Who is Muhammad Yunus - Biography, Early Life, Education And Career

Muhammad Yunus: Short Biography

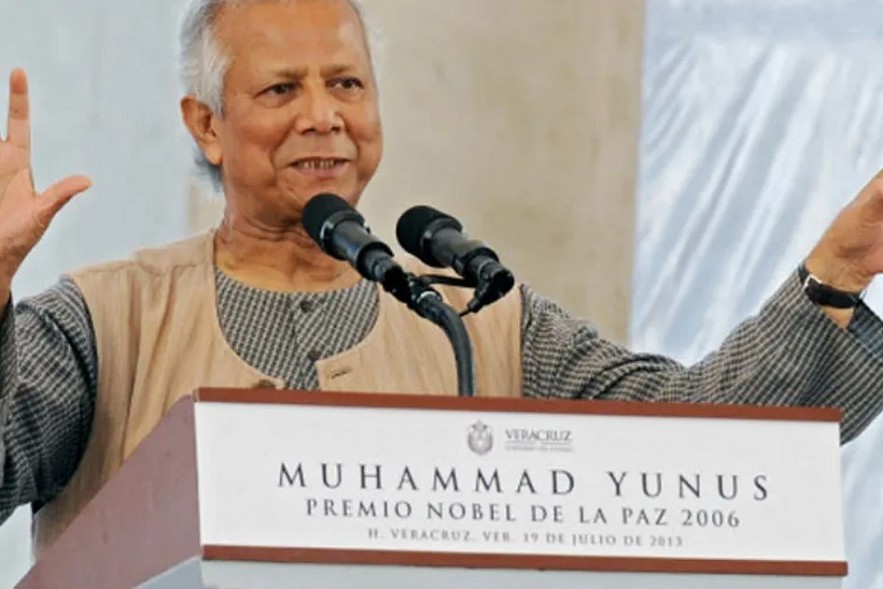

Muhammad Yunus is a Bangladeshi economist who was born on June 28, 1940, in Chittagong, East Bengal, which is now Bangladesh. He started Grameen Bank, an organization that helps poor people build creditworthiness and become financially independent by giving them small loans with no collateral.

Yunus and Grameen won the Nobel Peace Prize in 2006. Yunus was put in charge of an interim government in Bangladesh on August 6, 2024. This was after widespread political unrest and the resignation and flight of former prime minister Sheikh Hasina Wazed.

Leadership of 2024 Interim Government

In July 2024, student protests broke out in Bangladesh. They wanted the rules for hiring people for civil service jobs to be changed. Protests quickly turned into a larger movement against the government, which led to calls for Sheikh Hasina Wazed to step down by early August. Waker-uz-Zaman, the head of Bangladesh's army, confirmed that Hasina had quit on August 5 and said that an interim government would be set up soon. Hasina left the country and is now reportedly staying in India for a short time.

After Hasina left, Nahid Islam, a very important student leader, called for the Bangladeshi Parliament to be dissolved and Yunus to lead a temporary government. On August 6, President Mohammad Shahabuddin Chuppu gave in to both demands. Later that same day, Yunus accepted the job offer. Yunus is in charge of bringing peace and order back to Bangladesh, which is currently going through a national crisis that has turned violent and vandalized.

|

| Muhammad Yunus, the Nobel Peace Prize laureate who’ll head Bangladesh’s interim government |

Muhammad Yunus: Early Life, Education

Born on June 28, 1940, Muhammad Yunus was the third of nine children to a Bengali Muslim Saudagar family in Bathua, Hathazari, Chittagong District, Bengal Presidency.His parents were jeweller Haji Dula Mia Soudagar and Sufia Khatun. Early childhood in the village. In 1944, his family moved to Chittagong, and he attended Lamabazar Primary School instead of his village school.Psychological illness plagued his mother by 1949.Graduating from Chittagong Collegiate School, he ranked 16th out of 39,000 students in East Pakistan.He attended Jamborees in West Pakistan and India in 1952 and Canada in 1955 while active in Boy Scouts during his school years. In his later years at Chittagong College, Yunus participated in cultural activities and won drama awards.After enrolling in the Economics Department at Dhaka University in 1957, he earned his BA in 1960 and MA in 1961.

