Top 10 Richest People Living In New York

|

| Top 10 Richest People In New York |

Have you ever wondered who the richest people in New York are? The Forbes 400 of 2021 list gives a ranking of the wealthiest people in the U.S.

Out of the 400 people on the list, over 60 are from New York. Forbes said these wealthy Americans saw their collective fortune increase 40% over the last year to $4.5 trillion.

Here are the 10 richest people in New York.

List of top 10 richest people living in New York City

1. Michael Bloomberg

2. Julia Koch and family

3. Stephen Schwarzman

4. Leonard Lauder

5. Jim Simons

6. Rupert Murdoch and family

7. Donald Newhouse

8. Israel Englander

9. Chase Coleman, III

10. Leon Black

Who are the richest people in New York?

1. Michael Bloomberg

|

| Photo: Bloomberg |

Net worth: 82 billion USD

Michael Rubens Bloomberg (born February 14, 1942) is an American businessman, politician, philanthropist, and author. He is the majority owner, co-founder and CEO of Bloomberg L.P. He was the mayor of New York City from 2002 to 2013, and was a candidate for the 2020 Democratic nomination for president of the United States.

Bloomberg grew up in Medford, Massachusetts, and graduated from Johns Hopkins University and Harvard Business School. He began his career at the securities brokerage Salomon Brothers before forming his own company in 1981. That company, Bloomberg L.P., is a financial information, software and media firm that is known for its Bloomberg Terminal. Bloomberg spent the next twenty years as its chairman and CEO. As of March 2022, Forbes ranked him as the sixteenth-richest person in the world, with an estimated net worth of $70 billion and ranked 14th in Forbes 400 with net worth $55 billion. Since signing The Giving Pledge, Bloomberg has given away $8.2 billion to philanthropic causes.

Bloomberg was elected the 108th mayor of New York City. First elected in 2001, he held office for three consecutive terms, winning re-election in 2005 and 2009. Pursuing socially liberal and fiscally moderate policies, Bloomberg developed a technocratic managerial style.

As mayor of New York, Bloomberg established public charter schools, rebuilt urban infrastructure, and supported gun control, public health initiatives, and environmental protections. He also led a rezoning of large areas of the city, which facilitated massive and widespread new commercial and residential construction after the September 11 attacks. Bloomberg is considered to have had far-reaching influence on the politics, business sector, and culture of New York City during his three terms as mayor. He has also faced significant criticism for his expansion of the city's stop and frisk program, support for which he reversed with an apology before his 2020 presidential run.

After a brief stint as a full-time philanthropist, he re-assumed the position of CEO at Bloomberg L.P. by the end of 2014. In November 2019, Bloomberg officially launched his campaign for the Democratic nomination for president of the United States in the 2020 election. He ended his campaign in March 2020, after having won only 61 delegates. Bloomberg self-funded $935 million for his candidacy, which set the record for the most expensive U.S. presidential primary campaign.

In February 2022, Bloomberg was nominated to chair the Defense Innovation Board.

