How to Receive An International Wire Transfer BBVA's Banking Services?

|

| How Do I Receive An International Wire Transfer BBVA? |

BBVA's banking services include checking accounts, savings accounts, and credit cards for individuals and commercial clients. The bank also provides wealth management services. Businesses increasingly rely on cross-border transactions and need payments to go through as quickly as possible, while consumers are used to having their demands fulfilled instantly. How long do international bank transfers take? Unfortunately, there isn’t a definitive answer, although we can give you a good indication. Find out everything you need to know about international bank transfer times, starting with how international wire transfers actually work.

How do you make an international bank transfer (Secure Send transfer) with BBVA Compass?

BBVA Compass offers a number of ways to transfer money internationally:

- Online

- In person at a branch

- Through ATMs

BBVA Compass doesn’t offer international money transfers by phone.

Online

- Log into your BBVA Compass internet banking account

- Move your mouse over the “Payments and Transfers” tab, and click “International transfers”

- Fill in the required information and follow the on-screen prompts

At a BBVA Compass branch

- Gather the relevant information for the recipient bank (more on that below)

- Speak to a teller/cashier, and he or she will walk you through the process

At a BBVA Compass ATM

- To send an international money transfer from a BBVA Compass ATM, you must first go to a branch to enroll in Secure Send and add your transfer beneficiaries

- Insert your ATM or cheque card and enter your PIN

- Select “International Money Transfer” from the main menu

- Enter your customer number and PIN. Both of these will be provided for you at the branch when you enroll in Secure Send

- Select “Send International Money Transfer”

- Follow the on-screen prompts

How does an international wire transfer work?

In most cases, international bank payments are actioned through the SWIFT network – a secure messaging system that banks use to send information. When you send an international bank transfer, banks will use the SWIFT network to ensure that your payment reaches its destination.

However, it won’t always get there directly. Some payments go through intermediaries – also known as corresponding banks – almost like taking a series of connecting flights to arrive at your destination. It’s also worth mentioning that the SWIFT network doesn’t actually move your money, just your payment order.

Read More: What is Banco Bilbao Vizcaya (BBVA): History, Founder, Pros and Cons

How long does an international bank transfer with BBVA Compass take?

|

| Photo: remitly |

Generally speaking, international bank transfers will arrive within one to five working days. Let’s explore what this looks like.

To send an international payment, you simply need to gather all the necessary information (IBAN number, BIC/SWIFT number, recipient’s banking details, etc.) and submit them to your bank, whether that’s in person or via an online banking app. In most cases, international bank transfers can only be processed on business days, provided that they are requested before the cut-off time, which varies from bank to bank.

BBVA offers Secure Send international transfers to 20 different countries. Transferring money using Secure Send guarantees the money will be available in the recipient’s bank account no more than 15 minutes after it was sent. Sending money to countries not available with Secure Send takes longer - up to 5 business days.

Do international wire transfers have fees?

Sending international wire transfers by bank can be expensive. A recent analysis of 40 major U.S. financial institutions found that the median outgoing international wire transfer fee was $45. Costs can also apply when receiving an international wire transfer, with the median fee being $13.

Additionally, banks charge consumers a higher markup than the mid-market rate when converting currency. Banks tend to charge this as a percentage of the total wire transfer amount. Non-bank transfer services can help consumers avoid these expensive markups, with some companies charging customers the mid-market rate.

| BBVA Compass international transfers | Regular fees |

|---|---|

| Incoming international transfer | Free for Secure Send international money transferUp to $15 per transfer for wire transfer |

| Outgoing international transfer | Up to $5 per transfer for Secure Send international money transferUp to $45 per transfer for wire transfer |

What do I need or what should I give to the sender in order to receive an international bank transfer?

Banks are one of the most secure methods of sending wire transfers. That said, they can be slower and more expensive than other money transfer services, especially if you’re sending an international wire transfer. To send a wire transfer by bank, you will typically be asked to provide the following information:

-Recipient full name

-Sender full name

-Recipient phone number

-Sender phone number

-Recipient address

-Recipient bank name and information

-Recipient checking account information

You can fill out this information via a form online or in a local branch.

You will need both routing numbers and bank account numbers for domestic wire transfers within the United States. The ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks which identifies the financial institution from which the funds are sent. Designed by the American Bankers Association (ABA), this system facilitates the sorting, bundling, and delivery of money to the sender’s bank for debit to the recipient’s account. Electronic payment methods rely on ABA RTNs to identify the paying bank or other financial institution for bank wires. And the Federal Reserve Bank uses ABA RTNs when processing funds transfers.

For international wire transfers, you will need to know the recipient’s account international bank account number (IBAN), BIC, or SWIFT code. SWIFT/BIC codes globally identify banks and financial institutions. Used when transferring money between banks, particularly for international wire transfers or SEPA payments, these codes are also used to exchange messages between banks. When transferring funds internationally, you will also need to provide the dollar amount you are sending, and your financial institution may ask you to give a reason for the transfer. Be prepared to provide additional information, as well, as requested by the sending or receiving bank.

What is a wire transfer?A wire transfer is a fast and reliable method of transferring or receiving funds. It allows individuals in different locations to securely send money to other people or organizations across the world via a network of banks or transfer agencies. The traditional method of wiring money is between banks or credit unions by using a network like SWIFT (Society for Worldwide Interbank Financial Telecommunication). This is the most secure method of wiring funds. The term can also refer to any type of electronic money transfer. These can include Automated Clearing House (ACH) payments, money transfer services from companies like Western Union, and even digital payment tools such as PayPal. It is also possible to make wire transfers in cash by visiting a cash office or retail transfer shop. |

Can I use BBVA for international bank transfers?

|

| Photo: bbva |

As a global banking group, BBVA is able to offer safe and reliable money transfer services. BBVA has developed an award-winning mobile app designed to facilitate smooth international payments sent from a BBVA account or in cash.

