Copper Just Had a Historic Run. What’s Driving the Rally—and What Comes Next?

|

| Copper Prices Are Exploding After Gold and Silver |

Copper Is the Last Metal to Run—and It’s Running Fast

Gold surged. Silver followed. Now copper has joined the party—and it may be the most important move of all.

In 2025, copper prices climbed at a pace few investors expected, briefly pushing past levels that once seemed extreme. The rally has sparked a familiar debate: Is this just another commodity spike fueled by speculation, or is something more structural unfolding?

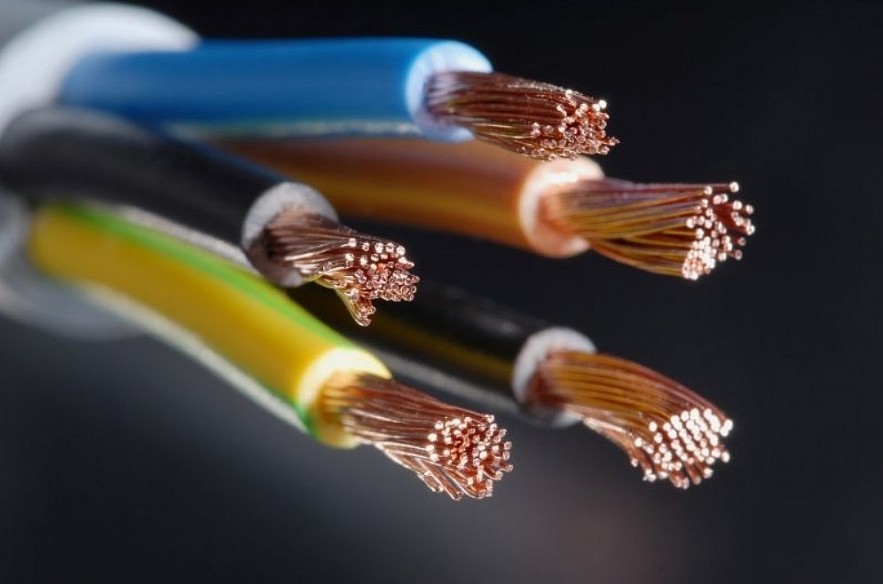

For investors, the answer matters. Copper isn’t just another metal. It sits at the center of power grids, electric vehicles, data centers, and the physical backbone of the modern economy. When copper moves, it often signals something bigger underneath.

To understand what’s happening, you need to look beyond simple supply-and-demand headlines. This rally is being driven by a mix of policy risk, physical market mechanics, and a longer-term shift in how copper is valued.

Read more: Will Copper Crash or Stay Elevated in 2026? Three Scenarios That Matter

First, How Big Is the Move?

Copper has posted one of its strongest annual runs in years, outperforming most industrial commodities. The speed matters as much as the size. Prices didn’t grind higher slowly. They jumped.

That kind of move usually points to stress somewhere in the system. Either demand is stronger than expected, supply is weaker than assumed, or the market is being forced to reprice risk very quickly.

In copper’s case, it’s all three—but not in the way most casual observers think.

This Isn’t Just About “Strong Demand”

It’s tempting to blame the rally on electrification alone. Electric vehicles, renewable energy, and grid upgrades are all copper-hungry. That story is real, but it’s not new.

What’s changed is how urgent that demand has become.

Power grids in the U.S. and Europe are being pushed harder by data centers, AI workloads, and electrification. Utilities are spending again after years of underinvestment. These projects aren’t optional. They’re required just to keep systems stable.

At the same time, copper supply isn’t elastic. New mines take years, often more than a decade, to permit, finance, and build. Even when prices rise, supply can’t respond quickly.

That creates a market with very little margin for error.

Read more: Gold vs Silver vs Copper: Same Rally, Different Drivers

The Tariff Effect Investors Overlooked

One of the most underappreciated drivers of the rally is policy risk.

Concerns over potential U.S. tariffs on copper imports triggered a rush to move metal into the country ahead of any policy change. Traders and consumers didn’t want to be caught short—or paying more later.