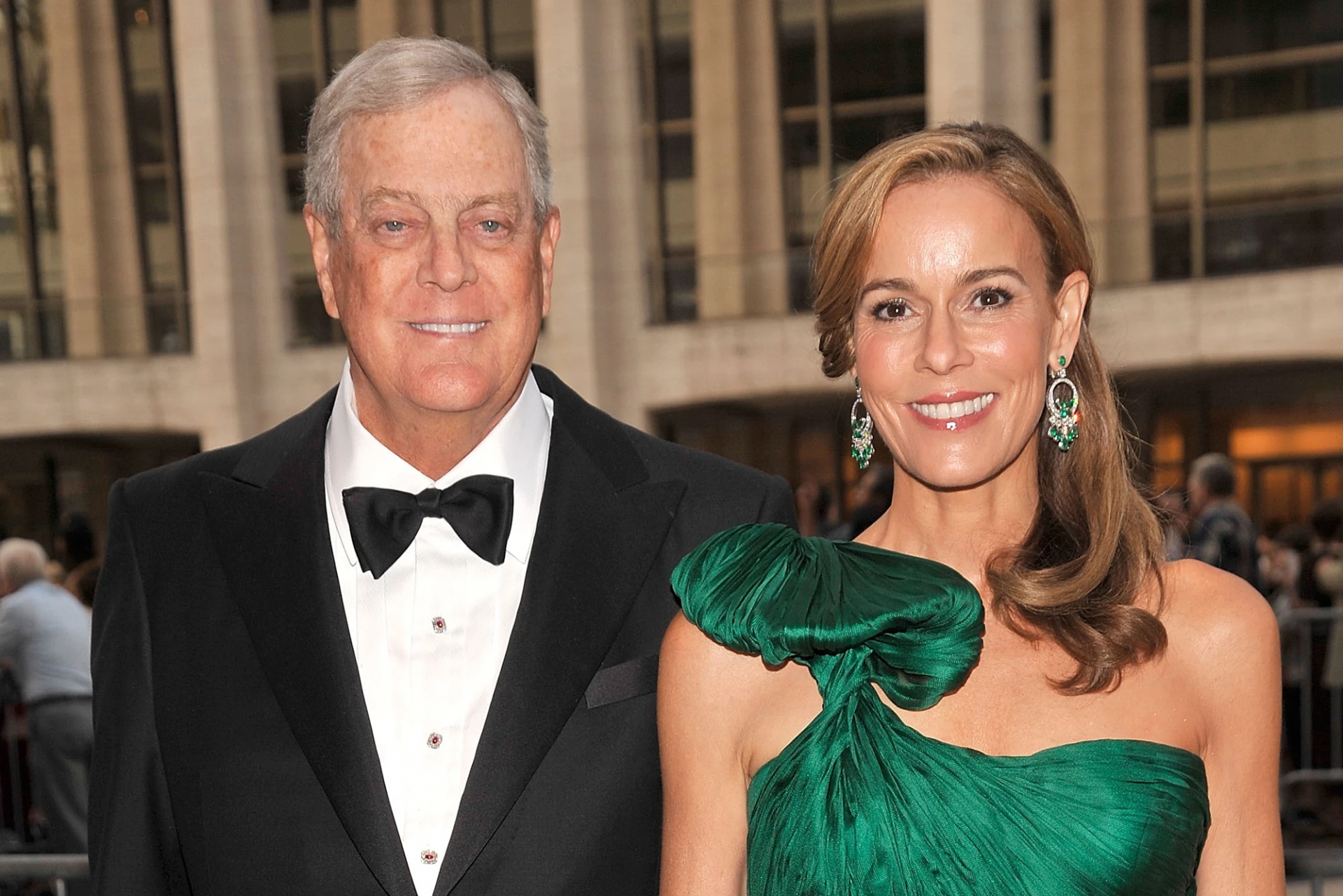

2. Julia Koch and family

|

| Photo: Forbes |

Net worth: 61.5 billion USD

Julia Margaret Flesher Koch (born April 12, 1962) is an American socialite, billionaire, philanthropist, and one of the richest women in the world. She inherited her fortune from her husband, David Koch, who died in 2019. As of January 2020, Forbes estimates her and her family's net worth at $43 billion, while Bloomberg estimates it at $61.6 billion.

Julia Margaret Flesher was born on April 12, 1962. Her family came from a farming background, but when she was born her parents, Margaret and Frederic Flesher, had a furniture store called Flesher's. She spent her early childhood in Indianola, Iowa, but when she was eight years old she moved to Arkansas, where her parents started a clothing store called Peggy Frederic's, which she considered "a beautiful, beautiful shop". By 1998, her mother still lived in Conway but her father had moved back to Indianola.

After graduating from the University of Central Arkansas and working as a model, in 1984 Flesher moved to New York City, where she worked as fashion designer Adolfo's assistant and did fittings for Nancy Reagan.

She met David Koch on a blind date in January 1991, but the date did not leave her with a good impression. She later described her reaction: "I'm glad I met that man because now I know I never want to go out with him". However, the two met again at a party later that year and started dating. She stopped working in 1993, and they got married in May 1996 at David Koch's house on Meadow Lane in Southampton.

In December 1997, she made what the New York Times called her "New York society debut" at the Met Gala. She was co-chairwoman of the gala that year, along with Anna Wintour and Patrick McCarthy. McCarthy said she was "one of those people who occur in New York every few years...she's beautiful, she loves fashion, she knows how to entertain, she's married to an extraordinarily rich man."

