Will Real Estate Prices Skyrocket In 2022?

|

| Will Real Estate Prices Skyrocket In 2022? Photo KnowInsiders |

The 2021 housing market was a double-edged sword for home shoppers.

Low rates and increased flexibility with working from home put many first-time buyers on the map. But limited inventory and skyrocketing prices made housing harder to come by.

Before seeing 2022 predictions, let's take a look at how the real estate market in 2021 has been.

Overview of Real Estate Market In 2021

General Trends

|

| Photo Fortune |

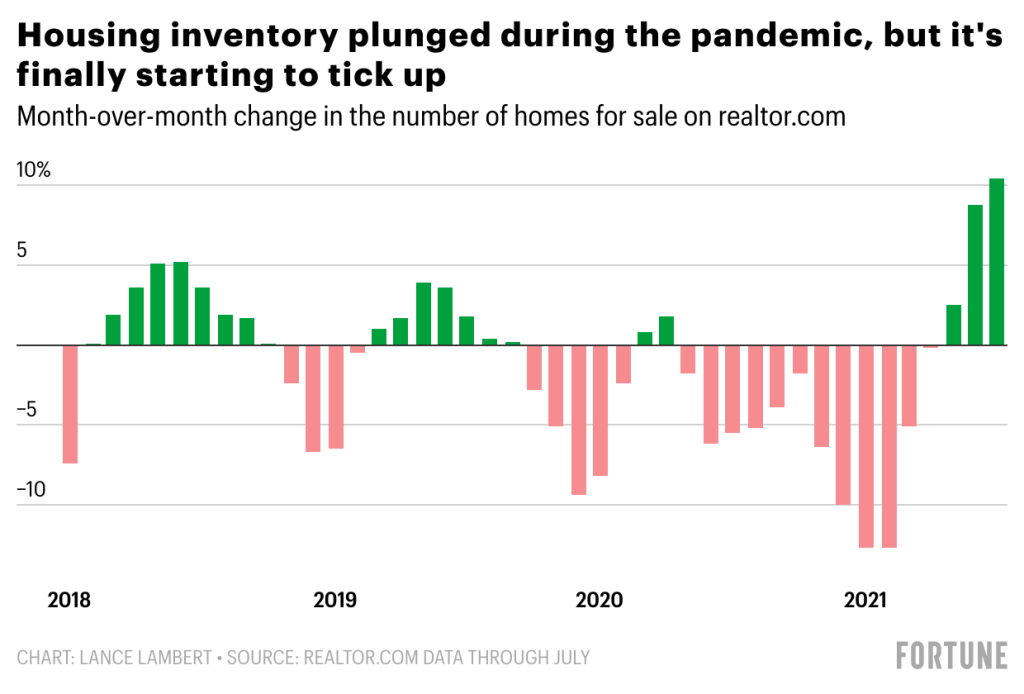

As October 2021 ends, the housing markets are demonstrating signs of rebalancing, as evidenced by a steady pace of transactions and more moderate price growth. As more homeowners list their homes for sale, these homes remain on the market for longer periods of time. Despite this, buyers must be prepared to act quickly, even if they get a few additional days to decide.

Numerous cities that experienced bidding wars earlier this year are now experiencing a more tranquil housing market, with price reductions bringing sky-high asking prices back down to earth, according to realtor.com. While the market continues to be active, there are fewer competing offers and contingencies have returned, both of which are clear indicators of a healthier housing market. For buyers, approachable mortgage rates and less competition mean increased chances of finding the perfect home. Nonetheless, buyers of a median-priced home will pay an additional $142 toward their mortgage payment today compared to a year ago, noradarealestate reported.

