Top 12 Most Outrageous Ponzi Schemes in the World of All Time

| Table of Contents |

A Ponzi Scheme: What Is It?

An investment scam known as a "Ponzi scheme" uses funds taken from later investors to compensate early investors in order to provide the impression of large gains. An investor in a Ponzi scheme is promised a high rate of return with low risk. It depends on word-of-mouth since new investors learn about the substantial returns that early investors obtained. When fresh funding stops coming in, the plan will inevitably come to an end because it can't pay out the claimed gains.

Both a Ponzi scheme and a pyramid scheme employ the money of new investors to settle debts owed by previous backers. A pyramid scheme breaks down when the pool of possible members shrinks and often depends on compensating early participants to attract more participants.

|

| Most Outrageous Ponzi Schemes in the World |

Quick Facts: Ponzi Scheme• In order to give the impression of profit, the Ponzi scheme depends on an increasing number of new investors. • A portion of the fresh funds are used to reimburse previous investors, giving the fraud an air of legitimacy and great profitability. • The person running the fraud keeps the most of the money for themselves. • When the flow of new investors slows down and the promised returns vanish, the scam falls apart. |

What Constitutes a Ponzi Scheme Example?

Adam lends his friend Barry $1,000 with the promise of a 10% return. Barry offers Adam $1,000 with the understanding that he will get $1,100 back after a year. Next, Adam gives his friend Christine a 10% return guarantee. Adam receives $2,000 from Christine.

Now that he has $3,000, Adam gives Barry his $1,100. With the hope that he may convince someone else to give him money before Christine's money is due back, he spends the remaining funds.

But the most successful Ponzi schemes depend on long-term investment. Adam will only have to pay Barry and Christine the interest he has promised on a monthly basis if he can convince them to allow him to keep investing their money. He knows that new investors will provide enough money to keep the hoax going, so he can spend the remainder.

Top 12 Most Outrageous Ponzi Schemes In History

1. Charles Ponzi

|

| Charles Ponzi: Creator of the Ponzi Scheme |

It is accurate to say that Charles invented the Ponzi scam. It has to have a good justification for being named after him, after all. That does not, however, imply that he was the first; William "520 Percent" Miller, Johann Baptist Placht, Sarah Howe, and Jacob Young all achieved it before him. Among these like-minded people, Charles Ponzi stood out for how swiftly he amassed wealth.

Italian businessman Charles Ponzi sought to profit from a possible pricing arbitrage opportunity in stamps that could be traded between Italy and the United States but were 400% less expensive in Italy as a result of post-World War I inflation.

Do Ponzi Schemes Break the Law?It is unlawful to run a Ponzi scheme for two basic reasons. The first explanation is that the offender is tricking investors into supporting a project that isn't really happening. In other words, it serves only as the main hub for the fraud and offers no products or services. The second reason is that in order to avoid being discovered, the criminal must make their fictitious business appear genuine. This typically entails fabricating and forging paperwork that companies have to turn in to the authorities. And that is unquestionably illegal. |

Who Is Charles Ponzi?

Charles Ponzi, born in 1882, is recognized as an Italian scammer and con man during the early 1920s. He operated his money-making operations in both the US and Canada. Ponzi would guarantee investors that they would receive a 50% profit back in 45 days if they put their money with him.

Ponzi's money-making schemes continued for years before coming to an end. He ultimately caused investors to lose tens of millions of dollars.

2. Tom Petters

|

| Tom Petters - The Rise And Fall Of A Ponzi Kingpin |

"Minnesotans should be reminded that our state is home to thousands of business owners who uphold moral principles, give liberally to charitable causes, serve as genuine role models for other entrepreneurs, behave ethically when managing their investments, and create excellent jobs." Tom Petters is not among them.

That statement comes from the court who found Tom Petters guilty of cheating individuals out of literally billions of dollars and sentenced him to 50 years in federal prison.

How then did he succeed? To put it plainly, by lying nonstop for more than ten years and not seeming to care what would happen when the IRS discovered something was wrong. Not to mention, though we haven't said it explicitly, the reason the individuals were apprehended in nearly all of these cases was because the IRS used a microscope to find "irregularities" in their finances.