Julia and David Koch spent years living in an apartment at 1040 Fifth Avenue, but in 2004 they moved to an 18-room duplex at 740 Park Avenue. According to 740 Park: The Story of the World's Richest Apartment Building, David Koch bought the apartment for about $17 million from the Japanese government, which previously used it to house their permanent representative to the United Nations. In 2018, the couple also bought an eight-bedroom townhouse in Manhattan from investor Joseph Chetrit for $40.25 million.

David Koch died in August 2019, and Julia Koch and their three children (David Jr., Mary Julia, and John Mark) inherited 42% of Koch Industries. As a result, she was listed by Bloomberg as the richest woman in the world and was included on Forbes' list of the 10 richest women in the world in 2020.

In 2022, Koch put the apartment at 740 Park Avenue on the market; a spokesperson said that she wanted to sell it because she was spending more time at houses in Southampton and Palm Beach.

Koch is on the board of directors of Koch Industries. She tends not to seek public attention.

Who is Kathy Hochul – New York’s First Female Governor: Biography, Personal Life, Net Worth

3. Stephen Schwarzman

|

| Photo: Forbes |

Net worth: 36.4 billion USD

Stephen A. Schwarzman is Chairman, CEO and Co-Founder of Blackstone, one of the world’s leading investment firms with $881 billion Assets Under Management (as of December 31, 2021). Mr. Schwarzman has been involved in all phases of Blackstone’s development since its founding in 1985. The firm has established leading investing businesses across asset classes, including private equity, where it is a global leader in traditional buyout, growth equity, special situations and secondary investing; real estate, where it is currently the largest owner of property in the world; hedge fund solutions, where it is the world’s largest discretionary hedge fund investor; and credit, where it is a global leader and major provider of credit for small, middle-market and other companies. Blackstone has also recently launched major new businesses dedicated to infrastructure and life sciences investing, as well as delivering the firm’s investment management expertise and products to insurance companies.

Mr. Schwarzman is an active philanthropist with a history of supporting education, as well as culture and the arts, among other things. In 2020, he signed The Giving Pledge, committing to give the majority of his wealth to philanthropic causes. In both business and philanthropy, Mr. Schwarzman has dedicated himself to tackling big problems with transformative solutions. In June 2019, he donated £150 million to the University of Oxford to help redefine the study of the humanities for the 21st century. His gift – the largest single donation to Oxford since the renaissance – will create a new Centre for the Humanities which unites all humanities faculties under one roof for the first time in Oxford’s history, and will offer new performing arts and exhibition venues as well as a new Institute for Ethics in AI. In October 2018, he announced a foundational $350 million gift to establish the MIT Schwarzman College of Computing, an interdisciplinary hub which will reorient MIT to address the opportunities and challenges presented by the rise of artificial intelligence, including critical ethical and policy considerations to ensure that the technologies are employed for the common good. In 2015, Mr. Schwarzman donated $150 million to Yale University to establish the Schwarzman Center, a first-of-its-kind campus center in Yale’s historic “Commons” building, and also gave a founding gift of $40 million to the Inner-City Scholarship Fund, which provides tuition assistance to underprivileged children attending Catholic schools in the Archdiocese of New York. In 2013, he founded an international scholarship program, “Schwarzman Scholars,” at Tsinghua University in Beijing to educate future leaders about China. At over $575 million, the program is modeled on the Rhodes Scholarship and is the single largest philanthropic effort in China’s history coming largely from international donors. Mr. Schwarzman is Co-Chair of the Board of Trustees of Schwarzman Scholars. In 2007, Mr. Schwarzman donated $100 million to the New York Public Library on whose board he serves.

In 2019, Schwarzman published his first book What It Takes: Lessons in the Pursuit of Excellence, a New York Times Best Seller which draws from his experiences in business, philanthropy and public service.

