Top 12 Largest Nickel Mines of the World by Production

|

| Top Largest Nickel Mines by Production Today |

Overview: Nickel Production in the World

Through the production of cobalt blue, nickel production began on a global scale in 1824. The first large-scale production, however, started in Norway in 1848. With the discovery of the metal in Canada, Russia, and South Africa, nickel production began to advance and demand for the metal increased in the late 19th and early 20th centuries.

Out of the 95 million metric tons of reserves worldwide, Indonesia currently has the largest amount of nickel reserves, at 21 million metric tons. In 2022, it is predicted that Indonesian mines will produce 1.6 million metric tons of nickel. With this quantity, Indonesia now leads the world in nickel mine production.

Since 2010, the amount of nickel mined in Indonesia has increased significantly—by more than six times. In 2022, the output of the nation's nickel mines made up almost half of the world's nickel production. In the same year, The Philippines produced 330,000 metric tons of nickel, making it the second-largest producer after China. The largest nickel mines in the world in terms of production volume are located in Russia, which was the third-largest nickel producer in 2022.

Coin production was nickel's first widely used application. However, it is quickly elevating to the position of one of the most crucial elements in EV batteries. The global EV market is anticipated to grow at a CAGR of 18.2% between 2021 and 2030, reaching $823.75 billion. Global EV sales were 2 million in 2020 and rose to 4.2 million in 2021, a rise of more than 100%.

In addition to the EV sector, the aerospace and defense sectors also present growth opportunities for the nickel market. Due to nickel's heat resistance and metal integrity, the aerospace and defense industries use nickel alloys for jet engine turbines, exhaust valves, thermostat valves, tanks, and piping.

Nickel is most frequently used to make stainless steel. The production of stainless steel for kitchen appliances, the chemical and metallurgical industries, as well as other industries, uses more than 66% of the world's nickel ore.

The value of the global nickel market, which was $33.31 billion in 2020, is predicted to increase to $59.14 billion by 2028 at a CAGR of 7.3%, according to Fortune Business Insights.

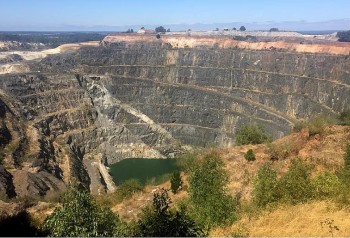

How is nickel mined and processed?The size, grade, morphology, and depth of the nickel deposit under consideration are just a few examples of the many variables that affect how nickel is mined and processed. Sulfide nickel deposits are frequently mined using underground extraction techniques, in contrast to lateritic nickel deposits, which are typically extracted from open pits via strip mining. After extraction, nickel ore is crushed and nickel-bearing material is separated from other minerals using a variety of physical and chemical processing techniques to create higher-grade concentrates. Prior to the final stage of refinement using pyrometallurgical and hydrometallurgical processes, the concentrates are then smelted in a furnace. How bad is nickel mining for the environment?Significant environmental issues associated with nickel mining include air and water pollution, habitat destruction, community uprooting, disruption of wildlife migration patterns, greenhouse gas emissions, and carbon-intensive energy use. Companies that mine nickel and want to supply the EV market are under pressure to reduce their operations' environmental impact. |

Top 10+ Biggest Nickel Mines in the World by Production Today

According to various sources, including GlobalData and Miningintelligence, the present study presents a list of the ten most significant nickel mines in terms of production for the period of 2023/2024 (Ranked by KnowInsiders.com).

1. Kola MMC Mine in Russia

The first place winner is Norilsk Nickel's (Nornickel) Kola division, which has five active mines.

The company's nickel refining hub, which is situated on the Kola Peninsula close to the borders with Norway and Finland, is a complex that is supplied by the Severny and Kaula-Kotselvaara mines.

The brownfield mine, owned by MMC Norilsk Nickel, is expected to produce 151.03 thousand tonnes of nickel in 2023.

Nornickel, which is being scrutinized for its environmental impact, has promised to spend about $5 billion over the following ten years to clean up the lines on the Kola Peninsula.

2. Sorowako Mine in Indonesia

In Sorowako, on the island of Sulawesi, PT Vale has been producing nickel in matte from lateritic ores at its mining and processing facilities since 1968. Vale is the owner of the Sorowako Mine, which is situated in South Sulawesi, Indonesia.

Long-term contracts are used to sell production for refining. Production for 2020 was 72,000 tonnes, and the total area is 190,509 hectares. In 2023, an estimated 77.27 thousand tonnes of nickel were produced at the surface mine. Till 2045, the mine will be in operation.

3. Nickel West in Australia

Third place goes to BHP's Nickel West operations, which have three active mines. High grade nickel sulphide ore is mined at the Cliffs and Leinster underground mines as well as Rocky's Reward open pit mine, while low grade sulphide ore is extracted from Mt. Keith, a sizable open pit operation.

BHP is increasing its exposure to nickel by purchasing Western Australian nickel tenements. The amount produced in 2017 was 75,000 tonnes.

