Facts About FUTA: What Is It, History, How It Works

|

| Everything We Know About FUTA: What Is It, History, How It Works Knowinsiders.com |

| Table Of Content |

The Federal Unemployment Tax Act (FUTA) is a piece of legislation that imposes a payroll tax on any business with employees. The revenue it generates is allocated to state unemployment insurance agencies and used to fund unemployment benefits for people who are out of work.

It's safe to say that 2020 was a tough year. In the grip of the COVID-19 pandemic, unemployment in the United States spiked at 14.8 percent — a post-World War II high. A great number of Americans quickly became acquainted with unemployment benefits.

But where did those benefits come from? As with many government-related terms, the answer is an acronym: FUTA.

Let’s learn about FUTA, what it is, history, how it works, and other information.

What is FUTA?

|

| Photo; Fincent |

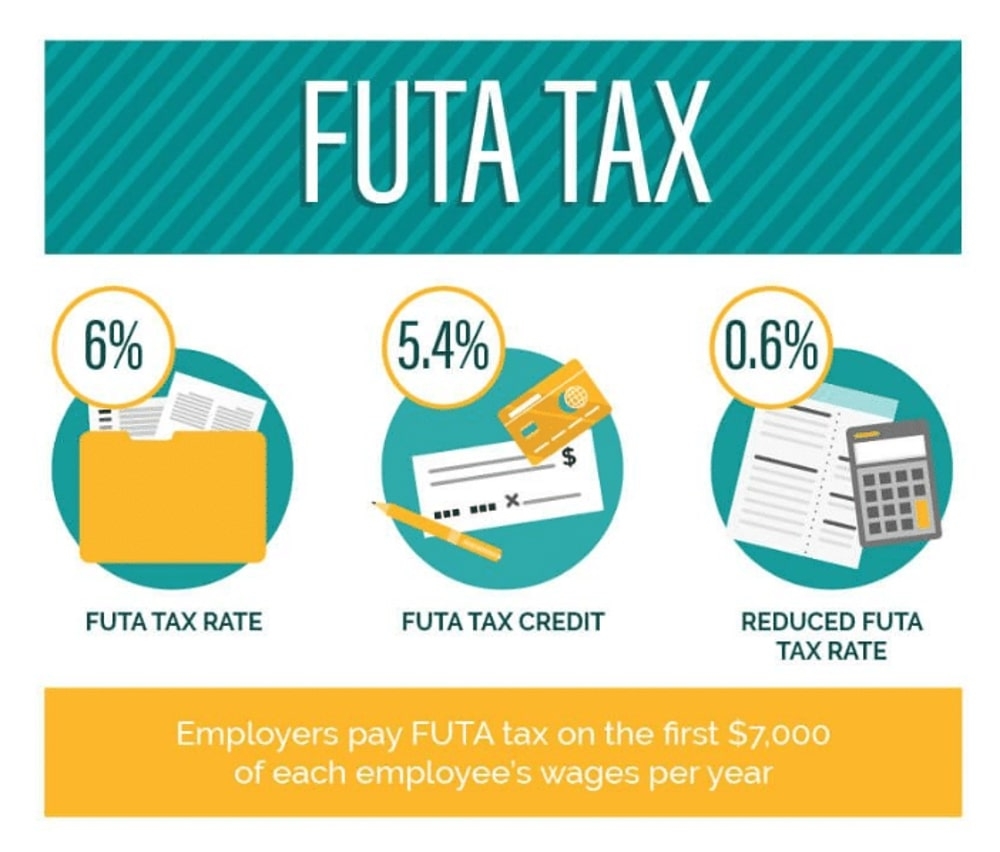

The Federal Unemployment Tax Act (FUTA) is a payroll tax paid by employers on employee wages. The tax is 6.0% on the first $7,000 an employee earns; earnings beyond $7,000 are not taxed. In practice, the actual percentage paid is usually 0.6%.

