5 Dangerous Investment - Beware of these Investment in 2021

This investment is nothing but trouble

|

| Photo: Finacial Times |

The largest digital token in the world by market cap hit an early morning high on Jan. 3 of $34,000. For some context, bitcoin has doubled since Nov. 27, is up 200% since mid-October, and has risen 363% over the trailing-12-month period. Bitcoin's implied market cap of $628.2 billion now accounts for nearly 73% of the $866.3 billion in value tied up in more than 8,100 digital tokens.

Why is bitcoin rallying? Search any number of social media platforms and you'll get no shortage of responses from enthusiasts. Bitcoin bulls often suggest that its competitive edge, community consensus, and game-changing potential to transform payment processing made this rally easy to predict.

As for me, I don't believe bitcoin is unique in any way, save for being one of the preferred investment mediums on cryptocurrency exchanges. In other words, if investors want to buy a less-popular token, they'll usually need to exchange their fiat currency to bitcoin first before making their purchase. That, my friends, is the only true utility that bitcoin serves.

Below is a growing list of reasons I believe bitcoin is the most dangerous investment of 2021.

The idea of shortage has been pulled out of skinny air

Bitcoin bulls usually level to its so-called laborious cap of 21 million tokens as proof of its shortage. Easy economics tells us that if demand for a great exceeds provide, and provide is proscribed, the worth of that good ought to rise. Case closed, proper?

Not exactly.

You see, we’re not speaking a couple of bodily good being in restricted provide. Bitcoin’s token cap is nothing greater than an arbitrary determine plucked from skinny air. Bodily gold is taken into account scarce as a result of we will not make any extra gold than what could be discovered and mined on planet Earth. That is not the case with bitcoin. Group consensus may result in a rise within the token restrict. The possibility of this occurring could be small, however it’s not 0%.

Bitcoin provides the notion of shortage, and this falsity has helped drive its valuation greater.

There’s minimal utility

You will additionally hear about bitcoin being the way forward for world funds. Once more, this is not completely correct or attainable.

Whereas the variety of companies accepting bitcoin as fee is climbing, the precise share of companies prepared to just accept bitcoin is tiny. In response to monetary companies firm Fundera, solely round 2,300 U.S. companies settle for bitcoin as fee. But, the U.S. Census Bureau finds there are 32.5 million companies within the U.S., together with sole proprietorships. Even when we simply counted companies which have an worker, that is 2,300 out of seven.7 million firms accepting bitcoin.

Plus, roughly 40% of bitcoin tokens are held by traders and stored out of circulation. That leaves about 11.2 million bitcoin for transactions. The worth of those tokens is near $380 billion. In 2019, world gross home product totaled $142 trillion.

Bitcoin has no path to game-changing utility, cites thefutureraise.

It's not a store of value

|

| Photo: Forbes |

No matter how much bitcoin enthusiasts want to equate bitcoin to gold, it's never going to be a store of value.

Store of value assets usually have identifiable relationships to government-backed fiat currencies, and they aren't all that volatile. For instance, gold has an identifiable inverse relationship with the U.S. dollar, and it's buoyed by physical scarcity.

Bitcoin doesn't have any identifiable relationships to government-backed fiat currencies. Enthusiasts would like you to believe that an inflated U.S. money supply is good news for bitcoin, but that would only be true if it had some sort of like-for-like federal government backing and had true scarcity -- neither of which is true.

Bitcoin has also lost 80% of its value multiple times over the past decade, including a handful of instances when it was halved in roughly a 24-hour period. That's not how store-of-value assets behave.

You have no ownership in the underlying blockchain

Bitcoin bulls are also quick to point out how bitcoin's blockchain is revolutionizing the payment and settlement process. While it's true that blockchain offers plenty of intrigue, buying bitcoin doesn't give token holders any ownership in the underlying architecture that might actually be worth something.

What's more, it's foolish (small f) to assume that bitcoin's blockchain is superior. Bitcoin may have first-mover advantage, but there are hundreds of ongoing blockchain projects that offer possibilities beyond the financial space.

There's virtually no barrier to entry

It's also important to note that the cryptocurrency space has virtually no barrier to entry. All it takes is some time and money to develop blockchain with or without a tethered digital currency. There are exactly zero guarantees that blockchain will be adopted on a broad scale, or that bitcoin will be in any way necessary.

There are a number of blockchain projects in development that may work with fiat currencies, or without a digital token at all.

It's not just bitcoin that's dangerous

Keep in mind that owning bitcoin isn't the only way you can gain exposure to this dangerous investment. The Grayscale Bitcoin Trust (OTC:GBTC) owns 607,038 bitcoin and essentially acts as a basket fund that investors can buy. Of course, those investors will pay a ridiculous 2% fee annually for the right to buy the Grayscale Bitcoin Trust, and may have to buy in at a premium, as in years past.

Likewise, business intelligence company MicroStrategy (NASDAQ:MSTR) sunk more than $1.1 billion in balance sheet cash into bitcoin. This cryptocurrency stock issued debt just to buy extra bitcoin. Meanwhile, MicroStrategy's sales through the first months of 2020 were down 1%, while its operating losses widened, according to The Motley Fool.

Top Apps for Learning and Playing Chess from Your Phone or Tablet Top Apps for Learning and Playing Chess from Your Phone or Tablet |

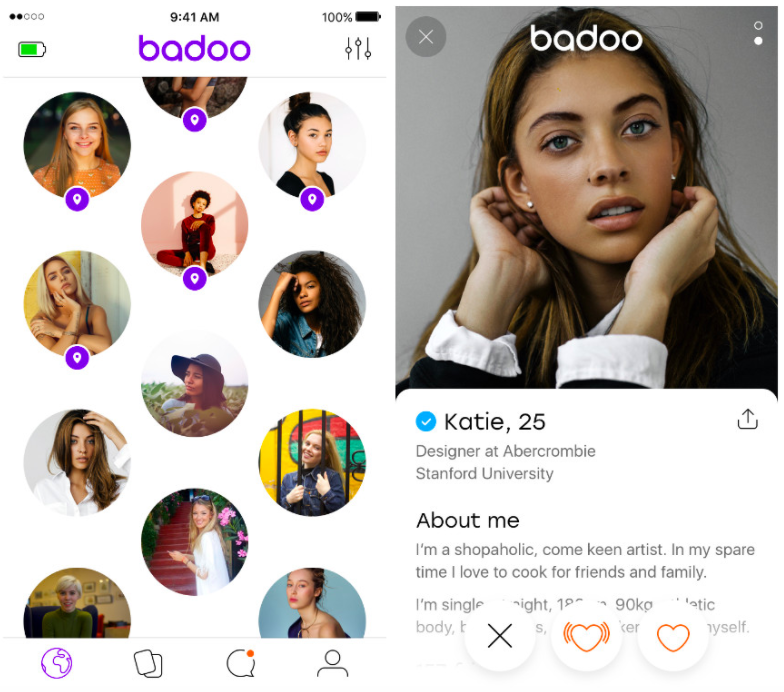

Top 10 safest dating apps in 2021 Top 10 safest dating apps in 2021 |

Top 10 Best Sites to Play Chess Online for Free Top 10 Best Sites to Play Chess Online for Free |