Something that typically occurs when you sell things that are blatantly fictitious, as Petters did. In particular, Petters would fabricate bogus orders for millions of dollars' worth of gadgets through his business Petters Group Worldwide, which he would then say were to be sold to big-box retailers like Costco or Walmart. Petters would then pledge these orders, which never existed, as security for loans. This is where the cunning part begins.

Using the same strategy, Petters would pay off previous loans with the proceeds from these ones, then apply for a larger loan to make even more purchases. After that, he would use that loan to settle the previous one, and so forth. Eventually, Petters was using this technique to casually ask banks for and receive actual billion-dollar loans.

| With the benefit of hindsight, of course, the swindle was clear, but how in the world were the banks supposed to know? Petters consistently exhibited official-looking documentation attesting to his billion-dollar purchases and sales of electronics, and he consistently repaid his loans with interest on schedule, occasionally ahead of schedule, and was always willing to pay the associated costs. He seemed like a sure thing to invest in. The only issue was that all of this information was only available on paper. |

3. Mutual Benefits Corporation

In the early 2000s, The Mutual Benefits Corporation was a life insurance provider in Florida. The business took in more than $800 million from investors after promising them great rates of return. But all of it was a Ponzi scheme. In addition to fabricating documents to give the impression that the money was being spent wisely, the company diverted funds from new investors to settle debts owed to previous ones.

The business failed in 2004, and individuals responsible entered guilty pleas to fraud charges. Joel Steinger, the mastermind of the scam, was among the more than a dozen individuals found guilty in this instance and received a 20-year prison sentence.

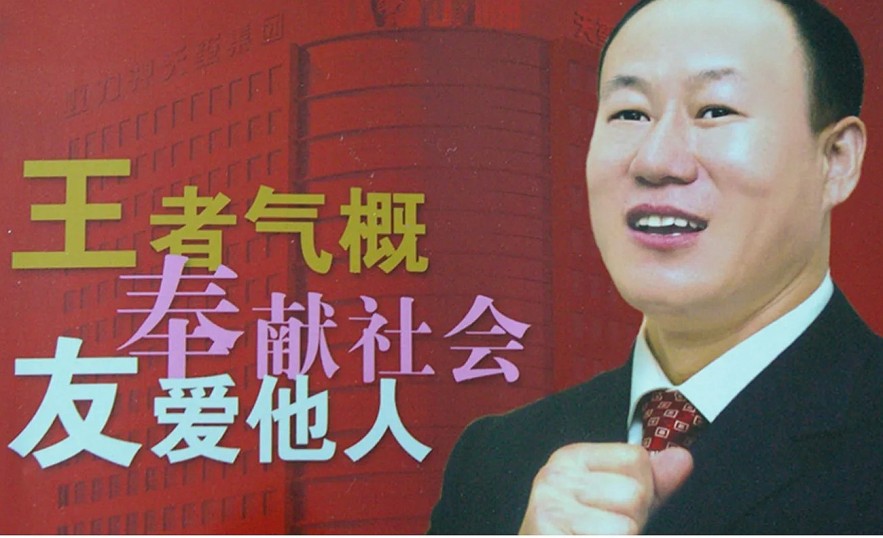

4. The Tianxi Yilishen Group

|

| A brochure for Wang Fengyou's investment ponzi scheme (Image credit: © Zhuang Pinghui/South China Morning Post via Getty Images) |

Between 1999 and 2007, the Yilishen Tianxi Group, a Chinese Ponzi scheme, defrauded investors of about $2 billion. Investing in traditional Chinese medicine derived from ants was the central theme of the scam. But that was only a front. But that was only a front. The company falsified paperwork to give the impression that they were profitable and utilized funds from new investors to settle debts owed to previous ones.

Following the revelation of the fraud in 2007, almost 200,000 individuals demonstrated outside the company's headquarters, alleging they had lost their life savings, and the company's leader was condemned to death. Yilishen Tianxi is said to have contributed to the suicide of several individuals.

5. Stanford, R. Allen

|

| Stanford, R. Allen |

The next in a long line of Ponzi schemers was Allen Stanford. He was found guilty in 2012 of conspiracy, fraud, and money laundering related to his $7 billion investment swindle. The certificates of deposit from Stanford International Bank, which asserted to be above suspicion due to its Caribbean location, were the center of the Florida-based fraud.