FUTA requires that employers contribute to the federal unemployment pool, covering employees who qualify for unemployment benefits. If you have at least one employee who works at least 20 weeks out of the year or have paid employees at least $1,500 in any quarter, you are responsible for paying FUTA taxes.

A Brief History of FUTA

|

| Photo: Hourly.io |

Let's start with the basics. FUTA stands for Federal Unemployment Tax Act (or the Federal University of Technology Akure, if you're in Nigeria).

FUTA was written into law in 1939 in response to the Great Depression, during which the American unemployment rate soared to nearly 25 percent. Like Social Security, it was designed to act as a safety net — in this case for workers who suddenly found themselves out of a job. Its goal is to provide a temporary, partial wage to help unemployed people stay on their feet during the job hunting process.

Over the years FUTA has been tweaked a number of times. In 1970, an extended benefits program was folded into the Act. This affords extra weeks of aid to workers in states where the job market was particularly awful. Another modification in 1987 made unemployment benefits taxable as income.

The most recent major modification to FUTA occurred in 2011, when the tax rate was decreased from 6.2 percent to 6.0 percent.

Understanding the Federal Unemployment Tax Act (FUTA)FUTA is a federal law that raises revenue to administer unemployment insurance and job service programs in every state. As directed by the Act, employers are required to pay annual or quarterly federal unemployment taxes; they make up a part of what is commonly known as payroll taxes. The funds in the account are used for unemployment compensation payments to workers who have lost their jobs. Although the amount of the FUTA payroll tax is based on employees' wages, it is imposed on employers only, not their employees. In other words, it is not deducted from a worker's wages. In this way, FUTA differs from other payroll taxes such as Social Security tax, which applies to both employers and employees. |

What is FUTA Tax?

|

| Photo: SmartAssset |

FUTA is an abbreviation for Federal Unemployment Tax Act. FUTA Tax is a United States federal tax imposed on employers to help fund unemployment payments. The tax is imposed solely on employers who pay wages to employees.

FUTA Tax is used to pay employees who leave employment involuntarily and are eligible to claim unemployment insurance. The act requires employers to file Form 940 annually with the Internal Revenue Service (IRS). In some cases, the IRS may allow some employers to pay the tax in installments during the year.

Who Has To Pay FUTA Taxes?

Only employers have to pay FUTA taxes, unlike FICA taxes (for Social Security and Medicare). In other words, you don’t withhold any FUTA taxes from your employees.

What's more, only certain employers need to pay FUTA taxes. But are you one of them? Most likely, yes. The IRS uses three methods to decide if you need to pay FUTA taxes. It uses a general method for general employees and special methods for employers who hire household or agricultural employees.

Most small business owners fall in the general category, which says you need to pay FUTA taxes for an employee if:

You paid that employee $1,500 or more (in wages) during any calendar quarter in the previous or current year, or

The employee worked at least 20 or more different weeks in the current or last year—this includes full-time, part-time and temp workers.

That first rule applies to individual wages, not your company’s total wages. So if you have three temp workers who each earn $1,000 per quarter, and your quarterly payroll is $3,000—you don’t have to pay FUTA taxes since none of your employees make more than $1,500.

What’s more, the general method only applies to employees that get a regular salary or W-2 wages. You don’t have to pay FUTA taxes if you hire an independent contractor.

Household and agricultural employers can use the additional tests in IRS Publication 15, Employers Tax Guide, to see if they have to pay FUTA taxes.

Self-employed individuals, such as independent contractors and freelancers, do not have to pay FUTA taxes on their income.

FUTA Reporting Requirements - Businesses

|

| Photo: Quickbooks |

According to the IRS, a bueinss owes FUTA if it meets one of two requirements. There are two broad measurements to determine whether a business must collect and remit FUTA, and a company only needs to satisfy one of the two following conditions in order to be required to remit FUTA:

1.It paid at least $1,500 in wages during any calendar quarter in the current or previous year. (A calendar quarter is January through March, April through June, July through September, or October through December.)