4. Taganito Mine in Philippines

The Taganito Mine is a surface mine located in Surigao del Norte, Philippines. Owned by Nickel Asia, the greenfield mine produced an estimated 73.89 thousand tonnes of nickel in 2023. The mine will operate until 2049.

5. Rio Tuba Mine in Philippines

Owned by Nickel Asia, the Rio Tuba Mine is a surface mine situated in Palawan, Philippines.

The greenfield mine produced an estimated 46.78 thousand tonnes of nickel in 2023. The expected mine closure date is 2028.

The open pit operation exports saprolite and limonite ore and provides limonite ore and non-mining services to the adjacent Coral Bay HPAL plant.

6. Cerro Matoso Mine in Colombia

The Cerro Matoso Mine is a surface mine situated in Cordoba, Colombia. Owned by South32, the brownfield mine produced an estimated 43.8 thousand tonnes of nickel in 2023. The mine is expected to operate until 2036.

7. Ambatovy Project in Madagascar

The Ambatovy Project is a surface mine situated in Atsinanana , Madagascar. Owned by Sumitomo, the brownfield mine produced an estimated 40 thousand tonnes of nickel in 2023. The mine will operate until 2048.

8. Weda Bay Project in Indonesia

Located in Maluku, Indonesia, the Weda Bay Project is owned by Tsingshan Holding Group. The surface mine produced an estimated 40 thousand tonnes of nickel in 2023. The mine will operate until 2069.

9. Voisey’s Bay Mine in Canada

The Voisey’s Bay Mine is a surface and underground mine located in Newfoundland and Labrador, Canada. Owned by Vale, the greenfield mine produced an estimated 39.67 thousand tonnes of nickel in 2023. The mine will operate until 2035.

10. Raglan Mines in Canada

The Raglan Mines is an underground mine located in Quebec, Canada, and is owned by Glencore Plc. In 2023, the brownfield mine is expected to produce 39.44 thousand tonnes of nickel. The mine is anticipated to close in 2035.

11. Murrin Murrin Mine in Australia

Surface mining is done at the Murrin Murrin Mine in Western Australia, Australia. The greenfield mine, owned by Glencore Plc, is anticipated to produce 36.74 thousand tonnes of nickel in 2023. The mine should continue to run until 2043.

12. Block 21 in Oman

The Sultanate of Oman may become a major producer of nickel, a key mineral at the center of the current global transition to clean energy, thanks to the development of a nickel-laterite mine that was given the go-ahead earlier this year.

Knights Bay, a strategic minerals miner based in the UK, received a mining concession for Block 21 in the Wilayat of Ibra in the North Al Sharqiyah Governorate in March of this year. The nickel laterite mine, which covers an area of 1,444 sq km, is also thought to contain rich deposits of strategic minerals, such as cobalt, chrome, and iron ore in addition to nickel.

According to a recent update on Block 21's promising mineral potential, the mine may end up being a significant source of nickel for the expanding global clean technology sector.

Nickel production from Block 21 is expected to be marketed in 2030-31, at which point “demand is forecast to exceed supply and should point towards higher nickel prices.

World nickel reservesThe U.S. Geological Survey calculated that there are more than 95 million tonnes of nickel reserves worldwide. The countries with the largest known reserves are Brazil (17%), Australia (22%), and Indonesia (22%). With an estimated 2 million tonnes of nickel reserves, Canada ranks seventh globally and accounts for 2% of global reserves. |

Top Biggest Nickel-Producing Countries in the World

|

| World mine production of nickel, by country |

1. Indonesia

Mine production: 1.6 million MT

By far the largest producer, Indonesia is a prime example of a nation looking to capitalize on the nickel market's explosive growth. Its output of the base metal increased dramatically from 345,000 metric tons (MT) in 2017 to an astounding 1.6 million MT in 2022. There are 21 million MT of nickel reserves in Indonesia.

Indonesia is actively developing its EV battery industry, and its proximity to China, the current global leader in EV production, makes for an ideal situation. The nation greeted the opening of its first facility to process nickel for use in EV batteries in May 2021. The Center for Strategic and International Studies claims that several more such projects are in the works.

2. Philippines

Mine production: 330,000 MT

For a long time, the Philippines has been a major producer of nickel and an exporter of nickel ore. The Philippines, another country in close proximity to China, is home to 30 nickel mines at the moment, including Rio Tuba, which is run by Nickel Asia, one of the country's top nickel ore producers. The Philippines increased its nickel output to 420,000 MT in 2019 after suffering a minor setback between 2017 and 2018, when it fell from 366,000 MT to 340,000 MT.

The country is still dealing with record rainfall that has flooded mining operations, so the upward trend was only temporary. The island nation's nickel production decreased by 50,000 MT in 2022 from the previous year to 330,000 MT.

3. Russia

Mine production: 220,000 MT

Despite being ranked third on this list, Russia's production of nickel has decreased recently. The nation's total nickel production in 2018 was 272,000 MT, but in 2022 it was only 220,000 MT.

