Does Medicare Cover Home Healthcare?

|

| Photo: KnowInsiders |

These days it is now possible for people to receive treatment from the comfort of their own home, rather than having to stay in a hospital or a nursing facility, but Medicare will only cover this if your situation is named on their list of requirements.

So, if you or someone you care about requires part-time nursing or rehabilitative therapy at home, there could be some assistance from Medicare.

What Is Medicare?

Medicare is the federal government’s health insurance program that primarily covers people 65 and older and certain younger people with disabilities or kidney failure. Original Medicare does not cover all medical costs. Medicare Advantage plans stand in the place of Original Medicare or you may opt to stay with Original Medicare and purchase a Medicare Supplement policy.

Is Medicare free?

You don’t have to pay premiums for Medicare Part A if you or your spouse paid Medicare taxes for at least 10 years. (Medicare taxes are part of the payroll taxes deducted from most working people’s paychecks. You can see if you qualify by checking your Social Security Statement, which is available through the Social Security website.)

Otherwise, eligible people pay monthly premiums for Part A of up to $471 each month ($499 in 2022). The other parts of Medicare, which cover things like doctor visits and prescription drugs, require monthly premiums.

Does Medicare cover Home healthcare?

|

| Photo: MedicareFAQ |

In order to receive home health care, Medicare have set out a list of requirements that people must meet in order to receive financial help. These include:

• Your doctor prescribing home health care for you.

• You must require part-time skilled nursing care or physical, speech, or occupational therapy.

• The home health care must be provided by a Medicare-approved agency.

• You must be confined to your home by an injury, illness, or other medical condition. (If you can physically leave home to receive treatment, you might not be eligible.)

• Your doctor must help set up a care plan in cooperation with the home health care agency.

It used to be a requirement of Medicare that the home health care must be expected to improve your condition, but a change to this means that you can now qualify if it means that you can maintain your condition or slow down the deterioration of your condition.

Should you require full-time nursing care, though, Medicare will not give the green light for home health care, although they may help cover the cost of a skilled nursing facility.

What home health services does Medicare cover?

Medicare covers a variety of home health services for as long as it is reasonable and deemed necessary to treat an injury or illness.

Medicare covers up to 8 hours of care a day for a maximum of 28 hours a week. For some people, the insurance program pays for up to 35 hours a week of home health. Medicare assesses the need for 35 weekly hours of care on a case-by-case basis.

Medicare covers the following services:

Rehabilitation therapy

Rehabilitation services help an individual regain daily function and improve their ability to live independently every day.

These services may include physical, occupational, and speech therapy.

Medical supplies and equipment

Medicare Part B covers certain medical supplies that are necessary for home health services. A doctor must prescribe the equipment for Medicare to provide coverage.

Medical supplies and equipment that Medicare covers may include:

• canes

• infusion pumps

• walkers

• wheelchairs

• hospital beds

• blood sugar testing strips and monitors

• nebulizer equipment

• traction equipment

• wound dressings and supplies

Medicare covers the cost of medical equipment for home use in a few different ways, depending on the type of supplies or equipment.

For example, Medicare pays rental costs for certain types of equipment. Patients may choose to buy the equipment, in which case, Medicare also covers the cost.

Medical social services

These services involve assistance from a social worker or counselor. They can help people deal with emotional issues that may be presenting barriers to recovery from an illness or injury.

Skilled nursing care

Medicare Part A also covers the provision of skilled nursing care through home health if it is intermittent or part-time.

Intermittent nursing involves under 8 hours of care a day for 21 days or, in some circumstances, up to 35 days. It can also refer to nursing care that a person receives on fewer than 7 days of the week.

Medicare does not cover skilled nursing care that requires more than 8 hours a day or is not intermittent.

A registered nurse or licensed practical nurse must provide skilled nursing during home health services for Medicare to pay. Home health skilled nursing care may include:

• wound care and dressing changes

• tube feedings

• administering intravenous (IV) drugs

• education in disease management

Home health personal care

Home health aides provide personal care, such as help dressing and bathing.