Upon graduation, Yunus became a research assistant for Nurul Islam and Rehman Sobhan at the Bureau of Economics.[16]He became a Chittagong College economics lecturer in 1961.He had a profitable packaging factory on the side during that time.In 1965, he won a Fulbright scholarship to study in the US. He earned a PhD in economics from Vanderbilt University's GPED program in 1971.Yunus taught economics as an assistant professor at Middle Tennessee State University in Murfreesboro from 1969 to 1972.

In 1971, Yunus and other Bangladeshis in the US established a citizen's committee and the Bangladesh Information Center to advocate for liberation during the Bangladesh Liberation War.[16]He also published the Bangladesh Newsletter from his Nashville home. He joined Nurul Islam's Planning Commission in Bangladesh after the war. However, he left the job due to boredom and joined Chittagong University as Economics department head.After witnessing the 1974 famine, he initiated a rural economic program to reduce poverty as a research project. He created a three-share farm called Nabajug (New Era) Tebhaga Khamar in 1975, which the government adopted as the Packaged Input Programme.Yunus and his team proposed Gram Sarkar, a village government program, to enhance project effectiveness.[In the late 1970s, President Ziaur Rahman established 40,392 village governments as a fourth layer of government in 2003. The High Court declared village governments illegal and unconstitutional on August 2, 2005, in response to BLAST's petition.

His idea of microcredit for supporting innovators in developing countries influenced programs like Info Lady Social Entrepreneurship.

Early Career

Yunus found that small loans could make a big difference to poor people in 1976 while visiting the poorest households in Jobra, near Chittagong University. Village women making bamboo furniture had to take out expensive loans to purchase bamboo and repay their profits. Traditional banks refused to give poor people small loans at reasonable interest due to high default risk.Yunus believed that microcredit was a viable business model because the poor would not need to repay the money.Yunus loaned US$27 to 42 village women, who profited by BDT 0.50 (US$0.02) each. Microcredit is Yunus' idea.

Yunus obtained a government loan from Janata Bank in December 1976 to assist the poor in Jobra. The institution continued to borrow from other banks for its projects. In 1982, it had 28,000 members. From 1 October 1983, the pilot project became Grameen Bank (also known as "Village Bank"), serving poor Bangladeshis.Grameen issued US$6.38 billion to 7.4 million borrowers by July 2007.The bank uses "solidarity groups" to guarantee repayment. These small informal groups apply for loans, co-guarantee repayment, and support each other's economic self-improvement.

Grameen began diversifying in the late 1980s by maintaining fishing ponds and irrigation pumps like deep tube wells.From 1989, these diverse interests split into separate organizations. Fisheries and irrigation projects became Grameen Motsho ("Grameen Fisheries Foundation") and Grameen Krishi ("Grameen Agriculture Foundation").Grameen now encompasses a variety of profitable and non-profit ventures, such as Grameen Trust and Grameen Fund, which manage equity projects like Grameen Software Limited, Grameen CyberNet Limited, and Grameen Knitwear Limited. Grameen Telecom also holds a stake in Grameenphone (GP), the largest private phone company in Bangladesh. From March 1997 to 2007, GP's Village Phone (Polli Phone) project provided cell phones to 260,000 rural poor in over 50,000 villages.

The Grameen microfinance model's success sparked efforts in over 100 developing countries, as well as developed nations like the United States.Many microcredit projects continue Grameen's focus on women. Over 94% of Grameen loans have gone to women, who are disproportionately poor and more likely to support their families.

Yunus was named an Ashoka: Innovators for the Public Global Academy Member in 2001 for his work with Grameen.According to Rashidul Bari's book Grameen Social Business Model, Grameen's social business model (GSBM) has evolved from theory to inspired practice, being adopted by universities, entrepreneurs, and corporations worldwide. Rashidul Bari says Yunus showed how Grameen Social Business Model can empower poor women and alleviate their poverty through Grameen Bank. Bari suggested that Yunus' ideas show that the poor are like a "bonsai tree" and can achieve great things if given access to social businesses that can help them become self-sufficient.

