Facts About 'Revival Plan’ for Terra (Luna) Price from Zero: Will It Recover

|

| Terra (LUNA) Founder Breaks Silence, Proposes New Revival Plan |

What will Terra Luna do Next and Will Luna Bounce Back?

Terra Luna suddenly collapsed for latest week and billions disappeared in a flash on Thursday and left people who spent their life savings on the once top-performing coin in trouble. They have turned to LUNA's founder for support, and he has outlined the company's next steps.

Finally breaking his silence after the recent collapse of the Terra ecosystem, founder Do Kwon came up with a revival plan for the Terra blockchain network called “Terra Ecosystem Revival Plan”, causing the luna price to surge over 1,000% as traders bet the project could recover.

The network is the talk of crypto bulls and crypto bears alike in the face of a major price meltdown this week. Those still invested are either buying in while prices are incredibly low, or they’ve lost so much they are just hoping for a miracle. Is LUNA going to come back from this?

Related: Terra Luna Price Skyrocketed, Investors Splashed Money to Play 'Lottery'

What is the 'Revival Plan’ for Terra (Luna) Price?

Do Kwon announced a proposal to fork LUNA to a new version in order to save the ecosystem on May 13. In Friday’s proposal, Kwon, who created the Terra blockchain with his Terraform Labs team, concedes that the Terra ecosystem has experienced total collapse.

According to Do Kwon, there are still UST worth billions in circulation even if the value of Luna has fallen to almost zero. With the massive dilution of Luna supply, it’s impossible to build back the confidence.

The Terra ecosystem and community should be preserved because of the value it has to offer, according to Do Kwon.

|

| Do Kwon pitches revival plan for Terra blockchain |

Kwon also offered ideas on how to reconstitute the blockchain network, with the central idea being resetting Luna’s supply to 1 billion tokens. He suggested that the new supply should be for Luna holders before the de-peg, UST holders, Luna holders at the chain halt, and the Community pool.

“Even if the [UST] peg were to eventually restore after the last marginal buyers and sellers have capitulated, the holders of Luna have so severely been liquidated and diluted that we will lack the ecosystem to build back up from the ashes,” Kwon wrote.

He continued, “UST holders need to own a large share of the network, as the network’s debt holders they deserve to be compensated for the tokens they have been holding to the end.”

| Atop these plans, the developers are also taking on a community proposal to increase the burn rate of UST. Moreover, they temporarily halted the blockchain completely, freezing all unsettled transactions. This was to prevent users from taking advantage of the low price of LUNA and buying it all up at once. |

Reset Network Ownership to 1B Tokens

Kwon said, The Terra community must reconstitute the chain to preserve the community and the developer ecosystem. Although there’s no way to fully restore the blockchain’s value, Kwon said the redistribution plan has to compensate the network’s debt holders and “loyal community members and builders.”

Validators should reset the network ownership to 1B tokens, distributed among:

♦ 400M (40%) to Luna holders before the de-pegging event (last $1 tick before the depeg on Binance should be reasonable).

♦ 400M (40%) to UST holders pro-rata at the time of the new network upgrade.

♦ 100M (10%) to Luna holders at the final moment of the chain halt – last-minute marginal luna buyers should be compensated for their role in attempting to provide stability for the network100M (10%) to the Community Pool to fund future development.All Luna besides the third tranche should be staked at the network genesis state.

♦ The network should incentivize its security with a reasonable inflation rate, say 7%, as fees will no longer be enough to pay for security without the swap fees.

Will LUNA Recovery Plan Work?

The blockchain underpinning luna and UST was shut down multiple times this week to "prevent governance attacks" following "severe [luna] inflation."

Terraform Labs and the Luna Foundation Guard, tasked with supporting UST, this week printed several billion luna tokens—increasing the luna supply from 340 million last week to 6.5 trillion—in a failed attempt to maintain the UST peg to the dollar.

There have been several responses to the proposal so far. Most of them are questions about those who hold Luna on centralized exchanges, aUST holders, wLUNA, etc. But some disagree with the redistribution methods.

Vitalik Buterin, Founder of Ethereum, Critiqued the Premise of UST

|

| Ethereum co-founder Vitalik Buterin |

Vitalik Buterin, creator of Ethereum, critiqued the entire premise of UST, citing it as, from inception, intentionally misleading and inherently flawed.

“‘Algostable’ has become a propaganda term serving to legitimize uncollateralized stables by putting them in the same bucket as collateralized stables like RAI/DAI,” Buterin tweeted.

