Dating App Bumble IPO: Prices, Potential BMBL Stock and Female Founder

|

| Founder and CEO of Bumble Whitney Wolfe - Vivien Killilea | Getty Images Entertainment | Getty Images |

Facts About Bumble

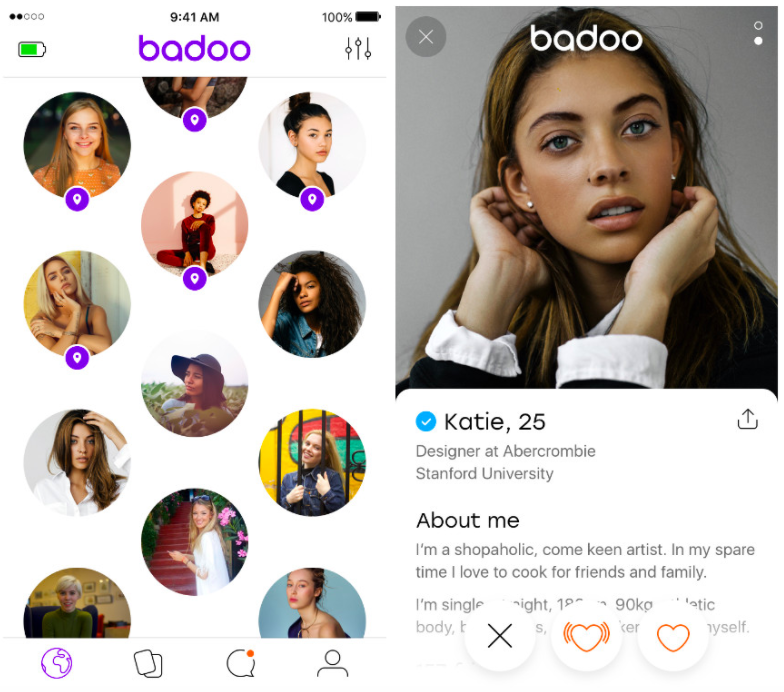

Bumble Inc. is the parent company of Badoo and Bumble, two of the world’s highest-grossing dating apps with millions of users worldwide. The Bumble platform enables people to connect and build equitable and healthy relationships. Founded by CEO Whitney Wolfe Herd in 2014, the Bumble app is one of the first dating apps built with women at the center, and the Badoo app, which was founded in 2006, is one of the pioneers of web and mobile dating products. Bumble currently employs over 600 people in offices in Austin, Barcelona, London, and Moscow.

Bumble Inc., the dating app where only women can make the first move, has raised $2.15 billion in an initial public offering, expanding the size of the listing and pricing the shares above a marketed range.

Bumble ranks as the second-highest-grossing dating app in the world with more than 12 million monthly active users (MAUs) as of the end of September 2020. Bumble also operates the Badoo app, one of the original pioneers in the online dating space.

Bumble IPO details

The company on Wednesday sold 50 million shares for $43 each, according to a statement. Bumble had planned to sell 45 million shares for $37 to $39 apiece, a target that was raised earlier from 34.5 million shares at $28 to $30.

Bumble has a market value of about $8.2 billion based on the outstanding Class A shares listed in its filings. Private equity firm the Blackstone Group Inc. took a majority stake in Bumble’s parent company in 2019, in a transaction that valued it at $3 billion.

The Bumble app was started in 2014 by Chief Executive Officer Whitney Wolfe Herd, who previously co-founded the dating app Tinder. At 31, Wolfe Herd is the youngest woman to take a large company public in the U.S. as CEO.

In a letter to investors, Wolfe Herd said women making the first move is a “powerful shift.”

“Archaic gender dynamics and old-fashioned traditions still ruled the dating world,” she said. “This led to all sorts of unhealthy dynamics that ultimately disempowered women and created unnecessary pressure for men.”

For the nine months ended Sept. 30, Austin, Texas-based Bumble had a pro forma net loss of $28 million attributable to owners and shareholders on revenue of $413 million, according to its filings.

The offering is being led by Goldman Sachs Group Inc., Citigroup Inc., Morgan Stanley and JPMorgan Chase & Co. Bumble’s shares are expected to begin trading Thursday on the Nasdaq Global Select Market under the symbol BMBL.

|

Covid-19 pandemic and online datingLike Tinder and Hinge, Bumble has seen a surge in users during the pandemic, as lonely singles look to occupy their time and find love during nationwide lockdowns and shelter-in-place orders. Last March, Bumble reported a 23% increase in sent messages in New York City and a 26% increase in San Francisco in just a 10-day period. Amid Covid-19, it also began offering in-app video to allow users to connect from the confines of their home. Now, users can implement a virtual dating badge which signifies a willingness to date via video call; they can also share audio voice notes and expand distance filters to match with anyone nationwide. *Read More: How to Find Love, Best online Dating Apps during Covid-19 Pandemic in 2021 |

Business details of Bumble

Bumble directly addresses the estimated 804 million single people worldwide between the ages of 18 to 69 that had access to the internet in 2020.

