aave is a promising cryptocurrency, and it uses a blockchain that will revolutionize online payments. Owning or trading AAVE is in demand, and ChangeNOW promises fast and secure AAVE to USD transactions. It will take place with the best possible rates, and there is no need to worry about hidden costs.

Aave Exchange Advantages on ChangeNOW

ChangeNOW cares about your privacy and security. We are a non-custodial service, and we never control, store, or hold your funds in any way.

The average transaction does not take more than two minutes, and we aim to reduce the times further in the future.

ChangeNOW is a versatile service that adapts to the crypto market. We add new and upcoming cryptocurrencies regularly and follow new trends.

There is no need to register or provide any personal info for exchanging crypto. ChangeNOW simply needs your wallet data for sending the funds, and that's it!

| Aave is a cryptocurrency with a price of $ 253.12 and marketcap of $ 3,412,363,820. Aave's market price has increased 29.80% in the last 24 hours. Aave price change in the last 7 days is 51.08%. It ranks 14 amongst all cryptocurrencies with daily volume of $ 1,403,626,205. Aave has a total supply of 16,000,000 AAVE with 12,275,091 AAVE coins in circulation. |

What Makes Aave Unique?

Aave has several unique selling points when compared with competitors in an increasingly crowded market. During the DeFi craze in the summer of 2020, it was one of the biggest projects in terms of the total value of crypto locked in its protocol.

The project allows people to borrow and lend in about 20 cryptocurrencies, meaning that users have a greater amount of choice. One of Aave’s flagship products are “flash loans,” which have been billed as the first uncollateralized loan option in the DeFi space. There’s a catch: they must be paid back within the same transaction.

Another big selling point is how those who borrow through Aave can alternate between fixed and variable interest rates. While fixed rates can provide some certainty about costs during times of volatility in the crypto markets, variable rates can come in handy if the borrower thinks that prices will fall in the near future.

For more interesting news of KnowInsiders, check out below!

Google Trends in the US: TOP 7 Most Searched News Google Trends in the US: TOP 7 Most Searched News The year 2020 has seen its fair share of major historic events and Google has revealed the most trending news of the year. Here are ... |

Update Texas' Lawsuit: What is the U.S Supreme Court Decision - Q&A Update Texas' Lawsuit: What is the U.S Supreme Court Decision - Q&A Update News Texas' Lawsuit over election: On Tuesday evening, the Supreme Court ordered the defendant states to reply by 3 p.m. on Thursday, Dec. 10. ... |

Update News Hunter Biden under investigation over taxes Update News Hunter Biden under investigation over taxes Latest Update Hunter Biden under investigation: President-elect Joe Biden’s son, Hunter Biden has recently disclosed that the US attorney’s office in Delaware had conducted ... |