When Will the First COLA-Adjusted Payments Arrive in January 2025?

06:08 | 30/11/2024 Print

2025 Social Security COLA: How All Benefits To Change and When Will the Payments Arrive 2025 Social Security COLA: How All Benefits To Change and When Will the Payments Arrive Here is what you need to know about the Social Security Cost-of-Living Adjustment (COLA), which will be revealed in October. How to calculate your 2025 ... |

This guide provides detailed information on the timing, process, and methods for ensuring timely payments.

|

| When will the first benefit checks arrive. Image: KnowInsiders |

When to Expect the First COLA-Adjusted Payments

The arrival of COLA-adjusted payments depends on:

• The Type of Benefit You Receive (e.g., SSI, SSDI, or retirement benefits).

• Your Date of Birth (for retirement and SSDI beneficiaries).

• Federal Holiday Adjustments (e.g., New Year’s Day falls on January 1).

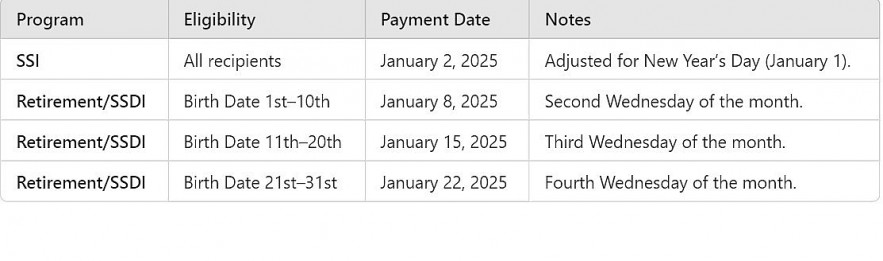

Here’s the detailed breakdown of January 2025 payment dates:

1. Supplemental Security Income (SSI)

SSI beneficiaries, many of whom rely on these payments for basic living expenses, will receive their first adjusted payment on:

- January 2, 2025, since January 1 is a federal holiday (New Year’s Day).

This date is earlier than usual for SSI recipients because SSA ensures payments are never delayed by holidays or weekends.

2. Social Security Retirement and Disability Payments

Payments for retirement and SSDI benefits are distributed on a staggered schedule, based on the beneficiary’s birth date:

• Birth Date 1st–10th: Payments arrive on January 8, 2025 (the second Wednesday of the month).

• Birth Date 11th–20th: Payments arrive on January 15, 2025 (the third Wednesday of the month).

• Birth Date 21st–31st: Payments arrive on January 22, 2025 (the fourth Wednesday of the month).

How COLA Adjustments Impact Your Payments

COLA ensures that Social Security payments remain aligned with inflation, preserving the purchasing power of beneficiaries. The COLA percentage for 2025 is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), typically announced in October 2024.

Key Factors Influencing COLA in 2025:

- Inflation Trends: The COLA reflects the increase in prices for essential goods and services.

- Automatic Adjustments: Beneficiaries do not need to apply for COLA; adjustments are automatically applied to monthly benefits.

- Individualized Impact: The dollar amount increase varies depending on the original benefit amount.

Example of COLA Application:

- A beneficiary receiving $1,500 monthly in 2024 with a COLA of 3.2% will see an increase of $48, bringing their monthly payment to $1,548 in 2025.

Understanding the January 2025 Payment Schedule

To provide clarity, the following table outlines the complete January 2025 payment schedule, adjusted for holidays and program rules:

|

| January 2025 payment schedule |

How to Ensure Timely Payments

To ensure your COLA-adjusted payments are received without delay, follow these tips:

1. Set Up Direct Deposit

Direct deposit is the fastest and safest method to receive your benefits. Advantages include:

- Payments are deposited automatically into your bank account on the scheduled date.

- There is no risk of lost or delayed checks.

- Setup is quick and easy through the mySocialSecurity portal or by calling SSA.

2. Verify Your Payment Schedule

Check the official SSA 2025 Payment Calendar to confirm your payment dates. These dates are adjusted for federal holidays to prevent delays.

3. Update Your Information

Outdated or incorrect information can delay payments. Ensure:

- Your bank account and routing information are accurate.

- Your current address is on file if you still receive paper checks.

4. Monitor Your COLA Increase

Log in to the mySocialSecurity portal to confirm your adjusted benefit amount and ensure payments reflect the COLA increase.

5. Plan Ahead for Holidays

For January 2025, note the adjustments for New Year’s Day, which may shift SSI payments to January 2. Planning ensures you are not caught off guard.

Conclusion

The first COLA-adjusted payments for 2025 will begin on January 2 for SSI recipients, followed by staggered payments for retirement and SSDI beneficiaries throughout the month. To ensure smooth access to your benefits:

- Set up direct deposit.

- Check your payment schedule.

- Keep your information updated with the SSA.

By staying informed and prepared, you can make the most of your Social Security benefits in 2025.

FAQs About COLA-Adjusted Payments in January 2025

Here’s an expanded list of frequently asked questions to help beneficiaries understand how COLA-adjusted payments work and what to expect in January 2025.

1. What is a Cost-of-Living Adjustment (COLA)?

The Cost-of-Living Adjustment (COLA) is an annual adjustment made to Social Security and Supplemental Security Income (SSI) payments to account for inflation. It is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

- Purpose: To ensure that beneficiaries maintain purchasing power despite rising costs of goods and services.

