Top 9 Biggest Hedge Funds in the US Today

| Table of Contents |

Different hedge funds use different investment techniques. Some hedge funds serve as activists, urging corporations to change their strategies in order to unlock value. Other hedge funds are more value-oriented, purchasing deep value stocks. Other hedge funds will attempt to apply an algorithmic approach to trading, developing highly sophisticated computer models that advise them when to purchase and sell specific equities. Because many hedge funds hedge their investments, they may not always outperform the market because they assume less risk.

|

| Top 9 Biggest Hedge Funds in the US Today |

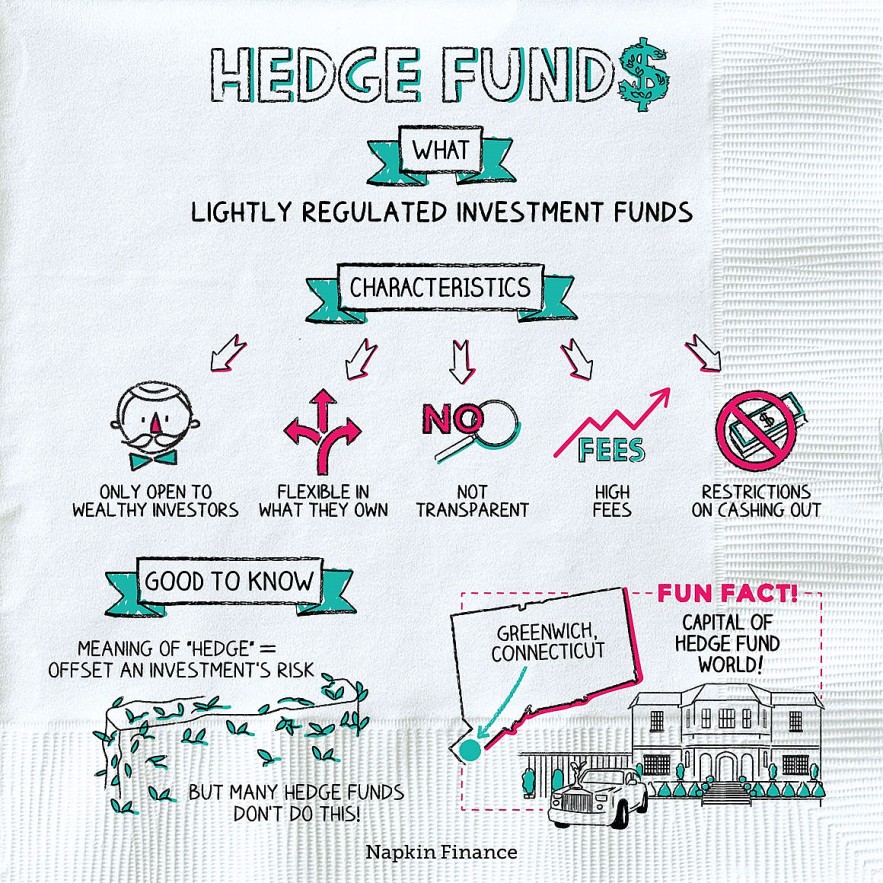

What is a headge fund?

A hedge fund is a limited partnership of private investors whose assets are pooled and managed by professional fund managers. To achieve above-average investment returns, these managers employ a variety of tactics, including leverage (borrowed money) and trading non-traditional assets.

Types of Hedge Funds

|

The four most prevalent hedge fund types are:

Global macro hedge funds are actively managed funds that seek to profit from large market movements induced by political or economic events.

Equity hedge funds: These can be global or country-specific, and they invest in profitable stocks while hedging against equity market downturns by shorting overvalued firms or indices.

Relative value hedge funds seek to profit on short-term price or spread disparities across linked securities.

Activist hedge funds invest in firms and pursue activities to increase stock prices, such as asking that corporations decrease costs, restructure assets, or alter their board of directors.

Hedge Fund vs Mutual Fund

The Securities and Exchange Commission (SEC) does not supervise hedge funds as tightly as it does mutual funds.

Mutual funds are a practical and cost-effective approach to develop a diverse portfolio of stocks, bonds, and short-term assets. They are available to both the general public and the typical investor.

Hedge funds typically only accept money from accredited investors, which are persons with an annual income of more than $200,000 or a net worth greater than $1 million, excluding their primary property. These investors are deemed qualified to bear the potential risks that hedge funds are permitted to accept.

A hedge fund can invest in land, real estate, stocks, derivatives, and currencies, whereas mutual funds employ stocks or bonds as its long-term investment vehicles.

Unlike mutual funds, which allow investors to sell shares at any time, hedge funds often limit redemption chances and often impose a one-year lock period before shares can be paid in.

Top 9 Biggest Headge Funds in the US (2024 Report)

|

1. Bridgewater Associates

Assets under management (AUM): $124,317,200,000

Bridgewater Associates, LP is the world's largest hedge fund, with $150 billion of assets under management. Given its scale, Bridgewater Associates, LP trades stocks, commodities, interest rates, sovereign and corporate credit, and developed market currencies.

The company, headquartered in Westport, Connecticut, offers an investment approach that is "driven by a tireless pursuit to understand how the world's markets and economies work — using cutting-edge technology to validate and execute on timeless and universal investment principles."