Mr. Schwarzman is a member of The Council on Foreign Relations, The Business Council, The Business Roundtable, and The International Business Council of the World Economic Forum. He is a former co-chair of the Partnership for New York City and serves on the boards of The Asia Society and New York-Presbyterian Hospital, as well as on The Advisory Board of the School of Economics and Management at Tsinghua University, Beijing. He is a Trustee of The Frick Collection in New York City and Chairman Emeritus of the Board of Directors of The John F. Kennedy Center for the Performing Arts. In 2007, Mr. Schwarzman was included in TIME’s “100 Most Influential People.” In 2016, he topped Forbes Magazine’s list of the most influential people in finance and in 2018 was ranked in the Top 50 on Forbes’ list of the “World’s Most Powerful People.” The Republic of France has awarded Mr. Schwarzman both the Légion d'Honneur and the Ordre des Arts et des Letters at the Commandeur level. Mr. Schwarzman is one of the only Americans to receive both awards recognizing significant contributions to France. He was also awarded the Order of the Aztec Eagle, Mexico’s highest honor for foreigners, for his work on behalf of the U.S. in support of the U.S.-Mexico-Canada Agreement in 2018.

Mr. Schwarzman holds a B.A. from Yale University and an M.B.A. from Harvard Business School. He has served as an adjunct professor at the Yale School of Management and on the Harvard Business School Board of Dean’s Advisors.

4. Leonard Lauder

|

| Photo: The New York Times |

Net worth: 24 billion USD

Leonard Alan Lauder (born 19 March 1933) is an American billionaire, philanthropist, art collector. He and his brother, Ronald Lauder, are the sole heirs to the Estée Lauder Companies cosmetics fortune, founded by their parents, Estée Lauder and Joseph Lauder, in 1946. Having been its CEO until 1999, Lauder is the chairman emeritus of The Estée Lauder Companies Inc. During his tenure as the CEO, the company went public at The New York Stock Exchange in 1996 and acquired several major cosmetics brands, including MAC Cosmetics, Aveda, Bobbi Brown, and La Mer.

In 2013, Lauder promised his collection of Cubist art to The Metropolitan Museum of Art. The collection is valued at over $1 billion and constitutes one of the largest gifts in the museum's history.

Bloomberg Billionaires Index reported that Lauder's net worth has been estimated to be USD$32.3 billion as of September 2021 making him 44th richest person in the world.

Lauder is a major art collector (he began by buying Art Deco postcards when he was six), but his particular focus, rather than on American artists, is on works by the Cubist masters Picasso, Braque, Gris, and Léger. He also collects Klimt. Much of his art comes from some of the world's most celebrated collections, including those of Gertrude Stein, the Swiss banker Raoul La Roche, and the British art historian Douglas Cooper.

In autumn, 2012, the Museum of Fine Arts, Boston opened an exhibition of 700 of his postcards, a tiny part of the promised gift he has made to the museum of 120,000 postcards: The Postcard Age: Selections from the Leonard A. Lauder Collection. In an interview in The New Yorker, Lauder explained how postcards turned him into a collector, and how these "mini-masterpieces" remained his lifelong pursuit to the point where his late wife, Evelyn, called the collection his "mistress". He donated his collection of Oilette postcards, published by Raphael Tuck & Sons, to Chicago's Newberry Library, and funded their digitization; the Newberry launched the 26,000-item Tuck digital collection in 2019.

Lauder's interest in postcards led him to be acquainted with one of the owners of the Gotham Book Mart, a Manhattan bookstore, and he sought to help the Gotham re-establish its presence in the city when the owner had sold its long-time building and needed a new space. Lauder bought a building at 16 East 46th Street along with a partner, letting the building's storefront space to the Gotham. Later, the Gotham fell behind on rents, eventually resulting in Lauder and his partner to file for eviction. In a much-publicized closure of the bookstore, the New York City Marshal later auctioned the store's inventory, which was bought in a lot by Lauder and his partner to some protest from many other independent book sellers and collectors who were present at the proceedings and hoping to purchase some of the bibliophilic treasures.

