How Upcoming Changes to US Retirement Age Impact Americans Over 50

2025 Social Security COLA: How All Benefits To Change and When Will the Payments Arrive 2025 Social Security COLA: How All Benefits To Change and When Will the Payments Arrive |

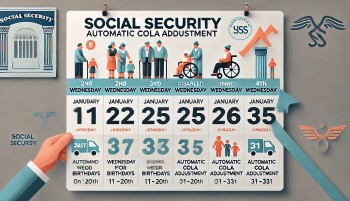

When Will the First COLA-Adjusted Payments Arrive in January 2025? When Will the First COLA-Adjusted Payments Arrive in January 2025? |

|

| US retirement age may change again |

Key Changes to Social Security and Retirement Age

1. Full Retirement Age (FRA) Adjustments

The full retirement age (FRA) is the age at which you can claim your full Social Security benefits without reductions. Currently:

- The FRA ranges between 66 and 67, depending on your birth year.

- Proposed changes may raise the FRA to 68 or higher for future retirees.

Why is this happening?

This adjustment is meant to reflect longer life expectancies, as Americans are living and collecting benefits for more years. By increasing the FRA, the Social Security Administration (SSA) aims to maintain the program’s financial sustainability.

Implications of FRA Changes:

- Delaying retirement will become more important for maximizing benefits.

- Those retiring early (at age 62) will face steeper reductions in benefits as the FRA increases.

| Year of Birth | Current FRA | Proposed FRA |

|---|---|---|

| 1943–1954 | 66 | No change |

| 1955–1959 | 66 + 2-10 months | No change |

| 1960+ | 67 | Likely to increase to 68+ |

2. Taxable Income Threshold Changes

In addition to adjusting the FRA, the SSA will increase the taxable income threshold:

- 2023 Threshold: $160,200

- 2025 Threshold: $176,100

This change ensures that higher earners contribute more to Social Security. By expanding the taxable wage base, the system gains additional funding to support future payouts.

3. Cost of Living Adjustments (COLA)

The annual Cost of Living Adjustment (COLA) is another major change:

- 2024 Increase: 2.5% (based on 2023 economic data).

COLA is designed to keep benefits aligned with inflation. It ensures retirees maintain purchasing power in an economy with rising costs.

Who Will Benefit?

- Retirees receiving Social Security benefits.

- Recipients of disability support and Veterans Affairs benefits.

- Those dependent on fixed incomes, especially as inflation impacts daily living expenses.

4. Early and Delayed Retirement Incentives

Social Security benefits vary significantly depending on the age you begin claiming:

-

Early Retirement (Age 62):

- Monthly benefits reduced by up to 30%.

- A common choice: The median retirement age in the US is 62.

-

Full Retirement Age (FRA):

- No benefit reductions.

-

Delayed Retirement (Up to Age 70):

- Benefits increase by more than 30%.

However, despite the financial advantages of waiting, only 4% of retirees delay claiming benefits until age 70.

| Retirement Age | Monthly Benefit Impact |

|---|---|

| 62 | Reduced by 30% |

| 67 | Full benefit |

| 70 | Increased by 30%+ |

Why These Changes Matter for Americans Over 50For those nearing retirement, these changes may feel daunting but offer an opportunity to reassess and refine financial strategies. While the FRA adjustments aim to stabilize the Social Security system, they also emphasize the importance of personal retirement savings and proactive planning. |

Challenges Facing Future Retirees

1. Rising Living Costs

Even with COLA adjustments, the increasing costs of healthcare, housing, and essentials may outpace benefit increases. Retirees must prepare for financial gaps that Social Security alone may not cover.

2. Health Considerations

Longer life expectancies mean retirees must plan for more years of healthcare expenses, which can become a significant financial burden in later years.

3. Economic Uncertainty

Market volatility and inflation can erode the value of retirement savings, making Social Security benefits an even more critical component of retirement income.

Steps to Adapt to the Changing Retirement Landscape

1. Stay Informed

Understanding the specifics of Social Security changes is the first step. Regularly check updates from the SSA and reliable financial news sources.

2. Optimize Your Claiming Strategy

Work with a financial advisor to determine the best age to claim benefits based on your financial situation, health, and life expectancy.

- Consider waiting until full retirement age or beyond to maximize monthly income.

3. Diversify Retirement Income Sources

Social Security benefits were never designed to be the sole source of retirement income.

- Increase savings: Contribute to 401(k) plans or IRAs.

- Invest wisely: Diversify portfolios to hedge against inflation.

- Consider part-time work: For those retiring early, part-time work can supplement income.

4. Plan for Longevity

Given longer life expectancies, consider strategies to ensure your savings last throughout retirement:

- Budget conservatively.

