Facts: Gold Prices are 'Dancing' Around the World Today

The recent surge in global gold demand can be attributed primarily to the increasing interest of central banks in various countries. Currently, the demand for gold remains strong as market participants anticipate potential interest rate cuts by major central banks in the near future. Gold prices have surged in numerous countries, leading to a multitude of consequences.

Gold prices have been fluctuating around $2,100/ounce since December 2023. Occasionally, this valuable commodity even exceeded expectations, reaching an all-time high of $2,360 per ounce, catching markets and traders off guard.

| Gold has risen 14% so far this year, surpassing the S&P 500's 10% gain. On April 19, spot gold hit a new high of $2,1392 per ounce, while gold futures reached an all-time high of $2,413 per ounce on the same day. |

|

| The world is in a gold rush - Image: KnowInsiders.com |

What Factors Contribute to the Surge in Gold Prices?

Gold is commonly seen as a reliable asset for investors seeking a safe haven. Commodity prices tend to experience upward movement during significant geopolitical crises. For instance, we witnessed this phenomenon during the COVID-19 pandemic in 2020, the Russia-Ukraine conflict in 2022, and the local banking crisis in 2023. The US approach and the escalating conflict in Gaza.

Could you please explain the factors behind the recent surge in gold prices?

Experts suggest that the surge in gold and stock prices in recent months can be attributed to the anticipation of interest rate cuts by major central banks such as the US Federal Reserve (Fed) and the European Central Bank (ECB). This has generated a sense of enthusiasm among investors. There has been some progress in containing hyperinflation in recent months, and it appears that monetary easing is a reasonable approach after a prolonged period of interest rates peaking.

However, another factor contributing to this is the aim to minimize loan interest costs. If interest rates are decreased, it would provide relief for businesses by reducing the financial burden of loan repayments. Gold is also advantageous, as it is highly responsive to risk factors.

Furthermore, due to its denomination in USD, gold exhibits a high level of sensitivity to fluctuations in the value of this currency. The value of the US dollar has been steadily declining for several months. When the USD experiences a decline in value, it tends to have an impact on the price per ounce of gold, causing it to rise. It occurs in a systematic manner. Put simply, when the value of the USD decreases, foreign investors will have to shell out more cash to purchase the same quantity of gold.

However, should the price of gold exceed $2,000 per ounce, it would not be unexpected. Gold prices have consistently shattered or established new records since the onset of the COVID-19 pandemic, with notable milestones in August 2020, March 2022, May and December 2023, and most recently in March 2024. In the 2020s, the impressive rise in gold prices can be attributed to the strong demand from central banks, particularly those in emerging economies. This insatiable demand has played a significant role in driving up the value of gold.

Significant Surge in Demand Across the Globe

According to the World Gold Council (WGC), financial institutions made significant purchases of gold in 2022 totaling 1,135 tons, which is a record-breaking amount in the previous 60 years. The upward trajectory persisted in 2023, with a substantial 1037 tonnes of gold being traded. The initial months of 2024 appear poised to mirror this pattern.

Global gold demand experienced a significant surge during the first quarter of 2024, as gold prices consistently reached new heights. Based on data from the WGC, there has been a notable 3% rise in global gold demand during the first quarter of this year compared to the same period last year. This increase, amounting to 1,238 tons, represents the most significant first quarter growth since 2016.

Notably, the purchase of gold is closely tied to the policies of certain nations, including China, Russia, and India. This is driven by their desire to reduce reliance on the US dollar and US bonds, which these countries happen to be the largest holders of.

Gold is widely regarded as a universally accepted form of currency, independent of any specific nation. It is a currency that is not owned by any entity and is immune to bankruptcy.

A surge in demand from Chinese consumers has led to a frenzy of purchases for these tiny "yellow beans," which weigh approximately 1/30 ounce and are priced between 80-87 USD. Gathering 1 gram of gold in a glass jar is gaining popularity among the younger generation in this nation. As a result, online store owners are actively promoting the sale of "yellow beans".