5. Jim Simons

|

| Photo: Cal Alumni Association |

Net worth: 28.6 billion USD

James Simons is an American mathematician and hedge fund manager who founded the famous Renaissance Technologies, one of the world's most successful hedge fund companies. Simons is a code breaker and an expert in pattern recognition. Using his expertise in the field, he employed mathematical models to analyze hedge funds in his company which provide more accurate predictions than other methods. He also amassed a large personal fortune through his investments and is considered a hero in the mathematical fraternity for having achieved such tremendous success in a field other than mathematics. Simons had always been interested in mathematics and dreamed of becoming a career mathematician. He completed his bachelor’s degree from the prestigious Massachusetts Institute of Technology (MIT) and earned his doctorate from the University of California at the age of 23. He proceeded to establish himself as a highly accomplished mathematician, primarily working in the fields of geometry and topology of manifolds. Over the course of his career he also worked with the National Security Agency to break codes and taught mathematics at MIT. He eventually went on to found Renaissance Technologies which made him a billionaire. He is also a generous philanthropist.

After receiving his Ph.D. he embarked on an academic career. He then joined the research staff of the Communications Research Division for the Institute for Defense Analyses (IDA) in Princeton as a code breaker in 1964. Simons enjoyed this post very much as he was naturally skilled at coming up with algorithms to attack particular types of cryptographic problems.

His time at the IDA proved to be a profound learning experience for him. The knowledge he gained there regarding the utilization of mathematical models to interpret data would greatly aid him in establishing his business in future.

Between 1964 and 1968 he also taught mathematics at MIT and Harvard University. Ultimately he joined the faculty at Stony Brook University and was appointed chairman of the math department in 1968.

At the Stony Brook University, he worked with mathematician Shiing-Shen Chern to develop the Chern-Simons invariants which are geometric measurements that are important not only in mathematics, but are also useful in both quantum field theory and condensed matter physics.

James Simons had always been interested in finance and during the 1970s he seriously started thinking about establishing his own business in the field. In 1978, he quit academia and founded a hedge fund management firm called Monemetrics.

He realized that he could use mathematical models to analyze the financial data and began recruiting the most brilliant minds he had known from his career at IDA and Stony Brook University—mathematicians, data-modeling experts, code breakers, scientists and engineers.

The company performed well and the mathematical models developed at the company gave better and better results each year. Simons changed the name of the company from Monemetrics to Renaissance Technologies in 1982.

Renaissance Technologies grew manifold over the ensuing years. Using its complex mathematical models to analyze and execute trades, the company currently has more than $22 billion in assets under management across the three funds it operates.

In 2009 Simons retired as the company’s CEO and became chairman of its board. He has been devoting more time to philanthropy in the recent years.

Top 5 Must-visit Destinations in New York City

6. Rupert Murdoch and family

|

| Photo: Wikiwand |

Net worth: 21.5 billion USD

Rupert Murdoch is a famous Australian businessman who is known for his establishment 'News Corporation'. After his father’s death, he started by acquiring small, struggling publications in Australia. The first foreign investment happened when he bought 'The Dominion', a New Zealand-based newspaper. Since then, he has gradually built his business empire, and has become a renowned name in the media industry. He boasts of having gained acquisition of publications including 'News of the World', 'The Sun', 'The Daily Telegraph', 'New York Post', and 'HarperCollins'. He has also launched new tabloids under his own banner, like 'The Australian'. With increasing business takeovers in the US, he opted to become a US citizen. Once he had a strong hold over print media businesses in the UK and the US, he moved on to purchase 'Twentieth Century Fox'. 'Fox Network' and 'Fox Studios' are popular production houses affiliated to '20th Century Fox'. This tycoon has also had his share of controversies, but has managed to sail through. Presently most of the operations are managed by his younger son, James. According to Forbes, he is one the richest and the most influential Americans in US and the world.

Murdoch as a businessman has acquired several large companies, but his most significant business decision was to establish the ‘News Corporation’. Under the banner, he has been able to gain access to other big names in the media industry. Within twenty years of existence, the firm accumulated wealth of $5 million.

From 1956-67, Murdoch was married to former air hostess, Patricia Booer, with who he had a daughter, Prudence.

After separating from his first wife, he married Scottish journalist, Anna Maria Torv in 1967. The couple had three children Elisabeth, Lachlan, and James, all of who are presently influential entrepreneurs. The couple got divorced after 32 years.

Following the separation, he married businesswoman Wendi Deng--the couple have two daughters, Grace and Chloe.

This business magnate has often been the source of inspiration for various TV show characters. Comedian Barry Humphries played this stalwart in the documentary series, 'Selling Hitler'. His character has also been essayed by English actor Hugh Laurie, in the TV program 'A Bit of Fry & Laurie'.