- Explore annuities or other income-generating investments.

5. Factor in Healthcare Costs

Medicare does not cover all healthcare expenses. Plan for supplemental insurance or out-of-pocket costs, which can be substantial.

Conclusion

The retirement age changes and Social Security adjustments are pivotal in ensuring the system’s sustainability. However, they require Americans over 50 to take a more active role in planning their financial futures. Whether it’s understanding the implications of FRA shifts, maximizing benefits, or managing living expenses, preparation is key.

For personalized advice, consider consulting a financial planner who can help you navigate these changes and make informed decisions to secure your retirement.

FAQs: Upcoming Changes to US Retirement Age and Social Security

To help you better understand the changes to the US retirement age and Social Security, here are some frequently asked questions:

1. What is the Full Retirement Age (FRA)?

The FRA is the age at which you are eligible to receive 100% of your Social Security retirement benefits. Currently:

- If you were born between 1943 and 1954, the FRA is 66.

- For those born in 1960 or later, the FRA is 67.

Future proposals may increase the FRA to 68 or higher.

2. Can I Still Retire at 62?

Yes, you can retire and start claiming Social Security benefits at 62, but your monthly benefits will be reduced by up to 30% compared to waiting until FRA. Early retirement is a tradeoff: lower monthly payments in exchange for starting benefits earlier.

3. Why is the Retirement Age Increasing?

The increase reflects longer life expectancies and aims to address the financial sustainability of the Social Security system. By delaying the age for full benefits, the SSA reduces the strain on the system caused by more retirees collecting benefits for longer periods.

4. What is the Cost of Living Adjustment (COLA)?

COLA is an annual increase in Social Security benefits designed to match inflation. In 2024, the COLA will be 2.5%, ensuring that benefits keep pace with rising costs of living.

5. What Happens If I Wait Until Age 70 to Claim Benefits?

If you delay claiming benefits beyond your FRA, your monthly benefits increase by about 8% per year until age 70.

- For example, waiting until age 70 can boost your benefits by over 30% compared to claiming at FRA.

- This option is ideal for those who expect to live longer or have other income sources to rely on until age 70.

6. How Are Social Security Taxes Changing?

The maximum taxable income for Social Security will rise:

- 2023: $160,200

- 2025: $176,100

This means higher earners will pay more into the system, helping support future benefits.

7. Will These Changes Affect Current Retirees?

For most current retirees, the main change will be the COLA increase in their benefits. Adjustments to the FRA will primarily affect future retirees.

8. How Can I Maximize My Social Security Benefits?

To optimize your benefits:

- Delay claiming benefits until full retirement age or later.

- Consult a financial advisor for strategies tailored to your financial situation.

- Continue working if possible, as higher lifetime earnings can increase your benefit amount.

9. How Do These Changes Impact Disability and Veterans Affairs Benefits?

Recipients of disability support and Veterans Affairs benefits will see increases through the COLA adjustment. This helps these groups maintain purchasing power amid inflation.

10. What Should I Do If I’m Nearing Retirement?

If you’re within a few years of retirement, consider the following steps:

- Review your Social Security statement to understand your estimated benefits.

- Factor in the proposed changes to the FRA when planning your retirement timeline.

- Explore supplemental income options, such as 401(k) plans, IRAs, or part-time work.

11. Will Medicare Be Affected?

Medicare is separate from Social Security, but the two are closely linked. While no specific changes to Medicare are tied to these Social Security updates, retirees should plan for out-of-pocket healthcare expenses, which can rise over time.

12. What’s the Average Retirement Age in the US?

The median retirement age is 62, but this often results in reduced Social Security benefits. Experts encourage working longer, if possible, to maximize financial security.

13. Where Can I Learn More?

For official updates, visit the Social Security Administration (SSA) website: ssa.gov. You can also speak with a financial planner for personalized advice.

Beneficiaries, Payment Schedules for 2025 Social Security Increase Beneficiaries, Payment Schedules for 2025 Social Security Increase For millions of people, Social Security is an essential part of their financial security, and this impending increase emphasizes how important it is to ensuring ... |

2025 Social Security Payment: Key Dates and How to Get Faster 2025 Social Security Payment: Key Dates and How to Get Faster The United States Government has officially finalized the payment schedule for Social Security and other federal assistance programs, including VA (Veterans Affairs), SSI (Supplemental Security ... |

When and How You’ll Get Your December 2024 Social Security Benefits When and How You’ll Get Your December 2024 Social Security Benefits This article outlines the exact payment dates, provides tips for timely receipt, and highlights important updates to Social Security benefits, including the Cost of Living ... |