7 Ways a Reverse Mortgage Can Help You in Retirement

|

| Ways a Reverse Mortgage for Retirement |

The staggering $11.81 trillion in housing wealth owned by retirees today, suggests that you may have more equity in your home than you initially believed. One way to tap into this equity is through a reverse mortgage.

In this blog post, we will discuss the numerous ways a reverse mortgage might give you financial security during your retirement years.

Supplementing Retirement Income

One of the primary reasons seniors turn to reverse mortgages is to supplement their retirement income. With a reverse mortgage loan, homeowners who are 62 years or older can turn some of their home value into cash without having to sell their house. This infusion of money might be used to meet ongoing costs, settle debts, or just have a more pleasant retirement.

With a reverse mortgage, the lender compensates you, instead of expecting monthly payments from you as with standard mortgages. Depending on your requirements and preferences, this financial structure may offer either a regular income stream or a lump amount. It is comparable to having a home-backed personal retirement fund.

Debt Consolidation

Many retirees find themselves carrying various debts into their retirement years, such as credit card debt, medical bills, or outstanding loans. These financial obligations can weigh heavily on seniors' budgets, making it difficult to enjoy retirement to the fullest.

A reverse mortgage can help by providing a lump sum payment or a credit line that can be used to consolidate and pay off these debts. You can lessen your monthly financial load and increase your overall financial security by doing this.

Covering Healthcare Costs

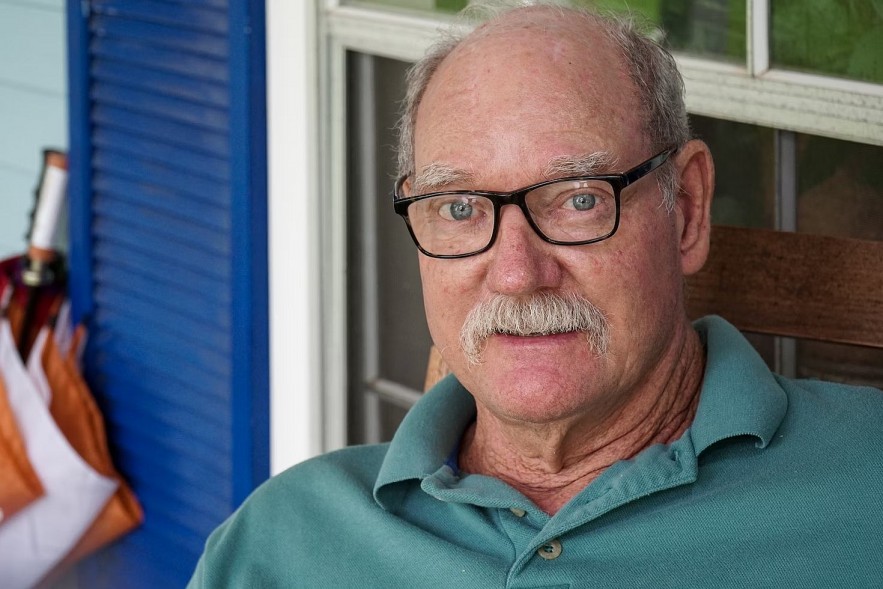

|

| With a reverse mortgage loan available to cover these medical costs |

Medicare or other insurance plans provide some protection, but seniors often incur out-of-pocket medical costs that exceed expectations due to healthcare prices rising with age. With a reverse mortgage loan available to cover these medical costs, your health and well-being will always come first.

Healthcare costs continue to soar, making accessing your equity through a reverse mortgage an invaluable way of providing yourself with top care without jeopardizing financial security.

Home Improvements and Maintenance

Our dwellings might need to be modified as we age to meet our changing demands. Ramps, wider doors, railings, and even complete home renovations might be included in these adaptations to make a location more accessible.

A reverse mortgage can fund these home improvements, allowing you to age in place comfortably and safely. By maintaining your home's value, you also ensure that your home equity remains a valuable financial asset for the future.

Delaying Social Security Benefits

Another strategy that a reverse mortgage can facilitate is delaying the collection of Social Security benefits. By waiting until your full retirement age or even beyond, you can increase the monthly benefits you receive from Social Security.

During this waiting period, a reverse mortgage can provide the necessary income to cover living expenses, reducing the need to tap into your retirement accounts prematurely. This approach can lead to a more financially secure and stable retirement, as it maximizes your Social Security benefits over the long term.

Enhancing Your Lifestyle

Retirement is a time to unwind, discover new interests, and fully appreciate life. Whether you wish to engage in more leisure pursuits, follow a passion for travel, or take up new interests, a reverse mortgage can provide you with the additional funds you require to improve your lifestyle.

You may live comfortably without worrying about running out of money with the financial independence a reverse mortgage offers. Saying ‘yes’ to experiences and possibilities that might otherwise have been out of reach can be made possible through it.

Estate Planning and Legacy

Reverse mortgage funds should only be used to enhance your retirement lifestyle. Eventually, you must repay them when selling or passing away, leaving an everlasting legacy behind for loved ones in your will or estate planning.

Once your reverse mortgage has been paid off, if its value continues to increase over time there may still be equity that can be passed onto heirs or beneficiaries as an enduring financial legacy. This residual equity can help create meaningful financial legacies while still enjoying its advantages during your lifetime.

Final Thoughts

For seniors wishing to safeguard their retirement and find financial security, a reverse mortgage can be a potent financial tool. A reverse mortgage offers a handy and adaptable option to access the equity in your home, whether you need more money, want to pay off debt, or just want to improve your lifestyle.

However, it's essential to approach a reverse mortgage with diligence and comprehend all of the conditions and obligations attached. Professional financial advisors or reverse mortgage specialists can assist in making decisions tailored specifically to your unique needs and goals. Reverse mortgages can be an invaluable addition to your retirement planning arsenal, providing numerous avenues for improving financial status and making for a less hectic retirement experience.

Top 10 Best States for Retirement in America Top 10 Best States for Retirement in America What will your retirement look like? If you are planning to relocate in this stage, find out top 10 best states that help you're no ... |

10 Best Job Search Sites For Older Americans 10 Best Job Search Sites For Older Americans It's hard to find a job when you are a retiree living in the United States, but these websites will help you with that. |

How To Get the Best Small Business Loans In The UK Today How To Get the Best Small Business Loans In The UK Today If you are wanting to open a business in the UK, this guide will help you solve your problems with small business loans and possible ... |