U.S Apartment Rental Markets: Top 10 Most Expensive Cities and Full List

|

| Apartment Rental Trend in the US. Photo: Mixi's |

| Contents |

What are the most expensive cities in America's aparment rental markets - Top 10?

The nation's most costly apartment rental market currently belongs to New York City.

Early on, the coronavirus epidemic severely disrupted New York's real estate market, but demand has subsequently recovered. Not only are rents recovering, but they are also reaching pre-pandemic levels.

According to a new research from Zumper, an apartment listing service that has been monitoring rental markets since 2014, New York is now somewhat more costly than San Francisco.

San Francisco's median one-bedroom rent was more than $800 higher than New York's just two years ago. In comparison to San Francisco, where the median rent for a one-bedroom apartment is $2,800, New York City's rent is currently $2,810.

Boston, San Jose, California, and Washington, D.C. round out the top five most expensive rental cities, each costing $2,300, $2,200, and $2,160, respectively.

The pandemic had the greatest impact on San Francisco and New York, where businesses closed and people fled to smaller cities or the suburbs. Particularly in New York, there was a significant exodus to the Sun Belt.

The median one-bedroom rent had decreased by about 24% in San Francisco and by nearly 18% in New York City just 8 months earlier, at the beginning of this year. But San Francisco was still $330 more costly than New York.

While San Francisco rent has increased by only approximately 5% since January, New York rent has increased by almost 20%.

"A disproportionate number of the city's citizens are tech professionals, and such firms are more likely to have widespread or ongoing work-from-home policies. According to Jeff Andrews, the author of the Zumper research, "This gives those workers the freedom to reside anyplace they want, and many of them have chosen they don't want to live in San Francisco.

|

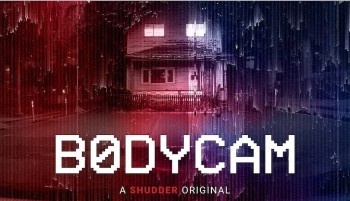

| Top 10 Most Expensive Cities in Apartment Rental Markets for 2021 |

National rent growth continues stunning acceleration

|

| Photo: Zumper |

Prospective purchasers flocked to local home sales marketplaces after the epidemic broke out in March 2020 in an effort to adapt their living situation to stay-at-home instructions and work-from-home policies. The sudden and unexpected demand caused sales volume and housing values to soar. That's now affecting the rental market and driving up rent dramatically. One-bedroom median rent has increased by 9.2% since the second quarter of 2020, while two-bedroom median rent has increased by 11%, according to Zumper's national rent index for August.

There are a lot of variables that have contributed to this. Renters who might otherwise be purchasing properties have been priced out of the market or become worn out by the rivalry in the property market as home prices have increased and bidding wars have grown. Others experienced financial difficulties and had to use money they had set aside for a down payment simply to get by. Over the course of the epidemic, the number of people in these situations has increased, gradually pushing rent prices higher. The national index has reached new all-time highs every month except one of this year, suggesting that the dam has cracked in 2021.

Yet many factors than just the hot housing market are at play in these figures. Those who are earning more money have been deciding to migrate as the economy has improved and unemployment has decreased. Those who lived with family during the pandemic are now relocating because they need to get back to their jobs or schools. After the pandemic started, a significant amount of the cyclical structure of rent prices—where rent increases in the spring and summer and decreases in the winter—stopped, which sparked a huge wave of seasonal-unrelated domestic movement. The events that fuel that cyclical nature of rent, however, are returning this autumn as universities open for in-person instruction, which causes the typical increase in rent that occurs as students migrate. All of this adds up to a recipe for nationwide rent increases that are unprecedented.

Nationwide benefits

Cities around the nation are experiencing increased rental activity and, in some regions, even bidding wars, which are generally only seen in for-sale markets. New York is experiencing the strongest recovery. According to RentCafe, another website that lists available rentals, the number of rental applications in New York City increased in the spring of this year compared to 2020. Potential renters increased by 79% in San Francisco and by 55% in Seattle.