2.It had at least one full-time, part-time, or temporary employee for at least some part of a day in any 20 or more different weeks in the current or previous year.1

FUTA Reporting Requirements - Household Employers

There is a different set of reporting requirements for household employers, those who hire a nanny, babysitter, maid, housekeeper, or other people to provide services within one's private home. Household employees must pay FUTA tax on wages if the following two conditions are met:

1.Cash wages of $1,000 or more were paid to a household employee in any quarter during the year.

2.The household employee performs household work in a private home, local college club, or local chapter of a college fraternity.

FUTA Reporting Requirements - Agricultural Employers

Yet another varying set of requirements exist for agricultural or farming employers. If the employer meets either of the conditions below, they are subject to FUTA tax collection and reporting:

- Cash wages of $20,000 or more were paid to farmworkers during any calendar quarter during the year.

- 10 or more farmworkers were employed during some part of the day during any 20 or more varying weeks within a calendar year.

FUTA Reporting Requirements - Other Employers

Indian tribal governments are exempt from FUTA tax. However, the tribe must have participated in the state unemployment system for the entire year and be compliant with prevailing unemployment laws. Religious, educational, scientific, charitable, or other tax-exempt organizations are also exempt from FUTA. Last, services performed by state or local government parties are also exempt.

How to Calculate FUTA Tax

When calculating FUTA taxes, it is important to understand the kinds of incomes that need to be taxed. Ideally, the unemployment tax is calculated on taxable wages that fall under the first $7,000 per employee per year limit. Any amounts exceeding $7,000 are tax-exempt. The taxable income comprises salaries and wages, commissions, bonuses, vacation allowances, sick pay, contributions to retirement plans, etc.

Other payments are also exempt from taxation, but they vary from state to state. Check with your state unemployment office to know which payments are exempt from the FUTA Tax. The tax amount is not deducted from the employee’s income – only the employer is responsible for it.

Sample Calculation

Let’s take the example of Company XYZ, which employs ten individuals. Each of these employees earns an annual taxable income of $10,000, bringing the total wages to $100,000. In such a case, the tax is applied to the first $7,000 in wages paid to each employee.

Therefore, the company’s annual FUTA tax will be 0.06 x $7,000 x 10 = $4,200. The employer will be required to submit $4,200 in FUTA taxes to the IRS. The company will also be required to remit any applicable state unemployment taxes to the state tax authority.

FUTA Credit Reduction

|

| Photo: Shutterstock |

Some states are categorized as credit reduction states and are, therefore, ineligible to claim maximum credit reduction. When these states are unable to pay unemployment tax to residents who lost employment involuntarily, they may borrow from the federal government to facilitate the unemployment insurance payments. The federal government is entitled to recover the unpaid loans from the states by reducing the amount of credit available to them.

The reduction schedule is 0.3% for the first year and 0.3% for the following years until the loan is fully repaid. Before the loan is fully paid, the states cannot benefit from the maximum credit reduction of 5.4% and will, therefore, pay higher FUTA taxes than other states. However, if a state has fully paid these loans, it can claim the max tax credit reduction of 5.4%. It means that they will only pay 0.6% in FUTA tax.

Payments Exempt From FUTA Tax

Various forms of payments are paid to employees that are exempt from the Federal Unemployment Tax Act. The payments include:

• Fringe benefits, which include the value of certain meals and lodgings, employer contributions to accident and health plans for employees, as well as employer reimbursements for qualified moving expenses.

• Group term life insurance

• Employer retirement/pension contributions to a qualified plan, such as a SIMPLE IRA plan or a 401(k) plan

• Dependent care not exceeding $500 per employee (or $2,500 for married couples filing separately) for qualifying person’s care

• Other payments, such as payment made to an employee under worker’s compensation law because of a sickness or injury inflicted at work; non-cash payments and certain cash payments to H-2A Visa workers for agricultural labor; payments for services provided by a spouse, parent, or child under 21 years; and payments to non-employees who are treated as your employees by the state unemployment agency

Example: Exempt Incomes

Assume that Company XYZ company employs three staff – John, James, and Peter. John earns an annual income of $30,000, including $2,000 in employer contribution to health insurance, James earns an annual income of $20,000, including $1,200 in contribution to a 401 (k), while Peter earns an annual income of $25,000, including $1,800 in employer contributions to a SIMPLE retirement account. It means that total payments exempted from FUTA taxes are $2,000 + $1,200 + $1,800 = $5,000.