Medicare only pays for a home health personal care aide when an individual also receives skilled nursing care or rehabilitation services through home health. Medicare does not cover home health personal care aides as a stand-alone service.

Understanding Medicare Coverage Plans

|

| Photo: Western Connecticut Area Agency on Aging |

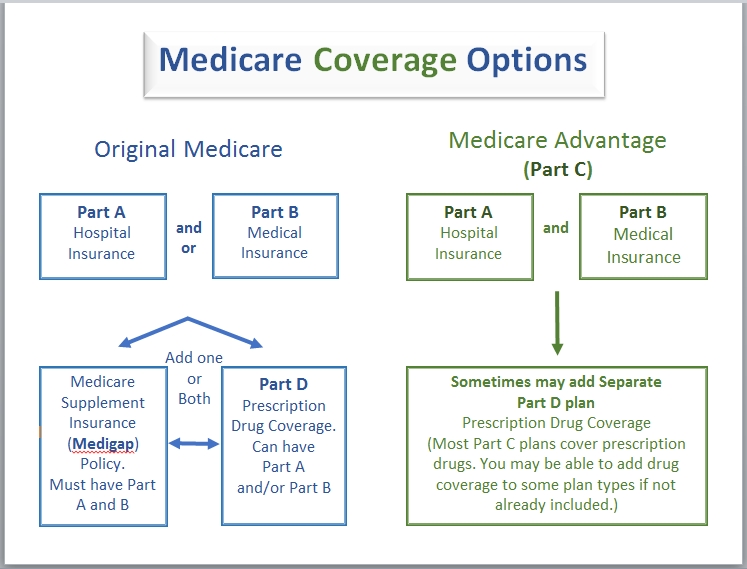

Medicare is divided into four parts, named alphabetically from Part A through Part D.

Parts A and B are sometimes referred to as Original Medicare. Parts C and D are newer options. Generally, you can get coverage through Original Medicare or through Medicare Advantage plans if you qualify.

Medicare Advantage plans require that you live in the service area of the plan you want to join.

Medicare Part A

Medicare Part A is hospital insurance. It covers the costs of a hospital or nursing facility stay, but does not cover long-term care.

What does Medicare Part A cover?

• Inpatient care in a hospital

• Inpatient care in a skilled nursing facility

• Home health care

• Hospice care

Part A does not cover the costs of treatments you receive while in the hospital. That falls under Part B.

Medicare Part B

Medicare Part B is medical insurance that covers doctor visits. It also covers the costs of what CMS calls medically necessary services and preventative services.

• Medically necessary services include those supplies, tests or other services to diagnose and treat your medical condition.

• Preventative services include health care required to detect and treat a condition early on.

Medicare Part C

Medicare Part C is also called Medicare Advantage, a form of private insurance. Enrollment in Part C is voluntary.

These plans are sold through insurance firms that have contracted with the federal government. All Medicare Advantage plans must provide the same coverage as Medicare Part A and Part B, but other benefits vary from plan to plan.

Most Medicare Advantage plans also offer prescription drug coverage. Medicare Advantage plans may also bundle coverage beyond what Original Medicare plans cover and may include vision, hearing and dental coverage.

Medicare Part D

Medicare Part D covers the cost of prescription drugs and is provided through private insurers. People who enroll in Part D pay a monthly premium. It covers the prescription drugs you buy at your local or mail-order pharmacy.

Most states have more than two dozen private insurers to choose from for Part D coverage.

Medicare Supplement Plans (Medigap)

A Medicare Supplement plan, commonly known as Medigap, is an additional coverage option to Original Medicare.

Medicare Part A and Part B only covers 80 percent of services. Adding a Medigap plan covers the remaining 20 percent, eliminating coinsurance or copayments as well as some additional out-of-pocket costs.

These policies are sold by private insurance companies. You cannot have Medigap coverage with a Medicare Advantage plan.

Who qualifies for Medicare?