Due to this, national airfare has increased. Apartments with one bedroom are up 9% year over year; according to Jumper, apartments with two bedrooms are up 11%. The most recent CoreLogic reading for June for single-family rental properties revealed a 7.5% year-over-year increase from a year earlier, which is more than five times the annual growth in June 2020.

Detached rentals are ultimately favored and continue to be in high demand for homeowners who are either out of the market or unable to find houses in today's supply-constrained market, according to Molly Bossel. The top economist said Core Logic.

While the most valuable rental markets are in New York and San Francisco, rents are skyrocketing in other cities. The cities with the most growth include Salt Lake City, Knoxville, Raleigh, Austin, Texas, and Phoenix, in that order. Chattanooga, Tennessee; Baltimore; Milwaukee; Rochester, New York; and Fort Worth, Texas are the cities with the lowest rent increases.

Full List of Rental Markets in the US

| 1 Bedroom | 2 Bedrooms | |||||||

|---|---|---|---|---|---|---|---|---|

| Pos. | +/- | City | Price | M/M % | Y/Y % | Price | M/M % | Y/Y % |

| 1 | 1 | New York, NY | $2,810 | 4.90% | 4.10% | $3,000 | 4.50% | -1.30% |

| 2 | -1 | San Francisco, CA | $2,800 | 2.90% | -7.90% | $3,830 | 2.10% | -5.90% |

| 3 | 0 | Boston, MA | $2,300 | 0.00% | 0.00% | $2,730 | 1.10% | -2.50% |

| 4 | 0 | San Jose, CA | $2,200 | 1.40% | -1.30% | $2,720 | -0.70% | -1.10% |

| 5 | 0 | Washington, DC | $2,160 | 4.90% | 5.40% | $2,910 | -1.00% | 3.20% |

| 6 | 0 | Los Angeles, CA | $2,050 | 2.50% | -1.40% | $2,800 | 0.00% | -2.80% |

| 7 | -1 | Oakland, CA | $2,000 | 0.00% | -9.10% | $2,600 | 0.00% | -7.10% |

| 7 | 1 | San Diego, CA | $2,000 | 2.00% | 11.10% | $2,700 | 1.90% | 14.90% |

| 9 | 0 | Miami, FL | $1,880 | 5.00% | 7.40% | $2,480 | 5.10% | 5.50% |

| 10 | -1 | Santa Ana, CA | $1,830 | 2.20% | 7.60% | $2,300 | 0.00% | 2.20% |

| 11 | 1 | Anaheim, CA | $1,760 | 2.30% | 6.70% | $2,160 | 2.90% | 8.50% |

| 11 | 2 | Scottsdale, AZ | $1,760 | 4.80% | 21.40% | $2,300 | 5.00% | 19.20% |

| 13 | 1 | Atlanta, GA | $1,660 | 3.80% | 15.30% | $2,120 | 1.90% | 11.60% |

| 13 | -2 | Fort Lauderdale, FL | $1,660 | -4.00% | -1.80% | $2,360 | 4.90% | 7.30% |

| 15 | -1 | Seattle, WA | $1,650 | 3.10% | -2.90% | $2,120 | 1.00% | -5.40% |

| 16 | 1 | Gilbert, AZ | $1,620 | 5.20% | 24.60% | $1,890 | 5.00% | 23.50% |

| 17 | -3 | Long Beach, CA | $1,600 | 0.00% | 0.00% | $2,150 | 4.90% | 2.40% |

| 18 | 2 | Denver, CO | $1,530 | 4.80% | 7.00% | $2,070 | 3.50% | 6.20% |

| 19 | 3 | Chandler, AZ | $1,520 | 4.80% | 21.60% | $1,740 | 4.80% | 18.40% |

| 20 | -2 | Providence, RI | $1,500 | 0.00% | 2.00% | $1,690 | 5.00% | -4.00% |

| 21 | -1 | Sacramento, CA | $1,490 | 2.10% | 6.40% | $1,870 | 0.50% | 13.30% |

| 22 | 4 | Orlando, FL | $1,460 | 5.00% | 18.70% | $1,610 | 5.20% | 15.00% |

| 22 | -3 | Honolulu, HI | $1,460 | -0.70% | -8.80% | $2,150 | 4.90% | -4.00% |

| 24 | -1 | Chicago, IL | $1,450 | 1.40% | -3.30% | $1,730 | 1.80% | -3.90% |

| 25 | -1 | New Orleans, LA | $1,430 | 2.10% | -1.40% | $1,700 | 1.20% | -1.70% |