On the government front, the Central Bank of China (PBOC) has been consistently acquiring gold since November 2022, resulting in a total reserve of 2,264 tons. Unfortunately, the purchasing volume in April saw a decrease when compared to the previous 2 months. In February and March, the People's Bank of China purchased an additional 390,000 ounces and 160,000 ounces of gold, respectively.

In Korea, the largest convenience store chain, CU, has partnered with the Korea Minting and Printing Security Corporation (KOMSCO) to offer mini gold bars. According to CNBC, this item is experiencing strong sales.

CU convenience stores have been selling a range of gold bars, with weights ranging from 0.1 to 1.87 grams, since April. A 1.87 gram bar of gold is priced at 225,000 won (approximately 165 USD), while the 0.5 gram bar is available for 77,000 won (around 56.5 USD). Local media reports indicate that the 1-gram gold bars, priced at 113,000 won (83 USD), were completely sold out within a mere two days of being available for purchase.

In the first quarter of this year, the demand for gold bars and coins in South Korea saw a significant increase of 27% compared to the previous year, totaling 5 tons. According to the WGC, the significant increase in precious metal prices is what caused this surge in demand. This marks a significant milestone for Korea, with the strongest quarterly increase in over 2 years.

The Central Bank of Korea is currently exploring the possibility of boosting its gold reserves over the medium and long term. In the past, the bank's Reserve management team emphasized the advantages of gold as a safeguard against inflation and a substitute for the USD.

In the US, starting from October of last year, Costco, a wholesale supermarket chain, has begun offering 1-ounce gold bar products for sale through online channels. Customers eagerly rushed to place their orders.

As a result, Costco generates an impressive monthly revenue of 200 million USD from the sale of gold bars in the US. In 2023, their gold sales revenue is projected to reach only 100 million USD per quarter.

Gold prices are being influenced by China's actionsOver the weekend, the spot price of gold saw a significant increase, closing at around $2,360 per ounce. This marks a $59 rise compared to the previous week. Surprisingly, gold prices have surged despite the US Federal Reserve (Fed) indicating its intention to keep interest rates higher for an extended duration, and even in the face of a rising USD price. Many experts believe that China, being the world's largest producer and consumer of precious metals, plays a significant role in driving this remarkable surge. The gold market is now influenced primarily by the demands of Chinese buyers and investors, rather than economic factors. Ross Norman, the CEO of MetalsDaily.com, a precious metals information site based in London, England, highlighted the significant impact of China on the rise of gold prices. Chinese individuals sought out this particular asset due to the downturn in the stock and real estate markets. |

In Summary

According to the World Gold Council, countries have recognized the significance of gold in addressing crises, its capacity to preserve value, and its role in diversifying asset portfolios. Furthermore, in 2024, the global landscape continues to be plagued by numerous political and economic uncertainties.

Given the current circumstances, it remains a viable approach to consider expanding one's gold holdings. The World Gold Council recognizes the significance of gold in the reserves of central banks worldwide due to its secure nature, strong liquidity, and potential for profitability. Central banks typically have three primary investment objectives.

As a result, these agencies have become the leading global holders of gold, representing a significant portion of the world's gold production.

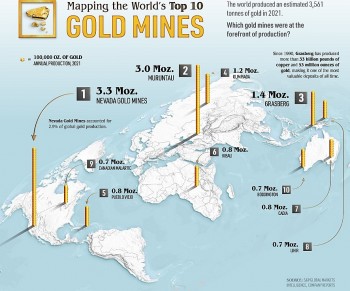

Top 9 Countries That Produce the Most Gold Top 9 Countries That Produce the Most Gold Gold is among the rarest elements in the world. Gold production increases national wealth. Which nations currently produce the most gold worldwide? |

Gold Fever: 10+ Biggest Gold Mines in the World Based on Production Gold Fever: 10+ Biggest Gold Mines in the World Based on Production There are currently over 1300 functioning gold mines worldwide. Where are the current most productive gold mines located with utmost precision? |