The FMHPI is an indicator for typical house price inflation in the United States. It indicates that home prices increased by 11.3 percent in the United States in 2020 as a result of robust housing demand and record low mortgage rates. Growth is expected to slow to 7 percent in 2022, according to their latest forecast. The pace of home sales has cooled since the first quarter of 2021 when it was at 7.2 million. Freddie Mac predicts home sales to hit 6.8 million for the full years 2021 and 2022.

| The median price of single-family existing homes rose in nearly all -- 99% -- of the 183 markets tracked by the National Association of Realtors in the third quarter, with double-digit price increases seen in 78% of the markets, cited CNN. But the stratospheric surges in prices have slowed a bit from earlier this year, according to NAR's quarterly home price report, released Wednesday. The median home price was up 16% to $363,700 in the third quarter from a year ago, a slower clip than the 22.9% jump in the second quarter. Continued strong demand from homebuyers and historically low inventory at a time when mortgage interest rates are expected to rise helped to push prices higher in nearly all of the markets that NAR measured. |

A smaller percentage of cities saw double-digit yearly price increases during the third quarter than in the previous quarter, when 94% of markets saw double-digit increases. There were three metro areas that saw 30% or more increases from one year ago -- Austin and Round Rock, Texas were up 33.5%; Naples, Immokalee and Marco Island, Florida, rose 32%; and Boise City and Nampa, Idaho, climbed 31.5%.

Home Prices Still Rose In The First Quarter

In the early months of 2021, home prices grew by nearly 20% compared to last year—rising to a national median of $300,000–400,000!4 Sellers, this should put a big smile on your face! And hang tight, buyers—we have some advice for you too.

Mortgage Interest Rates Are Still Super Low

The average mortgage interest rate (that fee lenders charge as a percentage of your loan amount) has been nice and low lately. In fact, the average rate for a 15-year fixed-rate mortgage dropped to 2.2% in January 2021—the lowest it’s been since Freddie Mac started reporting nearly 30 years ago!5 And now economist geeks think interest rates will continue to hover around 3% in 2021, which is still pretty low, ramseysolutions reported.

Online Real Estate Services Are Growing

No doubt you’ve heard of real estate services like Zillow that allow you to browse or list homes for sale online with the click of a button. But did you know that online services are now offering to buy and sell your house for you?

The pandemic’s lopsided impact on real estate

According to PWC, Even though the pandemic has spared no state or city, its impact on US property markets and sectors now diverges in ways significantly different than in the last recovery. That divergence means that some sectors, like industrial properties, have barely paused because a surge in online spending spurred tenant demand. The same is true for multifamily properties, with tenant demand still increasing and rents back to record levels throughout much of the country.

Despite this surge, the pandemic accelerated the retail property sector’s long slide, with store closings and vacancies rising. The only exceptions are grocery-anchored centers, dollar stores and home improvement retailers, all of which are thriving. The office sector is, unsurprisingly, in the midst of a major reset—with vastly different outcomes based on location and whether a building has flexible layouts and better ventilation systems. Even so, vacancies are likely to keep rising.

Vacation travel is recovering, with hotels within an easy driving range of population centers appearing set to reap some of the greatest benefits. But business and international travel may not return to pre-COVID-19 levels for years. That would take a toll on hotels, luxury retailing and upscale dining that’s often fueled by company expense accounts.

The pandemic magnified an ongoing shift away from expensive downtown markets and toward smaller, more affordable ones. As a result, businesses need to stay nimble. Uncertainty can be a curse, or an opportunity.

READ MORE: Top 10 Most Expensive Zip Codes In America: Home Price Skyrocketed

Prediction for Real Estate Market In 2022: Crash or Boom Next?

|

| Photo Mashvisor |

Housing demand and demographics

Ask Rick Sharga, executive vice president for RealtyTrac, and he’ll tell you that the housing market should continue its strong performance through 2022.

“Demand will continue to be driven by low mortgage rates and demographics. Consider that the largest cohort of millennials is approaching prime age for first-time homeownership,” he says.

“The pandemic has also contributed to the recent boom in home buying, in part due to the ability many employees now have to work from home and to health concerns, which encourages city dwellers — mostly renters — to look for more spacious residences in areas with lower population density.”

Potential for improvement

Paul Buege, president and COO of Inlanta Mortgage, also thinks the market will remain strong. But he foresees prices and demand cooling off at least a little in 2022.

“Positive indicators are hinting to a more favorable housing market in 2022. The heated pace of sales is beginning to show signs of moderation, and this is helping to increase the number of homes for purchase,” says Buege.

“With more homes on the market, prices should begin to moderate. This suggests that the balance between sellers and buyers will shift toward a more normalized market next year.”