- Announcement Timing: The COLA percentage is typically announced in October of the preceding year (e.g., October 2024 for 2025 payments).

2. How Will I Know My New Benefit Amount After COLA?

Beneficiaries will be notified of their updated benefit amount in one of two ways:

- Mail: The SSA sends letters in December detailing the new payment amount.

- Online: If you have a mySocialSecurity account, you can log in to view your updated benefit amount in December.

If you don’t receive a notification by the end of December 2024, contact the SSA for assistance.

3. When Will I Receive My First COLA-Adjusted Payment in 2025?

The timing depends on the program you are enrolled in:

- SSI Payments: Arrive on January 2, 2025 (adjusted for the New Year’s Day holiday).

- Retirement and SSDI Payments:

- Birth Date 1st–10th: January 8, 2025

- Birth Date 11th–20th: January 15, 2025

- Birth Date 21st–31st: January 22, 2025

Check the official SSA calendar to confirm your specific payment date.

4. Will My Spouse and I Receive Separate COLA-Adjusted Notifications?

Yes, if both spouses receive benefits individually (e.g., both are retired or one receives SSDI and the other receives retirement benefits), each person will receive their own COLA notification. The letters or online notifications will detail the adjusted amount for each beneficiary.

5. How Is the COLA Calculated?

The COLA is based on the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year. If the CPI-W increases, benefits are adjusted upward to match inflation.

For example:

- If the COLA for 2025 is announced as 3.2%, a monthly payment of $1,500 in 2024 will increase to $1,548 in 2025.

6. Can I Opt Out of Receiving COLA Adjustments?

No, COLA adjustments are automatically applied to all eligible benefits. These adjustments are mandatory and are part of the Social Security program's structure.

7. What Happens if My Payment Doesn’t Arrive on Time?

If your payment is delayed:

- Wait three business days after the scheduled payment date.

- Check your mySocialSecurity account or bank account for updates.

- Contact the SSA at 1-800-772-1213 or visit a local office to report the delay.

8. Are COLA-Adjusted Payments Taxable?

Yes, Social Security benefits, including COLA adjustments, may be subject to federal income taxes if your total income exceeds certain thresholds:

- Individual Filers: Combined income above $25,000 may result in taxation.

- Joint Filers: Combined income above $32,000 may result in taxation.

Up to 85% of your benefits may be taxable, depending on your total income.

9. How Can I Get My Payments Faster?

To ensure timely payments:

- Use Direct Deposit: Funds are electronically deposited into your account on the payment date.

- Update Personal Information: Ensure your bank account and contact details are current.

- Avoid Paper Checks: Paper checks are more prone to delays.

10. Will COLA Adjustments Affect Other Benefits Like Medicaid or SNAP?

In some cases, increased Social Security benefits due to COLA adjustments can affect eligibility for income-based programs like Medicaid or SNAP (Supplemental Nutrition Assistance Program). If your total income surpasses program thresholds, you may need to reapply or provide updated income documentation.

11. What Should I Do if I Disagree with My COLA Adjustment?

If you believe your COLA adjustment is incorrect:

- Review your notification letter or the details in your mySocialSecurity account.

- Contact the SSA to request clarification or corrections.

- Keep relevant documents (e.g., previous payment details or COLA announcements) handy for reference.

12. Does COLA Affect Survivor Benefits?

Yes, survivor benefits are also adjusted annually based on the COLA percentage. Beneficiaries of survivor benefits (e.g., a spouse or child of a deceased worker) will receive COLA-adjusted payments starting in January 2025.

13. Are There Any Special Rules for New Beneficiaries?

If you are applying for Social Security benefits in late 2024 or early 2025:

- Your initial payment will already include the 2025 COLA adjustment if approved.

- Ensure all required documentation is submitted promptly to avoid delays in processing.

14. Can COLA Be Negative?

No, COLA cannot reduce your Social Security benefits. If inflation is flat or prices decline (deflation), the COLA is set to 0%, and benefits remain unchanged. However, in periods of inflation, COLA increases benefits accordingly.

15. Where Can I Find More Information About COLA and Payments?

Visit the official SSA website at ssa.gov for:

- Updates on COLA percentages and payment schedules.

- Access to the mySocialSecurity portal.

- Tools and resources to estimate your benefits.

Beneficiaries, Payment Schedules for 2025 Social Security Increase Beneficiaries, Payment Schedules for 2025 Social Security Increase For millions of people, Social Security is an essential part of their financial security, and this impending increase emphasizes how important it is to ensuring ... |

2025 Social Security Payment: Key Dates and How to Get Faster 2025 Social Security Payment: Key Dates and How to Get Faster The United States Government has officially finalized the payment schedule for Social Security and other federal assistance programs, including VA (Veterans Affairs), SSI (Supplemental Security ... |

When and How You’ll Get Your December 2024 Social Security Benefits When and How You’ll Get Your December 2024 Social Security Benefits This article outlines the exact payment dates, provides tips for timely receipt, and highlights important updates to Social Security benefits, including the Cost of Living ... |

Ngosugar

Article URL: https://knowinsiders.com/when-will-the-first-cola-adjusted-payments-arrive-in-january-2025-41645.html

All rights reserved by KnowInsider