Even Rupert's business scandals have been the subject of the movie, 'Outfoxed', and the TV show, 'Hacks'.

7. Donald Newhouse

|

| Photo: Forbes |

Net worth: 14.8 billion USD

Donald Edward Newhouse (born 1929) is an American billionaire heir and business magnate. He owns Advance Publications, founded by his father, Samuel Irving Newhouse Sr., in 1922, whose properties include Condé Nast (publisher of such magazines as Vogue, Vanity Fair, and The New Yorker), dozens of newspapers across the US (including The Star-Ledger, The Plain Dealer, and The Oregonian), cable company Bright House Networks and a controlling stake in Discovery Communications. According to Bloomberg Billionaires Index, he has an estimated net worth of $19.4 billion. He resides in New York City.

Newhouse's father, Samuel Irving Newhouse Sr., was born on the Lower East Side of Manhattan and began the family media business. His mother, Mitzi Epstein, was an arts patron and philanthropist who grew up in an upper middle class family on the Upper West Side, the daughter of a silk tie importer. Donald Newhouse is Jewish, and was listed on the Jerusalem Post's list of the world's 50 richest Jews in 2010.

In January 2020, Newhouse donated $75 million to the S.I. Newhouse School of Public Communications at his Alma mater Syracuse University. The communications school is named after his father, Samuel Irving Newhouse Sr.

It was announced in March 2021 that Newhouse and his wife Susan would launch a fund at the Association for Frontotemporal Degeneration (AFTD) with a $20m donation, the largest donation in the charity's history.

Top 5 Things You Must Do When Visiting New York City

8. Israel Englander

|

| Photo: Bloomberg |

Net worth: 11.5 billion USD

Israel Englander (born 1948) is an American investor, hedge fund manager, and philanthropist. In 1989, he founded his hedge fund, Millennium Management, with Ronald Shear. The fund was started with $35 million, and as of 2019 had $39.2 billion in assets under management.

Israel "Izzy" Englander was born in 1948 and was raised in a Polish-Jewish family in the Crown Heights neighborhood of Brooklyn. He was raised in a religious home and attended yeshiva.

His father's entire family was killed in the Holocaust. His Polish parents were deported to a Soviet labor camp after the war, where Englander's two older sisters were born. They then immigrated to the United States in 1947.

Always interested in the stock market, Englander began trading stocks while in high school. During college, he interned at Oppenheimer & Co. (where his future brother-in-law, Jack Nash, would eventually become president and chairman) and at the New York Stock Exchange. In 1970, he graduated from New York University with a B.S. in finance. His first full-time job was with the Wall Street firm Kaufmann, Alsberg & Co. He later enrolled in New York University's MBA program in the evenings but never completed the degree.

Early business career

At Kaufmann Alsberg, Englander focused on trading convertible securities and options. When the American Stock Exchange began to list options, he purchased a seat on the exchange. In 1977, he formed a floor brokerage house, I.A. Englander & Co.

In 1985, Englander and his partner John Mulheren Jr., started an investment firm called Jamie Securities Co. with a $75 million investment from the Belzberg family of Canada. Mulheren had previously worked as a trader for Ivan Boesky. In February 1988, when Boesky was later convicted of insider trading, and agreed to testify against Mulheren in a plea deal to receive a lesser sentence, Mulheren was arrested for carrying a loaded assault rifle, convicted of orchestrating illegal stock trades for Boesky, but the ruling was later overturned. Although Englander was never implicated in the matter in any way, Jamie Securities was dissolved in 1988 due to the negative publicity in the aftermath of Mulheren's situation.

Millennium Management

In 1989, Englander started Millennium Management with Ronald Shear - whom he knew from his time at the American Stock Exchange - with $35 million in seed money (including $5 million from Englander himself and another $2 million from the Belzberg family). The firm got off to a rough start and Shear left in 1990. Since then, Englander has grown Millennium into a $39.2 billion (under management) enterprise by using investment strategies like statistical arbitrage (quantitative analysis); fundamental long-short pairing; merger arbitrage (taking advantage of price differentials between a buy-out target company's stock price and bid price) and convertible arbitrage (taking advantage of price differentials between a company's stock price and convertible bond or stock warrant price). At any given time, Millennium holds thousands of investment positions and makes over 2 million trades on an average day. At the end of 2019, Millennium had 2,900 employees in more than 12 offices in the United States, Europe and Asia.