Pioneering Microcredit and Grameen Bank

|

| Muhammad Yunus |

Yunus even asked students to help farmers in the fields, but he came to the conclusion that teaching farmers how to farm would not help the large group of poor people who didn't own any land and had no assets. He thought that what the poor needed was access to money that could help them start small businesses. He knew that traditional moneylenders charged very high interest rates. Yunus started a project in 1976 called "micro" loans to help poor people in Bangladesh get the money they needed.

People who need small loans, like $25 or less, join lending groups. Borrowers are more likely to pay back their loans when they have support from other people in the group. The Bangladeshi government turned the Grameen Bank Project into a separate bank in 1983, though the government still owned a small part of the bank. Other types of microloans have sprung up around the world because of Grameen.

Politics

Yunus got involved in Bangladeshi politics in February 2007 when he started a party called Nagorik Shakti (Citizen Power) and said he was going to run for office. His announcement came at a time when the country's two main parties, the Awami League and the Bangladesh National Party, were in a state of emergency and fighting very badly. Yunus said that his movement would work to get rid of corruption and restore good government. But in May 2007, Yunus gave up on starting the party because he didn't have enough support.

After the documentary film Caught in Micro Debt came out in 2010, Yunus and the Grameen Bank got a lot of attention. The movie not only said bad things about microloans, but it also said that Yunus and the bank had stolen money from Norway. The Norwegian government later cleared both of them, but the Bangladeshi government started an investigation anyway. In 2011, Yunus was fired as managing director of Grameen by the country's central bank, which said he had to retire at age 60. Yunus, who turned 60 in 2000, immediately went to court to fight the decision. But in the end, Bangladesh's courts upheld his removal. Yunus said that his firing was politically motivated and planned by Sheikh Hasina Wazed, who had been his rival for a long time.

Literary Contributions and Global Recognition

In 2010, Yunus wrote Building Social Business: The New Kind of Capitalism That Serves Humanity's Most Urgent Needs. In 2017, he wrote A World of Three Zeroes: The New Economics of Zero Poverty, Zero Unemployment, and Zero Net Carbon Emissions. The Bangladeshi Independence Day Award (1987), the World Food Prize (1994), and the U.S. Presidential Medal of Freedom are some of the awards he has received. The King Hussein Humanitarian Award was given to him for the first time (Jordan, 2000).

Criticism of Muhammad Yunus

Some people don't like Yunus's idea to help poor people get loans. People say that the interest rates on microfinance loans are unusually high because there is no collateral and there are costs involved in managing small loans.

Yunus has even said that some groups may have taken advantage of the microcredit system to make money. Also brought up is the huge rise in the amount of microcredit. As it spread around the world, it became less likely that borrowers would be watched and kept from getting too deep in debt, like they used to be.

Bangladesh National Anthem: English Translation, Original Lyrics And History Bangladesh National Anthem: English Translation, Original Lyrics And History "Amar Sonar Bangla" ('My Golden Bengal') is the national anthem of Bangladesh. Take a look at its history, original lyrics, English translation. |

Who is Muhammed Aziz Khan - Richest Person in Bangladesh: Biography, Personal Life And Net Worth Who is Muhammed Aziz Khan - Richest Person in Bangladesh: Biography, Personal Life And Net Worth According to American business magazine Forbes, Summit Group Chairman Muhammad Aziz Khan is among the world's wealthiest individuals. |

Top 10 Free Websites to Download/Watch Bengali Web Series Top 10 Free Websites to Download/Watch Bengali Web Series How can we download and watch Bengali online series? Here is a list of our top ten favorite websites! |

10 Best FREE Sites to Watch Euro 2024 Live in Bangladesh (Without Cable) 10 Best FREE Sites to Watch Euro 2024 Live in Bangladesh (Without Cable) Bangladeshi football fans are preparing to watch the UEFA Euro 2024 tournament live. This is your ultimate guide to watching Euro 2024 online from Bangladesh, ... |