| 26 | 2 | Henderson, NV | $1,420 | 5.20% | 20.30% | $1,610 | 5.20% | 19.30% |

| 27 | -3 | Portland, OR | $1,400 | 0.00% | 0.00% | $1,760 | 1.70% | 1.10% |

| 27 | 1 | St Petersburg, FL | $1,400 | 3.70% | 5.30% | $1,960 | 4.80% | 19.50% |

| 29 | 3 | Nashville, TN | $1,380 | 5.30% | 8.70% | $1,500 | 0.70% | 4.20% |

| 30 | 6 | Austin, TX | $1,370 | 5.40% | 7.00% | $1,730 | 4.80% | 10.20% |

| 30 | 2 | Charlotte, NC | $1,370 | 4.60% | 13.20% | $1,580 | 3.90% | 12.10% |

| 32 | -4 | Philadelphia, PA | $1,350 | 0.00% | -10.00% | $1,700 | 0.00% | -2.90% |

| 33 | -1 | Dallas, TX | $1,340 | 2.30% | 8.90% | $1,790 | 1.70% | 5.90% |

| 33 | 4 | Tampa, FL | $1,340 | 4.70% | 13.60% | $1,590 | 5.30% | 13.60% |

| 35 | 2 | Boise, ID | $1,310 | 2.30% | 24.80% | $1,430 | 5.10% | 15.30% |

| 36 | -9 | Baltimore, MD | $1,300 | -5.10% | -4.40% | $1,460 | -5.20% | -12.60% |

| 36 | -4 | Plano, TX | $1,300 | -0.80% | 15.00% | $1,730 | -1.10% | 15.30% |

| 38 | -7 | Cleveland, OH | $1,290 | -3.70% | 22.90% | $1,340 | 0.80% | 16.50% |

| 39 | 1 | Madison, WI | $1,280 | 4.90% | 15.30% | $1,490 | 1.40% | 8.00% |

| 40 | 3 | Durham, NC | $1,260 | 5.00% | 14.50% | $1,410 | 5.20% | 11.00% |

| 40 | 1 | Reno, NV | $1,260 | 4.10% | 14.50% | $1,630 | 0.00% | 14.80% |

| 42 | -3 | Newark, NJ | $1,250 | 0.00% | -7.40% | $1,520 | 0.70% | -15.10% |

| 43 | 1 | Irving, TX | $1,240 | 5.10% | 14.80% | $1,630 | 0.60% | 14.80% |

| 44 | -3 | Virginia Beach, VA | $1,230 | 1.70% | 13.90% | $1,400 | 2.20% | 12.00% |

| 45 | 4 | Phoenix, AZ | $1,200 | 5.30% | 15.40% | $1,510 | 4.90% | 20.80% |

| 46 | 5 | Raleigh, NC | $1,180 | 5.40% | 13.50% | $1,350 | 1.50% | 8.90% |

| 47 | 5 | Salt Lake City, UT | $1,160 | 5.50% | 16.00% | $1,400 | 2.90% | 7.70% |

| 48 | -4 | Minneapolis, MN | $1,150 | -2.50% | -13.50% | $1,630 | 5.80% | -15.10% |

| 49 | -2 | Aurora, CO | $1,140 | -0.90% | 3.60% | $1,590 | 0.60% | 10.40% |

| 50 | 2 | Pittsburgh, PA | $1,130 | 2.70% | 5.60% | $1,360 | -0.70% | 0.70% |

| 51 | 6 | Las Vegas, NV | $1,120 | 4.70% | 10.90% | $1,360 | 4.60% | 8.80% |

| 52 | -6 | Chattanooga, TN | $1,100 | -5.20% | 15.80% | $1,240 | 5.10% | 15.90% |