In actuality, the bank was a fraud, and Stanford paid off previous investors with funds from new ones. He is accused of lying regarding the security of up to 30,000 investors' money, including members of his family. He has been given a 110-year prison sentence.

6. Bitconnect

In January 2018, Bitconnect, a global cryptocurrency investment scheme, was closed. Before it was discovered to be a Ponzi scheme that had defrauded its investors, its market capitalization had reached $2.6 billion. After the developers paid back the original Bitcoin investors, the coin's value instantly fell from $500 to $1.

The top Bitconnect promoter in the country, Glen Arcaro, was charged with a crime by the US Department of Justice in October 2021. The allegations included conspiracy to commit wire fraud and criminal forfeiture. Arcaro entered a guilty plea.

7. Gerald Payne

Taking advantage of individuals is how a Ponzi scheme operates. However, very few experienced as many low points as Gerald Payne and his associates with Greater Ministries International.

They engaged in an affinity scam in which they perverted biblical teachings, using verses and delivering lectures to persuade churchgoers to donate millions of dollars in the hope that the money would be multiplied through a phony "double your blessings" scheme.

God's plan was interrupted when the IRS closed them down for questionable bank transactions. It was the biggest Ponzi fraud at the time, taking almost half a billion dollars from gullible churchgoers and using some of the proceeds to buy off church officials across the country

Gerald Payne received a life sentence ranging from 12 and a half to 27 years, along with the sentences of the other members of Payne's group.

8. Reed Slatkin

Mr. Slatkin is attributed to being a co-founder of Earthlink, an internet service provider that has existed since the 90s. But his criminal enterprise dates much longer into the mid-80s, where he masterminded a Ponzi scheme to the tune of half a billion dollars, mainly duping fellow Scientologists.

At a particular point, Slatkin paid nearly $300 million to early investors who had invested $128 million in his venture from money received from later investors, a classic Ponzi scheme.

This scheme was to go on no longer than 2001 when the Securities Exchange Commission (SEC) shut down his operations, issued a restraining order, and froze his assets. Some of his victims included actors Anne Archer, Giovanni Ribisi, and Joe Pantoliano and producers Armyan Bernstein and Art Linson.

On September 2, 2003, Slatkin was sentenced to 14 years in federal prison, having pled guilty to mail fraud, wire fraud, obstruction of justice, and money laundering.

9. The Swedish Match King

Ivar Kreuger was a tremendously successful businessman, but he also conned many people out of millions of dollars, therefore some would probably argue that he shouldn't be on this list. Which is somewhat how he handled the first situation.

As you can see, Krueger had a reputation for selling a lot of matches. Actually, almost all of them. According to some estimates, during the height of his power, Krueger's company, Swedish Match—a conglomerate of different match factories that he acquired after purchasing his own father's match factory in the early 20th century—was responsible for producing up to 75% of the matches used globally. Given this, it should come as no surprise that many began referring to Krueger as the Match King.

It seems sense that Krueger gained a great deal of wealth and power from this virtually complete, worldwide monopoly. He would use his influence to buy the ears of many influential people and his money to buy a plethora of respectable companies. It will eventually turn into the main component of Krueger's scam.

You see, Krueger would take the profits from his legal ventures and just sort of rearrange them, manipulating the balance sheets of struggling businesses to make them appear successful and using his title as King of Matches to persuade investors to put money into them.

One particularly clever (but twisted) aspect of Krueger's scam is that he would lend enormous sums of money to developing nations in exchange for the sole right to market matches there. After getting indebted to him, he would start acquiring more companies to expand his holdings and cover up his financial malfeasance.

He killed himself after learning the truth, leaving a troubled legacy and serving as a direct inspiration for the securities acts.

10. Mavrodi Mondial Moneybox

|

| Mavrodi financial pyramid scheme operates in Asia and India |

Recall our previous statement, "If something seems too good to be true, it probably is," and our discussion of how astronomically high returns on investment—like a 25% yield—should raise red flags for you right away and make it plain that something is a scam. That's right—people fell for Sergey Mavrodi's promise of a 3,000% return on their money. Just shut it all off now.