Changpeng Zhao (CZ) - Binance CEO - does not believe

|

| Binance CEO does not think LUNA recovery plan will work |

Binance CEO, CZ, has revealed that he does not believe that Do Kwon’s plan to save LUNA will work. He goes on to ask where the LFG held BTC went after it was loaned to market makers. Do Kown has stated that a full report is incoming regarding this and LFG is documenting the use. He asks for “patience” as the team is “juggling multiple tasks at the same time.” CZ also compares the strategy to trying to fork Bitcoin at the ATH and expecting the value to be retained.

CZ also notes that he has never held UST and doesn’t “know it too well,” claiming he is “usually busy with other things, but now dragged into this.” His disdain for Do Kwon and the Terra chain is evident in his recent tweets.

He even posted a link to a dead cat bounce explanation thread on Binance Academy in reference to LUNA jumping after Do Kwon released his proposal.

He also seems to take some credit for the Terra blockchain restarting saying “If we didn’t push the issue, the Terra blockchain may still be in “halted” mode, or worse with super minting…”

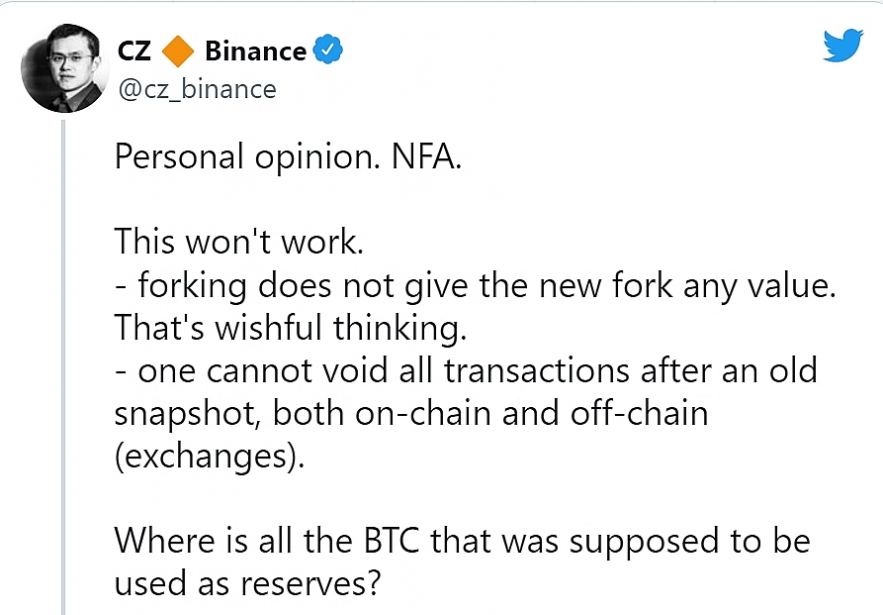

Zhao, one to rarely comment on the operations of cryptocurrencies traded on his company’s platform, made an exception yesterday to tweet that “forking” LUNA, or splitting the blockchain to create a second version, “won’t work.”

“Forking does not give the new fork any value,” Zhao stated flatly. “That’s wishful thinking.”

Zhao elaborated that the fatal flaw of such a strategy is Kwon’s failure to understand that “minting coins (printing money) does not create value, it just dilutes the existing coinholders.”

Zhao went further, openly questioning the transparency of Kwon and Terra’s handling of the crisis spurred by UST and LUNA’s collapse.

|

| Zhao openly questioning the transparency of Kwon and Terra’s handling of the crisis |

Billy Markus - Co-founder of Dogecoin

The Co-founder of Dogecoin, Billy Markus, advised Do Kwon to leave the crypto industry saying that “ My recommendation is to stop trying to bring in new victims to fund the previous victims and leave the space forever.”

The Terra community proposed three more emergency actions, which boil down to simply lighting as much UST on fire as possible (without having to mint LUNA on the other end).

The final result? Another algorithmic stablecoin bites the dust.

Investing Cube

Investing advice site Investing Cube has speculated there is a “good chance” the cryptocurrency could recover.

Analyst Kelvin Maina wrote: “For Luna to recover, they will need to address the problem and show clearly that such a drop will not happen again. As an analyst, I expect to see a bump in Luna prices after UST is pegged back to the dollar. I also expect the prices to start recovering after the Terra project shows that similar problems will not happen in the future.”

| Price prediction site WalletInvestor is remaining extremely bullish with its 12-month LUNA prediction. It expects the coin to reach $151 by May 2023. Meanwhile, peer outlet Gov Capital is predicting a $108 price for the coin in the same time frame. |

Analyst Miles Deutscher: Difficult for Terra Recover

Analyst Miles Deutscher says that it would be difficult for Terra to command those valuations once again.

