Most Expensive And Cheapest Places For Property Rents In The UK

|

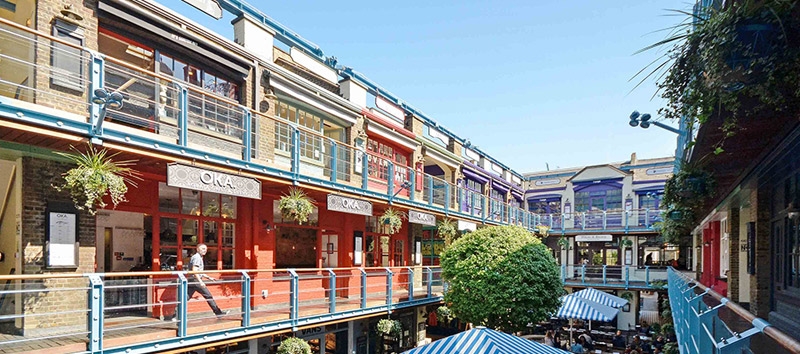

| Most Expensive And Cheapest Places For Property Rents In The UK. Photo KnowInsiders |

UK rents are up 9.7% on pre-pandemic levels, but most of the increases have happened this year, according to the HomeLet Rental Index.

In September, the average household spent 29.6% of their gross income on rent, compared with 30.9% in September 2019, before the pandemic.

Top 5 Most Expensive Places For Property Rents In The UK, According to ONS data

1.London (£1,425 p/m)

2.South east (£900 p/m)

3.East England (£795 p/m)

4.South West (£725p/m)

5.West midlands (£645 p/m)

Of course London comes first on this list. Could it really be anywhere else? The problem with discussing London in this list is that its boroughs differ so greatly. Now we’ve been talking about two bedroom properties for every other place on this list. In some areas of London, the average one bedroom flat greatly exceeds these figures. In Kensington and Chelsea a one bed will set you back around £2,134 a month which can be compared to the cheapest borough in London where the same size property would be around £1,341pcm. Eye-watering prices which aren’t necessarily in keeping with the extra income a London job offers.

Best Places to Rent in London – The Top “rent value” Boroughs Revealed

London has and will probably always remain the most expensive place to rent in the UK but why? Below are some reasons why London is more expensive compared to other UK cities: Many high profile companies have their head offices set up in London which means some of the richest people in the world often come there. It’s been proven many times that places where there is an abundance of money plus smart people shifting the market to their advantage results in higher prices. London is widely seen as the financial capital of the world which means big money is always on show there. People generally pay for everything without kicking up a fuss which keeps prices high. In an article by Homes and Property they state that London is currently the most expensive place to rent in Europe as well and the fourth most expensive in the world! There are however ways to reduce the amount of rent you pay and live in London at the same time, although it’s not something that appeals to everyone. So what’s the trick? Well, according to OntheMarket you have to rent in a group of four people. An example of this is for a four bedroom property in Bexley, the monthly total rent is £1,633.52 but divided between four people, it is £408.38 each! Not bad right? |

The index also revealed South East of England is the second most expensive region for renting, with prices averaging £1,139 pcm, a 6.1% increase from 2020. Rental prices in the East of England averaged £1,021, a 5.6% rise year-on-year and the South West saw rents go up by 7.6% to £971.

“Typically, rental prices rise in line with inflation and wage growth; that’s something we’ve continued to see. Despite record rents, tenants moving home spend a similar percentage of their income on their monthly rent," said Matthew Carter, HomeLet & Let Alliance head of marketing.

“Housing follows the same fundamental laws of economics as other goods that consumers need. Ultimately demand, coupled with lower stock levels for certain types of property, are driving up rental values. The concern is that we’re at a point where there are some areas with exceptionally high demand.

Top 4 Cheapest Places to Rent In the UK, According To ONS

1.North East (£495 p/m)

2.Yorkshire and the Humber (£550 p/m)

3.North West (£575 p/m)

4.East Midlands (£600 p/m)

The North East came out as the place with the lowest average rent, costing just over half of the average rent in the South east.

Average rent in the North east will cost you under £500 a month on average.

The data revealed the average rent in this region was just £495 per month, with the close-by Yorkshire and Humber region coming in close at £55 more per month.

The North West is the most affordable, with renters spending 22.1% of their income on rent.