Federal Unemployment Tax Deposits

The IRS requires employers to make payments to the federal tax agency by the last day of the month after the end of the quarter. The FUTA tax liability for the quarter must be $500 or more for the employer to make a deposit with the IRS. If it is less than $500, it is carried forward to the next quarter.

The frequency of FUTA tax payments depends on the amount of tax owed and the number of employees. Employers must use the Electronic Federal Tax Payment System to make payments to the IRS.

Let’s take the example of a company that owes the IRS $400 in Quarter 1, $350 in Quarter 2, $490 in Quarter 3, and $550 in Quarter 4. Since the FUTA tax liability in Q1 is less than the required $500, the company will carry forward the $400 for Q1 to Q2. That will bring the total tax liability for Q2 to $750 ($400 + $350), which the company will be required to remit to the IRS by July 31st (the last day of the next month after the end of Q2).

The tax liability for Q3 is below the FUTA tax limit by $10. The tax liability will be carried forward to the last quarter of the year. It will bring the FUTA tax liability for Q4 to $1,040 ($490 + $550). The company must remit the FUTA tax liability by January 31st of the following month.

What is the FUTA tax rate?

The FUTA tax rate is currently 6.0%. The federal tax applies to the first $7,000 in wages you pay each employee during a calendar year after subtracting any exempt payments. It’s important to note that all wages paid are counted as FUTA wages.

The good news is that companies can qualify for a tax credit of up to 5.4% based on their timely payment of state unemployment taxes if the state isn’t a credit reduction state. So for these businesses, the rate would be as low as 0.6%. Just be aware that employers in a credit reduction state can’t claim the full credit.

What Is the Difference Between FUTA and SUTA?FUTA and SUTA are essentially the same type of payroll tax used to fund government unemployment programs. However, FUTA is assessed at the federal level, while SUTA is assessed at the state level. What Is the Difference Between FUTA and FICA?FUTA is a payroll tax implemented on just an employer to help fund federal unemployment programs. FICA is a payroll tax implemented on both the employer and employee that provides funding for Medicare and Social Security. Who Is Subject to FUTA?Most businesses are subject to FUTA if they have employees. If a company paid wages of more than $1,500 to employees in any calendar quarter during the year, they are subject to FUTA. In addition, if one or more employees worked part of a day in 20 or more different weeks during the year, the company they work for is subject to FUTA. Is FUTA Paid By the Employer?Yes, FUTA is paid for by the employer. Unlike other payroll taxes, FUTA is not deducted from an employee's paycheck, and all tax liability for FUTA resides with the employer. |

Tax Day: Deadline to File Tax, What to Know Tax Day: Deadline to File Tax, What to Know The last day to request a 2017 Tax Refund is May 17. That means you have less than one week to manage everything. Mark the ... |

Top 18 Countries With Lowest Corporate Tax Rates Top 18 Countries With Lowest Corporate Tax Rates Taxes are the backbone of an economy. This article will give you a thorough look at top 18 countries with the lowest corporate tax rates. |

Gun in America: Amazing Facts, Ownership, Sales and Tax Gun in America: Amazing Facts, Ownership, Sales and Tax Check out the amazing facts about firearms in the US: Gun Ownership, Sales, Tax, Crimes and Deaths. |

Top 30 Highest income Earners in America and Their Tax Top 30 Highest income Earners in America and Their Tax Find out the list of the Americans with the highest annual incomes, based on IRS data, including Top 30 and Top 400. |