Why home prices may not rise as much in 2022

The Federal Reserve has indicated its intent to raise interest rates and pull back on its financial support of the bond and financial markets. Initial predictions were to start tapering support and incrementally increase rates to combat inflation in 2022, but now experts are predicting rates won't rise until 2023, or at the soonest, the end of 2022.

Rate increases matter because they mean borrowing money to purchase things like homes will be more expensive, and that could mean fewer homeowners and prospective buyers will move into the marketplace. The longer the Fed waits to do this, the more likely it is to see home prices increase at comparable rates to 2021.

Supply chain issues will also directly affect home prices because they impact housing deliveries by slowing the number of homes being built and delivered to the market. The longer it takes to rectify the current product and labor shortages because of supply chain issues, the more likely home prices will remain elevated.

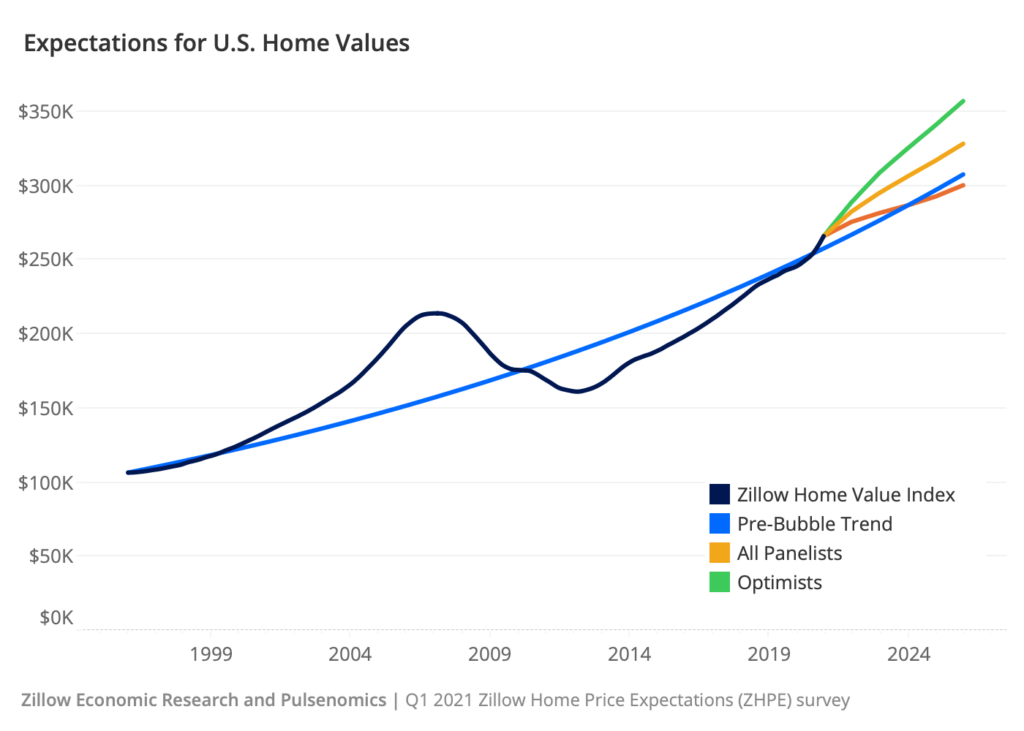

| There are also still 1.2 million loans in forbearance as of September 2021, according to Black Knight, which are expected to expire by year's end. The exit outcome, or how the borrowers choose to address the accrued amount due, can also impact home prices. If borrowers choose to sell their homes or the home ends up in foreclosure, it could increase supply, slowing the rate at which prices increase in those markets. Zillow, the largest online residential real estate listing platform in the world, shared its predictions for home values in 2022, indicating there will be continued growth but at a much slower pace, of around 11.7% from August 2021 to August 2022. The company doubled down on its theory for a slowing housing market by pulling out of its iBuying business after reporting an expected $500 million loss from the inability to sell its current inventory at higher prices in 2022. |

Fannie Mae recently predicted a housing price increase of 7.4% for the coming year, while Goldman Sachs predicts over double that, estimating a 16% home price increase in 2022. CoreLogic, on the other hand, is estimating a sluggish 1.9% year-over-year increase from September 2021 to September 2022. There are even contrarians out there who believe the market isn't in a shortage, but is, in fact, oversupplied, putting real estate values at risk for a correction in 2022.