The main component of Mavrodi's strategy was a "aggressive" marketing effort targeted directly at Russian working-class people, promising the previously mentioned enormous returns in exchange for shares in MMM that could be exchanged for a full house. Since this was a Ponzi scheme, it didn't really matter what MMM did or didn't do. Yes, some people did become millionaires, which was fantastic for them but not so great for the millions of other people who fell for their exceptional good luck to get in while business was booming. Yes, we did just say millions at that point. This man defrauded that many people, which is why he was rightfully dubbed the Bernie Madoff of Russia. To give you a sense of the amount of money Mavrodi made, it was apparently necessary for Russian officials to deploy 17 vehicles in order to remove all of the cash he had stolen from his home.

The incident of Sergey Mavrodi is particularly perplexing because of the extreme insolence with which he handled himself. Upon being detained for tax evasion and fraud, he decided to run for office in the hopes of using his position to pardon himself backwards. He fled after this failed, naturally creating new Ponzi and pyramid schemes in the process.

After being apprehended, Mavrodi merely spent four years behind bars before returning to defrauding people nearly immediately. Aiming for the Third World, he conned African investors with a business proposal that reads like the textbook definition of a pyramid scam and a new company he also dubbed MMM (because, well, why not, at this point). assuring investors that the money they receive will come from the fees that new investors they persuade to join will pay. Put in that scene from The Office where Jim is sketching a triangle on a whiteboard.

Eventually, Mavrodi had his heart attack and passed away in 2018. He was a fraudulent guy through and through, and investors in his bitcoin firm in Africa supposedly paid for his funeral. Naturally, this individual became interested in cryptocurrency as well.

11. Scott Rothstein

|

| The most infamous financial scams in history |

Ponzi schemes are primarily focused on one goal: generating money. However, for other people, the money—while certainly a welcome bonus—is not as important as what it allows them to purchase. Reputation, authority, and peer regard. This appears to be the motivation behind Florida-based attorney Scott Rothstein's scheme to con people out of more than $1 billion.

He also purchased a lot of other items, such as a collection of cars that he kept in a separate, air-conditioned garage and gold-plated toilets for him and his spouse. You see, he's romantic in that way. However, he appeared to truly enjoy the notoriety that his illicit wealth bestowed upon him.

With the money he got from selling litigation investments—which seems like the most American thing ever—Rothstein funded local events in Florida, funded politicians, and made large charitable donations. His profile increased significantly as a result of all of these things, enabling him to socialize with the wealthiest people and interact with famous people like Kevin Spacey, Chris Tucker, and Arnold Schwarzenegger.

Here's a not-so-fun truth for you guys, though: if the IRS finds out that you donated money that you gained illegally to a charity, the charity is kind of required to return the funds. That's what happened when Rothstein was discovered; a million-dollar donation he had made to feed his own ego had to be returned to the Fort Lauderdale Holy Cross Hospital.

You might be pleased to hear that Rothstein has been serving a 50-year sentence for several offenses, including fraud, since 2010.

12. Bernard “Bernie” Madoff

The same Bernie Madoff from the film "Wizard of Lies," as the name suggests, stole around $65 billion from investors.

Yes, you read correctly: this is the biggest Ponzi scheme ever, with actors like Kevin Bacon and Steven Spielberg among the celebrities it has defrauded, along with major baseball star Sandy Koufax. Additionally, banks including the Royal Bank of Scotland, HSBC Holdings, and Japan's Nomura Holdings were scammed by Bernie's organization.

In Brief

The top 12 well-known Ponzi schemes worldwide have been identified. Naturally, we're not encouraging anyone to invest their money in any of these ventures, but it's crucial to understand why this specific grift is so widespread even if its name is widely used in everyday speech.

Wise Investment Tips for Each Zodiac Sign in 2024 - Yearly Finance Horoscope Wise Investment Tips for Each Zodiac Sign in 2024 - Yearly Finance Horoscope Investment Tips: The yearly horoscope for finance and business in 2024 helps you find the most suitable and luckiest way to invest successfully. |

10+ Most Famous Sites To Make Money Without Investment 10+ Most Famous Sites To Make Money Without Investment Want to earn money online without making huge investment? Thos sites are available to help you! Check out Top 10+ Most Famous Sites To Make ... |

3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text) 3 Investment Lessons From 2024 Warren Buffett's Letter to Shareholders (And Full Text) Warren Buffett is one of the world's most successful investors. Investors consistently notice and appreciate the advice he provides to Berkshire Hathaway shareholders in his ... |