Exchange rates and fees

Sometimes the costs incurred when arranging an international bank transfer can add up to a great deal more than you may have bargained for. In the interest of transparency, we have taken a look at the exchange rates and transfer fees offered by BBVA for individuals and businesses who require help sending money overseas.

Exchange rates

40 different foreign currencies are available for international money transfers sent with BBVA. However, exchange rates set by BBVA typically incur mark-ups of approximately 3 – 5% above the mid-market rate. It is possible to review the historical evolution of BBVA exchange rates by visiting this page on the website which is updated daily.

Transfer fees

Fees for international transfers can range from $5.00 to up to $45.00 per transfer for customers with a BBVA checking or savings account sending up to $3,000 per day. BBVA Premier and Preferred Clients can utilise the service free of charge.

Additional costs

Recipients will not be charged for receiving or collecting any money sent to them; applicable fees charged will be paid by the customer arranging the money transfer.

How do BBVA transfer fees compare to using a money transfer provider?

Generally speaking, the total cost of a BBVA transfer is pretty expensive, considering the additional costs of exchange rate mark-ups added to the transfer amount. Although the bank has established a wide-reaching network and can guarantee secure money transfers across continents, more affordable deals can be acquired elsewhere through various money transfer operators.

What factors are most likely to slow international bank transfer times?

Although you’d assume that international bank transfer times would be instantaneous, particularly given the rise of online banking, they can be delayed for a number of reasons:

Fraud prevention

One of the main reasons for delays to international wire transfers are the fraud prevention processes and procedures put in place by banks. The SWIFT network requires transfers to pass through up to three correspondent banks before arriving at their destination. Then, once the funds have actually arrived, processing time at the recipient’s bank could delay payment even further.

Incorrect payment details

Another factor that can have a big effect on international bank transfer times is erroneous payment details. Payments can be sent back if any of your beneficiary’s information is incorrect, so before you make a payment, double-check the name of your recipient, the name of their bank, their account number, their IBAN number, and their SWIFT/BIC code.

Bank holidays and weekends

Sometimes, slow international payments are caused by something as prosaic as bank holidays and weekends. Put simply, if the bank is closed, then your payment can’t be processed. If you’re making a payment that needs to be sent as soon as possible, check whether there’s a bank holiday in your recipient’s country beforehand. It’s also a good idea to send your payment at the start of the week so that it has time to arrive and go through processing before the weekend.

Different currencies

Currency conversion can be another drag on international bank transfer times. If your payment needs to be received in a different currency to the one it was sent, processing times can be lengthened.

Different time zones

It might be midday in London, but it’s the middle of the night in Los Angeles. If you want to make sure your international bank transfer goes through as quickly as possible, you should try to send it during business hours in your recipient’s country.

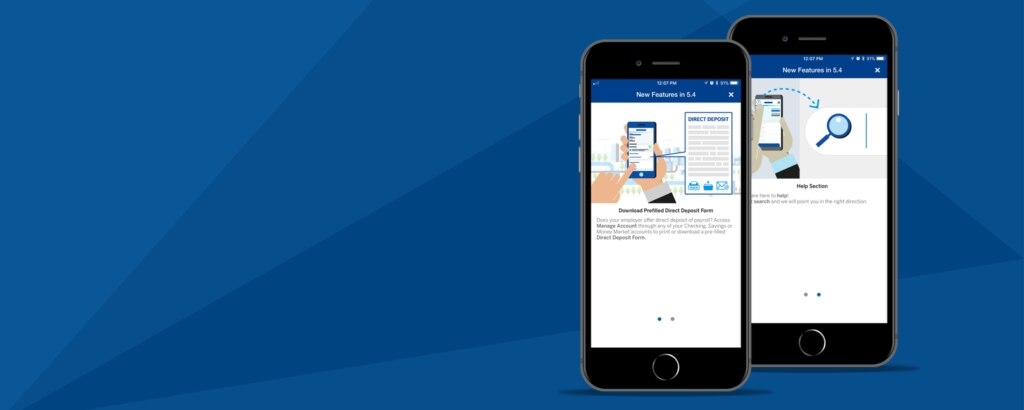

BBVA Compass Mobile Banking AppThe BBVA Compass Mobile Banking App, with a multitude of functionality, features a patent-pending Payments & Transfers functionality which gives customers the ability to schedule a payment or transfer directly from their phone fast. Among the features of Payments & Transfers are the ability to move money between accounts at BBVA Compass or another financial institution, transfer money to other people, view transaction activity, send international money transfers, schedule payments and transfers and much more. To use Payments & Transfers, customers go to the main menu, select Payments & Transfers, choose the account you’ll be sending money from, and then choose the destination account. Then, just enter the amount, the frequency of transfer, the date or date range the money should be sent, review the details and then submit. You can also review the scheduled transactions via Transaction Activity, and cancel any that have not yet been paid. With Manage Destination Accounts, you can add or delete destination accounts. With advanced functionalities, the BBVA Compass Mobile Banking App gives you the ability to bank when, where and however you want. |

What is Banco Bilbao Vizcaya (BBVA): History, Founder, Pros and Cons What is Banco Bilbao Vizcaya (BBVA): History, Founder, Pros and Cons What is Banco Bilbao Vizcaya and when was it established? Scroll down this article to know more detail about BBVA! |

5 Most Powerful Women in Banking of the World 5 Most Powerful Women in Banking of the World Women's role in bank and financial industry have been treasured more than they did in the past. Here is 5 most powerful women in banking ... |

10 Oldest Surviving Banks In The World 10 Oldest Surviving Banks In The World Banking has been a part of life since the early days of human civilization. What is the first bank in the world? |