The North West saw the greatest change in affordability in the year to September 2021. Renters are now spending on average 27.2% of their income on rent, improved from 29% 12 months ago.

| What Age Group is the Most Likely to Rent? Despite ongoing issues like Brexit, the rental market in the UK is still going strong. A report released earlier this year by the ONS states that the number of households in the private rented sector in the UK increased from 2.8 million in 2007 to 4.5 million in 2017. That’s an increase of whopping 1.7 million (63%)! What’s even more interesting is that younger people are much more likely to rent than anyone else (across England, Scotland, Wales and Northen Ireland). According to the BBC with statistics taken from the House of commons library – over 60% of 16-24 year olds are likely to rent privately. |

What documents do you need to rent a house or flat?

Character and employment references

A letting agent or landlord will ask you to provide references that indicate your eligibility for the property that will become your home. Often, whether your application is successful or not will depend on the results of your references. There are several things that will be checked as part of this process, including what your character is like and your employment and salary information.

You’ll need to speak to your employer and ask if they’ll provide a reference for you confirming your employment details, your income and giving an insight into your character. You may also need to provide a reference from your previous landlord that shows you’re a responsible tenant, for instance stating how reliable you are with rent payments and how well you looked after the house or flat.

How you provide your references will depend on the way in which the letting agent or landlord handles their referencing. If they manage this manually, you’ll need to provide a written copy of your references along with the referees’ contact details. If the agent or landlord uses an external company to process references, then you may need to get set up with the company and provide the contact details of the relevant people. Typically, the company will then get in touch with them via phone or email to obtain the references.

Documents that show your income and employment status

In addition to getting a reference from your employer, you’ll need to provide certain documents that prove your employment status and your monthly or annual income. This is so the landlord can determine if you can afford the rent and that your income is stable. Which documents you need to give will depend on whether you’re a full-time employee or self-employed.

| If you’re an employee If you’re an employee, there are several documents you can provide to prove your income and employment. This is most commonly three to six of your most recent payslips from work. Alternatively, you can provide your contract of employment or a letter from your workplace, as long as it contains the relevant information. Technology is helping to make the income verification process much smoother, with innovations in the use of Open Banking, we're now able to automate this process in many cases, where your letting agent uses our Tenant Referencing services you'll be able to benefit from this feature. If you’re self-employed If you’re self-employed, you may need to prove your earnings over a longer time period – often between one and three years. This could be in the form of bank statements, trading records or your tax returns. If you use an accountant, you may also need to provide their details so the letting agent can get a reference from them. The reason the landlord or letting agent will need confirmation of your income is so that they can run an affordability check, which establishes whether you will be able to keep up with rent payments. To pass this part of the application process, your salary will need to be 30 times higher than the monthly rent. For example, if your rent is £800 per month, your annual salary will need to be £24,000 or higher. If you’re moving into a flat with friends, family members or your partner, the affordability check will take all incomes into consideration. |

Documents that confirm your identity and right to rent

So, what other documents do you need to rent a house or flat? You’ll also need to provide paperwork that confirms your identity and your current address, such as your passport, driving license or a utility bill. If you’re moving to the UK from abroad, you’ll need to provide a copy of your visa.

You must also provide documents that prove you and any other adults living in the property have the right to rent in the UK. This could be a passport, national identity card, immigration status document or other paperwork listed as acceptable in the Government’s list for right to rent checks.

Credit references

Often when you apply to rent a property, the landlord or letting agency will run a credit check to assess your credit score. This gives them insight into your credit history so they have an idea of how reliable you may be with rent payments. Your credit score is calculated by looking at several financial factors and can be impacted negatively by things like missed payments, unpaid loans and defaults on accounts.

No matter where you’re planning to move, it’s worth preparing the documents you need to rent a house in advance if you can. Demand for properties can be extremely high, so when an attractive house or flat comes along, there may be many prospective tenants keen to make it their own. This can mean that time is of the essence when it comes to house-hunting.

Having all the necessary paperwork ready in advance means you can hand it over straight away once you find the right place. This could give you the advantage over other tenants who need time to get their paperwork together, especially if the landlord is keen to get everything sorted quickly.

Plus, by having everything ready to go, the rest of the process should be less stressful, giving you more time to plan other elements of the move into your new home.

Top 10 Most Expensive Cities To Rent Housing In Canada Top 10 Most Expensive Cities To Rent Housing In Canada If you are looking for a house which is not too expensive to rent in Canada, houses in these 10 following cities are not for ... |

Apartment Rental Markets in America: Top 10 Most Expensive Cities and Full List Apartment Rental Markets in America: Top 10 Most Expensive Cities and Full List Check out the full list and the top 10 most expensive apartment rental markets in the US for 2021 right below! |

Top 10 Most Expensive Houses in the U.K in 2021/2022 Top 10 Most Expensive Houses in the U.K in 2021/2022 What do expensive homes that are driving the UK real estate market really look like? Here is the list of the top 10 most expensive ... |