You’re entitled to Medicare if you’re at least 65 and a U.S. citizen, or a permanent legal resident for the past five years. Medicare also covers some disabled people under age 65. People who receive Social Security disability insurance usually become eligible for Medicare after a two-year waiting period, although those with end-stage renal disease (permanent kidney failure) are enrolled automatically upon signing up and those with amyotrophic lateral sclerosis (ALS, also known as Lou Gehrig’s disease) are eligible the month disability begins.

How do I enroll in Medicare?

If you’re receiving Social Security benefits when you turn 65, you will be enrolled automatically in Medicare Part A, which covers hospital costs, and Part B, which covers doctor visits. If you want Medicare Part D prescription drug coverage you’ll need to enroll yourself — that’s not automatic.

If you’re not receiving Social Security benefits, you’ll sign up through the Social Security Administration website. You typically should do so in the seven-month window around your 65th birthday (which includes the three months before the month you turn 65, your birthday month, and the three months after your birthday month) to avoid permanent penalties.

If you want Medicare Supplemental Insurance (Medigap), you would sign up during the six-month Medigap enrollment period, which starts the month you turn 65 and are enrolled in Medicare Part B. The private insurers who provide Medigap plans are required to take you if you sign up during that period. Otherwise, there is no guarantee they will sell you a Medigap plan.

If you miss your initial window, or want to switch plans later, there are several annual Medicare open enrollment periods.

| Who’s eligible for in-home care through Medicare? Medicare enrollees are eligible for in-home care under Medicare Parts A and B provided the following conditions are met: • The patient is under the care of a doctor who reviews his or her treatment plan regularly. • A doctor has certified that the patient needs skilled nursing care or some type of therapy. • The patient only needs physical, speech, or occupational therapy for a limited period of time. • A doctor has certified that the patient is homebound. • The need for skilled nursing is only part-time or intermittent. • The home health agency used to provide care is approved by Medicare. Additionally, other than durable medical care, patients usually don’t pay anything for in-home care. Many seniors require assistance with activities of daily living, as opposed to an actual medical condition. A long-term care policy can help defray the cost of home health aides whose services are strictly custodial in nature. It can also help pay for assisted living facilities, which offer seniors the ability to live independently, albeit with help. |

* Medicare does not cover:

• 24-hour care at home

• Custodial or personal care when this is the only home care you need.

• Household services such as shopping, cleaning and laundry when they are not related to your care plan.

• Meal delivery to your

How Much Will I Have to Pay if I Qualify?

With Original Medicare coverage (Part A and/or Part B), eligible seniors will pay nothing for home health care services that are ordered by a doctor and provided by a certified home health agency. Any additional services provided outside of the approved care plan will not be covered and must be paid for out of pocket.

Be aware that before services begin, the home health agency should provide an itemized receipt or plan of care that identifies what is eligible for Medicare coverage and what is not. A written notice called the “Advance Beneficiary Notice of Noncoverage” (ABN) will detail any services and durable medical equipment that Medicare will not pay for as well as the costs the patient will be responsible for.

Out-of-Pocket Medicare Costs in 2022

| Part A Premium |

|

| Part A Hospital Inpatient Deductible and Coinsurance |

|

| Part B Premium |

|

| Part B Deductible and Coinsurance |

|

| Part C Premium |

|

| Part D Premium |

|

Top 3 Zodiac Signs Born To Be Successful Real Estate Agents Top 3 Zodiac Signs Born To Be Successful Real Estate Agents Who are the 3 most successful real estate agent zodiac signs? Check out this articles of KnowInsiders to know whether you're one of them or ... |

Who Is Charles Koch - The Richest Person in Kansas Who Is Charles Koch - The Richest Person in Kansas Charles Koch, CEO of Koch Industries, is the richest people in Kansas of America with a huge, mouth-watering net worth. |

How To Remove Acne Scars: Simple Natural & Medical Treatments How To Remove Acne Scars: Simple Natural & Medical Treatments There are several tips to get rid of acne scars that you can do at home rignt now. |