| 52 | 7 | Chesapeake, VA | $1,100 | 4.80% | -1.80% | $1,300 | 0.80% | 5.70% |

| 52 | -5 | Fresno, CA | $1,100 | -4.30% | 0.90% | $1,430 | 2.90% | 8.30% |

| 52 | -3 | Houston, TX | $1,100 | -3.50% | -0.90% | $1,410 | -4.70% | 3.70% |

| 52 | 0 | Mesa, AZ | $1,100 | 0.00% | 14.60% | $1,430 | 5.10% | 19.20% |

| 57 | 4 | Glendale, AZ | $1,080 | 4.90% | 24.10% | $1,330 | 4.70% | 14.70% |

| 58 | -2 | Richmond, VA | $1,070 | -0.90% | -7.00% | $1,300 | -1.50% | -6.50% |

| 59 | 0 | Buffalo, NY | $1,050 | 0.00% | -2.80% | $1,140 | -0.90% | -10.90% |

| 60 | 7 | Anchorage, AK | $1,040 | 5.10% | 9.50% | $1,220 | -1.60% | 6.10% |

| 60 | 3 | Colorado Springs, CO | $1,040 | 4.00% | 6.10% | $1,390 | 4.50% | 11.20% |

| 60 | -5 | Fort Worth, TX | $1,040 | -4.60% | -4.60% | $1,380 | -4.80% | 3.80% |

| 63 | 0 | Jacksonville, FL | $1,030 | 3.00% | 12.00% | $1,250 | 1.60% | 11.60% |

| 64 | -1 | Norfolk, VA | $1,020 | 2.00% | 5.20% | $1,210 | 5.20% | 10.00% |

| 64 | -7 | Rochester, NY | $1,020 | -4.70% | 7.40% | $1,270 | -2.30% | 9.50% |

| 64 | 5 | Spokane, WA | $1,020 | 5.20% | 22.90% | $1,270 | 5.00% | 19.80% |

| 67 | -5 | Des Moines, IA | $1,000 | -2.00% | 11.10% | $1,050 | 4.00% | 10.50% |