9. Chase Coleman, III

|

| Photo: Forbes |

Net worth: 10.3 billion USD

Charles Payson "Chase" Coleman III (born June 1975) is an American billionaire hedge fund manager, and the founder of Tiger Global Management. As of October 2021, his net worth is estimated at US$10.3 billion.

Coleman grew up in Glen Head, Long Island. His father, C. Payson Coleman Jr., born in 1950, is a partner at the New York law firm Pillsbury Winthrop Shaw Pittman, and his mother, Kim Coleman, owns an interior design firm.

His grandfather, Charles Payson Coleman, who was managing partner of the New York law firm Davis Polk & Wardwell until his death in 1982, was married to Mimi C. Thompson (née Louise Stuyvesant Wainwright), a descendant of Peter Stuyvesant, the last Dutch Governor who surrendered New Amsterdam to the British.

Coleman followed his father to both Deerfield Academy and Williams College, where he graduated in 1997, and was co-captain of the lacrosse team.

He started his career in 1997, working for Julian Robertson and his hedge fund, Tiger Management. Coleman had grown up with Robertson’s son, Spencer, who lived close to Glen Head, in Locust Valley. In 2000, Robertson closed his fund, and entrusted Coleman with over $25 million to manage, making him one of the 30 or more so-called "Tiger Cubs", fund managers who started their fund management careers with Tiger Management. “I’ve known Chase since he was a young boy on Long Island and a good friend of my son Spencer,” [Julian] Robertson said.

Coleman serves as partner of the investment firm he founded, Tiger Global Management. The hedge fund was an early investor in both Facebook and LinkedIn.

On the Forbes 2019 list of the world's billionaires, he was ranked #458 with a net worth of US$4.5 billion. According to Business Insider, he was born into "old money" and has made a lot of "new money" as well. According to Institutional Investor, he made an estimated $2.5 billion in 2020.

In 2012 Coleman donated US $30,800 to the National Republican Senatorial Committee and US $5,000 to Mitt Romney's presidential campaign. He has also donated to Democratic candidates, including $10,000 to New York Governor Andrew Cuomo, $4,950 to Manhattan Borough President Scott Stringer, and $2,700 to New York Senator Charles Schumer.

10. Leon Black

|

| Photo: Financial Times |

Net worth: 10 billion USD

Leon David Black (born July 31, 1951) is an American investor, best known as the co-founder, and former-CEO of private equity firm Apollo Global Management. Black also served as the chairman of The Museum of Modern Art (MoMA) in New York City from July 2018 until July 2021.

Black stepped down as CEO and chairman of Apollo Global Management in 2021, after revelations that he paid the disgraced businessperson and convicted sex offender Jeffrey Epstein $158 million for family office tax-related advice over the period from 2012 to 2017.

Black started out as an accountant at Peat Marwick (which later became KPMG) and with the publisher of Boardroom Reports. He also interviewed at Lehman Brothers but was told that he didn't have the brains or personality to succeed on Wall Street. From 1977 to 1990, Black was employed by investment bank Drexel Burnham Lambert, where he served as managing director, head of the Mergers & Acquisitions Group, and co-head of the Corporate Finance Department. Black was regarded as "junk bond king" Michael Milken's right-hand man at Drexel. In 1990, he co-founded, on the heels of the collapse of Drexel Burnham Lambert, the private equity firm Apollo Global Management. Notable founders included: John Hannan, Drexel's former co-director of international finance; Craig Cogut, a lawyer who worked with Drexel's high-yield division in Los Angeles; Arthur Bilger, the former head of the Drexel's corporate finance department; Antony Ressler, who worked as a senior vice president in Drexel's high yield department with responsibility for the new issue/syndicate desk; and Marc Rowan, Josh Harris and Michael Gross, who all worked under Black in the mergers and acquisitions department.

Black stepped down as CEO of Apollo in 2021 due to his ties to convicted sex offender Jeffrey Epstein. He remained chairman for several months but stepped down abruptly in March 2021.