"Remember, crypto valuations are based on future growth. That’s why we’ve seen valuations in the tens of billions for L1s with hardly any transaction volume. But with Terra’s reputation so damaged, the acquisition of new users/investors becomes challenging.

Similarly, for Terra to command a comparable valuation, it would need to factor in sizeable growth. Where’s this growth coming from? The acquisition of new investors and users. This acquisition becomes exponentially harder when you’ve lost the trust of the industry”, Miles Deutscher wrrites In his recent Tweets.

Further, he adds that without the UST, Terra’s tech won’t give it any leverage over other Layer 1s. Thus, it will be even more difficult to convince that LUNA 2.0 would be the place to invest. On the other hand, it will also be difficult for small projects to pull capital to build and develop dApps on Terra.

More Negative

Many have their doubts. It seems that most talk about the network online is quite negative, with lots of investors already considering the project dead. The Motley Fool’s Trevor Jennewine is advising investors steer clear of LUNA now, even with its exceptionally low cost.

Price predicting websites like CoinPriceForecast and DigitalCoinPrice see no growth opportunities for the network on the horizon either. The two sites predict an end-of-year price of 6 cents and less than 1 cent, respectively, for LUNA.

What happened to Terra's UST and LUNA?

|

| Will Luna Terra Recover |

Amid the craziest week in crypto ever, the collapse of Terra's UST stablecoin and governance token LUNA emerged as the biggest story.

There were several forces at work. The first is the mechanism behind Terra and its stablecoin.

The second was general panic: Many investors—who may have been wholly unaware of exactly why the stablecoin was dropping—rushed to the exit at the first whiff of a depegging.

Analysts from Bitfinex Market Analysis said the trouble showed the strength of other, more established coins.

They said: "The capitulation of Terra Luna and the issues that we see with Terra’s dollar-pegged algorithmic stablecoin UST are part of the growing pains of a space where innovation charts a course at a frenetic pace.

"The real story of the day is the relatively strong performance of the three leading cryptocurrencies, bitcoin, Ethereum and Tether tokens (USDt).

"The trinity stands strong, demonstrating the strength and resilience of a digital token ecosystem that will define this entire decade.”

Why did LUNA price drop dramatically?

♦ LUNA price sharply decreased because UST, Terra’s stable coin, collapsed to lower than 1 USD resulting in the investors’ sell-off.

♦ The reason behind UST crash is the US dollar depreciated on May 9, 2022. BusinessToday analyst mentioned that the incident has caused strong shockwaves in the crypto market as it reveals the stablecoin’s disadvantage of relying directly on the supporting algorhim (unlike USDT and USDC which are supported by fiat money). Therefore, the collapse caused investors to sell off LUNA resulting in the most decline on the record.

♦ Looking back at the beginning of 2022, LUNA price rose dramatically because of high UST demand on Anchor protocol raising 20% APY. However, due to economic uncertainty, this particular stablecoin model might not be the most stable option at the moment. Although LPG has invested in Bitcoin as the supporting fund, it doesn’t really help when facing the actual issue.

How risky is cryptocurrencyafter Luna?People invest at their own risk and cryptocurrencies are not regulated by financial authorities. All crypto investments are risky, but meme coins like Shiba Inu are particularly volatile, and you should be prepared to lose everything you invest. The Financial Conduct Authority (FCA, UK) warned in January: “Investing in cryptoassets, or investments and lending linked to them, generally involves taking very high risks with investors’ money. “If consumers invest in these types of product, they should be prepared to lose all their money.” Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown said: “On top of being extremely volatile, most cryptocurrencies are unregulated, which not only adds another layer of uncertainty but also means that investors have little or no protection against fraud.” |

Who is Do Kwon-Terra Luna Founder: Biography, Family, Career and Net Worth Who is Do Kwon-Terra Luna Founder: Biography, Family, Career and Net Worth Do Kwon is a South Korean crypto entrepreneur best known for co-founding Terraform Labs (Terra Luna) in January 2018 and leading the company as its ... |

Who is The True Creator of Bitcoin by Trial in Florida: Satoshi Nakamoto Not Real! Who is The True Creator of Bitcoin by Trial in Florida: Satoshi Nakamoto Not Real! The true identity of the creator of Bitcoin unveiled in an trial in Florida. Who is Satoshi Nakamoto as a real person? |

Top 20+ Expert's Predictions For Cryptocurrency In 2022 Top 20+ Expert's Predictions For Cryptocurrency In 2022 How do the experts predict crypto in 2022? Crypto analysts are still bullish about Bitcoin’s future and believe it could surpass $100,000 in 2022. |