| 67 | 1 | San Antonio, TX | $1,000 | 2.00% | 11.10% | $1,240 | 3.30% | 12.70% |

| 69 | 7 | Knoxville, TN | $970 | 5.40% | 18.30% | $1,140 | 4.60% | 12.90% |

| 70 | 0 | Kansas City, MO | $950 | 0.00% | -2.10% | $1,200 | 0.00% | 4.30% |

| 70 | -7 | Milwaukee, WI | $950 | -5.00% | -8.70% | $1,100 | 0.00% | -7.60% |

| 72 | 1 | Columbus, OH | $940 | 1.10% | 10.60% | $1,100 | 1.90% | 0.00% |

| 73 | -3 | Arlington, TX | $930 | -2.10% | 3.30% | $1,290 | 4.90% | 9.30% |

| 73 | 0 | Indianapolis, IN | $930 | 0.00% | 4.50% | $1,000 | 1.00% | 2.00% |

| 73 | -3 | St Louis, MO | $930 | -2.10% | -2.10% | $1,260 | 0.00% | 3.30% |

| 76 | 1 | Cincinnati, OH | $920 | 2.20% | -3.20% | $1,100 | 4.80% | -4.30% |

| 77 | -4 | Bakersfield, CA | $900 | -3.20% | 5.90% | $1,150 | 0.90% | 15.00% |

| 78 | 3 | Augusta, GA | $890 | 4.70% | 8.50% | $990 | 4.20% | 10.00% |

| 78 | 0 | Louisville, KY | $890 | 0.00% | 4.70% | $990 | -1.00% | 4.20% |

| 78 | 3 | Memphis, TN | $890 | 4.70% | 4.70% | $940 | 4.40% | 4.40% |

| 81 | -3 | Lincoln, NE | $870 | -2.20% | 7.40% | $1,030 | -4.60% | 6.20% |

| 82 | 2 | Corpus Christi, TX | $850 | 1.20% | 2.40% | $1,080 | 2.90% | 0.90% |

| 82 | 5 | Detroit, MI | $850 | 4.90% | 14.90% | $1,040 | -5.50% | 22.40% |

| 82 | 2 | Winston Salem, NC | $850 | 1.20% | 1.20% | $990 | 1.00% | 10.00% |

| 85 | -5 | Omaha, NE | $840 | -2.30% | -1.20% | $1,160 | 5.50% | 9.40% |

| 86 | 0 | Baton Rouge, LA | $830 | 0.00% | 0.00% | $980 | 3.20% | 5.40% |

| 86 | -5 | Syracuse, NY | $830 | -2.40% | 3.80% | $1,030 | 0.00% | -6.40% |

| 88 | -1 | Greensboro, NC | $810 | 0.00% | 6.60% | $880 | -1.10% | -1.10% |

| 88 | 1 | Tallahassee, FL | $810 | 1.30% | 6.60% | $970 | 2.10% | 7.80% |

| 88 | 1 | Tucson, AZ | $810 | 1.30% | 12.50% | $1,060 | 5.00% | 14.00% |

| 91 | 0 | Oklahoma City, OK | $800 | 1.30% | 5.30% | $910 | -3.20% | 2.20% |

| 92 | 0 | Albuquerque, NM | $770 | 1.30% | 4.10% | $1,030 | 5.10% | 9.60% |

| 92 | 2 | El Paso, TX | $770 | 2.70% | 13.20% | $970 | 5.40% | 16.90% |

| 92 | 0 | Lexington, KY | $770 | 1.30% | 2.70% | $1,000 | 5.30% | 9.90% |

| 95 | 0 | Laredo, TX | $760 | 2.70% | -3.80% | $920 | 2.20% | 8.20% |

| 96 | 0 | Tulsa, OK | $720 | 4.30% | 10.80% | $900 | 1.10% | 8.40% |

| 97 | 1 | Lubbock, TX | $680 | 1.50% | 4.60% | $850 | 0.00% | 6.30% |

| 97 | -1 | Shreveport, LA | $680 | -1.40% | 4.60% | $800 | 0.00% | 0.00% |

| 99 | 0 | Akron, OH | $630 | -1.60% | 8.60% | $760 | 1.30% | 5.60% |

| 100 | 0 | Wichita, KS | $620 | 1.60% | -4.60% | $800 | 1.30% | 6.70% |

Rental Industry Trends in USA1. Rent payments reflect resilience, but challenges remain As the country continues to recover from the epidemic, the National Multifamily Housing Council (NMHC) published encouraging advice about the state of multifamily housing. At the same time, the council recognized that there could be future difficulties, such as rising material costs and a developing labor shortage in the building sector, according to CNBC. Over 95% of the rent was paid in May 2021, and 77% of the money for June had been paid by June 6. There is now a June 30 countrywide eviction moratorium in effect. 2. Annual housing report highlights price hikes, disparities The Joint Center for Housing Research at Harvard University published its annual State of the Nation's Housing report for 2021 on June 16. The paper details the record-low inventory levels that are currently pushing up housing prices and stoking the affordability fire. Since some time, home price growth has outpaced income growth, and as of this year, the price-to-income ratio has reached its highest point since 2006. This implies that many prospective homebuyers may be left behind as those who can afford to buy rush to enter the market while the cost of becoming a homeowner — the gathering of a down payment and closing costs — climbs. The report notes that while the homeownership gap between households of color and white households is closing, it is still very wide. As a result, all households with lower median incomes and/or other significant expenses, such as student loans, continue to be at risk of not being able to afford homeownership. |

Top 20 Weirdest Laws in the US That Still Exist Top 20 Weirdest Laws in the US That Still Exist What are weirdest laws in the US? the If you are living in the US, have you ever failed to abide by the law because ... |

Top 10 Most Beautiful Lakes In The US Top 10 Most Beautiful Lakes In The US There are hundreds of prettiest lakes in the US spread out over varying geographical backgrounds, and all of them are beyond compare. |

Top 10 Most Beautiful Mountains In The U.S Top 10 Most Beautiful Mountains In The U.S America has some of many beautiful spots that are visited most by people from around the world. Check out the list of top 10 most ... |