One of the biggest producers of nickel and palladium in the world is Norilsk Nickel of Russia (MCX:GMKN, OTC Pink:NILSY). In order to increase its mining output by 2030, the company intends to invest US$35 billion in energy infrastructure upgrades over the following ten years. The conflict between Russia and Ukraine was to blame for the 2022 spike in nickel prices.

4. New Caledonia

Mine production: 190,000 MT

The production of nickel in this French nation off the coast of Australia has also decreased recently, falling from 220,000 MT in 2019 to 190,000 MT in 2022. The price of nickel has a significant impact on the nation's economy.

To protect its domestic smelting and refining industry, which is a major source of revenue, New Caledonia has previously resisted selling nickel ore directly to major nickel consumers like China. The New Caledonian government did, however, grant requests from nickel miners to export more than 2 million MT of ore to China in December 2016.

Major mining company Vale (NYSE:VALE) sold its ownership stake in the New Caledonian Goro nickel mine in 2020. Currently, the mine is 51 percent owned by provincial authorities and local interests, with significant stakes also held by global commodities trader Trafigura and EV manufacturer Tesla (NASDAQ:TSLA).

5. Australia

Mine production: 160,000 MT

Australia, one of the top producers of nickel, saw an increase in production from 2021 to 2022, from 151,000 MT to 160,000 MT. With its Nickel West division, BHP (NYSE:BHP,ASX:BHP,LSE:BHP) is one of the top producers in the nation.

Several mines shut down in the wake of the 2014–2016 nickel price crash. Miners in Australia have, however, given the base metal another chance since the metal's recovery. Among them is Mincor Resources (ASX:MCR,OTC Pink:MCRZF), the operator of the three-mine Kambalda nickel operation in Western Australia. The fact that Kambalda processed its first ore in May 2022 and generated its first reportable revenue of AU$25.3 million in June 2022 was a significant highlight of Mincor's 2022 annual report.

6. Canada

Mine production: 130,000 MT

Between 2019 and 2022, Canada's nickel production fell from 180,000 MT to 130,000 MT. The Sudbury operation of Vale is situated in the Sudbury Basin, which is the second-largest supplier of nickel ore in the world.

Glencore (LSE:GLEN,OTC Pink:GLCNF), which owns the Raglan mine in Quebec and the Sudbury Integrated Nickel Operations in Ontario, is another significant producer of nickel in Canada. The Nickel Rim South mine, the Fraser mine, the Strathcona mill, and the Sudbury smelter are all part of the Sudbury operations.

7. China

Mine production: 110,000 MT

In recent years, China's nickel production has remained largely stable. China is not only the world's top producer of nickel, but it also dominates the market for nickel pig iron, a low-grade ferronickel used in stainless steel. A significant nickel producer in China is Jinchuan Group, a division of Jinchuan Group International Resources (HKEX:2362).

Due to its significant contribution to the production of stainless steel, China also affects the dynamics of nickel prices.

8. Brazil

Mine production: 83,000 MT

Brazil's nickel production has been increasing in recent years, rising from 74,400 MT in 2019 to 83,000 MT in 2022. Through 2025, the CAPEX for Brazil's nickel project pipeline is expected to be $1.06 billion USD.

The Jaguar nickel project in the Carajás mineral province was sold to Centaurus Metals (ASX:CTM,OTCQX:CTTZF) in April 2020 by Vale, a significant producer with headquarters in Brazil. A resource of 40.4 million MT at 0.78 percent nickel, or 315,000 MT of contained nickel, is present at the project. The Brazilian government chose three mining projects, including Jaguar, to receive assistance in obtaining environmental permits.

9. United States

Mine production: 18,000 MT

Last but not least, US nickel production increased from 14,000 MT in 2019 to 18,000 MT in 2022. According to the US Geological Survey, nickel was added to the list of critical minerals for the US in early February 2022.

The only major nickel mining project in the US is the Eagle mine. Lundin Mining (TSX:LUN,OTC Pink:LUNMF) owns the small, high-grade nickel-copper mine project, which is situated on the Yellow Dog Plains in the Upper Peninsula of Michigan.

Top 10+ Largest Gold Mines in the World by Production Top 10+ Largest Gold Mines in the World by Production There are currently more than 1300 gold mines open around the world.Where, exactly, are the world's most productive gold mines right now? |

Top 15+ Largest Silver Mines in the World by Production Today Top 15+ Largest Silver Mines in the World by Production Today There are more than 743 silver mines in operation globally today. Find out the 15 plus silver mines in the world right now. |

Top 10 Largest Coal Mines In The World By Reserve Top 10 Largest Coal Mines In The World By Reserve Which coal mine is the biggest in the world? What is its reserve? Check out Top 10 Biggest Coal Mines In The World. |

Top 10+ Largest Lithium Mines in the World by Production Today Top 10+ Largest Lithium Mines in the World by Production Today There are more than 26 lithium mines in operation globally today. Find out the biggest lithium mines by production today. |