The singles population in North America is projected to grow from 103 million people in 2020 to 111 million by 2025. The global singles market is modelled to grow from 804 million people to 981 million over the same time period.

Bumble and Badoo both operate a freemium business model where the use of the core service is free but customers can make in-app purchases or pay for a subscription. As of September 2020, the company boasted 2.4 million paying users that are able to unlock premium features, such as unlimited swipes, the ability to rematch with expired connections, unlimited backtracks, among other features.

The company was the first of its kind to launch in-app video chat capabilities, introduce automated photo verification capabilities as a security feature, and leverage machine-learning technology to remove lewd images.

Bumble’s consumer data and analytics along with user feedback allow the company to focus on new areas of growth. As such, buying BMBL stock gives investors exposure to other ancillary revenue-generating opportunities, such as a platform for platonic friendships and business networking.

Financial details

Bumble revenue growth slowed during the first nine months of 2020, although the COVID-19 pandemic is to blame as it ground a near-halt to in-person encounters. Specifically, revenue from January 1, 2020, through September 30 was up just 15 per cent year-over-year at $416.6 million. By comparison, full-year revenue growth in 2019 was 35.8 per cent.

Here are some other metrics Bumble provided for the first nine months of 2020 that investors will be looking at before buying Bumble’s shares:

|

The female founder behind the dating app making market history

When Bumble founder and CEO Whitney Wolfe Herd launched the dating app in 2014, she wanted to solve a real-world 21st century relationship problem: how to find love for the millions of women just waiting around for men. So she turned traditional dating norms upside down, creating an app launched by women, guided by women and for women that defied age-old gender norms by letting the women make the first move.

Nearly seven-years later, the company that prides itself on its female-first approach — and which begins trading today after raising $2.2 billion in an initial public offering that exceeded expectations and valued the firm at over $7 billion — has garnered a devoted following. As of the third quarter of 2020, it boasted nearly 42 million active users looking to find love with the swipe of a finger. Now, Bumble also can boast about becoming a member of a small but growing list of female-founded companies to IPO, which already includes Stitch Fix founder Katrina Lake and the RealReal’s Julie Wainwright.

Corporate America and the technology sector have come under fire for the lack of diversity in boardroom and power-wielding positions. Just 6% of companies in the S&P 500 have a female CEO, including General Motors, Oracle and Ulta Beauty, but they’re still in short supply although the number doubled between 2007 and 2017, according to Pew Research Center.

Nasdaq, where Bumble is listing its shares, recently filed a proposal with the U.S. Securities and Exchange Commission which would require all companies in the U.S. Nasdaq Exchange to share diversity statistics pertaining to their board of directors. Goldman Sachs said last month it wouldn’t take companies public if they didn’t have at least one diverse board member.

Wolfe Herd is no stranger to dating apps. Before launching Bumble, the 31-year-old entrepreneur worked at Tinder, the dating platform well-known in Gen-Z and millennial hookup culture, and a tough competitor to Bumble. Shortly after graduating from college, the then-22-year-old joined Hatch Labs, a Los Angeles-based incubator for start-ups run by IAC, where she began working with peers on what later became Tinder, where she served as vice president of marketing.

Face-to-face with #MeToo era issuesBumble and Wolfe Herd’s history have directly confronted the #MeToo era reckoning. In 2014, Wolfe Herd resigned from Tinder and filed a sexual harassment and discrimination suit against the company and fellow executives. The company reportedly settled for roughly $1 million and stock awards later that year. After departing Tinder, Wolfe Herd sought to build a competitor to Facebook’s Instagram geared toward younger generations, according to an interview with Business Insider in 2015. But after connecting with Andrey Andreev, co-founder of a dating app called Badoo, whom she met while working at Tinder, she was convinced to rejoin the dating scene. |

The company’s shares will become available for CFD trading right after the Bumble IPO date. You can speculate on the Bumble market value without the need to buy shares of this popular online dating app. Choosing CFDs, you can make profit from any BMBL stock movement: open a long position if you believe the stock will rise, or a short position if you expect the stock to fall.

What is Clubhouse App - How to Get a Invite What is Clubhouse App - How to Get a Invite Clubhouse is an up-and-coming social media platform that connects people via audio chat rather than posting status updates or sending direct messages. What is Clubhouse ... |

Top 15 most popular social networks in the World Top 15 most popular social networks in the World Social networking sites have proved their important role in both the work and life of people in the world. Let’s join with Knowinsiders to explore ... |

Top 10 safest dating apps in 2021 Top 10 safest dating apps in 2021 Tired of matchmaking services? Now you can actively find the most compatible partner thanks to these smart dating apps. |

How to Find Love, Best online Dating Apps during Covid-19 Pandemic in 2021 How to Find Love, Best online Dating Apps during Covid-19 Pandemic in 2021 Dating is a complicated and often clumsy dance even in the best of times. So how can you date in this current situation of Covid-19 ... |