Many of the cities NAR mentions are undersupplied and still recovering from an exodus after the pandemic. New York, for example, saw its residents flee in droves in search of more affordable housing and space. While demand is slowly returning to NYC, occupancy levels for the five boroughs still haven't returned to stabilized levels, indicating there is sufficient supply based on current demand.

Home price predictions for 2022

|

| Photo Forbes |

According to CoreLogic, prices increased by more than 18% between August 2020 and August 2021.

This was “the largest annual gain in home prices in the 45-year history of the CoreLogic Home Price Index” — and it came right on the heels of large year-over-year increases in July and June.

Unfortunately, home values aren’t likely to stop rising or start falling any time soon.

But the good news is, home prices gains might slow down, which could take some of the pressure off prospective buyers.

| Home price gains could slow to around 5% “I expect home prices to continue to rise, primarily due to limited supply. However, price increases will moderate next year to accommodate household affordability,” says Albert Lord, founder and CEO of Lexerd Capital Management. He notes that the national median listing price in August was $380,000 — 16% higher than in 2020. “For 2022, I predict an increase in home prices by 5%,” says Lord. |

| High demand means price trends won’t reverse Nik Shah, CEO of Home.LLC, anticipates home price appreciation cooling slightly next year. “Nevertheless, we expect prices to continue increasing in 2022, fueled by millennial demand, low interest rates, and low housing inventory levels,” Shah continues. Sharga points out that the work-from-home movement may continue to enable people to move from more expensive markets to smaller, less expensive areas, which would dramatically inflate prices in some of the smaller markets. |

Market Trend Predictions (Forecasted by 15 members of Forbes Biz Council)

|

| Photo KnowInsiders |

Natural Disasters

Natural disasters will change the desirability and pricing of real estate. For example, the California wildfires have resulted in home fire insurance rates skyrocketing near forests that have flammable trees such as the eucalyptus tree. In the meantime, I expect the increasingly dire hurricanes and storms in Texas, Florida and Louisiana to hurt neighborhoods that tend to be consistently impacted by them - Deniz Kahramaner, Altasa

More Smart Homes

We are going to see more adoption of smart home technology and self-showings, and we will continue to see more investors embrace 3D virtual tours. I think 3D is just scratching the surface in the single-family rental industry, and in five years, every property will have a 3D tour that will be used for both operations and marketing purposes. - Kori Covrigaru, PlanOmatic

More Property Tech Innovations

Property tech will transform the industry such that various processes will utilize digital services. It will create efficiencies to allow professionals to focus solely on the interpersonal aspect of the business. At the end of the day, it is a relationship business and while technology will advance to ease transactions, it can never take away personal connections. Focus on those quality connections. - Pam Scamardo, TPK Properties LLC

Virtual Tours Focused On Visuals

Per the National Association of Realtors' recent survey, millennials made up 38% of U.S. homebuyers in 2020. Most of these buyers toured properties they selected online, and nine out of 10 credited photos as the determining factor. For your listings, invest in high-quality photography, virtual tours and short films of the neighborhood to provide buyers with a true sense of where they will be living. - Tara Hotchkis, Compass.

Cash-Only Deals

Investment companies are increasingly approaching sellers with attractive cash-only deals. Over the coming years, this will result in a massive loss of transactions for agents. If you can't beat them, join them. Ask yourself how you can partner with these companies—for example, by serving as a seller's agent when these properties go back on the market. Or just get into the investment business. - Kevin Markarian, Marker Real Estate

Higher Customer Service Expectations

As residents and tenants expect the same strong customer experience they get from delivery apps and other online platforms from the places they work and live, operators that deliver on those expectations will be set apart. Multifamily and commercial real estate is increasingly becoming a customer-centric business and technology like tenant experience platforms increasingly will become the norm.

How Do Real Estate Agents Get Paid? How Do Real Estate Agents Get Paid? Do you want to become a real estate agent and wonder how much they earn and how they get paid? |

Who Is A Real Estate Agent? Who Is A Real Estate Agent? Who is a real estate agent? And why should you become a real estate agent? |

Top 5 States Where Home Prices Rose The Most In The US Top 5 States Where Home Prices Rose The Most In The US Home prices rose in many US states. What states had the higehst rate of home price increase? |