That set off a chain reaction:

-

Copper was pulled from global markets into U.S. warehouses.

-

Price differences between U.S. and international exchanges widened.

-

Physical availability tightened in unexpected places.

This wasn’t speculative frenzy. It was defensive positioning.

And once those flows start, they can move prices much faster than fundamentals alone would suggest.

Why Inventories Don’t Tell the Full Story

Some skeptics point to inventory data and argue the market isn’t truly short of copper. On paper, they’re not entirely wrong.

But copper inventories aren’t all created equal.

What matters is where the metal is, not just how much exists globally. When inventories pile up in one region and drain from another, prices can spike even without a global shortage.

That’s exactly what happened.

Copper moved to where it was most urgently needed—or most protected from policy risk. The result was localized tightness that forced prices higher.

For investors, this is a critical lesson: commodity markets don’t reprice smoothly. They jump when logistics and incentives change.

Supply Risks Are No Longer Theoretical

On the supply side, the market has little cushion.

Major copper mines are aging. Ore grades are declining. Costs are rising. And disruptions—from labor disputes to weather events—are happening more often.

Even small hiccups now matter. When a large mine goes offline or cuts output, there’s no quick replacement. That fragility is forcing the market to price in a higher risk premium.

In past cycles, investors assumed supply would eventually catch up. Today, that assumption looks far less certain.

Why Copper Is Trading Like a Strategic Asset

Gold trades on fear and currency risk. Silver straddles the line between money and industry.

Copper is different.

It’s increasingly being treated as a strategic input, not just a raw material. Governments care about it. Utilities depend on it. Tech companies indirectly require it to scale power-hungry systems.

That changes how it’s priced.

Instead of oscillating purely with economic cycles, copper is starting to reflect long-term infrastructure commitments and policy priorities. That tends to push price floors higher, even if volatility remains.

What Happens Next?

After a run like this, pullbacks are normal. No commodity moves in a straight line.

But the bigger question isn’t whether copper corrects—it’s whether it falls back to old ranges or establishes a new, higher base.

That will depend on three things:

-

Whether policy-driven stockpiling continues

-

How quickly grid and data-center spending accelerates

-

Whether supply disruptions worsen or stabilize

If even one of those stays supportive, copper prices may remain elevated longer than many expect.

What Investors Should Watch

For retail investors, the takeaway is simple: don’t dismiss this rally as noise.

Copper is sending a signal about the physical economy—about electricity, infrastructure, and constraints that don’t show up neatly in GDP numbers.

Key indicators to monitor:

-

U.S. vs global copper price spreads

-

Inventory trends by region, not totals

-

Utility and grid investment announcements

-

Policy signals around trade and critical materials

Copper doesn’t move quietly when something important is changing.

Right now, it’s speaking loudly.

FAQs

Why are copper prices rising so fast in 2025?

A: Copper prices are rising due to policy-driven stockpiling, tight regional inventories, strong grid investment, and limited supply growth.

Is the copper rally speculative?

A: While momentum plays a role, much of the rally is tied to physical market flows and long-term infrastructure demand.

Will copper prices fall soon?

A: Short-term pullbacks are possible, but structural demand and supply constraints may keep prices elevated.

Gold Price Retreats from Record Highs: What’s Next for the Precious Metal? Gold Price Retreats from Record Highs: What’s Next for the Precious Metal? After soaring above $3,100 per ounce, gold prices have pulled back sharply. Is this a temporary dip or the start of a broader correction? |

Gold Fever 2025: Why Experts See $4,500 Ahead Gold Fever 2025: Why Experts See $4,500 Ahead Gold is soaring past $3,200 an ounce in 2025—and analysts aren’t surprised. With global tensions rising and central banks hoarding gold, experts now predict the ... |

Will Gold Reach $5,000—or Even $10,000 per Ounce? A Deep Dive into the Future of Gold Will Gold Reach $5,000—or Even $10,000 per Ounce? A Deep Dive into the Future of Gold Could gold reach $5,000 or even $10,000 per ounce? Explore expert forecasts, economic drivers, central bank activity, and how to prepare for a potential gold ... |