2. Renaissance Technologies

AUM: $106,026,795,439

Billionaire Renaissance Technologies LLC, run by Jim Simons, is a major quantitative hedge fund based in New York that uses complex quantitative models to determine what to purchase and sell. Medallion Fund, Renaissance Technologies LLC's flagship fund, is also among the best-performing in history. Unfortunately, the Medallion Fund only accepts current and past employees.

Some of Renaissance Technologies LLC's other funds have not performed as well, with Renaissance Institutional Equities Fund down roughly 20% in 2020. Like other quant funds, Renaissance Technologies LLC employs numerous people with advanced degrees from non-financial backgrounds. According to SWFI, Renaissance Technologies LLC oversees $121.8 billion.

3. AQR Capital Management

AUM: $94,523,700,000

AQR Capital Management is a Connecticut-based investment firm with over 1,000 people and offices in Boston, Chicago, Los Angeles, Bangalore, Hong Kong, London, Sydney, and Tokyo. In general, AQR's investments drive quantitative analysis, as well as the expected values and speeds used to develop financial models that are eventually published in financial markets.

The financial corporation established in Greenwich, Connecticut, maintains a focus in education and is well-known for its academic personnel, with at least half of its employees holding PhDs. In 2014, the business and the London Business School co-founded the AQR Asset Management Institute. The program mostly teaches critical investment skills. AQR Capital Management's largest stock holding is Apple Inc., with 16,476,321 shares.

4. Two sigma

AUM: $67,471,220,893

Two Sigma Investments is a leading quantitative fund headquartered in New York City. The fund differs from many other standard hedge funds in that 60% of its workers are from non-financial backgrounds. Nevertheless, more than 600 of the fund's 1600 staff hold graduate degrees. According to SWFI, Two Sigma Investments has $74.4 billion in assets under management.

READ MORE: Who Are The Crypto Speculators - Not Investors?

5. Millennium Management

AUM: $57,670,000,000

Millennium Management, founded in 1989, today employs almost 2,600 people and provides services throughout North America, Europe, and Asia. There are 200 investment teams that provide volunteer assistance for private enterprises, industrial sectors, asset classes, and regions. Israel Englander, based in New York, is the founder and one of the finest hedge fund managers, earning $3.8 billion in 2020, more than any other hedge fund manager the following year.

6. Citadel

AUM: $51,573,787,000

Citadel LLC, a Chicago-based international institutional investor, was created in 1990 and specializes in stocks, fixed income, commodities, credit, and quantitative methods. Surprisingly, Kenneth Griffin, a 19-year-old Harvard student, launched this firm. As a sophomore, he began trading convertible bonds, and his net worth is now 16 billion dollars. Today, the company employs 1,400 people and has offices in North America, Europe, and Asia, offering diversification from traditional stock markets.

7. Tiger Global Management

AUM: $51,000,000,000

Tiger worldwide Management LLC is a New York-based fund that invests in public and private firms in the worldwide internet, software, consumer, and financial technology sectors. Tiger Global Management LLC has grown into a tech behemoth over the years, owning investments in a number of major technology businesses in both public and private markets, including ByteDance. Despite the fact that several IT stocks have declined significantly this year, Tiger Global Management LLC's

8. D. E. Shaw

AUM: $45,772,700,000

D.E. Shaw & Co., founded in 1988 by David E. Shaw, is an institutional investor that use advanced mathematical models and computer algorithms to determine when market anomalies arise and when they should be reported. It employs a combination of quantitative and qualitative approaches to identify independent and seldom discovered sources of return across global financial markets or public and private companies. The company employs 1,400 people. Since its inception, it has continuously produced the world's fifth-highest return on investment.

READ MORE: 10 Most Attractive Cities For Investment In The World

9. Coatue Management

AUM: $42,338,946,229

Coatue Capital, L.L.C. is a New York-based fund that invests in both public and private equity markets. Coatue Capital, L.L.C. focuses on technology and invests in both early and late stage ventures. As of September 2022, Coatue Capital, L.L.C. has a 23-year track record and $24 billion in private investments, with an active private portfolio that includes over 200 innovative startups. According to SWFI, the fund's assets are $73.3 billion.

Conclusion

Hedge fund investing is seen as a dangerous alternative investment option, requiring investors to make a significant minimum commitment or have a high net worth. Hedge fund strategies typically include investments in debt and equity securities, commodities, currencies, derivatives, and real estate.

Can Foreigners Purchase Or Invest In The Australian Stock Exchange?? Can Foreigners Purchase Or Invest In The Australian Stock Exchange?? How do overseas residents buy (invest in) stocks in Australia? Continue reading to learn the guidelines and tips for foreigners investing in stocks in Australia! |

What was Warren Buffett's Biggest Investment Mistake? What was Warren Buffett's Biggest Investment Mistake? One of the worst decisions of Warren Buffett's career, according to him, was the purchase of the shoe manufacturer Dexter Shoe. Additionally, Buffett foresaw that ... |

3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text) 3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text) Warren Buffett is one of the world's most successful investors. Investors consistently notice and appreciate the advice he provides to Berkshire Hathaway shareholders in his ... |